Edge DeFi and the USDC Depeg

In Brief

The collapses of Silverbank and SVB have shaken the crypto community and repegged Circle’s USDC.

Circle’s exposure on SVB amounted to $3.3bn.

USDC has since repegged to $1.

Over the course of the past two years, we have learned that crypto, while a budding and innovative industry, is still built upon trust that certain protocols and institutions can function as designed. This assumption has proven to be the downfall of many, from small-time users to massive funds and cartels.

In the case of Luna, FTX, or Mango Markets, they gained enough TVL and trust to be considered “too big to fail” by ecosystem participants. What participants misunderstood was there is no backstop or buyer of last resort that could save these entities in extreme conditions.

Edge Capital never bought into these assumptions and instead used a research and risk management framework that has so far protected its investors and left the company largely unscathed by the myriad of “black swan” events that have occurred since its inception. The brief collapse of USDC was handled no differently.

Edge’s Team has always been cognizant of systemic risks, and I personally have more than a decade of experience working in countries experiencing all forms of economic turmoil, from debt crises and hyperinflation to bank runs. The banking crisis concerns over the weekend showed that history is repeating itself, and Edge Capital was prepared for that.

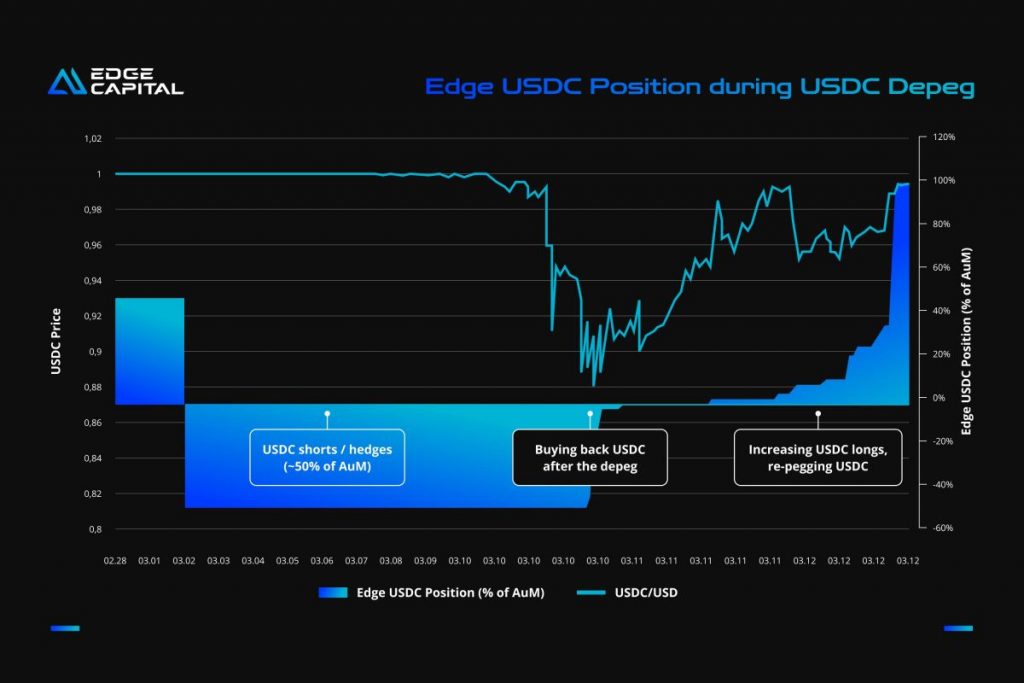

Edge’s story with USDC begins a few weeks prior to the depeg during the collapse of Silvergate bank. During this time period, Edge was running a strategy that required borrowing stablecoins using AAVE. Typically, Edge would borrow USDT as a systemic risk hedge because of market concerns around its reserves and relatively low borrow rate.

In the wake of Silvergate’s collapse, Edge changed exposure by instead borrowing and selling USDC for USDT. This decision was based on a few factors, including the fact that we were unaware of Circle’s exact exposure to Silvergate. We also understood the regulators had Crypto banking in their crosshairs.

We assumed that there could be a situation where Circle’s pipes could be squeezed, and the instant redeem and mint mechanisms could stall out temporarily, creating panic. Additionally, Edge was optimizing for interest rates, and it was cheaper to borrow USDC at the time, which was synergetic with other strategies running.

The above foresight allowed Edge to be net short USDC at $1 with minimal risk or drag on the portfolio. Fast forward to the news of SVB going down due to the bank run it faced on Thursday and Friday last week.

When the news of the $3.3bn Circle’s exposure on SVB hit the tape, USDC’s slight depeg began to accelerate into 5-7% discounts. We began to cover our shorts and crystallized a healthy amount of profit in excess of our monthly projections and waited for more news.

During the panic, many believed that if USDC had a balance sheet “hole,” the equilibrium price of USDC would trend much below par as redeemers and arbitrageurs would drain the remaining treasury. While we entertained that idea, we had a strong belief in Circle and found it to be impossible for USDC to lose its peg for a prolonger period of time for a few reasons:

- Circle is a company run by people and not a protocol driven by code – therefore, there would be a gate imposed on redemptions prior to the treasury being exhausted.

- Circle is a regulated, transparent entity that would do its best to remain the peg.

- The amount of liquid USDC on chain did not equal the amount of USD/US T-Bills owned by Circle. There is $2bn+ USDC locked in bridges, vaults like Makers PSM, and accounts that had been frozen for exploiting protocols or violating OFAC.

The next decision was when to be long USDC after the news that the FDIC and Fed would backstop deposits and Circle’s wire from SVB was out prior to the cutoff. Prior to this, we had tested the rails to on and offramp USDC and were confident that there would be a sharp repeg once redemptions began to process.

As expected, the above played out to near perfection, and at the time of writing, USDC has fully repegged to $1.

The lesson we learned was simple: In nascent industries like crypto, it does not matter how big or how stable you are marketed to be, participants tend to act irrationally and can create chaos. We prefer to subscribe to Murphy’s law because so many of our peers have fallen victim to complacency, and so many events that used to be considered impossible have come to fruition.

In conclusion, we have faced headwinds from exercising caution when trading on chain. Hedges have dragged our returns minimally but noticeably since our inception, whether it be stablecoin shorts or DeFi protocol hack coverage, but these hedges are like any other insurance product. When you need it most, you are always relieved to have purchased it.

We look forward to the next challenge we face and tip our cap to the team at Circle for handling such a difficult situation over the weekend and will continue to use and support USDC in our on-chain endeavors.

Special credit to Nico Katsafanas, Senior Trader and Risk Manager, Edge Capital.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Vadim is Founder and CIO at Edge Capital and has 10+ years of professional experience across alternative investments, frontier markets, fundamental macro research, computational methods, tech, asset management, and policy- making. Prior to starting Edge Capital, he was a member of the investment team at a global macro hedge fund Trend Capital. Prior to that he led a FI/FX strategy team at Bank of America Merrill Lynch in London and was Advisor to the Executive Director at the International Monetary Fund in Washington, DC. Vadim holds a Ph.D in Economics from UCLA.

More articles

Vadim is Founder and CIO at Edge Capital and has 10+ years of professional experience across alternative investments, frontier markets, fundamental macro research, computational methods, tech, asset management, and policy- making. Prior to starting Edge Capital, he was a member of the investment team at a global macro hedge fund Trend Capital. Prior to that he led a FI/FX strategy team at Bank of America Merrill Lynch in London and was Advisor to the Executive Director at the International Monetary Fund in Washington, DC. Vadim holds a Ph.D in Economics from UCLA.