CGV Tendency: Seize the Opportunity for Q1 Correction, and Perseverance Will Pay Off

In Brief

The DXY has strongly rebounded while risk assets retreated under pressure

Balance of long/short sentiment returns, with moderate bullishness in future’s spread basis

US Treasury yields remain high, and the foundation of a comprehensive bull market is not yet established

Conclusion: Short-term obstacles do not change the long-term trend, and the market is expected to oscillate upward in the future

After experiencing the difficult and challenging winter of 2022, we welcomed the “spring frenzy” in the first two months of 2023, with varying degrees of increase in risk assets.

Recently, US inflation has shown resilience, causing a revision in market expectations towards a dovish stance by the Fed, and the crypto market has also declined. Although the US inflation has fluctuated, it’s clear there is a downward trend. However, the Fed is likely to stop raising interest rates by mid-2023, so we should not be overly pessimistic. And yet, there is still considerable uncertainty about whether the US economy will decline, and we are unable to find the driving force for risk assets to rise significantly. As a late-cycle risk asset, crypto is still greatly affected by global macro factors.

Looking ahead, we believe that after experiencing the recent correction, the long/short sentiment has returned to balance, and BTC will experience some consolidation before rising. “Buy low and sell high” will generate significant excess returns. It is worth noting that confidence in on-chain funds has begun to recover, judging by the level of heightened on-chain activity. We will see more Alpha opportunities this year.

The DXY has strongly rebounded while risk assets retreated under pressure

Since the February FOMC meeting, the DXY has regained its upward momentum, and risk assets like gold and Nasdaq have retreated under pressure. Although the CPI has fallen on a month-on-month basis, NFP and PCE have far exceeded expectations, indicating that the decline in US inflation is not smooth sailing, and the market’s optimistic expectations for the Fed’s dovish turn are starting to be revised.

As a late-cycle risk asset, BTC cannot be separated from the influence of global macro factors. In August 2022, BTC’s high point of the rebound reached approximately $25,300. BTC attempted to break through this level several times last week but failed every time. By now, it has returned to the consolidation range from late January. We believe that this does not mean that the uptrend has ended. Although the downward trend in inflation has fluctuated, the trend itself has been established. This is already entirely different from last year’s situation. The Fed’s interest rate hike speed has been reduced to 25 bps, indicating that the end is not far away.

Once inflation continues to fall, the market will become optimistic again. We predict that the Fed will stop raising interest rates in the middle of the year, and we are bullish on the market’s upward trend after some consolidation. “Buy low and sell high” will generate significant excess returns.

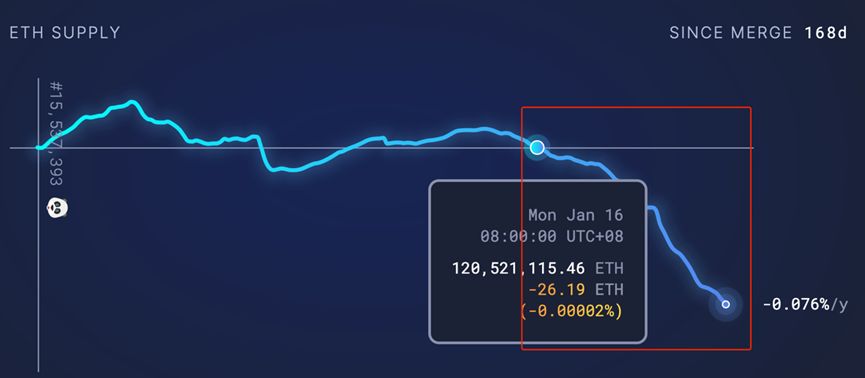

The Shanghai upgrade of Ethereum is just around the corner, but ETH’s performance is not strong, and the ETH/BTC exchange rate is still around 0.07. This indicates that the market is concerned about the selling pressure caused by the upcoming Ethereum unlock. According to calculations, under neutral circumstances, 23,000 ethers will be sold daily, lasting for more than two months [1]. Calculated at the current price of $1,560, the total selling pressure will reach $2.2 billion, enough to prepare the market in advance. With a market value of nearly $200 billion, the impact of the unlock is more psychological, and the Shanghai upgrade is conducive to the long-term development of the Ethereum ecosystem. We are still long-term bullish on ETH as the L1 leader.

Balance of long/short sentiment returns, with moderate bullishness in the future’s spread basis

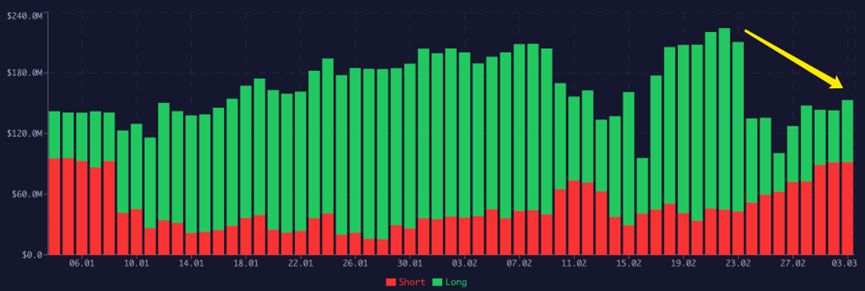

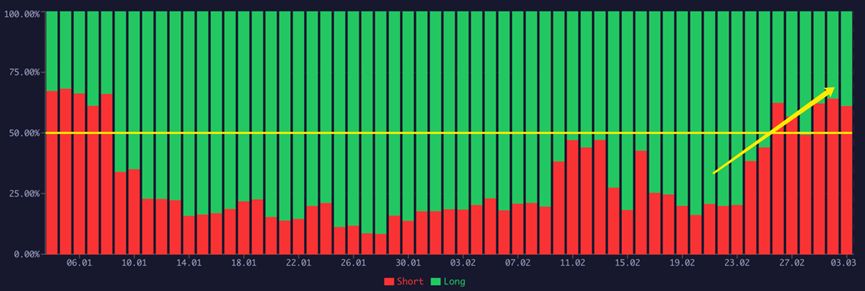

The trading mechanism of the on-chain futures trading platform GMX does not require a strict balance between short and long contracts. It can provide higher leverage and lower slippage than centralized exchanges, highly favored by high-leverage traders. Currently, GMX’s open interest exceeds $100 million, providing a specific reference value for the overall market sentiment.

According to data from GMX, long positions have been continuously opened since January, with the highest long ratio even exceeding 90%, indicating a consistent bullish expectation. When the price is at the bottom, and market participants gradually join the long camp, it is often the beginning of an uptrend. With the price increasing for a period of time, almost all market participants are buying, but they cannot break through the pressure level, which indicates the potential risk of a pullback. After BTC failed to break through the level of around $25,300 multiple times, the long position decreased from $160 million to $60 million, and the short position increased from $40 million to $90 million, with the short ratio exceeding 50% for the first time. When the fervent longs surrender, the rapid downside risk of “killing the longs” has dramatically reduced.

Looking at the spread basis of OKX BTC quarterly futures contracts, the basis rate at the peak of the bull market in November 2021 exceeded 6%, while the current basis rate is 1.4%, only reaching the level of October 2020. Market participants have a relatively mild expectation of the future price, and there is still significant room for the basis rate to rise.

US Treasury yields remain high, and the foundation of a comprehensive bull market is not yet established

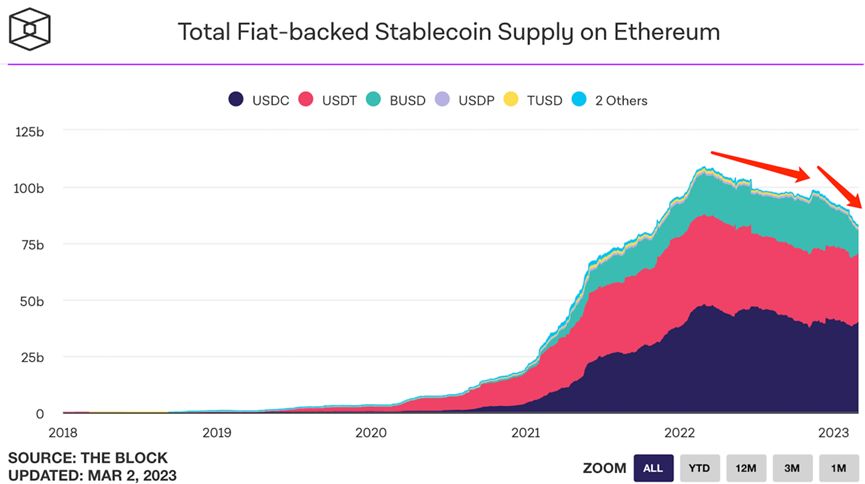

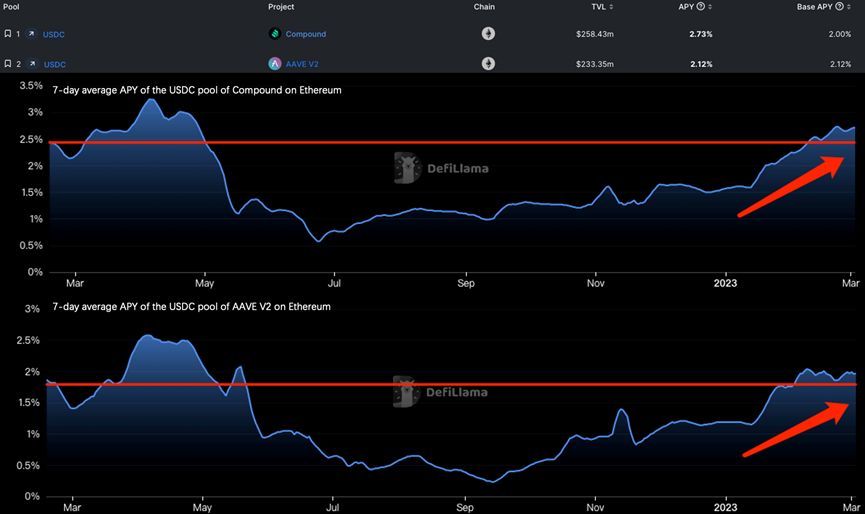

We cautioned against excessive pessimism in the previous section, but we should not hold a bull market fantasy at this point either. Since March 2022, the total market value of stablecoins has started to decline, and with the addition of unexpected events such as Luna, 3AC, FTX, and others, funds have continued to flow out of the market. After multiple rate hikes by the Fed, the US Treasury yield is generally above 4%, while the yield of stablecoins of major DeFi protocols is generally below 3%. Large funds obviously tend to allocate to US Treasury bonds with lower risk and higher returns, thus continuing to flow out of the crypto market. Without incremental funds, a comprehensive bull market is difficult to generate. We expect the Fed to begin cutting rates at the end of this year or early next year, and mainstream funds will gradually allocate funds to crypto, helping to boost a new round of bull market.

A significant increase in on-chain activity creates more alpha opportunities

Since there is no sign of incremental capital entering the market, we believe that there is currently no foundation for a comprehensive bull market. However, from the perspective of on-chain capital activity, the bullish sentiment has been significantly better than in the second half of 2022. Since mid-January, ETH has entered a continuous deflationary state, and the USDC APY of the two major DeFi lending protocols, Compound and AAVE, has also rebounded to the level of March last year, both of which indicate a significant increase in on-chain activity and capital utilization efficiency. Although we believe it will be difficult to see a massive Beta in the first half of this year, active on-chain capital makes it easier for high-quality projects to enter the “price discovery phase.” As the saying goes, “Confidence is more important than gold,” We will see more Alpha opportunities this year.

Conclusion: Short-term obstacles do not change the long-term trend, and the market is expected to oscillate upward in the future

Although there are uncertainties in macro factors and the FTX-related event has not been completely cleared up, the worst phase has passed, and we should not be excessively pessimistic now. As the ancient saying goes, “Those who weather the storm and endure the rain will see the clouds part and the moon again.” We believe that a deep correction will bring good opportunities to buy, and we expect the market to oscillate upward in the future. We should patiently wait for the clouds to disperse and the moon to shine.

Reference: [1] Estimated Selling Pressure from Partial and Full Withdrawals, @korpi87

About Cryptogram Venture (CGV): Cryptogram Venture (CGV) is a Japan-based research and investment institution engaged in crypto. With the business philosophy of “research-driven investment,” it has participated in early investments in FTX, Republic, CasperLabs, AlchemyPay, Graph, Bitkeep, Pocket, and Powerpool, as well as the Japanese government-regulated yen stablecoin JPYW, etc. Meanwhile, CGV FoF is the limited partner of Huobi venture, Rocktree capital, Kirin fund, etc. From July to October 2022, it launched the first TWSH in Japan, which was jointly supported by the Ministry of Education, Culture, Sports, Science and Technology (MEXT), Keio University, SONY, SoftBank, and other institutions and experts. Currently, CGV has branches in Singapore, Canada, and Hongkong.

Disclaimer: The information and data introduced in this article are all from public sources, and our company does not make any guarantees regarding their accuracy and completeness. Descriptions or predictions regarding future situations are forward-looking statements, and any suggestions and opinions are for reference only and do not constitute investment advice or implications for anyone. The strategies that our company may adopt may be the same, opposite, or unrelated to the strategy speculated by readers based on this article.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

CryptogramVenture FoF Asian アジアの暗号化資産ベンチャーファンドオブファンズ