Twitter Users Launch $3 Million Challenge to See if ChatGPT Can Beat Hedge Funds

In Brief

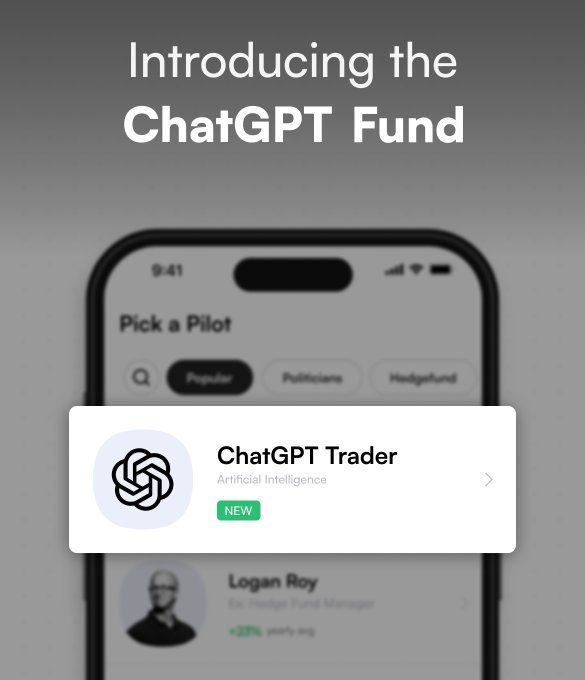

A $3 million challenge started by Twitter users that pitted ChatGPT against hedge funds in a novel battle of the bots is the newest craze in the financial markets.

1500 people have already signed up for the challenge, and ChatGPT is automatically allocating another million bucks.

The developers jailbroke ChatGPT in order for it to scan stock news articles and find pertinent trends in order to achieve this.

The latest trend in financial markets is a $3 million challenge launched by Twitter users, with ChatGPT pitted against the hedge funds in a unique battle of the bots. So far, 1,500 people have joined the challenge, and now an additional million dollars are being deployed with ChatGPT on autopilot. As the excitement builds, many questions have arisen about how ChatGPT can successfully challenge the hedge funds and outperform the markets.

The first challenge was to get ChatGPT to act in a financial context. To achieve this, the developers of the deep learning-based algorithm jailbroke it so it would be able to parse stock news articles and identify relevant trends. To get the most current data and insights, the developers supplied ChatGPT with up-to-date macroeconomic information, such as GDP, unemployment rate, inflation rate, interest rates, and housing market indicators. To analyze individual stocks, the developers extracted the most recent news articles for all listed stocks with a market cap greater than $300 million, then analyzed the headlines and extracted favorable or unfavorable sentiment with the help of the ChatGPT API.

Finally, the developers bought the top 20 stocks, using weekly or monthly averages, and conducted their analysis to buy and hold them for roughly three days before repeating their automated process.

The initiative has thus far been very successful, with over 3 million dollars raised. As excitement builds to see who will come out ahead, investors and spectators alike eagerly await the outcome of the ChatGPT challenge, hoping the new technique will beat the hedge funds and redefine the future of automated trading. In the meantime, people are left to simply eat popcorn and watch the bots do battle.

Recently, a study of public markets published by researchers at the University of Florida found that trading models based on ChatGPT can generate returns of up to 500% over a 20-year period, a stark contrast to the S&P 500 ETF, which returned -12% over the same period. The research team used sentiment analysis of news headlines to build a trading model, and the results showed that ChatGPT demonstrated superior performance compared to other sentiment analysis methods. Additionally, the performance of the GPT-4 score was higher than that of the GPT-3, while the GPT-3 was found to have a higher overall return.

These results show that utilizing complex language models to make financial decisions can help forecast stock market returns more accurately and enhance the performance of quantitative trading strategies. The research also showed that predicting stock market returns is particularly beneficial for small stocks, suggesting there may be market inefficiencies that provide arbitrage opportunities. In the future, AI will likely become a cornerstone of stock market prediction, and this study has laid a marker demonstrating the accuracy and dispersion of returns from such models.

In April, Bloomberg announced the creation of BloombergGPT, a sizable artificial intelligence model. The model will improve current financial NLP tasks like news classification, sentiment analysis, entity recognition, and question-answering. It is being trained on a wide variety of financial data. It is anticipated to open up new options for organizing data, such as letting users navigate the astounding volumes of data in Bloomberg Terminal. The model already performs better than comparable-sized open financial natural language processing models. The business is eager to leverage BloombergGPT to enhance current NLP procedures while also coming up with fresh ideas for how to use this model to delight customers.

Read more about AI:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.