Tokenized RWAs Are Bridging the Gap Between DeFi and TradFi

In Brief

Real-world assets (RWAs) in crypto are gaining popularity in 2024, offering unique benefits and challenges, with top projects already open for users.

When we talk about real-world assets, we usually refer to some physical asset of the material world or some trading instrument in traditional finance (TradFi). However, the possibility to tokenize practically any object of value has now emerged, bringing it into the realm of web3, and opening up unique benefits that are associated with DeFi.

RWAs in crypto is one of the major trends in 2024 within the space and in this article, we will try to explain its concept, talk about the advantages it can offer, the challenges that have yet to be addressed, and explore some of the top RWA projects already open for users.

What is RWA Tokenization?

In essence, it means converting assets from the physical world, or the rights of their ownership, to a digital token allowing it to be utilized in DeFi and easily traded using the blockchain. These can include real estate, treasury bills, intellectual property rights, currency, and even credit cards.

Converting RWAs into their digital representations provides all the benefits that come with blockchain like improved security, immutability, and transparency. Since they are backed by physical assets, these tokens are less susceptible to volatility and speculative trading, making them a dependable digital investment.

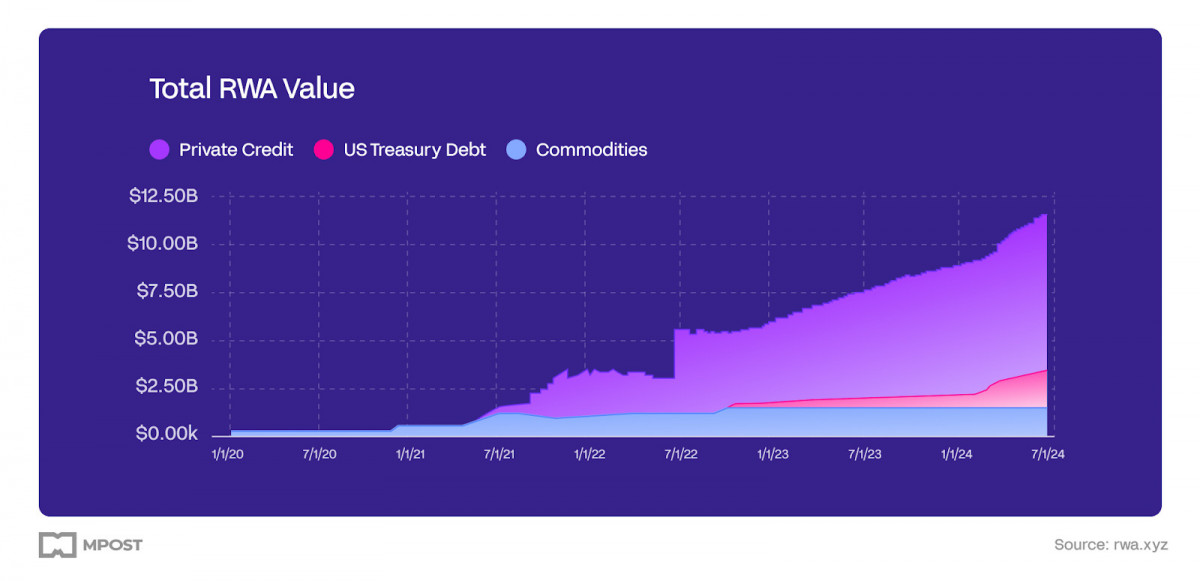

The total amount of RWAs on-chain has now reached over $10.5 billion, according to rwa.xyz. This significant contribution to DeFi’s growth puts it in direct competition with TradFi institutions, which traditionally handled RWA transactions. However, many more organizations are now joining the web3 realm as the advantages of decentralized asset management are clear.

Take, for example, a real estate developer. He has just finished work on a new residential building and wants to sell or lease parts of it. By converting individual properties or square meters of the development into tokens, international clients receive an opportunity to bid for property rights and transfer equity securely on-chain. This is just a single example from a multitude of use cases for RWAs.

Essentially, any form of physical asset can benefit from tokenization and efficient blockchain use. Types of RWAs include:

- Currencies/stocks/bonds

- Real estate

- Vehicles

- Consumer goods

- Collectibles

- Commodities

- Cultural works (Art/books/music)

- Intellectual property

Why Tokenize RWAs?

Tokenizing provides multiple benefits both to the asset holder and the ecosystem as a whole:

- One advantage of RWA is that it enables partial ownership, providing the opportunity for any investor to purchase shares regardless of the available capital.

- This lower barrier to entry coupled with the borderless nature of the blockchain and a large number of available exchange platforms boosts the potential liquidity of the RWAs and their accessibility.

- Tokenized asset ownership is safe and indisputable through inheriting the level of security of the underlying network, reducing risks of fraudulent activity.

- Records of RWA transfers are kept in an open and decentralized ledger to ensure transparency.

- Tokenizing assets boosts efficiency and lowers costs by allowing for peer-to-peer asset transfers, eliminating the reliance on intermediaries and extensive bureaucratic procedures involved.

Challenges That the RWA Sector Has

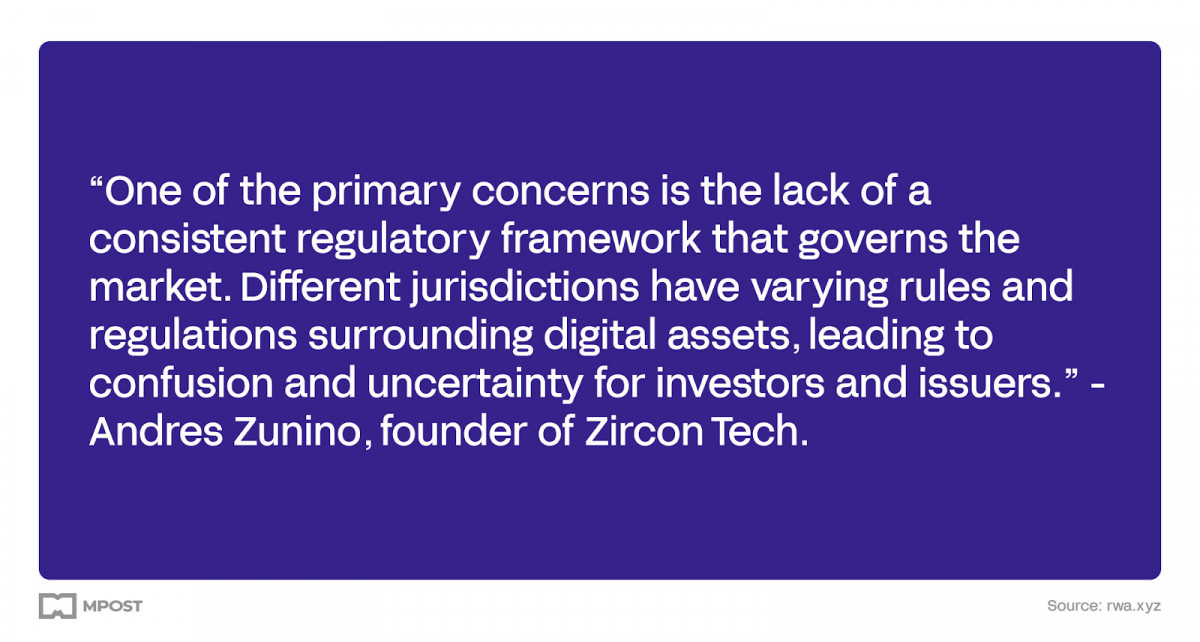

Even though tokenization provides clear potential benefits, parts of the industry are still facing specific challenges like regulatory uncertainties within various jurisdictions, legitimizing tokenized ownership rights in the courts, and security concerns with the coupled smart contracts.

This is especially evident for real estate RWAs, where the largest challenge is navigating various legal frameworks, enforcing compliance, and establishing trust.

Despite these issues, the tokenization sector is on a stable growth trajectory. Tokenizing financial instruments and precious metals has proven to be a well-established industry, increasing total value by 33% since the start of 2024.

Top RWA Projects of 2024

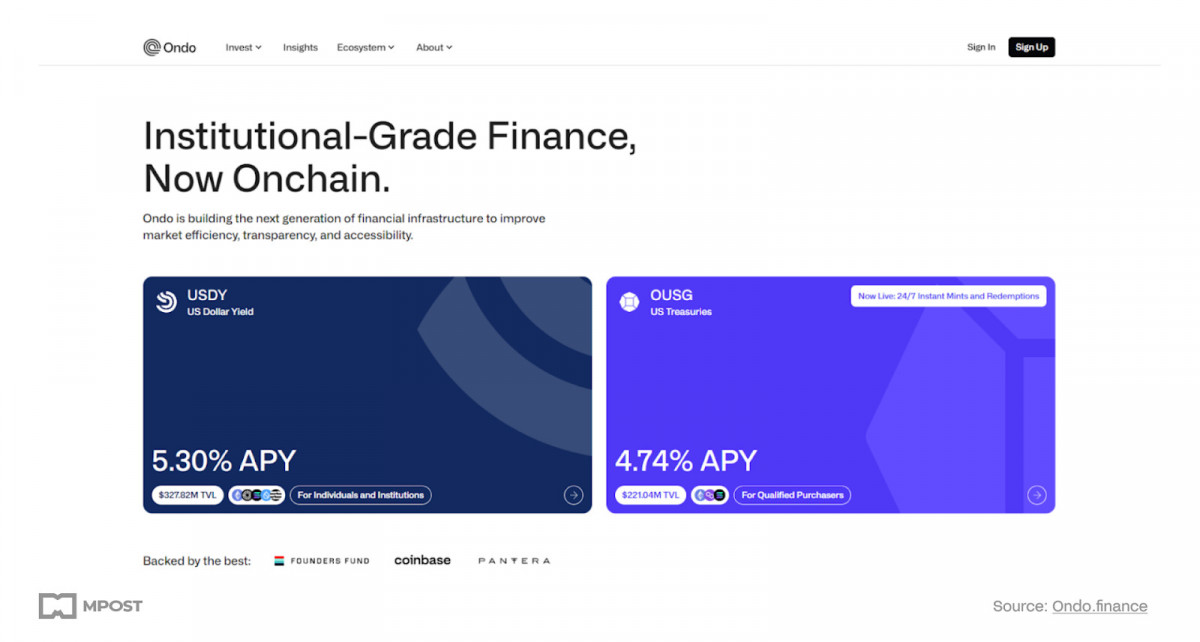

Ondo

Launched in 2021, Ondo Finance is dedicated to democratizing access to institutional-grade finance by bridging the gap between TradFi and DeFi. It facilitates low-risk investment into short-term US Treasuries in a regulated environment for sustainable yield.

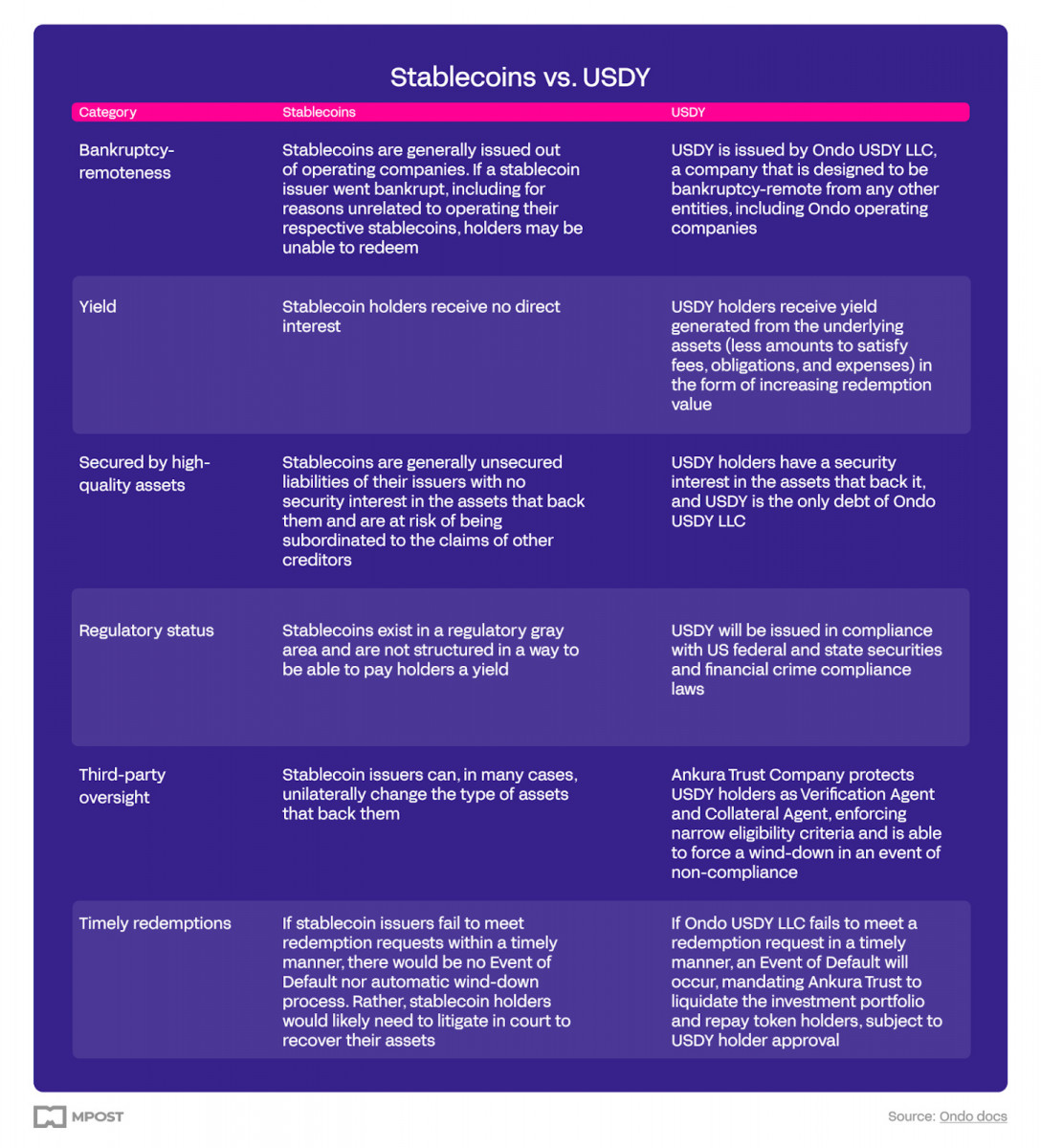

Ondo classifies its $USDY token as a tokenized security note, allowing it to operate as a bearer asset, like stablecoins, but also earning holders the majority of the yield from collateralized assets.

Polymesh

It’s a permissioned L2 blockchain that is purpose-built for trading security tokens. Its mission is to streamline TradFi processes by providing a blockchain environment with identity verification and compliance with regulatory norms required for trading regulated assets.

By combining a platform that adheres to regulatory requirements in a decentralized framework with ecosystem-driven governance, Poymesh combined the best of both FradFi and DeFi worlds, aiming to solve the legal uncertainties of trading tokenized RWAs.

MakerDAO

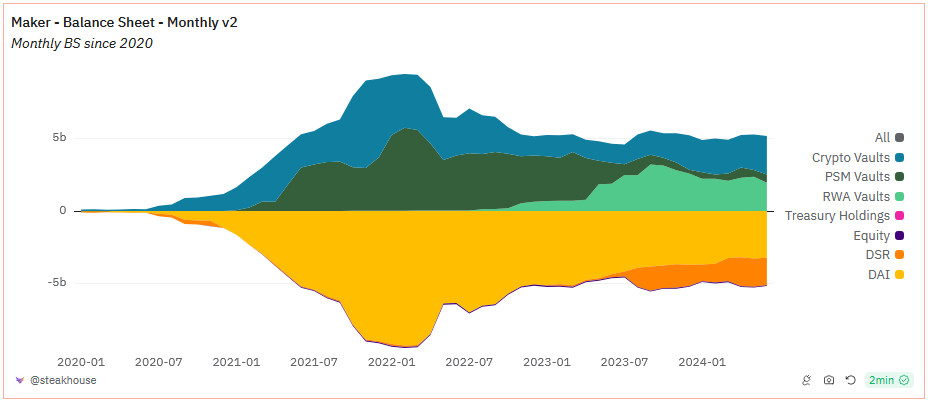

One of Ethereum’s best-known protocols. In recent years, MarerDAO has made significant strides to diversify the collateral backing the $DAI stablecoin.

As of June 2024, almost $2B of the total $5.15B backing $DAI (~37.8%) are RWAs, effectively making it the first treasury bill-backed stablecoin.

Source: Dune.com/steakhouse

Paxos Gold

$PAXG is an RWA token representing gold stored in specialized vault facilities. One token corresponds to one ounce of a gold bullion bar. Paxos undergoes monthly audits to ensure that the token is continuously backed by real gold at a 1:1 ratio.

Unlike purchasing gold ETFs and bars, Paxos does not charge custody fees, supports fractional ownership, and provides instant purchases for its users. Any $PAXG holder can redeem their holdings for gold bullion bars at any time through a network of retailers worldwide or instantly swap them for USD at the current market price.

Source: Paxos

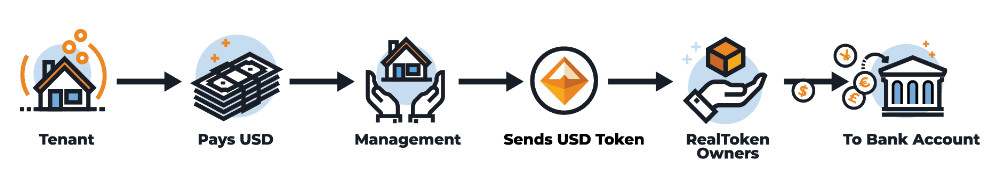

RealToken

It’s the current market leader in real estate RWAs, offering fractional ownership of US properties in a permissionless but compliant manner. Real estate can’t yet be officially tokenized in the US, but RealToken has found a legal workaround.

Each property in its marketplace is owned by a separate company which itself is tokenized into a defined number of unique tokens. This company then employs a property management firm that is charged with sourcing tenants, collecting rent, and conducting property maintenance. RealToken fractional landlords simply invest once and collect their part of the rent every week.

Source: RealToken

The service continuously adds new properties to its marketplace and its TVL has been steadily rising for more than 2 years, now valued at almost $110M (Defillama).

TokenFi

Built as a platform for users to launch their tokens in a simple environment without the need for coding skills, they plan to launch the RWA Tokenization Module in 2024.

When open to the public, it will allow anyone to easily tokenize any class of assets besides securities. Though it is yet unknown how they will tackle regulatory challenges and enforcement requirements, the platform has gained considerable traction in the space. If successful, TokenFi may set a foundation for secure and versatile RWA tokenization.

RWAs Spearhead DeFi’s Mass Adoption

The integration of RWAs into the blockchain landscape is one of the major developments in the space, gaining considerable attention from large players in the TradFi world and contributing to DeFi’s recognition among institutional investors.

In a recent analytical forecast, McKinsey & Company predicted that the crypto RWA market would reach a capitalization of $2T (up to $4T in an optimistic scenario) by the year 2030. Such injection of capital into the blockchain ecosystem would undoubtedly solidify DeFi’s standing in the financial world, attract even more investment, contribute to further innovation, and pave the way for the next wave of web3 adoption.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Anthony is a blockchain analyst and writer with an academic background in biochemistry. He works as researcher and content creator in the PowerPool protocol, covering ecosystem updates, new DeFi/dePin/AI products, and analysis of various web3 protocols.

More articles

Anthony is a blockchain analyst and writer with an academic background in biochemistry. He works as researcher and content creator in the PowerPool protocol, covering ecosystem updates, new DeFi/dePin/AI products, and analysis of various web3 protocols.