Bridging the Gap: Why Global AML Standards Still Fall Short in Crypto

In Brief

Crypto’s early “Wild West” of fast, anonymous trading soon drew global regulators’ attention as untraceable money invited abuse.

In crypto’s early days, regulation was an afterthought. The market was fast, anonymous, and borderless — a digital frontier where exchanges popped up overnight and oversight was virtually nonexistent. It was, as many described it, the “Wild West” of finance.

But what started as an experiment in decentralized freedom quickly drew the attention of regulators worldwide. The reason was simple: where there’s money — especially untraceable money — there’s opportunity for abuse.

From Chaos to Control: The First Steps Toward Regulation

By the mid-2010s, authorities began tightening the reins.

- 2013: France took an early lead, issuing guidance for virtual currency professionals and setting rules for exchange operations and taxation.

- 2015: The European Union adopted its Fourth Anti-Money Laundering Directive (4AMLD), formally bringing crypto entities into the AML fold.

- 2015: Across the Atlantic, New York State rolled out the BitLicense, a pioneering — and controversial — framework for digital asset firms.

These milestones marked the end of the no-rules era. By the late 2010s, compliance had evolved from a regulatory checkbox to a survival requirement. Exchanges began building dedicated AML/KYC departments, and “digital compliance” became a buzzword across the crypto markets.

BitOK was founded in 2019 and has been at the forefront of crypto compliance since then. Moving ahead with the new standards, creating solutions suitable for and working in different jurisdictions, and developing its unique approach to analytics and risk alert systems.

With six years of experience in the industry, we are one of the few global AML brands that possess both deep expertise and excellent technology, allowing for 100% protection, detailed analysis, and investigation.

In 2025, the AML crypto scene has regulatory requirements and guidelines imposed on market participants. However, digital compliance is still not fully established, and business risk management requires strong attention to KYT checks and overall transaction monitoring to keep operations on the safe side.

A Fragmented Landscape

Fast-forward to today, and the picture is mixed. Many jurisdictions now enforce strict anti-money-laundering rules for crypto platforms. Yet global consistency remains elusive.

While Europe pushes forward with MiCA and the FATF’s Travel Rule, some regions still lag behind. Decentralized finance (DeFi) platforms — operating without intermediaries — present particular headaches. Without KYC procedures or clear legal accountability, they remain fertile ground for illicit activity.

Meanwhile, privacy-focused tools like mixers and tumblers continue to complicate investigations. Cross-chain transactions allow funds to hop across blockchains and jurisdictions in seconds, leaving regulators playing catch-up. And even legitimate users are caught in the tension between personal privacy and regulatory transparency.

To keep track and foresee the possible risky transactions, any crypto business that deals with payments should have transaction monitoring and AML checks in place.

2025: A Year of Lessons and Losses

This year has already seen some of the industry’s most high-profile AML challenges play out in real time.

Bybit – $1.5 Billion Hack (February 2025)

The FBI linked the theft to North Korea’s Lazarus Group — a familiar name in crypto crime. Attackers swiftly moved the stolen funds through decentralized exchanges, cross-chain swaps, and aggregators.

This investigation was carried out with the help of BitOK Graph

The breach exposed a regulatory blind spot: the Travel Rule applies to regulated virtual asset service providers (VASPs), not to DeFi protocols. The FATF’s 2025 update explicitly called this gap a “critical weak link” in the global AML chain.

In other words: moving straight from a CEX to DEXes/bridges side-steps originator/beneficiary data exchange—exposing an enforcement blind spot between regulated VASPs and unregulated/non-custodial services.

Coinbase – $400 Million Insider Breach (May 2025)

Coinbase disclosed a massive insider-led incident involving bribed overseas contractors. Unlike the typical smart-contract exploit, this was an old-school social engineering attack.

The attack was launched by Coinbase’s overseas support contractors, whom the criminals bribed. The precedent serves as an alert to all industry players: your risk exposure can arrive from a third-party vendor that isn’t bound by the same level of crypto compliance and data-protection standards.

Weak KYC/AML data sharing across vendors and jurisdictions, as well as outdated crypto compliance frameworks, hinder rapid cross-border responses. (Coinbase publicly argued that current AML rules are “broken” and need modernization.)

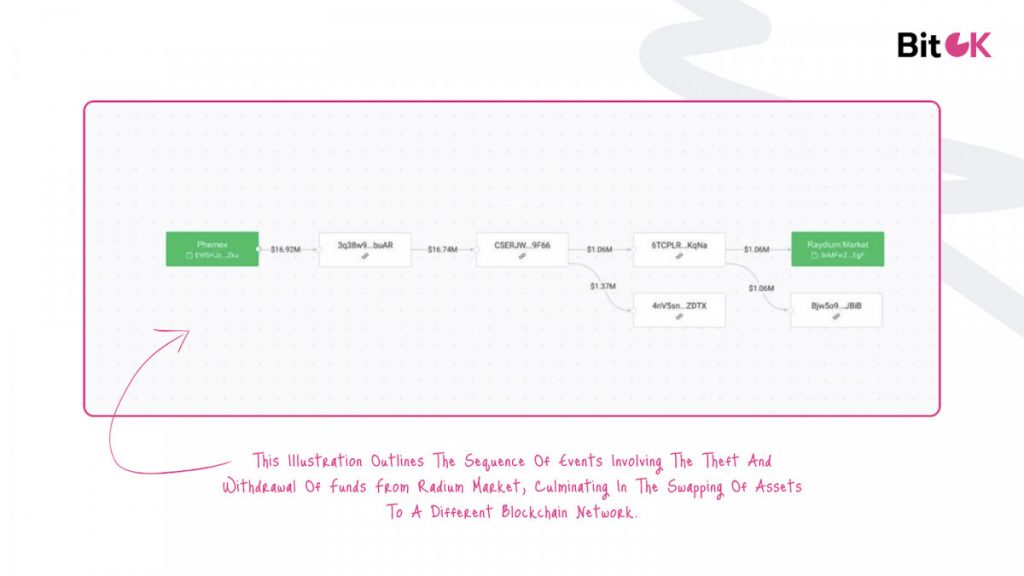

Phemex – $85 Million Hot-Wallet Compromise (January 2025)

This investigation was carried out with the help of BitOK Graph

When Phemex suffered a multi-chain breach affecting 16 blockchains, investigators faced a nightmare: tracing funds that ricocheted across decentralized bridges and non-VASPs.

This incident illustrated how inconsistent enforcement of FATF’s Recommendation 16 — the backbone of crypto AML — slows cross-border recovery and enforcement.

Multi-chain hops into non-VASPs (DEXes/bridges) degrade Travel-Rule traceability; receiving VASPs in other jurisdictions may not implement Rec.16 consistently, slowing freezes and recovery.

Bridging the Gap

These cases carry clear lessons for the industry. Exchanges and custodians can no longer treat crypto compliance as a box-ticking exercise. They must:

- Track cross-chain flows and flag potential Travel-Rule evasion patterns.

- Partner only with compliant VASPs, ensuring interoperability of AML data standards.

- Treat vendors as extensions of compliance, binding them to AML/KYC and incident-response standards.

The days of separating “tech risk” and “compliance risk” are over. In 2025, they are one and the same. Crypto regulation is still lacking global consistency. Besides, tech evolves quicker than the legal framework, meaning the law will also stay slightly behind new technological opportunities.

So the modern approach to crypto compliance is not about being in line with the rules of your own jurisdiction, but about protecting your business, assets, and reputation. In this approach, digital compliance instruments are not there just to comply with the rules, but help to foresee the risks and escape any suspicious activity.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.