Layer 1 Blockchains or Layer 2 Solutions The Intense Debate Over the Future of Blockchain Scalability

In Brief

The blockchain industry, initially based on Layer 1 blockchains like Bitcoin and Ethereum, is evolving with the emergence of Layer 2 solutions, addressing scaling challenges and potential drawbacks.

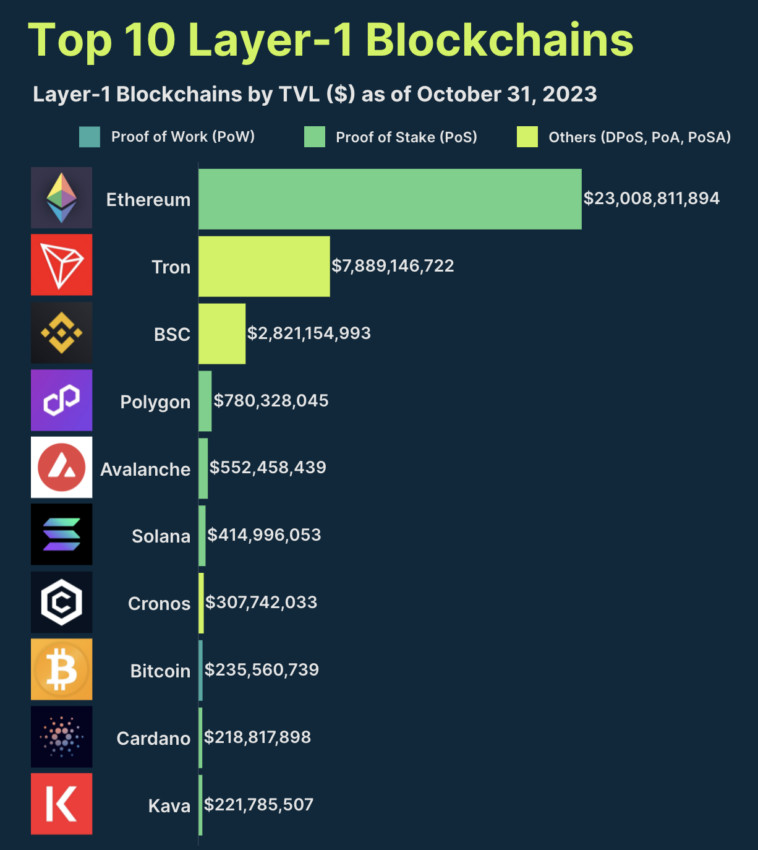

Originally based on innovative Layer 1 (L1) blockchains like Bitcoin and Ethereum, the blockchain industry has grown into a vast ecosystem with other L1 projects that all promise innovation, scalability, and decentralization. However, in a market that is becoming more and more cluttered, the growth of new L1 chains has brought up concerns over the true worth of these initiatives.

The Purpose of Layer 1 Blockchains and Their Development

Decentralized apps (dApps) are made possible by Layer 1 blockchains, which are fundamental protocols that make up the basic layer of blockchain networks and support a variety of protocols. The emergence of the most well-known L1 blockchains, such as Ethereum and Bitcoin, opened the door for the current wide range of L1 solutions. These systems seek to address the three main issues with blockchain: decentralization, security, and scalability. Usually, every new L1 blockchain makes a claim to provide special answers to these problems, ranging from increased throughput to reduced transaction costs.

Skale Labs co-founder Jack O’Holleran draws attention to this concentration of market activity, pointing out that although the L1 ecosystem has expanded, very few initiatives have commercial momentum. Given the intense rivalry and resource-intensive difficulty of creating a blockchain from scratch, O’Holleran contends that merely releasing a new L1 chain is insufficient to garner sustained interest or participation.

Is the Ecosystem Being Overcomplicated by New Layer 1 Chains?

Some have begun to wonder if the ecosystem is getting too difficult due to the growing number of L1 blockchains. Users and developers may find it challenging to manage the fragmented environment created by the launch of each new L1 chain, which carries with it new tokens, user experiences, and frequently distinct sets of protocols. According to O’Holleran, a lot of new L1 ventures are having trouble getting off the ground and are depending on tactics like airdrops to get consumers in without attaining steady growth or a sizable market share.

Interoperability and liquidity are further complicated by an overabundance of L1 platforms. It becomes more difficult for assets to flow easily across platforms with each new chain that doesn’t mesh well with the networks that already exist.

For instance, certain L1 blockchains may unintentionally divide the liquidity offered by other platforms, even while they may address certain scalability concerns. Because users must traverse several chains to access assets and applications—often via third-party bridges that pose security risks—this fragmentation leads to a less integrated market structure.

The natural rivalry in the L1 space might also hinder innovation. Instead of enhancing and expanding upon current platforms, the emphasis frequently moves toward developing the next “breakthrough” blockchain due to the abundance of initiatives competing for attention. This fragmented strategy may result in a vicious cycle whereby new initiatives surface, attract early enthusiasm but eventually find it difficult to stay relevant in the face of well-established behemoths like Ethereum.

The Case for L1 Development’s Ongoing Innovation

Notwithstanding these concerns, several industry insiders think that innovation depends on the ongoing development of new L1 blockchains. According to Charles Wayn, co-founder of Galxe and Gravity, the emergence of new L1 chains is a logical development in the blockchain world, giving developers a chance to tackle certain problems that more established blockchains could encounter. With an emphasis on cross-chain interactions, Wayn’s firm recently introduced Gravity, its own L1 solution, to solve scalability difficulties.

According to Wayn, newer L1 blockchains can provide reduced costs and increased transaction throughput, whereas older blockchains are limited in their usefulness by issues like congestion and high transaction fees. In order to improve security and privacy, several more recent L1 blockchains also include modern technologies such as Zero-Knowledge Proofs. These technologies make the case for new, specialized L1 blockchains by addressing certain demands that incumbent L1 blockchains would not prioritize.

Emerging L1 initiatives like Gravity seek to close the gaps left by general-purpose blockchains like Ethereum by concentrating on specialized features or applications. Wayn claims that by placing a strong focus on specialization, developers may produce apps that are suited to certain market niches while simultaneously increasing the ecosystem’s adaptability. Although these specialized blockchains may initially cater to a smaller user base, they are better able to meet niche demands than more general L1 platforms because of their concentration on certain features.

Layer 2 Solutions: A Good Substitute?

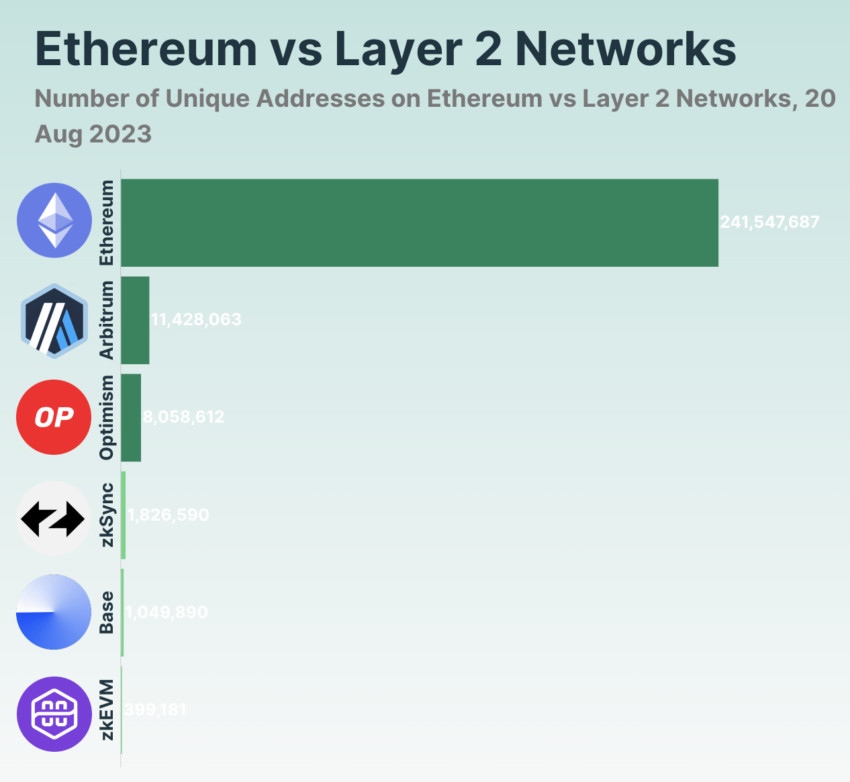

Although there is ongoing discussion on the merits of new L1 blockchains, Layer 2 (L2) solutions are becoming a more and more well-liked substitute for dealing with scalability problems. Without requiring a completely new chain, L2 solutions expand the capabilities of current L1 blockchains by operating on top of them. Caldera co-founder and CEO Matt Katz supports L2 solutions because he sees them as a workable and effective approach to solving scaling issues without the drawbacks of expanding the ecosystem with more L1s.

Rollups and state channels are examples of L2 solutions that relieve the main chain of part of the transactional and computational burden. They can lower prices and boost throughput without sacrificing security by doing this. For instance, Katz’s business offers a “rollup-as-a-service” platform that enables programmers to swiftly build Ethereum L2 chains. This method avoids the difficulties involved in building a stand-alone blockchain while giving developers flexibility and scalability.

Katz further highlights the interoperability benefit of L2 solutions over new L1 chains. L2 solutions, like Ethereum, are intended to integrate easily with their parent chains, in contrast to the majority of L1 blockchains. This compatibility lowers the danger of liquidity fragmentation by enabling them to benefit from the security and liquidity of their parent chains without the need for independent bridges. Katz claims that this interoperability makes it possible for an environment that is more unified and easy to use, with fewer obstacles when transferring assets between chains.

Is There a Middle Ground for the Industry?

The blockchain industry must make a crucial decision in the future because both L1 and L2 solutions have unique advantages and difficulties. L1 blockchains, which offer crucial security and decentralization, are, on the one hand, the fundamental layer on which decentralized applications and protocols are constructed. However, L2 solutions offer a practical means of improving scalability without having to deal with the difficulties of developing brand-new, stand-alone blockchains.

According to O’Holleran, the market will inevitably weed out weaker L1 chains, leaving only those that provide genuine value. He believed that this self-regulating system may lessen fragmentation and simplify the environment. Wayn, however, argues that the development environment should remain flexible and dynamic and that innovation should not be constrained by the launch of additional L1 blockchains. Katz, on the other hand, believes that the emergence of L2 solutions would help to streamline the blockchain environment by reducing the need for more L1s.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.