Leveraged Yield Farming in 2024: New Developments and Top-picks

In Brief

This article explores leveraged yield farming (LYF), an investment strategy in DeFi that offers investors higher passive income with lower APRs compared to TradFi.

DeFi presents lots of possibilities for investors to receive passive income with APRs consistently higher than in TradFi. Starting from low-risk but relatively low-gain token staking to liquidity mining, and high-gain leveraged strategies, anyone can find a strategy for themselves with an acceptable risk/return ratio.

In this article, we are going to explore the principles of leveraged yield farming (LYF) – an investment strategy that allows to supercharge DeFi earnings.

Liquidity Mining Explained

To grasp the idea of leveraged farming, one must first understand DeFi yield farming (e.g., liquidity mining) in general.

For a decentralized exchange (DEX) to operate, tokens must accrue in its liquidity pools (e.g., UniSwap’s USDC/ETH pool). These assets are provided by DeFi users (liquidity providers) who receive passive yields from their deposits. These yields typically come from trading fees, bonus DEX tokens, and loyalty points.

That’s the idea behind liquidity mining – contributing to DeFi liquidity to earn passive income.

However, as with any DeFi strategy, liquidity mining comes with its set of risks. In this case, it’s impermanent loss (IL) that may occur in market volatility periods. In order to reduce exposure to IL, liquidity providers (LPs) are required to be tuned into market trends and rebalance their portfolios when they shift.

What is Leveraged Yield Farming?

It’s obvious that the more tokens you can provide to liquidity pools, the more returns you can receive. LYF protocols allow you to use more liquidity for farming purposes than you have in stock!

In essence, they allow you to borrow external funds, use them for farming yield, and receive boosted earnings.

Of course, lenders don’t provide you liquidity out of the kindness of their hearts. They also expect to turn a profit. Borrowers have to pay royalties on their loans even though borrowing interests in LYF are relatively high. Potential yields are higher thanks to efficient capital utilization.

The unique feature of LYF protocols is that they allow farmers to borrow more than their deposit is worth as collateral. You might ask – but how is this safe for lenders? It actually is. Because unlike regular crypto lending protocols, the leveraged assets can’t leave the platform. Farmers use DEXs integrated into the platforms for farming yield, ensuring asset security for lenders.

How Does Leveraged Yield Farming Work?

Two types of users must participate in LYF: lenders and borrowers (farmers). The first provides assets to lending pools, and the latter borrows them to farm yield.

For leveraged farming, users must lock some assets as collateral and borrow up to 10 times the collateral (depending on the protocol and pool). This leverage can then be used to open a position on any supported yield farming platform.

When a position is opened, the LYF protocol will use one of its partner DEXs to swap and add tokens to a liquidity mining pool, possibly staking the minted LP tokens to further boost the APR. These transactions happen “under the hood” and the farmer only needs to open his LYF position and occasionally claim rewards.

LYF provides the opportunity to farm with more assets than the users have, boosting capital efficiency, and facilitating substantially higher returns on investment, though with additional risks that we will discuss below.

Leverage lenders can also expect higher returns than in traditional lending platforms. These protocols usually employ an algorithm for increasing loan interest rates at higher utilization (ratio of assets lent to the total in the lending pool) and in LYF, users can leverage more than they deposit as collateral (undercollateralized loans), boosting utilization and lending returns.

Risks of Undercollateralized Loans

With boosted yields, LYF inevitably has increased risks. As on any lending platform, users can be subject to liquidations.

It can occur when the debt ratio (collateral/leverage value) drops below a point where you won’t have enough assets to repay the lenders. In leveraged positions, the debt ratio is even more susceptible to market dynamics. Leverage borrowers have to carefully choose and fine-tune their strategies as well as check their debt condition regularly to mitigate potential losses.

To minimize the risks of liquidation, you can consider the following:

- Check your debt ratio/health factor regularly. If it approaches the protocol/pool-specific thresholds, add collateral or repay part of your debt;

- Do your research, follow market trends, and keep a safety margin on your position;

- Use lower leverage. Maximum leverage levels mean the highest risks;

- Deposit and farm stablecoins. They typically provide lower APRs but are mostly safe from liquidations.

Top 4 Leveraged Yield Farming Platforms

Different protocols provide their users with different implementations for LYF, using various available strategies and safety mechanics. Let’s discuss some of the well-established platforms you can potentially explore further to start farming with leverage.

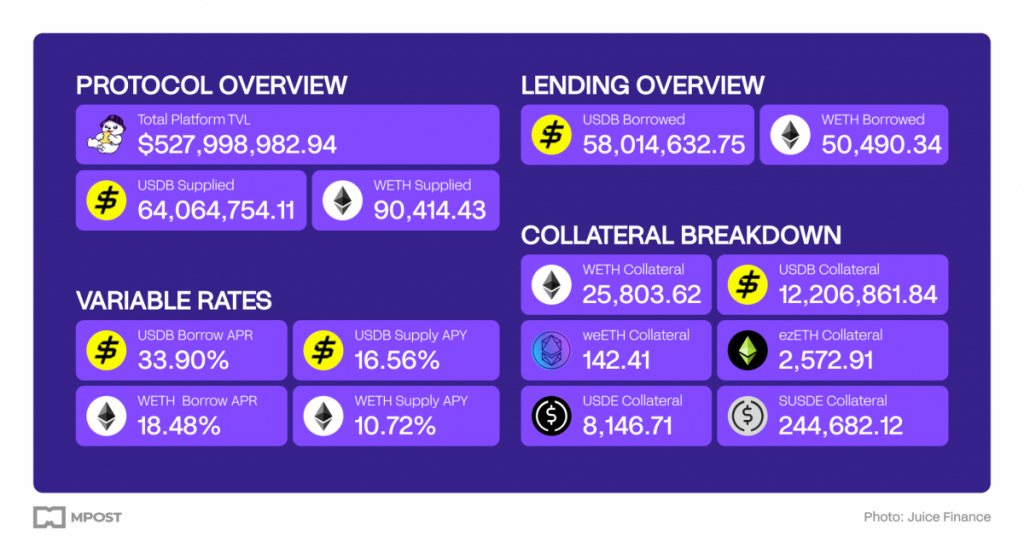

Juice Finance

Built within the Blast ecosystem, it’s a leveraged yield farming platform with approx. $530M TVL accepting $USDB and $WETH deposits and providing lenders with ~15% APR, depending on the supplied asset.

Farmers can leverage these tokens against stablecoin or LSTETH collateral to earn yields in a variety of vetted vaults from ecosystem partners. Juice users can not only farm by providing liquidity to DeFi but also use WETH leverage to farm in restaking platforms like EtherFi, Kelp, and Renzo, among others.

By maximizing points and yield farming, Juice Finance can provide substantial yields to borrowers, ranging from 20-35% at the time of writing.

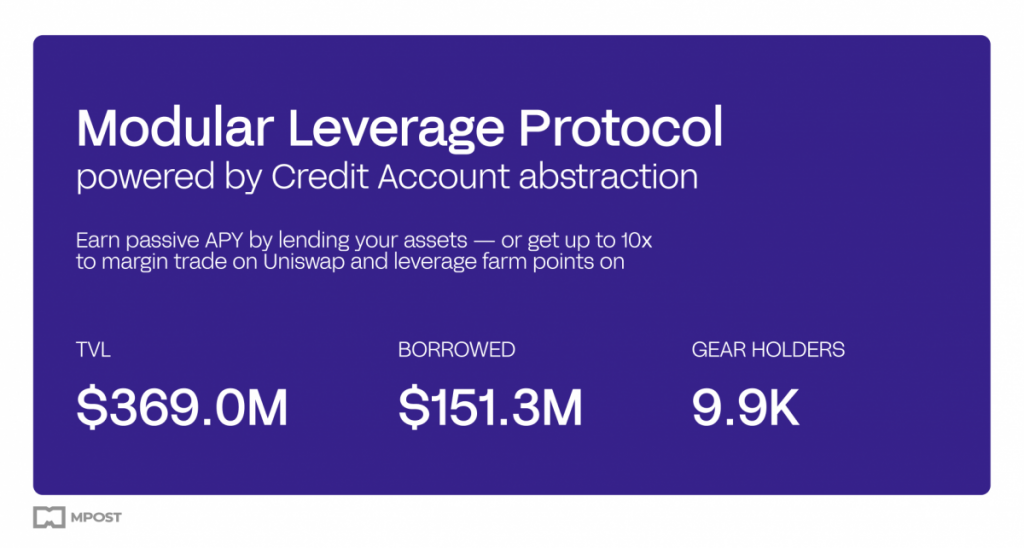

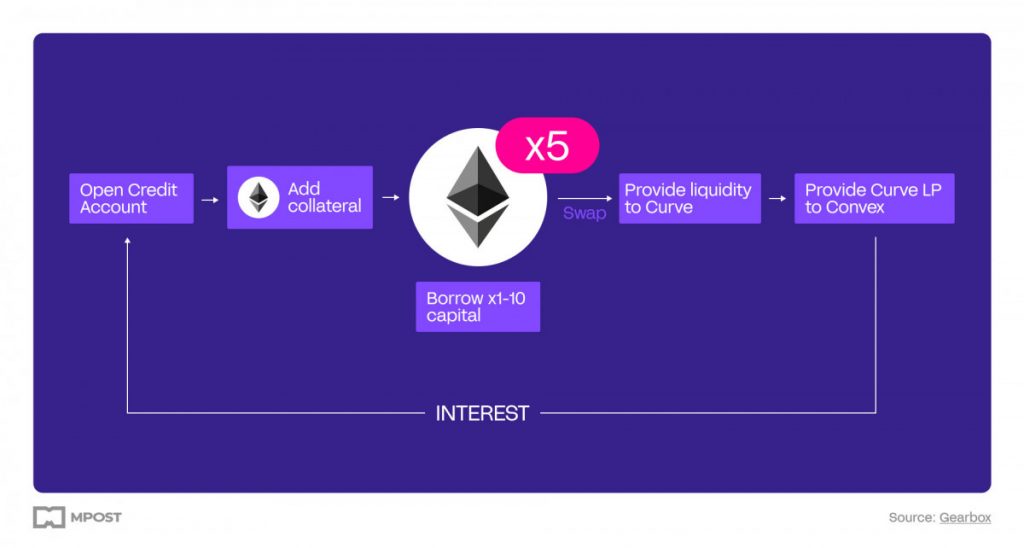

Gearbox Protocol

Operating in the Ethereum, Arbitrum, and Optimism ecosystems, Gearbox has accumulated over $350M TVL since its launch in late 2023.

With Gearbox, users can borrow assets to participate in leveraged farming, staking, and restaking. Their model is straightforward – deposit collateral and leverage up to 10x to farm in protocols like Curve, Convex, Lido, etc.

With their wide choice of one-click strategies and gauge voting boosts, Gearbox can provide supercharged LYF yields (ATTOW, up to 88% APR on some Convex pools).

Francium

Built as a decentralized yield strategy aggregator on Solana, it provides its users with a variety of smart trading strategies, including up to 3x leveraged yield farming.

With the introduction of auto-rebalancing vaults, Francium provides easy-to-use one-click strategies with minimized impermanent loss and liquidation risks, offering lenders and farmers APRs of up to 10% and 40%, respectively.

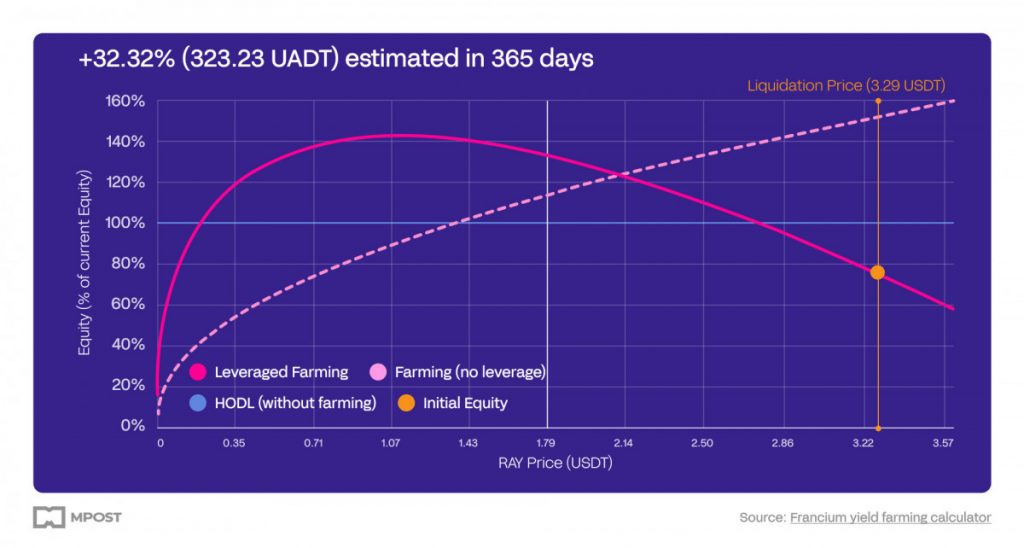

With a built-in yield farming calculator, users can easily visualize and compare their potential earnings for regular and leveraged farming to make informed strategy decisions based on expected market tendencies.

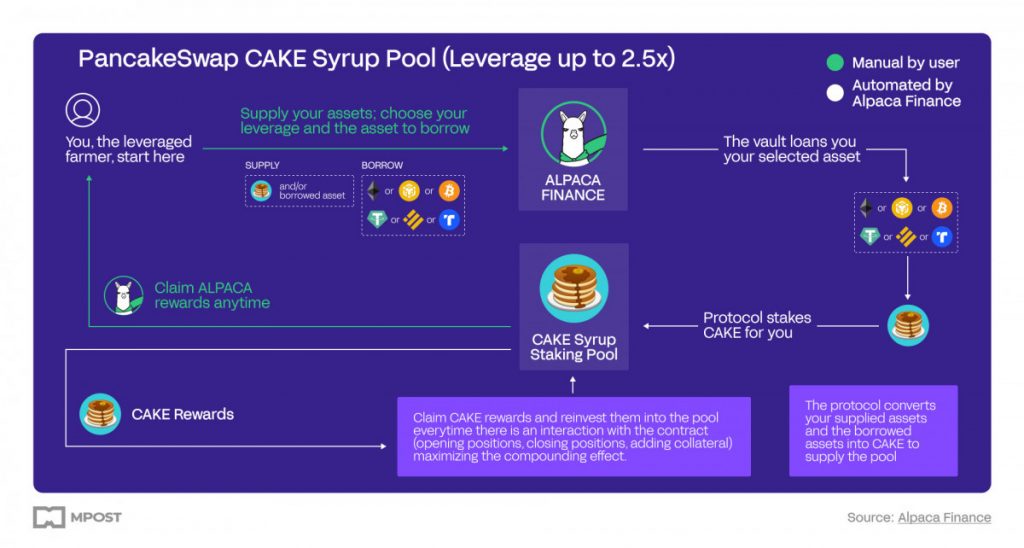

Alpaca Finance

It’s an OG DeFi earning ecosystem on BNB and Fantom, providing users with a variety of products like lending, LYF, automated vaults, perpetual futures exchange, and Alpie NFTs with multiple utilities.

However, Alpaca leveraged yield farming is the core product, offering the opportunity to leverage up to 3x (4.5x if Alpie NFT is staked) for farming on PancakeSwap, Mdex, and Biswap with boosted returns.

The Future of Leveraged Yield Farming

Utilizing undercollateralized loans for yield farming has proved to be a great opportunity to maximize DeFi profits. In the beginning, these high-gain strategies were efficiently applied only by experienced traders. Now, with the introduction of automated vaults and built-in liquidation protection mechanics, they are becoming ever more enticing for regular DeFi users.

“The evolution from 1st Generation to 5th Generation was only around a year. The pace of development in yield farming and DeFi is shocking. Going forward, there will be more products that focus on higher leverage, expand on new blockchains, and develop new strategies.” – stated re:base ventures.

By providing high yields to users from enhanced capital efficiency rather than from the protocol’s governance tokens (like the majority of DeFi platforms), leveraged yield farming promises to be a more sustainable pathway for earning in DeFi.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Anthony is a blockchain analyst and writer with an academic background in biochemistry. He works as researcher and content creator in the PowerPool protocol, covering ecosystem updates, new DeFi/dePin/AI products, and analysis of various web3 protocols.

More articles

Anthony is a blockchain analyst and writer with an academic background in biochemistry. He works as researcher and content creator in the PowerPool protocol, covering ecosystem updates, new DeFi/dePin/AI products, and analysis of various web3 protocols.