The $10 Billion Ethereum Boom: Unpacking the Potential Market Impact of CBOE’s Groundbreaking ETF Launch

In Brief

The Chicago Board Options Exchange has confirmed the launch date for five spot Ethereum ETFs, marking a significant shift in the cryptocurrency regulatory environment.

The cryptocurrency industry is buzzing with excitement as the Chicago Board Options Exchange officially confirmed the July 23, 2024, launch date for five spot Ethereum ETFs.

On May 23, the US SEC approved rule modifications that made it possible for spot Ether ETFs to be listed. Many industry observers were taken aback by this decision, considering the SEC’s prior examination of Ethereum-focused businesses and its typically cautious stance against financial products linked to cryptocurrencies.

Only four months after spot Bitcoin ETFs were introduced in the US, spot Ethereum ETF certification shows how quickly the cryptocurrency regulatory environment is changing. The SEC’s new position reflects a larger movement in favor of accepting and incorporating digital assets into established financial institutions.

The Five Pioneering Spot Ethereum ETFs

Five spot Ether ETFs are scheduled to start trading on the designated day, according to the CBOE’s release. Among these are: EZET, QETH, ETHV, FETH, and CETH. With none of these offerings requiring investors to keep or handle cryptocurrency directly, they will all provide them exposure to Ethereum’s price swings.

The wide range of interest in Ethereum from different segments of the investment world is demonstrated by this diversified lineup of ETF providers, which includes both well-known financial institutions and businesses specializing in DeFi. The participation of prominent figures in traditional finance, in addition to crypto-native businesses, highlights the increasing convergence of the traditional and digital asset markets.

Competitive Pricing Techniques in a New Market

The majority of ETF issuers have declared intentions to temporarily eliminate or reduce fees in an attempt to obtain an early market edge. This competitive approach seeks to draw in investors and gain market share. Although various issuers provide varying cost structures, there is a general tendency toward extremely low rates, at least during the first stages of introduction.

For example, one of the biggest names on the market, BlackRock, has stated that it will impose a management fee of 0.25% on its spot Ethereum ETF, ETHA. However, during the first launch phase, which will be the same until the ETF hits $2.5 billion in net assets or a full year of operation, the business intends to lower this cost to 0.12%.

ETF issuers frequently employ this tactic of providing reduced fees during the launch period in an effort to draw in early adopters and cultivate a sizable investor base.

Investors stand to gain from the competitive pricing environment, which might result in cheaper access to Ethereum through regulated investment tools. It is unclear, though, how viable these low-charge arrangements will be in the long term and how they could change as the market gets more established.

Possible Effects on the Market and the Possibility of a Supply Shortage

The cryptocurrency market as a whole is anticipated to be greatly affected by the launch of spot Ethereum ETFs. Industry observers estimate that in the months after their introduction, these ETFs may draw net inflows of billions of dollars. The amount of money coming in from both institutional and individual investors might significantly affect Ethereum’s price and market dynamics.

Tom Dunleavy has voiced a bullish view, speculating that capital inflows into Ethereum ETFs might total $10 billion this year alone, with monthly inflows potentially reaching $1 billion. With such large inflows, Ethereum’s price and market capitalization may rise as a result of greater demand.

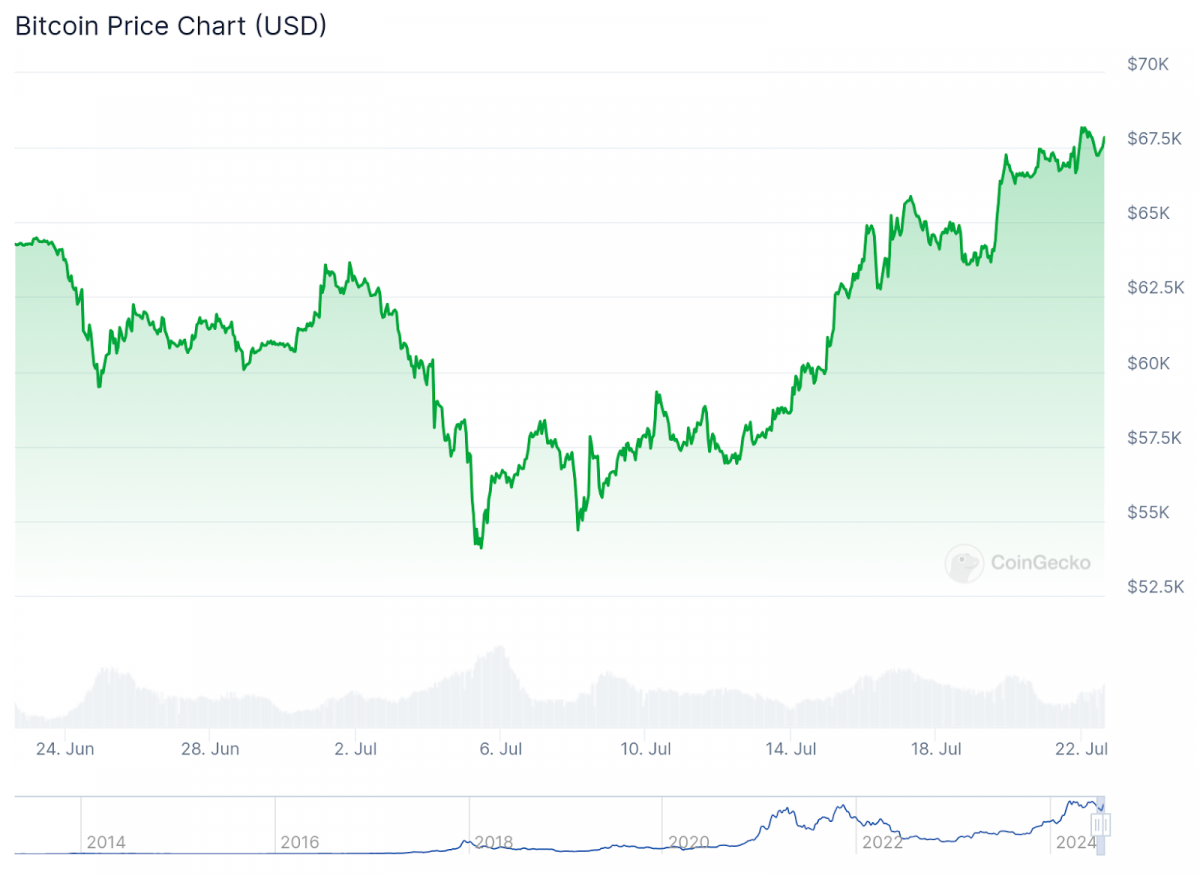

Photo: CoinGecko

There may be a shortage of Ether due to institutional investors’ growing desire to include it in their ETFs. The quantity of Ether that is available for purchase on cryptocurrency exchanges is tracked by the Ethereum Exchange Reserve, which is presently at multi-year lows. Due to the decreased liquidity, there may be more price volatility and a chance that Ether may surpass Bitcoin in terms of percentage gains.

In a recent analysis, Kaiko emphasized Ether’s 1% market depth and hypothesized that less liquidity may lead to more price volatility, which would raise Ether’s price in response to stronger demand. In the short to medium term, at least, this dynamic may cause Ether to exceed Bitcoin in percentage terms.

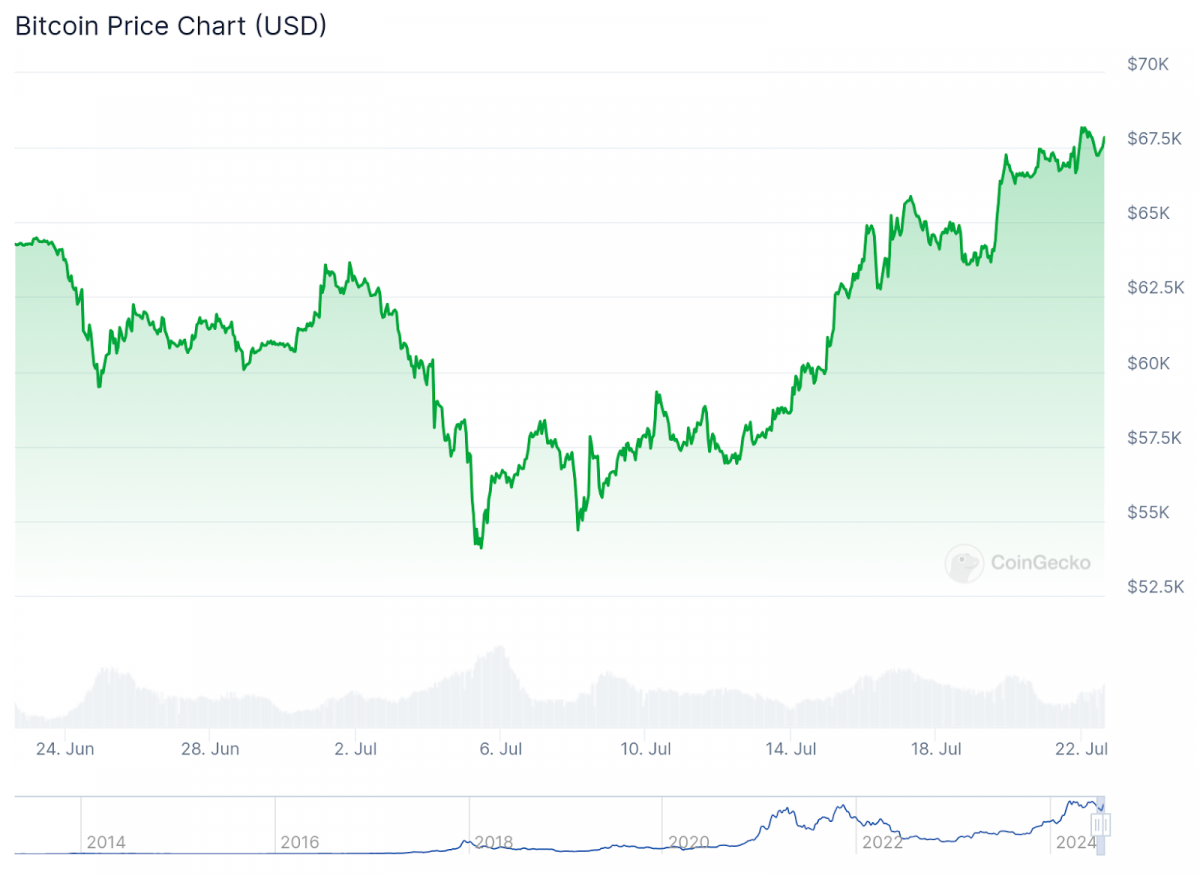

Photo: CoinGecko

Staking Dynamics and Holder Behavior

There have been some intriguing advancements in Ethereum’s staking environment in tandem with the announcement of spot ETH ETFs. Bitwise’s chief investment officer, Matt Hougan, has observed that Ethereum holders seem less likely than Bitcoin holders to liquidate their holdings. The fact that over 28% of Ether’s supply is now locked up in staking contracts lends credence to this claim.

Moreover, a rise in withdrawals to cold storage from exchanges suggests that holders of Ether wait for higher prices in the future. This conduct indicates that current holders have high faith in Ethereum’s long-term value proposition, which may further exacerbate supply shortages and lead to price hikes.

The Future of Crypto ETFs and Regulatory Considerations

The approval process and forthcoming launch of Ethereum ETFs raise questions about whether other cryptocurrencies may be used to create comparable products. Though some industry players think Solana could be the next cryptocurrency to get a spot ETF in the US, it’s unclear how other digital assets will be regulated in the future.

The introduction of cryptocurrency ETFs other than Bitcoin and Ethereum, according to Bloomberg ETF expert James Seyffart, is unlikely to occur without major regulatory reforms. Seyffart highlights the distinct places that Bitcoin and Ethereum have in the regulatory environment and stresses the necessity of a regulated market to keep an eye out for fraud and manipulation using these assets.

The regulatory environment around cryptocurrencies has also influenced the approval process politically. Seyffart thinks that political choices rather than just financial ones most likely had an impact on the acceptance of spot Ethereum ETFs.

Market Reaction and Price Implications

Remarkably, Ethereum’s price has not been greatly impacted in the near term by the news of the ETF debut date; as of the most recent data, ETH is trading at $3,495.

Nonetheless, a lot of market observers believe that the cash coming into spot Ethereum ETFs will have a long-term favorable impact on the value of the cryptocurrency. A new class of investors may be drawn to Ethereum by its expanded accessibility through regulated investment procedures. These actions might result in long-term demand and price growth.

It’s important to remember that the cryptocurrency industry has already grown greatly in 2024, with Bitcoin rising to record highs after the introduction of spot Bitcoin ETFs. A similar pattern for ETH may be sparked by the launch of Ethereum ETFs, but historical performance does not guarantee future outcomes.

Bridging Traditional Finance and Cryptocurrency

An important first step toward closing the divide between conventional finance and the cryptocurrency sector is the introduction of spot Ethereum ETFs. Potentially, it can help with the attraction of a wider range of investors who would otherwise have been reluctant to interact directly with cryptocurrency exchanges or wallets.

This might result in better price discovery, more liquidity, and general market maturation for Ether. The fact that well-known financial institutions are selling Ethereum ETFs gives the asset legitimacy and may open the door for more cryptocurrency incorporation into traditional financial systems.

Regulatory Hurdles and Final Approvals From Authorities

The debut of the spot Ethereum ETFs is still pending the SEC’s final approval of each fund issuer’s S-1 registration statement, despite the fact that the CBOE has announced the trading date. In the CBOE’s release, the term “pending regulatory effectiveness” emphasizes this important point.

A detailed examination of each fund’s registration paperwork is required in order to receive final regulatory clearance. It is needed for adherence to all applicable securities laws and regulations. Although the May approval of the 19b-4 forms was a big step in the right direction, these goods can only go forward if this last regulatory obstacle is overcome.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.