Tide Capital: The Main Uptrend for BTC May Have Quietly Begun

In Brief

The macroeconomic environment has stabilized, leading institutional investors to increase cryptocurrencies, with BTC outperforming U.S. stocks and gold, indicating a potential uptrend.

Recently, the macroeconomic environment has stabilized, and institutional investors are increasing their allocations to cryptocurrencies. BTC has begun to outperform U.S. stocks and gold, signaling that a new main uptrend may be underway. Although the altcoin season has not yet arrived, the meme sector deserves close attention.

Stable Macroeconomic Environment, Risk Assets Continue to Rise

Since entering the fourth quarter, the U.S. economy has shown strong performance and resilience, with inflation under effective control. The market generally expects a “soft landing” to be the baseline scenario. Supported by both fiscal and monetary policies, the U.S. stock market has reached new highs, benefiting the overall rise of risk assets.

Source: TradingView

However, the U.S. has significantly increased its debt to boost the economy, leading to a rapid expansion of its debt size, which has triggered a crisis of confidence in the dollar among investors. To hedge against the potential risks of a dollar credit collapse, investors are turning to gold, which has a limited supply, driving it to continuously reach historical highs.

Source: TradingView

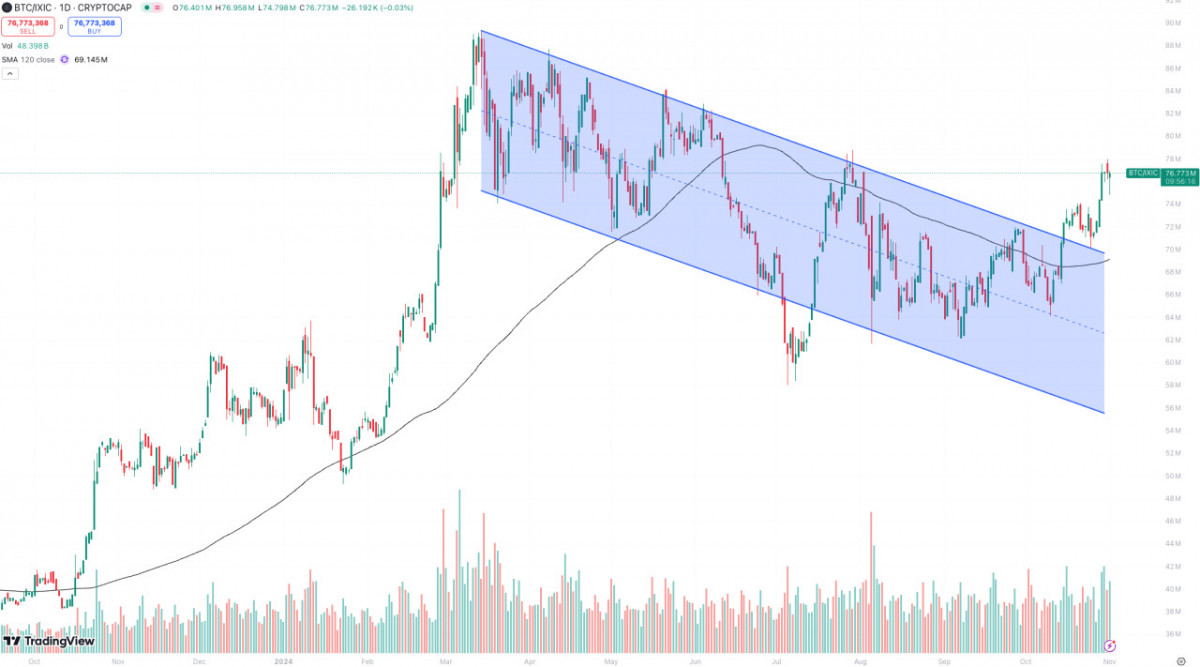

At the same time, Bitcoin, known as “digital gold,” has once again surpassed $70,000, approaching its historical peak. Unlike six months ago, Bitcoin has undergone substantial consolidation, absorbing the selling pressure from the previous surge and resulting in a healthier chip structure.

Source: TradingView

Overall, the recent macroeconomic environment appears stable. Risk assets are benefiting from the dual support of U.S. fiscal and monetary policies, and they are currently on an upward trend. Looking ahead, the Federal Reserve is expected to further cut interest rates, and quantitative tightening (QT) will conclude next year. Liquidity will become more accommodative, helping to sustain the rise of risk assets.

BTC Begins to Outperform U.S. Stocks and Gold, Main Uptrend May Have Started

As Bitcoin’s market capitalization continues to grow, its correlation with the U.S. stock market has gradually strengthened. Global liquidity typically first flows into U.S. stocks before spilling over into the cryptocurrency market. Consequently, Bitcoin may sometimes outperform or lag behind U.S. stocks, reflecting changes in investor risk appetite.

Notably, Bitcoin has recently outperformed the Nasdaq index significantly, with the BTC/IXIC breaking out of a downtrend and stabilizing above the 120-day moving average. This indicates that institutional investors are gradually shifting their asset allocation focus toward Bitcoin.

Source: TradingView

Moreover, Bitcoin’s shadow stock, MSTR, has recently outperformed Bitcoin itself, reaching a historical high. MSTR’s business model involves issuing bonds to purchase Bitcoin, effectively making its stock a leveraged instrument for Bitcoin. The continuous rise of MSTR reflects strong confidence among institutional investors in Bitcoin’s future performance.

Source: TradingView

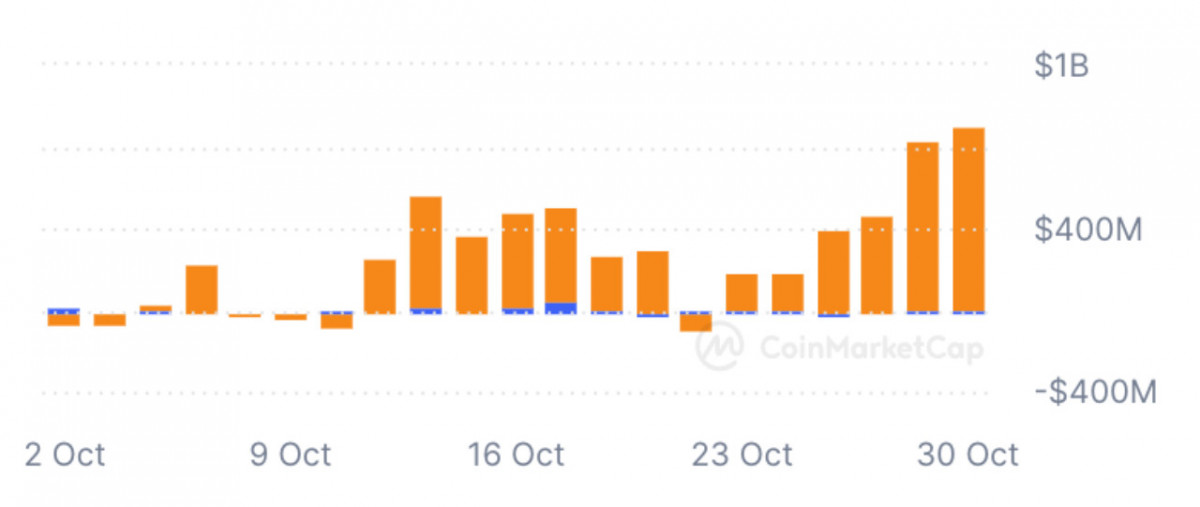

In addition, Bitcoin ETFs have seen significant inflows for several consecutive days, reminiscent of the substantial rise in BTC following the launch of Bitcoin ETFs. On October 30, the net inflow for Bitcoin ETFs reached $900 million, marking the second-highest single-day total in history.

Source: CoinMarketCap

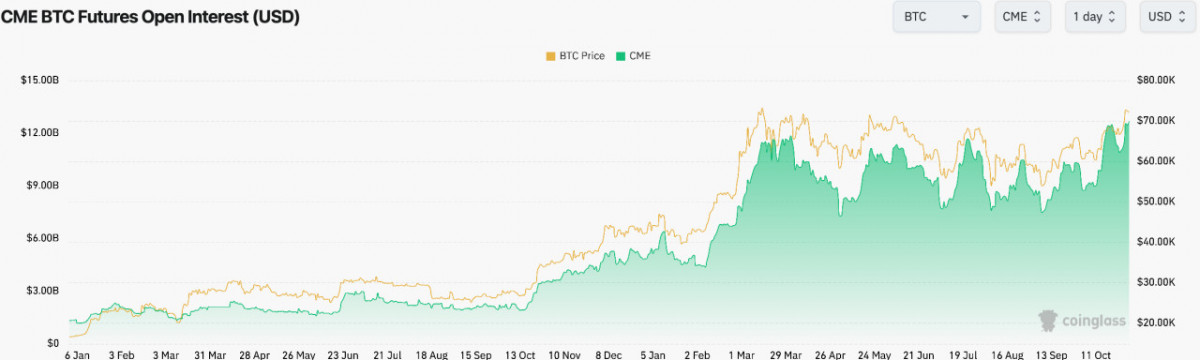

Furthermore, CME data reflecting U.S. institutional trading activities shows a significant increase in BTC futures open interest, reaching a new high of $12.7 billion.

Source: Coinglass

These data points indicate a substantial increase in institutional interest in Bitcoin, with off-market funds accelerating their inflow into Bitcoin. BTC has begun to outperform other major asset classes, and a new main uptrend may have quietly commenced.

The Altcoin Season Has Not Yet Arrived, but the Meme Sector Is Worth Watching

Although Bitcoin is nearing its historical peak, the overall performance of altcoins remains lackluster. Excluding BTC, the total market capitalization of cryptocurrencies (TOTAL2) remains relatively low, failing to break the September highs, which suggests a weak upward sentiment in the altcoin market.

Source: TradingView

This indicates that new market inflows are primarily directed toward Bitcoin, with little to no capital flowing into other cryptocurrencies. The dominance of Bitcoin (BTC.D) has recently reached new highs, exceeding 60%. Until Bitcoin breaks its historical peak, the bullish sentiment will likely remain concentrated in Bitcoin, making it difficult for altcoins to attract significant inflows, and the overall downtrend may persist.

Source: TradingView

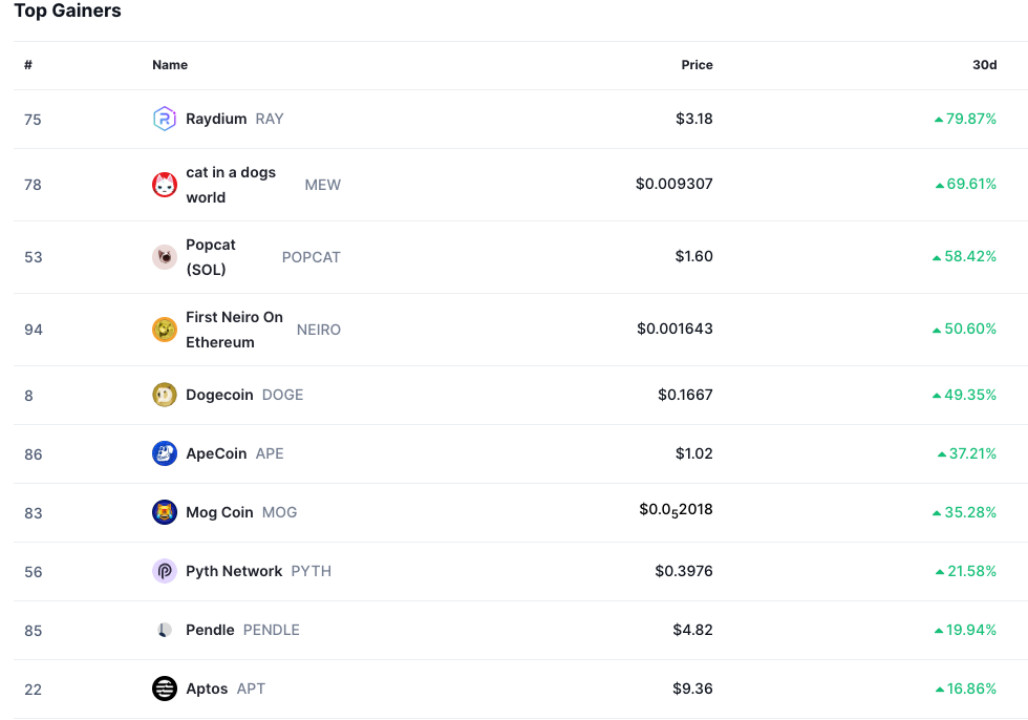

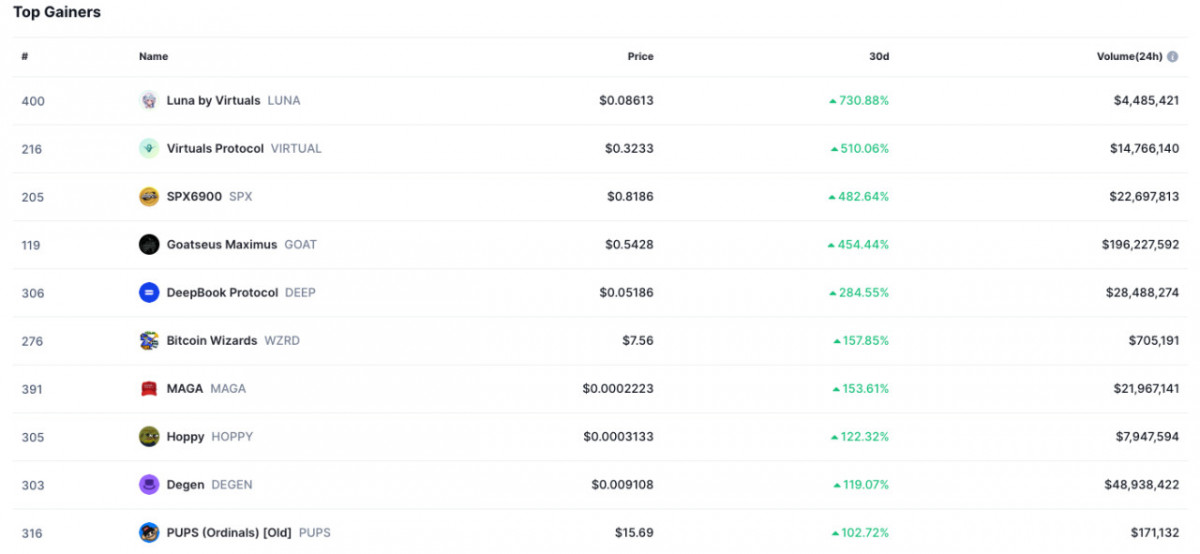

However, the meme sector presents a noteworthy exception. Among the top 100 tokens by market capitalization, 6 of the 10 tokens with the highest returns over the past 30 days are meme coins.

Source: CoinMarketCap

In the top 500 tokens by market capitalization, the best performers are almost all meme coins. In a context where overall funds are not abundant, small-cap meme coins can achieve higher returns in a short time, capturing nearly all the attention and liquidity in the altcoin market.

Source: CoinMarketCap

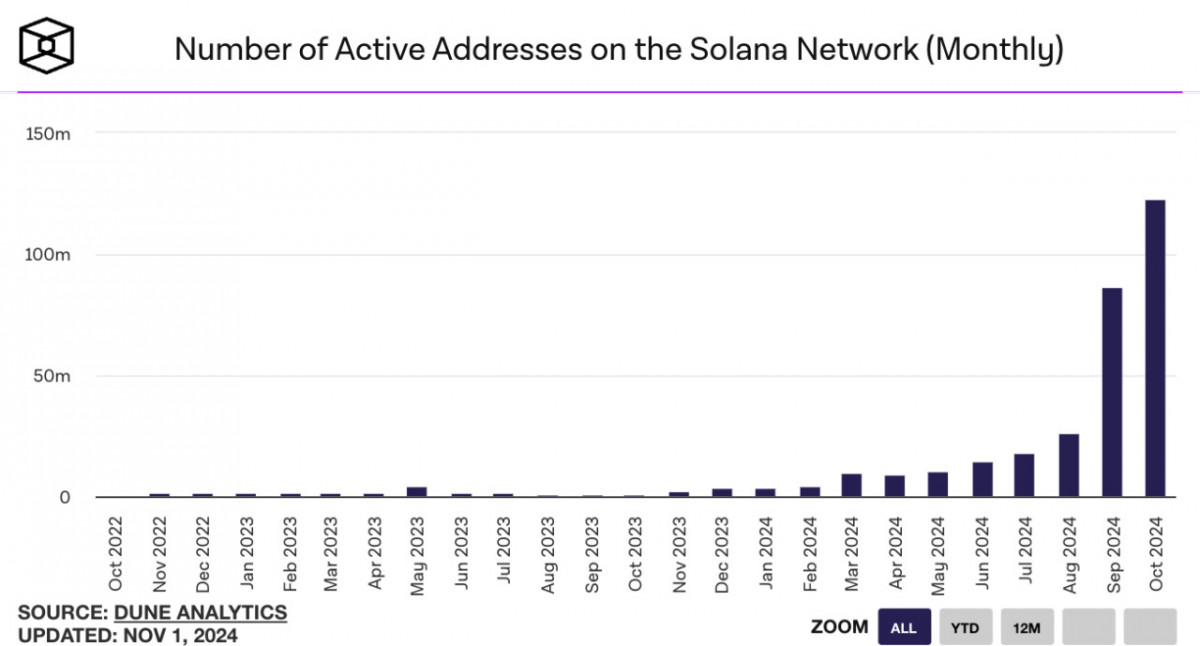

At the same time, Solana is gradually becoming the main trading network for meme tokens. Its low costs and high TPS performance are well-suited for retail traders engaging in meme transactions, and the popularity of the meme sector has brought a significant number of new users to Solana. In October, Solana’s active addresses surpassed 100 million, setting a new historical high.

Source: The Block

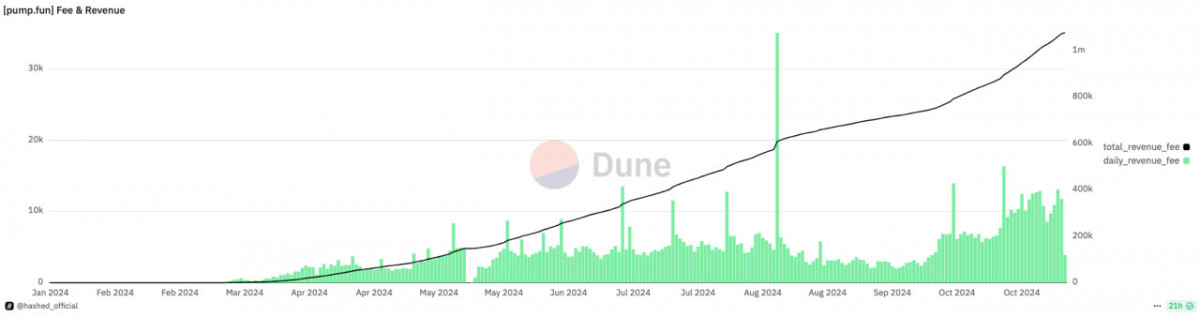

The emergence of new token issuance and trading platforms is also accelerating the adoption of meme coins. For instance, Pump.fun launched on the Solana network this year, providing users with convenient Meme token issuance and early trading services, with its trading volume once accounting for over half of Solana’s network activity. In October, Pump.fun set new records for both token deployment and revenue, with daily income exceeding $1 million.

Source: Dune Analytics

Another popular trading platform for meme tokens is Moonshot, which is well-received for its easy deposit process and simple operations. Moonshot combines the functions of a wallet and an exchange, significantly lowering the entry barrier for users. The platform has a streamlined registration process, allowing users to avoid managing private keys or mnemonic phrases, and it supports fiat currency deposits through various payment methods, including credit cards, PayPal, and Apple Pay. Moonshot has demonstrated a noticeable “listing effect”, as well-known meme coins such as $GOAT, $MOODENG, and $SPX have experienced multiples in returns after being listed.

Source: Moonshot Website

Overall, the influence of the meme sector in the cryptocurrency market is continually growing. Despite the inherent lack of utility of meme tokens, the underlying infrastructure, including blockchain networks, trading platforms, and payment tools, is developing positively, continually lowering barriers and enhancing user experience. As the macro environment becomes more accommodative and investor risk appetite increases, the meme sector may see even more impressive performances.

Institutional investors are increasing their allocations to cryptocurrencies, and a new main uptrend for BTC may have quietly begun.

Disclaimer

The information in this article is from public sources, and Tide Capital does not guarantee its accuracy or completeness. Opinions and forecasts are speculative and may differ from actual outcomes due to data limitations and unforeseen risks. This article does not provide investment advice, recommendations, or solicitations to buy or sell digital assets. Tide Capital bears no responsibility for any misuse or misinterpretation of this content.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Tide Capital stands as a research-focused digital asset investment and trading firm committed to navigating the evolving landscape of digital finance. With a foundation in both macroeconomic analysis and fundamental research, the firm identifies and captures both beta and alpha opportunities, harnessing shifts from crypto waves to broader financial trends.

More articles

Tide Capital stands as a research-focused digital asset investment and trading firm committed to navigating the evolving landscape of digital finance. With a foundation in both macroeconomic analysis and fundamental research, the firm identifies and captures both beta and alpha opportunities, harnessing shifts from crypto waves to broader financial trends.