U.S. Federal Reserve releases 49-page framework for fintech firms seeking master accounts

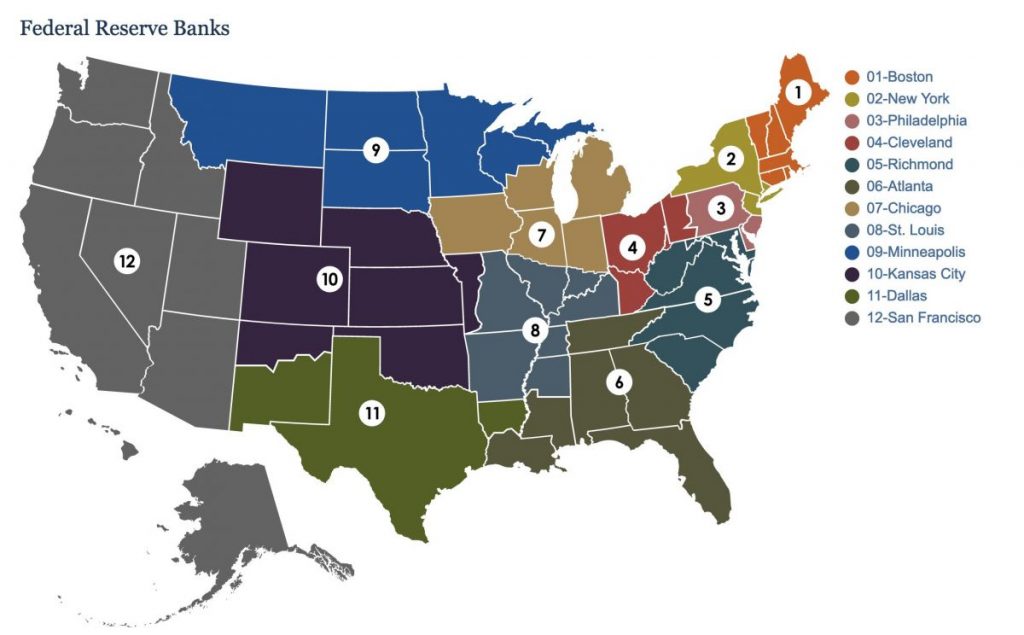

Yesterday the U.S. Federal Reserve released final guidelines for the twelve regional Feds fielding master account requests in our brave new reality.

The updated terms outlined in the Fed’s 49-page ‘Final Guidance’ document apply to all existing and pending accounts. However, the impetus for this redux stems largely from crypto-empowered fintech firms, referenced vaguely throughout as “novel” institutions.

Why would a decentralized entity want to align with the Fed, the most centralized of them all? Well, U.S. firms all buy into America by paying taxes. Reuters said master accounts yield “access to payment and account services that the Fed typically provided to banks as a way to quickly route and store money.”

“All federally-chartered banks possess a master account,” Decrypt noted.

Emerging fintechs have worked tirelessly to secure their own seat at the financial power table, but master account applications related to crypto have languished. Some companies have decried the “opaque and subjective” nature of the Fed’s application review process.

Maybe that’s because the Fed had to cover its bases before granting what Chairman Jerome Powell called “hugely precedential” permissions. Page 4 of Monday’s document clarified the risks novel fintechs could pose with master accounts, including “risks to the Reserve Banks, to the payment system, to the financial system, and to the effective implementation of monetary policy.”

The Fed proposed its first ideas for evaluating novel institutions in May 2021. The institution’s second swing dropped in March 2022, proposing for the first time a tiered review system “to provide additional clarity on the level of due diligence and scrutiny that Reserve Banks would apply to different types of institutions when applying the six risk-based Principles.”

But Decrypt said the master account situation grew direr in June 2022, when Wyoming-based Custodia (founded by former Morgan Stanley director Caitlin Long) sued the Fed over a 19-month delay on their application. “The Fed’s application paperwork for a master account cites a typical turnaround time of five to seven business days,” Decrypt pointed out. Kraken is still waiting to hear back on their account as well.

Attempting to increase transparency and efficiency in this process, the Fed’s new tiered framework assesses applications according to an institution’s risk level. Tier 1 encompasses federally-insured applicants, the blue-chip banks of the bunch. Tier 2 spans those who aren’t federally-insured but who would still be “subject to federal prudential supervision.”

Finally, Tier 3 “includes institutions that are neither federally insured nor subject to prudential supervision,” Cointelegraph reported. Experts estimate most fintechs would fall into this category, which faces “a supervisory or regulatory framework that is substantially different from, and possibly weaker than… federally insured institutions.” More freedom presumably means less access here.

The Fed formulated their final framework based on “46 individual comment letters and 281 duplicate form letters in response to the Original Proposal,” page 5 reads. The board outlined and responded to key feedback throughout the document.

For example, one commenter recommended “applying an activity and risk lens to access requests” rather than a tiered framework. “A different commenter recommended that the tiering framework should focus on an institution’s past performance as a key criterion for determining whether it is included in Tier 2 or Tier 3,” the Fed added on page 26.

Outlining their own responses to highlighted feedback throughout, the Fed said they altered section two of the final guidelines “to provide more comparable treatment between non-federally-insured institutions chartered under state and federal law.”

“Lastly, in response to concerns raised by some comments that the language in the description of Tier 3 implies that supervision conducted by state banking authorities is broadly weaker than federal supervision, the Board has removed references to ‘supervisory’ differences in the description of Tier 3,” they wrote.

In a statement, Fed governor Michelle Bowman warned, “there is a risk that this publication could set the expectation that reviews will now be completed on an accelerated timeline.”

In fact, page 15 of the official document says, “the Board has not adopted a timeline expectation in the final Account Access Guidelines.” They have, however, beefed up language requiring “both timeliness and consistency in evaluating access requests.”

Although these guidelines were meant to clarify the application process, they leave a lot of room for interpretation. Custodia, Kraken, and their cohorts will likely have to keep waiting.

“Many commenters argued that the Proposed Guidelines should require ongoing review of non-federally-insured institutions,” read page 12 of their report. “Some commenters singled out cyber risk as a specific area for ongoing review.”

That ongoing review goes for everyone, though, and many firms aren’t excited about it. What’s more, legal eligibility alone doesn’t guarantee access. The Fed says their services are a privilege, not a right.

And though DeFi’s definitely in an era of self-discovery right now, the debates underpinning these developments transcend just crypto. In June, American Banker wrote that some experts “see the heightened attention being paid to master account policies as hastening the resolution of some related, long-running issues about how the Fed operates.”

In their piece, Brookings Institution senior fellow Aaron Klein “said the Fed was never given the authority to decide which banks are given access to its services, but rather it has ‘invented’ that discretion.”

“This spotlight is long overdue,” Klein remarked directly. “Certain regional Feds have used their master account authority to engineer social policy.”

Same as it ever was, DeFi is both a cause and symptom in the larger questions of power preoccupying society at this pivotal moment.

Read related posts:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Vittoria Benzine is a Brooklyn-based art writer and personal essayist covering contemporary art with a focus on human contexts, counterculture, and chaos magic. She contributes to Maxim, Hyperallergic, Brooklyn Magazine, and more.

More articles

Vittoria Benzine is a Brooklyn-based art writer and personal essayist covering contemporary art with a focus on human contexts, counterculture, and chaos magic. She contributes to Maxim, Hyperallergic, Brooklyn Magazine, and more.