Top 30+ Crypto Fund Asset Managers in 2023: Pros&Cons, Ranked

Cryptocurrency has become one of the most popular forms of investment in recent years, and as a result, many crypto asset managers have emerged. These companies specialize in investing in cryptocurrencies and blockchain-based projects, offering investors the opportunity to gain exposure to this exciting market.

- Digital Currency Group

- Multicoin Capital

- Polychain Capital

- Amber Group

- Pantera Capital

- Dragonfly Capital

- Systematic Alpha

- Electric Capital

- Electric Capital

- ParaFi Capital

- Bitwise

- CoinFund

- Wave Financial Group

- 10T Holdings

- BlockTower Capital

- Off The Chain Capital

- Hazoor Partners

- Cambrian Asset Management

- Galois Capital

- Shima Capital

- Eaglebrook Advisors

- Sino Global Capital

- Walden Bridge Capital

- Stratified Capital

- Nine Blocks Capital Management

- Pythagoras Investment Management

- NovaWulf Digital Management

- Hartmann Capital

- BitBull Capital

In this article, we will explore the top 30 crypto asset managers, discussing their investment strategies, strengths, and weaknesses. From the well-established and largest asset managers to the early-stage investors and niche-focused managers, this list provides a comprehensive overview of the most prominent players in the crypto asset management space.

What is crypto asset manager?

A crypto asset manager is a financial professional or company that manages investment portfolios containing various cryptocurrencies or digital assets. These managers provide services such as portfolio management, investment advice, and risk management to individuals and institutional investors.

Crypto asset managers use a variety of strategies to manage these portfolios, including long-term buy-and-hold, active trading, and diversified investments across different cryptocurrencies. They may also offer custodial services to safeguard their clients’ assets.

The top 30 crypto asset managers are determined based on factors such as assets under management (AUM), investment performance, and reputation within the industry. These managers may be specialized in different areas, such as hedge funds, venture capital, or private equity, and may cater to different types of clients, from high-net-worth individuals to institutional investors.

Crypto asset managers Rankings

| Rank | Fund Manager | AUM (USD) | Region |

| 1 | Digital Currency Group | $50,000,000,000 | North America |

| 2 | Multicoin Capital | $8,895,417,383 | North America |

| 3 | Polychain Capital | $6,627,305,743 | North America |

| 4 | Amber Group | $5,000,000,000 | Asia |

| 5 | Pantera Capital | $4,700,000,000 | North America |

| 6 | Dragonfly Capital | $3,481,586,469 | North America |

| 7 | Systematic Alpha | $1,750,000,000 | North America |

| 8 | Electric Capital | $1,726,885,880 | North America |

| 9 | Hunting Hill Global Capital, LLC | $1,329,363,287 | North America |

| 10 | ParaFi Capital | $1,309,736,697 | North America |

| 11 | Bitwise | N/A | North America |

| 12 | CoinFund | N/A | North America |

| 13 | Wave Financial Group | N/A | North America |

| 15 | 10T Holdings | N/A | North America |

| 16 | BlockTower Capital | N/A | North America |

| 17 | Off The Chain Capital | N/A | North America |

| 18 | Hazoor Partners | N/A | North America |

| 19 | Cambrian Asset Management | N/A | North America |

| 20 | Galois Capital | N/A | North America |

| 21 | Shima Capital | N/A | North America |

| 22 | Eaglebrook Advisors | N/A | North America |

| 23 | Sino Global Capital | N/A | Asia |

| 24 | Walden Bridge Capital | N/A | North America |

| 25 | Stratified Capital | N/A | Asia |

| 26 | Nine Blocks Capital Management | N/A | Middle East |

| 27 | Pythagoras Investment Management | N/A | North America |

| 28 | NovaWulf Digital Management | N/A | North America |

| 29 | Hartmann Capital | N/A | North America |

| 30 | BitBull Capital | N/A | North America |

Digital Currency Group

Digital Currency Group: With $50 billion in AUM, Digital Currency Group is one of the largest crypto asset managers. The company invests in various cryptocurrencies and blockchain startups, and also operates subsidiaries such as Grayscale Investments and CoinDesk. Its diversified portfolio and strong industry connections make it an attractive choice for investors. However, the company’s limited transparency into its investment strategy can be a concern for some.

Pros: Large AUM, diversified portfolio, strong industry connections.

Cons: Limited transparency into investment strategy.

Multicoin Capital

Multicoin Capital: Multicoin Capital manages a portfolio of cryptocurrencies and blockchain projects. The company is known for its research-driven approach and focus on early-stage investments. Multicoin’s strong research capabilities and active involvement in early-stage investing make it an attractive option for investors. However, its relatively small AUM compared to some competitors can be a drawback.

Pros: Strong research capabilities, active in early-stage investing, diversified portfolio.

Cons: Relatively small AUM compared to some competitors.

Polychain Capital

Polychain Capital: Polychain Capital is another early-stage crypto asset manager that focuses on blockchain projects. The company is known for its long-term outlook and willingness to take on high-risk investments. Its focus on early-stage projects, strong industry connections, and long-term outlook make it an attractive option for investors. However, its high-risk investments may not be suitable for all investors.

Pros: Focus on early-stage projects, strong industry connections, long-term outlook.

Cons: High-risk investments may not be suitable for all investors.

Amber Group

Amber Group: Amber Group is an Asian crypto asset manager that offers services such as trading, lending, and asset management. The company has a strong focus on risk management and uses AI and machine learning in its investment strategies. Its diversified range of services, strong focus on risk management, and use of AI and machine learning make it an attractive option for investors. However, its limited presence in North America and Europe can be a concern for some.

Pros: Diversified range of services, strong focus on risk management, use of AI and machine learning.

Cons: Limited presence in North America and Europe.

Pantera Capital

Pantera Capital: Pantera Capital is a well-known crypto asset manager that invests in various cryptocurrencies and blockchain projects. The company has been active in the space since 2013 and has a strong reputation for its industry expertise. Its strong industry reputation, diversified portfolio, and long history in the space make it an attractive option for investors. However, it may have a relatively conservative investment approach.

Pros: Strong industry reputation, diversified portfolio, long history in the space.

Cons: May have a relatively conservative investment approach.

Dragonfly Capital

Dragonfly Capital: Dragonfly Capital is a crypto asset manager that focuses on blockchain protocols and infrastructure. The company has a global presence and invests in projects around the world. Its focus on blockchain infrastructure, global presence, and experienced team make it an attractive option for investors. However, its relatively small AUM compared to some competitors can be a drawback.

Pros: Focus on blockchain infrastructure, global presence, experienced team.

Cons: Relatively small AUM compared to some competitors.

Systematic Alpha

Systematic Alpha: Systematic Alpha is a crypto asset manager that uses quantitative analysis and trading algorithms to manage its portfolio. The company has a strong focus on risk management and aims to generate alpha through market inefficiencies. Its use of quantitative analysis and trading algorithms, and strong focus on risk management make it an attractive option for investors. However, its limited transparency into its investment strategy can be a concern for some.

Pros: Use of quantitative analysis and trading algorithms, strong focus on risk management.

Cons: Limited transparency into investment strategy.

Electric Capital

Electric Capital: Electric Capital is a crypto asset manager that invests in various cryptocurrencies and blockchain projects. The company has a strong focus on data analysis and uses machine learning to identify market opportunities. Its use of data analysis and machine learning, diversified portfolio, and experienced team make it an attractive option for investors. However, its limited track record compared to some competitors can be a drawback.

Pros: Use of data analysis and machine learning, diversified portfolio, experienced team.

Cons: Limited track record compared to some competitors.

Electric Capital

Hunting Hill Global Capital, LLC: Hunting Hill Global Capital is a crypto asset manager that invests in various cryptocurrencies and blockchain projects. The company has a strong focus on value investing and aims to identify undervalued assets.

Pros: Focus on value investing, experienced team, diversified portfolio.

Cons: Limited transparency into investment strategy.

ParaFi Capital

ParaFi Capital: ParaFi Capital is a crypto asset manager that invests in various cryptocurrencies and blockchain projects. The company has a strong focus on decentralized finance (DeFi) and aims to identify disruptive projects in the space.

Pros: Focus on DeFi, experienced team, diversified portfolio.

Cons: Limited track record compared to some competitors.

Bitwise

Bitwise: Bitwise is a crypto index fund provider that offers a range of investment products. Their flagship fund is the Bitwise 10 Crypto Index Fund, which provides exposure to the top 10 cryptocurrencies by market capitalization.

Pros: Offers a range of investment products, including index funds and actively managed funds. The Bitwise 10 Crypto Index Fund provides diversified exposure to the top 10 cryptocurrencies by market capitalization.

Cons: Some of their funds have relatively high expense ratios compared to other crypto asset managers.

CoinFund

CoinFund: CoinFund is a crypto asset manager that focuses on early-stage investments in blockchain-based projects. They invest in a range of projects, including decentralized finance (DeFi) protocols, NFT platforms, and blockchain infrastructure projects.

Pros: Focuses on early-stage investments in innovative blockchain-based projects. Has a strong track record of identifying high-potential projects in the crypto space.

Cons: May be riskier than some other crypto asset managers due to their focus on early-stage investments.

Wave Financial Group

Wave Financial Group: Wave Financial Group is a crypto asset manager that offers a range of investment products, including passive and active funds. They also offer a digital asset treasury management service for institutional clients.

Pros: Offers a range of investment products, including passive and active funds. Has a digital asset treasury management service for institutional clients.

Cons: Some of their funds have relatively high expense ratios compared to other crypto asset managers.

10T Holdings

10T Holdings: 10T Holdings is a crypto asset manager that invests in a range of blockchain-based projects, including DeFi protocols, NFT platforms, and digital asset custody solutions.

Pros: Invests in a diverse range of blockchain-based projects. Has a strong track record of identifying high-potential projects in the crypto space.

Cons: May be riskier than some other crypto asset managers due to their focus on early-stage investments.

BlockTower Capital

BlockTower Capital: BlockTower Capital is a crypto asset manager that offers a range of investment products, including hedge funds and venture funds. They invest in a range of crypto assets, including cryptocurrencies, tokens, and blockchain infrastructure projects.

Pros: Offers a range of investment products, including hedge funds and venture funds. Invests in a diverse range of crypto assets.

Cons: Some of their funds have relatively high minimum investment requirements.

Off The Chain Capital

Off The Chain Capital: Off The Chain Capital is a crypto asset manager that invests in a range of blockchain-based projects, including cryptocurrencies, tokens, and DeFi protocols.

Pros: Invests in a diverse range of blockchain-based projects. Has a strong track record of identifying high-potential projects in the crypto space.

Cons: May be riskier than some other crypto asset managers due to their focus on early-stage investments.

Hazoor Partners

Hazoor Partners: Hazoor Partners is a crypto asset manager that invests in a range of blockchain-based projects, including cryptocurrencies, tokens, and DeFi protocols. They also offer a digital asset treasury management service for institutional clients.

Pros: Invests in a diverse range of blockchain-based projects. Has a digital asset treasury management service for institutional clients.

Cons: May be riskier than some other crypto asset managers due to their focus on early-stage investments.

Cambrian Asset Management

Cambrian Asset Management – Founded in 2018, Cambrian Asset Management is a crypto-focused hedge fund based in San Francisco. The firm focuses on cryptocurrency trading and provides exposure to various digital assets. The firm’s investment strategies include quantitative trading, technical analysis, and fundamental analysis.

Pros: Cambrian Asset Management’s quantitative trading strategies enable the firm to take advantage of market inefficiencies and generate alpha for its clients. The firm has a team of experienced professionals with backgrounds in quantitative trading, technology, and finance.

Cons: Cambrian Asset Management is a relatively new firm and may lack the track record and reputation of more established crypto asset managers.

Galois Capital

Galois Capital – Based in San Francisco, Galois Capital is a quantitative crypto asset manager that focuses on developing and implementing high-frequency trading algorithms. The firm’s investment strategies are data-driven and rely on machine learning and other advanced technologies.

Pros: Galois Capital’s use of advanced technologies allows the firm to generate alpha by identifying and exploiting market inefficiencies. The firm has a team of experienced professionals with backgrounds in computer science, finance, and trading.

Cons: Galois Capital’s investment strategies may be too complex for some investors to understand, and the firm’s use of leverage may increase risk.

Shima Capital

Shima Capital – is a crypto fund manager based in California, USA, that offers access to a diversified portfolio of digital assets. Their investment strategy includes long-term holding of cryptocurrencies and digital assets with strong fundamentals. They also participate in ICOs and STOs to gain exposure to innovative blockchain projects.

Pros: Diversified portfolio, long-term investment strategy.

Cons: Limited information available about their investment track record.

Eaglebrook Advisors

Eaglebrook Advisors is a US-based digital asset management firm that provides institutional-grade investment solutions to accredited investors. Their investment strategy includes a mix of active and passive management, with a focus on long-term capital appreciation.

Pros: Experienced team, institutional-grade investment solutions.

Cons: Limited information available about their investment track record.

Sino Global Capital

Sino Global Capital is a China-based crypto fund manager that provides investment services to high-net-worth individuals, institutional investors, and family offices. Their investment strategy includes investments in cryptocurrencies, blockchain technology, and other digital assets.

Pros: In-depth knowledge of the Chinese market, diversified portfolio.

Cons: Limited information available about their investment track record.

Walden Bridge Capital

Walden Bridge Capital is a US-based crypto fund manager that provides investment services to institutional investors and family offices. Their investment strategy includes investments in cryptocurrencies, blockchain technology, and other digital assets.

Pros: Experienced team, diversified portfolio.

Cons: Limited information available about their investment track record.

Stratified Capital

Stratified Capital is a Singapore-based crypto fund manager that provides investment services to institutional investors and family offices. Their investment strategy includes investments in cryptocurrencies, blockchain technology, and other digital assets.

Pros: Experienced team, diversified portfolio.

Cons: Limited information available about their investment track record.

Nine Blocks Capital Management

Nine Blocks Capital Management is a Dubai-based crypto fund manager that provides investment services to institutional investors and family offices. Their investment strategy includes investments in cryptocurrencies, blockchain technology, and other digital assets.

Pros: Experienced team, in-depth knowledge of the Middle East market.

Cons: Limited information available about their investment track record.

Pythagoras Investment Management

Pythagoras Investment Management is a US-based crypto fund manager that provides investment services to high-net-worth individuals and institutional investors. Their investment strategy includes investments in cryptocurrencies, blockchain technology, and other digital assets.

Pros: Experienced team, diversified portfolio.

Cons: Limited information available about their investment track record.

NovaWulf Digital Management

NovaWulf Digital Management is a US-based crypto fund manager that provides investment services to institutional investors and family offices. Their investment strategy includes investments in cryptocurrencies, blockchain technology, and other digital assets.

Pros: Experienced team, diversified portfolio.

Cons: Limited information available about their investment track record.

Hartmann Capital

Hartmann Capital is a US-based crypto fund manager that provides investment services to institutional investors and family offices. Their investment strategy includes investments in cryptocurrencies, blockchain technology, and other digital assets.

Pros: Experienced team, diversified portfolio.

Cons: Limited information available about their investment track record.

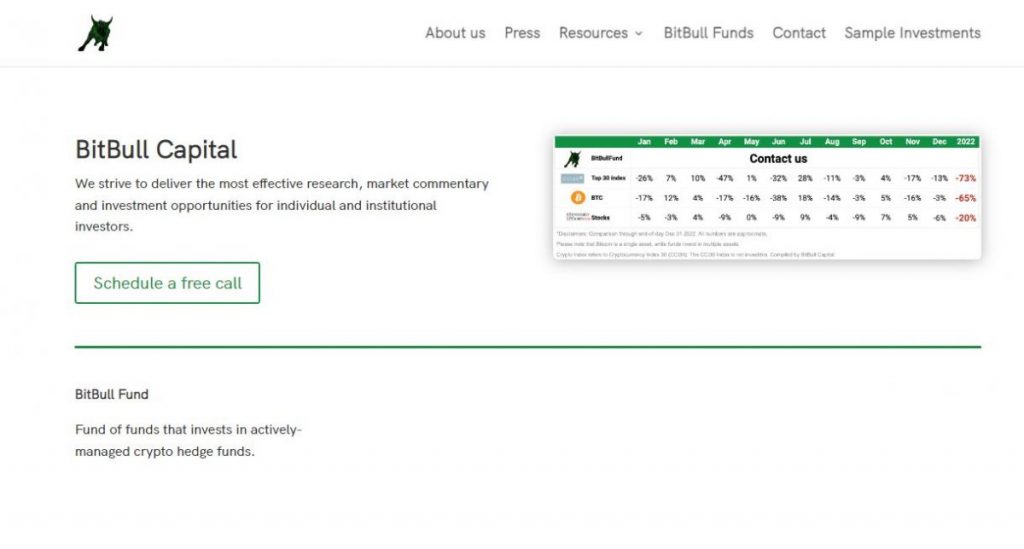

BitBull Capital

BitBull Capital is a US-based crypto fund manager that provides investment services to high-net-worth individuals and institutional investors. Their investment strategy includes investments in cryptocurrencies, blockchain technology, and other digital assets.

Pros: Experienced team, diversified portfolio.

Cons: Limited information available about their investment track record.

FAQs

Crypto asset managers are important because they offer investors a way to access the cryptocurrency market through professionally managed portfolios. These managers can provide expertise, advice, and risk management strategies to help investors navigate the volatile and complex cryptocurrency market.

Crypto asset managers typically charge a management fee based on a percentage of the assets under management (AUM). This fee can range from 1% to 2% annually, depending on the manager and the size of the portfolio. Some managers may also charge performance fees based on the returns they generate for their clients.

Crypto asset managers use a variety of investment strategies, including long-term buy-and-hold, active trading, and diversified investments across different cryptocurrencies. Some managers may also specialize in certain areas, such as hedge funds, venture capital, or private equity.

Crypto asset managers may cater to different types of clients, from high-net-worth individuals to institutional investors. Some managers may also specialize in serving certain types of clients, such as family offices or hedge funds.

Cryptocurrencies are highly volatile and can experience significant price fluctuations in short periods of time. They are also subject to regulatory risks, as governments around the world are still grappling with how to regulate the cryptocurrency market. Additionally, cryptocurrencies are vulnerable to hacking and cyber attacks, which can result in the loss of investor funds.

Investors should consider factors such as the manager’s track record, investment philosophy, and reputation within the industry when choosing a crypto asset manager. They should also consider the manager’s fees and whether they are appropriate for the size of their portfolio. Additionally, investors should conduct due diligence and research the manager’s performance, risk management strategies, and regulatory compliance.

Conclusion

Crypto asset management has become an increasingly important industry as cryptocurrencies continue to gain mainstream adoption. The top 30 crypto asset managers listed in this article represent some of the most prominent players in the space, each with their own strengths and weaknesses. Investors looking to gain exposure to cryptocurrencies may benefit from researching these managers and their investment strategies to determine which may be the best fit for their investment goals and risk tolerance.

Read more related articles:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.