NFT Legal Issues: An Overview of the Landscape for 2022–2023

The purpose of this article is to identify and address legal questions facing the NFT industry in 2022, anticipate legal issues that will arise in the NFT industry over the next year, and explore potential solutions.

Origination

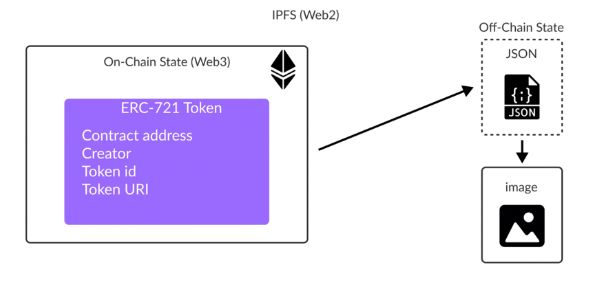

NFTs are cryptographic tokens (digital certificates) recorded in a blockchain registry that confirm ownership of nearly anything in the digital and even physical world (such as images and real estate). Each NFT is unique and has its own value due to its connection with an asset.

The concept of using NFTs, or non-fungible tokens, as a way to represent and manage real-world assets on a blockchain can be traced back to Meni Rosenfeld’s article “Overview of Colored Coins,” published on December 4, 2012. In this article, Rosenfeld introduces the idea of “colored coins,” which are similar to bitcoins but have an added “token” element that gives them a specific use or utility, making them unique. The author suggests using these tokens not only within the blockchain, but also for connecting with real-world applications.

On May 3, 2014, digital artist Kevin McCoy created the first known NFT, called “Quantum,” on the Namecoin blockchain. “Quantum” is a digital image of a pixelated octagon that changes color and pulsates, resembling an octopus. This early use of NFT technology has become a prototype for the entire field of digital art.

From a technical perspective, the blockchains that were available at the time (primarily Bitcoin) were not designed to be used as a database for tokens representing ownership of assets. The active development of NFTs began with the emergence and popularity of Ethereum.

It is also important to distinguish between three options for the relationship between NFTs and the main asset they represent:

1. On-chain: all transactions involving the NFT are recorded on a single blockchain, which can be easily verified using a blockchain explorer. An example of this is the recent sale of real estate as an NFT.

2. Off-chain: transactions are recorded not only on the blockchain, but also in a centrally managed database. One unusual example of this can be found on the OpenSea, with the sale of a 2000-pound tungsten cube.

3. The legal relationship that exists between on-chain and off-chain is known as the “right to follow,” where the second is dependent on the first and requires a certain level of rights.

Before discussing the legal issues in more depth, it is important to consider what types of assets may be represented by NFTs.

Utility

NFTs have become particularly popular in the art world, where the uniqueness of a work is highly valued. As a result, NFT owners are often seen as “the chosen ones.

However, many people associate NFTs with strange, colorful pictures that sell for millions of dollars. The reality is that NFTs can represent a wide range of assets, both digital and physical, that hold value in the virtual and real world.

NFTs should not be limited to the realm of crypto art. They are more accurately described as a technological tool that offers new opportunities in both worlds.

Below I have collected a few examples of how NFTs are being used.

Digital art

One of the main uses for NFTs is in the realm of art and collectibles. Traditional works of art, such as paintings, are valuable because they are one of a kind – created by hand using unique techniques and materials. Digital files can be easily copied, but NFTs offer a way to certify ownership of a unique digital or physical asset. NFTs provide a new way for creators to monetize their digital art and for collectors to own and trade unique items. NFT platforms can even offer the possibility of automated royalties for the artist from future sales, but it depends on the platform (platform examples – OpenSea, Rarible).

Representative examples: Art Blocks, Murakami Flower Seeds.

PFP

NFTs as a PFPs, or “profile pictures” are commonly found on Twitter, where they are linked to a specific account. If the NFT profile photo is verified by Twitter, the user may receive a special outline or badge. PFP ownership can also allow users to join certain communities and access games or other products created by those communities.

Representative examples: BAYC, CryptoPunks.

Virtual Land

These NFTs represent user-owned areas of digital land on metaverse platforms and give the owner the ability to use the land for a variety of purposes, such as advertising, communication, gaming, work, or rental.

Representative examples: The Sandbox, NFT Worlds.

Games

These are in-game objects, such as avatars, weapons, animals, and lands.

Membership

NFTs can also be used to address issues of user privacy and data processing. They can eliminate the need for remembering passwords for multiple platforms and can be resold on the secondary market for profit.

Representative examples: Proof, Premint.

Community-NFT

NFTs can also provide certain benefits when participating in online and offline social events.

Representative example: VeeFriends.

Music

NFTs that represent content bundles, such as music or video, typically differentiate between “the right to the token” and “the right from the token.” In most cases, users obtain the token itself, which gives them the right to sell, transfer, or otherwise dispose of the token.

However, any intellectual property rights tied to the token remain with the creator, and the token holder may only be entitled to a portion of the royalties from streaming as a co-investor.

Representative examples: Royal, Rocki, Sound

Brands

The popularity of NFTs has prompted many brands to examine their potential use as digital assets and their potential for integration into web3.

Representative examples: Adidas, Nike (acquired one of the most well-known NFT studios – RTFKT)

Account/Domain name

In web 2, traditional account or domain names do not belong to the user in the full sense. For example, Twitter owns all account information and has the right to revoke or delete accounts. NFTs can be used to create a decentralized, blockchain-based system of accounts, each of which is verified by a digital certificate.

Representative examples: ENS, Unstoppable.

There are also other areas where NFTs can be useful due to their unique nature:

- Identification tool (e.g. SoulBound Token): NFTs can serve as a universal ID for various digital services and databases, such as voting systems, attendance tracking, medical records, and certificates. They can even be used as a way to identify anonymous individuals in legal proceedings.

- Real estate: NFTs can be used to represent ownership of real estate assets.

- Logistics: NFTs can be used to track and verify the movement of goods through the supply chain.

Legal status

From a legal perspective, NFTs can be complex objects with varying legal nature depending on the specific circumstances. This may subject them to different state regulations, including taxes, licenses, and other requirements.

Below is an overview of the positions of leading jurisdictions on the legal status of NFTs.

UK

In the UK, there are no specific regulations governing NFTs, which are considered a type of crypto asset. The Financial Conduct Authority distinguishes between three types of tokens:

- Security: Provides rights and obligations specified in the investment agreement, including shares, deposits, and insurance. Regulated under the Financial Services and Markets Act of 2000.

- E-money: Electronically stored monetary value which is subject to Anti-Money Laundering Regulations.

- However, the majority of NFTs do not fall under these categories and are therefore unregulated.

European Union

Like in the UK, there is no specific regulation or legal definition of NFTs in the EU, and there is no agreed regulatory regime across member states.

On 5 October 2022 the European Commission published a Market in Crypto-assets Regulation (MiCA), which is expected to be the final version of MiCA subject to further Parliament’s agreement in 2023, and which does not include NFTs in its scope.

However, the proposed regulation would explicitly apply to NFTs that grant the owner certain rights, such as rights to financial instruments, profit-making rights, or other benefits. In these cases, the NFT may be considered a security. NFTs may also be subject to national legislation within the EU.

China

In China, cryptocurrencies are banned, but individuals are allowed to make transactions with NFTs. Currently, there are no specific laws or regulations governing NFTs in China. However, on April 13, 2022, the National Internet Finance Association of China, the Securities Association of China, and the Banking Association of China jointly launched an initiative to prevent financial risks associated with NFTs. Although this initiative is not a regulatory act under Chinese law, it reflects the general attitude of the government towards NFTs.

According to the initiative, NFTs are not considered cryptocurrencies or virtual currencies. However, the following should be kept in mind:

- NFTs should not include securities, insurance, credit, precious metals, or other financial assets.

- The non-fungible characteristics of NFTs should not be weakened by dividing the property or other means.

- Centralized transactions should not be performed.

- Virtual currencies, such as Bitcoin, Ethereum, and USDT, should not be used as pricing and settlement tools for issuing and trading NFTs.

- The real names of individuals performing the issuance, sale, and purchase of NFTs should be authenticated, and client identification information and records of the issuance and trading of NFTs should be properly preserved.

- Active cooperation in anti-money laundering efforts is required.

- Investment in NFTs, either directly or indirectly, and financial support for NFT investments, should not be provided.

United Arab Emirates

Regulation of NFTs and crypto assets here often occurs at the level of free economic zones. For example, the Abu Dhabi Free Economic Zone (ADGM) recently published a consultation document entitled “Proposals for Improving Capital Markets and Virtual Assets”. ADGM believes that companies will need a license from the financial regulator of the free zone to trade NFTs, and that NFTs may be subject to ADGM Anti-Money Laundering and Sanctions Regulations.

These proposals are still in the consultation phase, but market participants should take them into account.

The Dubai Free Economic Zone (DMCC) has introduced licensing for NFT marketplaces. In addition, NFTs may be subject to the “Rules for Crypto Assets”, which apply to crypto assets that are securities or traded on an exchange. Depending on the nature of the underlying asset, anti-money laundering requirements may be relevant.

Singapore

The Monetary Authority of Singapore (MAS) has announced that it will not regulate the NFT market, as it believes the market is still in its infancy and does not want to regulate people’s investments. However, under Singapore law, if an NFT has the characteristics of a capital markets product under the Securities and Futures Act (SFA), it will be subject to MAS regulatory requirements.

For example, if an NFT represents the rights to a portfolio of shares listed on a stock exchange, it will be subject to requirements for securities issuance, licensing, and business conduct, similar to other collective investment schemes.

Similarly, if an NFT has the characteristics of a digital payment token under the Payment Services Act (PSA), it may impose special restrictions and obligations on the seller of such an NFT.

USA

Currently, there is no clear regulation of NFTs in the US, and they should be considered crypto assets. The Responsible Financial Innovation Act (RFIA) is being considered, which will create the first comprehensive regulatory framework for digital assets in the US.

The bill classifies most digital currencies as commodities, which means they will be regulated by the Commodity Futures Trading Commission (CFTC). RFIA offers a clear standard for determining when digital assets will be considered commodities and when they will be considered securities.

Until then, the nature of NFTs as objects of regulation is determined by the Securities and Exchange Commission (SEC), which usually applies the “Howey test”. The current approach to regulating all crypto assets is reflected in the comment of SEC Chairman Gary Gensler, who stated that “securities laws should apply to crypto assets.”

Overall, the approach of all analyzed jurisdictions is similar: we are not yet sure what NFTs are, but if they resemble an object of regulation (commodity, currency, security), we will not hesitate to regulate them.

In addition, there is a trend towards increased regulation of crypto assets and NFTs in particular (FTX case gave another reason), with the US expected to take the lead in this effort in 2023.

Copyright

Attention, spoiler!

Owning an NFT does not automatically grant copyright to the object behind the NFT.

Under 17 U.S.C. § 102 of the US Copyright Law, the protection of “original works of authorship fixed in any tangible medium of expression” is automatic and belongs to the author as soon as the original expression is fixed.

This includes eight categories of works:

- literary works;

- musical works, including any accompanying words;

- dramatic works, including any accompanying music;

- pantomimes and choreographic works;

- pictorial, graphic, and sculptural works;

- motion pictures and other audiovisual works;

- sound recordings; and

- architectural works.

NFT images fall under the category of pictorial and graphic works.

Copyright protection grants the holder the right to reproduce, distribute, publicly display, perform, and create derivative works based on the original, as well as the right to prohibit others from doing so. When purchasing an NFT, the authenticity of the work can be confirmed through the blockchain.

However, it is important to note that purchasing an NFT does not automatically grant copyright to the object behind it, and it is the responsibility of the buyer to ensure that the work does not infringe on any existing copyrights.

Let me emphasize it. An advantage of purchasing an NFT is that the authentication process is carried out on the blockchain. When you buy an NFT from a renowned artist, the authenticity of the NFT will be verified through the original seller’s association with the artist (the marketplace is responsible for verifying this). You can trust that the NFT you purchased is authentic, no matter how many times it has been resold, as everything can be traced using a blockchain explorer.

However, the blockchain will not provide information about whether the NFT you purchased is a copy of another artist’s copyrighted work.

Under 17 U.S.C. §504 of the US Copyright Act, the sale of a work that infringes copyright, even if it is done without intent, makes the seller automatically liable for actual damages and/or statutory damages ranging from $750 to $30,000 per violation. If the violation is found to be intentional, the damages will increase to $150,000 per violation. It is important to note that this is per violation, meaning that the number of NFTs involved in the sale could result in multiple violations.

There is currently some complexity surrounding the transfer of rights through NFTs. While NFTs and copyrights are separate entities, the transfer of one may also involve the transfer of the other. For example, the Terms & Conditions of the Bored Apes Yacht Club state that “when you purchase an NFT, you own the underlying Bored Ape, the Art, completely.” This suggests that the ownership of the NFT includes ownership of the underlying work of art.

One interesting aspect of NFTs is the possibility of separating the token from the rights it represents. For example, the owner of a Bored Ape NFT (which includes both the token and the associated artwork) may decide to transfer the image rights for use on T-shirts to person A, while selling the NFT itself to person B.

According to the Bored Ape Rules, the transfer of the NFT should include all the rights associated with it. This means that person A would be in violation for doing so because person B did not transfer the rights to use the image for T-shirts to person A.

However, it could also be interpreted that person B is not involved in the transaction between the owner and person A regarding the image rights, and therefore there is no any violation. The same logic can be implied if person B also uses the image from the Bored Ape NFT to make T-shirts.

This issue could potentially be resolved by treating the rights associated with the NFT like real property rights, where encumbrances follow the object.

I found only one project with such an approach. The World of Women project operates under this model and it is subject to French law. However, this solution may not fully address the problem.

Under section 204(a) of the US Copyright Act, “a transfer of copyright ownership, other than by operation of law, is not valid unless an instrument of conveyance, or a note or memorandum of the transfer, is in writing and signed by the owner of the rights conveyed or such owner’s duly authorized agent”. This requirement applies to both physical documents and electronic agreements, such as those involving “click if you agree” options.

This will only apply to the initial purchase, when the owner in the example above completed the first transaction. Later on in the chain, no one checked any boxes or signed any documents. This is a separate issue. If you’re interested, there is a good article about the relationship between smart contracts and legal contracts. In other words, the logic is as follows:

- The owner of the NFT is also the copyright holder of the content behind the NFT.

- The owner of the NFT transfers the NFT through a smart contract, which does not affect the content behind the NFT unless specifically stated.

- According to the law, a separate document is needed for the transfer of rights.

- This document must be signed by the copyright holder.

One important aspect of copyright is understanding the concept of a derivative work of the author’s material. In my opinion, derivatives can be even more valuable than the original in some ways. Let me explain: the value of the original can often be determined by the number of derivative works, in other words the uniqueness of a truly new approach by the original author can be “measured” through the network effect of the number of derivative works (virality).

From a legal perspective, a derivative is a work based on one or more pre-existing works. Examples could include translation, musical arrangement, adaptation for the stage, movie adaptation, sound recording, artistic reproduction, reduction or any other form of processing, transformation, or adaptation.

The copyright on the derivative only applies to the portion introduced by the author of the derivative, which distinguishes it from the pre-existing material, and does not imply any exclusive rights to the pre-existing material.

There are two key criteria for recognizing a derivative work: originality and legality.

Originality

In order for a work to be considered a derivative, the new material must be original and capable of being copyrighted on its own. This requirement helps to ensure that the author of the derivative work has contributed a significant amount of original expression to the final product. If the derivative work merely copies the original work with little or no original content, it may not be considered a derivative and may not be eligible for copyright protection.

Legality

It is also important for the creation of a derivative work to be legal. If a copyrighted work is used without the permission of the copyright owner, the copyright protection does not extend to any part of the derivative work in which the original material was used illegally. In order to create a derivative work that can be copyrighted and potentially sold, it is necessary to obtain permission from the copyright owner of the original work.

The ability to create derivatives is often cited as a key factor in the success of the Bored Apes Yacht Club collection. The Rules of Bored Apes grant an unlimited worldwide license for the use, copying, and display of acquired works of art in order to create derivative works, including for commercial purposes. However, these same Rules also state that when an NFT is purchased, the buyer fully owns the underlying Bored Ape art object. This creates a contradiction, as it is unclear what rights are being transferred for commercial use if the buyer already owns the work of art. Maybe they were trying to highlight the separate right to create derivatives, but didn’t do so effectively.

It is important to note that copyright law treats NFTs the same way as traditional works of art, as copyright takes precedence over the blockchain in this case. When an artist creates a new work of art, they automatically acquire the copyright to that work and a number of exclusive rights. These rights include the right of authorship, the right to the author’s name, and the right to the inviolability of the work, which cannot be transferred. Other rights, such as the right to reproduce, create derivative works, or distribute copies of the work, may be the subject of a contract and transferred to others for commercial purposes. It is crucial to clearly define the volume of rights being transferred with an NFT in order to avoid any potential conflicts.

To understand how copyright infringement is currently being addressed in the context of NFTs, it is helpful to look at some public cases.

Benjamin Ahmed and “Weird Whales”.

A 12-year-old programmer named Benjamin Ahmed sold 3350 computer-generated “Weird Whales” NFTs for almost 300,000 pounds, but it was later discovered that the graphics for the project were directly copied from another project. The original creator of the graphics has not come forward.

Quentin Tarantino vs. Miramax.

Director Quentin Tarantino announced that he would be selling seven NFTs related to the 1994 movie Pulp Fiction. The NFTs were to include “uncut first handwritten scripts” from the film with “exclusive individual comments” by the director. Miramax, the distributor of the film, filed a lawsuit against Tarantino, claiming that he had no legal rights to create and sell the NFTs and was misleading consumers about the involvement of Miramax in the creation of the NFTs. The case is currently ongoing.

The French fashion house Hermès filed a lawsuit against Californian artist Mason Rothschild over his NFT project “MetaBirkin,” which depicted Hermès Birkin bags and the company’s trademark. Hermès argued that Rothschild had misappropriated the Birkin trademark and benefited from the sale of more than 100 digital collectibles. The case is currently ongoing.

In February 2022 Nike filed a lawsuit against online sneaker company StockX for selling its “Vault” NFT without permission. Nike claimed that StockX intentionally and knowingly used its trademarks without permission to create the NFT and mislead consumers about Nike’s involvement in the creation of the NFT. The case is currently ongoing.

The cryptocurrency project SpiceDAO made headlines after it paid $3.5 million for a copy of an unpublished manuscript of the script for the film “Dune” and intended to create an NFT based on it, before later realizing that the acquisition of the manuscript did not include the rights to it.

This case involves two collections of pixel images of punks, with CryptoPunk being the original and CryptoPhunk being a copy. The original creator of CryptoPunk, Larva Labs, notified NFT marketplace OpenSea of the copyright infringement and the CryptoPhunk collection was removed from the website in accordance with the Digital Millennium Copyright Act.

The HitPiece website was accused of selling NFTs featuring the work of a number of musicians without their permission. The website was found to have sold NFTs featuring content from Disney, Nintendo, John Lennon and many others. The original website was shut down and the developers re-launched it again soon. The situation did not escalate to a legal case as far as I know.

To combat copyright violations in the NFT space, online gallery DeviantArt and California startup Optic are using image recognition technology and machine learning to analyze smart contracts and identify infringing NFTs on marketplaces. Optic works closely with the NFT marketplace OpenSea. It seems that proving NFT originality projects will be in a trend in 2023.

Licenses

In the process of creating an NFT, such as the PFP collection, there can be several participants:

- The owner of the project. The author of the concept, producer, founder, and ideologist. This is the one who started the project and brought everyone together.

- Creator/Creator. The creative person who brings the project to life, whether he is the creator or a hired specialist.

- Investor. The buyer of the NFT.

- Community. This usually includes anyone who is involved in the project, from the owner to subscribers of social networks. This can include creators, authors who create derivatives, sponsors, promoters, influencers, and others who are interested in the project and may contribute to its development.

- Marketplace. NFT trading platforms.

These parties need to address issues related to the transfer of rights, such as the ability to create derivatives, parodies, merchandise, and reselling the NFT.

To address these issues, NFT market participants have recognized the need for clear rules to regulate intellectual property rights and have proposed their own options for licensing NFTs.

In 2018, Dapper Labs (known for their work on CryptoKitties and NBA Top Shot) offered the first known NFT license, and in August 2022, the a16z VC fund released their own vision for NFT licenses.

In the summer of 2022, there was a widespread use of Creative Commons licenses when selling NFTs. a16z wrote a great article about why NFT creators choose the CC0 tool (Creative Commons has several license variations) for transferring rights.

By accepting the CC0 license, the copyright holder agrees to relinquish their copyright and related rights to a copyrighted work to the greatest extent permitted by law. As a result, the work is effectively “dedicated” to the public domain. If for any reason this waiver of rights cannot be achieved, then CC0 functions as a license granting the public an unconditional, irrevocable, non-exclusive, free right to use the work for any (!) purpose.

This means that NFTs regulated by CC0 have no restrictions on the commercialization of NFTs or their use in any way the owner sees fit. The owner of an NFT regulated by CC0 becomes equal with the creator in terms of owning the NFT collection.

However, since no one owns a work of art under the CC0 license, this also means that anyone (even someone who does not own an NFT) can use the work of art for any purpose, including creating an NFT. This creates a paradox, as why spend resources on creating an NFT if you can’t prohibit others (who aren’t even the owners of your NFTs) from using the art related to your NFT? The only reason for doing so would be to promote the ideology of NFTs, rather than for financial gain.

Actually there are a few main options for determining the extent of rights transferred with an NFT, which can be grouped as follows:

- The buyer does not receive any rights beyond the right to display the NFT

- The buyer receives limited commercial rights in relation to the NFT that he owns

- The buyer receives full commercial rights in relation to the NFT that he owns

- The copyright holder may relinquish his exclusive rights to a copyrighted work to the greatest extent permitted by law.

Another issue with NFT license agreements (in addition to determining the scope of rights transferred) is the asymmetric control that the copyright owner has over the license. Copyright holders can modify or revoke the NFT license from NFT owners at their discretion through updating the Terms & Conditions even without any notification if they believe that the license agreement has been violated, or for any other reason, or for no reason at all. This ability to change the license agreement at any time can be a major concern for the entire NFT industry, as the rights of each NFT owner can be limited or completely revoked unilaterally.

Given the variety of options for determining the limits of rights transferred with an NFT, I would suggest that NFT creators consider the current and potential problems in the industry for their own project specifically, and discuss them with members of their community in the spirit of web3. After all, it is the community that holds power in this industry. Only then should they formally determine how licensing will work in relation to their NFT, and make sure to exclude the possibility of changing the terms of license agreements unilaterally.

Dispute resolution

The NFT industry is still too new to have many judicial precedents to analyze. However, the rules of intellectual property law can (and should) be applied in cases of disputes about authorship and the use of someone’s intellectual property when creating an NFT.

The court may be interested in several key issues:

- Is there evidence of the use of someone else’s intellectual property?

- Has the person claiming a violation of his copyright proven the authorship?

- Is there any damage?

- What was the goal of the violator?

- What specific actions did the violator take in regards to the violation and what were the results for him?

There may be even more questions, but these are sufficient to understand the court’s logic. The answers to these questions will help the court distinguish culpable actions taken for profit from the other ones, and the judge may also consider the “Fair Use Doctrine” in their decision. This doctrine, created by Anglo-American law in the 18th – 19th centuries, allows for the limited use of someone else’s copyrighted materials without their permission.

The doctrine includes four factors that the court needs to consider:

- Purpose and nature of use

The court needs to determine whether the use is for commercial or non-commercial purposes. To be considered “fair,” the use must contribute to the advancement of knowledge in the art by adding something new, which the courts interpret as “transformativity.”

- Nature of copyrighted materials

In order to prevent private ownership of a work that rightfully belongs to the public domain, the court needs to understand the source of the idea. In this case, already known facts and ideas are not protected by copyright, only their specific expression (such as description, methodology, or scheme). If already known information is reinterpreted in this way, it may be considered as expressing authorship.

- Scope and significance

These two factors should be considered together. The court first determines the amount of disputed information (such as the pieces in a text or in a photo) in relation to the original work. In general, the less that is used in relation to the whole, the more likely it is that the use will be considered fair. However, the materiality of the disputed information also plays a role, and often this second factor is more significant legally.

- Effect of the violation

If the use damages the copyright holder’s ability to profit from the original work and substitutes demand for it, it is not considered fair.

The court may also consider additional criteria specific to the case in order to provide greater clarity.

If we apply the fair use doctrine to the situation between CryptoPunk and CryptoPhunk, it would be the basis for the court’s decision. It would be interesting to see how the court would rule, but since OpenSea resolved the issue internally, we can only speculate on how the court might have approached the case.

In his open letter, the anonymous CryptoPhunk author-violator stated that the purpose of creating his collection was “parody and satire” (which falls under the “Purpose and nature of use” criteria of the doctrine). However, upon consideration of other criteria, it appears that the anonymous author-violator:

- Failed to sufficiently transform the original work (first criteria)

- Used materials that were already in the public domain (second criteria)

- Used a significant amount of original ideas, with only a minor change (third criteria)

- Had a significant impact on the copyright holder’s reputation and income (first and fourth criteria)

- Was aware of the original author (additional criteria)

Given these factors, OpenSea’s solution seems reasonable.

Conclusion

2022 was absolutely the age of NFTs. Despite the principles of openness, the industry needs rules to function properly. Players who take the NFT industry seriously and plan to stay in it for the long term quickly adapt to these rules, understanding that they are in place to protect everyone.

Understanding the legal status of their future digital assets, the methods of transferring them, and the extent of the rights included in them will help create a more reliable industry for NFT creators.

As the industry grows, it’s likely that the number of controversial situations will increase. Potential areas of contention in the NFT space include:

- Royalty payments

- Disputes over the scope of rights transferred under a license

- Theft of NFTs

- Counterfeit (confusingly similar) NFTs

- Taxes

- Advertising and promotion

- Hacker attacks

- Personal data

- Identifying violators

- Concluding transactions with NFTs as collateral

- Responsibility of NFT marketplaces

Read more about NFT:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Professional with over 12 years of experience in venture capital and startups who is passionate and business-oriented. Proven track record of delivering value and results in organizing and structuring processes, product management, and legal in complex and diverse sectors. Constructing a link between web3 and environmental preservation.

More articles

Professional with over 12 years of experience in venture capital and startups who is passionate and business-oriented. Proven track record of delivering value and results in organizing and structuring processes, product management, and legal in complex and diverse sectors. Constructing a link between web3 and environmental preservation.