CBDC Tracker 2025: US, China, EU, And Israel Shape The Future Of Government-Backed Digital Currency

In Brief

In 2025, countries around the world are advancing at different speeds in developing central bank digital currencies (CBDCs), balancing innovation with privacy, security, and national policy priorities, as they prepare for a digital future where physical cash plays a reduced role.

In 2025, many governments and national banks are working on CBDCs — central bank digital currencies. These are digital forms of government money that can be used like cash or bank transfers but in a digital system. The goal is to update how money works in each country and prepare for a world where cash is no longer the main way people pay.

Different countries are moving at their own pace. Some have already launched CBDCs. Others are still writing the rules or testing the technology. The biggest focus areas are how to protect people’s privacy, how much control central banks should have, and how to make digital money work with existing systems.

For earlier milestones and background on the global CBDC race, including China’s early pilots and the EU’s investigation phase, refer to this detailed overview.

This article looks at how the United States, China, European Union, and Israel are building their CBDC systems — and how each one reflects a different political and technical strategy.

The U.S. Approach: Policy First, Privacy Still the Priority

The United States has not yet launched a digital dollar, but there have been many discussions. In the last few years, the Federal Reserve has released multiple documents explaining what a future CBDC might look like in the U.S.

The U.S. is focused on these three points:

- Protecting user privacy and freedom;

- Stopping illegal activity using digital money;

- Keeping the U.S. dollar as the leading currency in the world.

In 2022, the U.S. Congress introduced the eCASH Act — short for Electronic Currency and Secure Hardware Act. This bill suggests creating a digital dollar that works like cash. It would be private, work offline, and not be controlled by one central database. Users could make payments without linking their identity, similar to how physical cash works today.

But this bill is still under review. There’s no official digital dollar yet. The Federal Reserve and other agencies like the U.S. Treasury and Congress are still working out how to design it. Their approach is slower than in other countries because they want to make sure it fits the U.S. Constitution and public expectations.

China: Moving Fast with Central Control

China is far ahead in creating and testing its CBDC, called the digital yuan or e-CNY. It started small in 2020 and expanded quickly. The People’s Bank of China (PBoC) has tested the digital yuan in many big cities. People can already use it to pay for buses, shop online, and even receive salaries.

By 2023, over 260 million people had access to e-CNY. That makes it the largest CBDC pilot in the world.

But China’s model is very different from the U.S. It is fully centralized. The government can track how the money is used. It can follow each transaction in real time and stop money from moving if needed. Chinese leaders say this helps stop fraud, tax evasion, and corruption. Critics worry that it gives the government too much control and not enough privacy to users.

European Union: Privacy Comes First

The European Central Bank (ECB) is building a digital euro. Unlike China, the EU puts privacy and personal choice at the center of its plan.

In October 2023, the ECB finished its research phase and started working on a real version. The digital euro will be:

- Usable both online and offline;

- Protected by privacy settings;

- Built to work in all EU countries;

- Designed with limited data sharing, only what’s needed for law enforcement.

Banks and other companies that handle the digital euro will only collect the minimum information required by anti-money laundering rules. Users will have more freedom to choose how private their payments are.

This plan matches the EU’s usual rules that protect user rights and give people more control over how their information is used.

Israel: Building and Testing, but Not Rushing

In March 2025, the Bank of Israel introduced a full draft of the digital shekel. It includes many new features like:

- Smart contracts, which let money follow certain rules;

- Offline mode, so payments still work without the internet;

- Faster and cheaper payments for local and cross-border uses.

Israel also created the Digital Shekel Challenge, which invites tech companies to test the currency in creative ways. But even though the design is ready, Israel is waiting to see how things develop in the European Union before launching its own CBDC.

This shows that Israel is taking a careful, step-by-step approach. It wants to be ready but not go first.

The Rise of No-KYC Crypto Wallets as an Alternative

While governments build their own digital currencies, some users are turning in a different direction. They want more privacy than what CBDCs can offer.

This is where no-KYC crypto wallets come in. These tools allow people to buy Bitcoin without KYC — meaning they don’t have to show ID or personal information. Unlike traditional banks, these wallets don’t collect user data. That makes them attractive to those who care about privacy and freedom.

Many privacy-focused investors believe government-issued currencies, even in digital form, could increase financial surveillance. This has created more interest in non-custodial wallets and decentralized exchanges that give full control to the user.

Smaller Countries Already Live — But Still Face Challenges

While the world watches the U.S., China, and the EU, some smaller countries have already gone live with CBDCs. These include:

- The Bahamas — with the Sand Dollar;

- Nigeria — with the eNaira;

- Jamaica — with Jam-Dex.

These early movers showed that launching a digital currency is possible. But their systems have faced issues. Many people still use cash. Merchants are slow to accept digital money. And some areas have limited internet coverage.

Still, they offer a test case for others, showing what works and what needs improvement.

The Bigger Picture: CBDC Plans Around the World

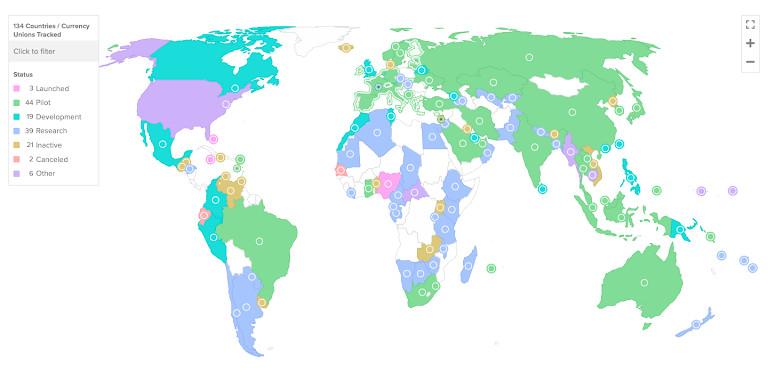

According to the latest data, 134 countries are working on CBDCs in some form — whether it’s research, pilot programs, or full-scale design. Most central banks are trying to figure out how to make digital money that works safely and respects their country’s laws.

A 2024 report by the International Monetary Fund (IMF) says that CBDCs could reduce the cost of money transfers by 30–40%. They could also make public spending more transparent and cut down delays in government payments. But there are also risks: cyberattacks, technical failures, and over-centralization of user data.

One Global Trend, Many Local Paths

In March 2025, Christine Lagarde, President of the European Central Bank, stated during her speech:

“A digital euro could help to ensure a socially optimal level of data protection and would enable citizens to transact in the digital economy while enjoying the privacy benefits associated with cash.”

Her words highlight the central question governments now face: how to bring digital currency into everyday use without losing the freedoms people associate with traditional money. Trust will not come from speed or innovation alone — it will depend on how well new systems reflect the values they’re meant to serve.

The shift is already underway. As digital currencies move from theory to practice, public confidence will shape their future more than policy timelines.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.