Top 20 Overrated Cryptocurrencies in 2023

In Brief

In 2023, several crypto coins have been deemed overrated due to various factors.

These coins have garnered significant attention and investment, but their actual value and potential may need to align with the hype surrounding them.

Investors need to take a closer look at these overrated crypto coins and consider the risks involved before making any investment decisions.

By understanding the reasons behind their overvaluation and the potential pitfalls, investors can navigate the cryptocurrency market more effectively and make informed choices that align with their investment goals.

In 2023, the cryptocurrency market is flooded with numerous coins, but not all live up to their hype. This article delves into the top 20 overrated cryptocurrencies, shedding light on the reasons behind their inflated reputation and the associated risks for potential investors.

Understanding Overrated Cryptocurrencies

While cryptocurrencies have revolutionized the financial landscape, some coins are considered overrated due to various factors. It is crucial to evaluate these coins’ true value and potential before making any investment decisions.

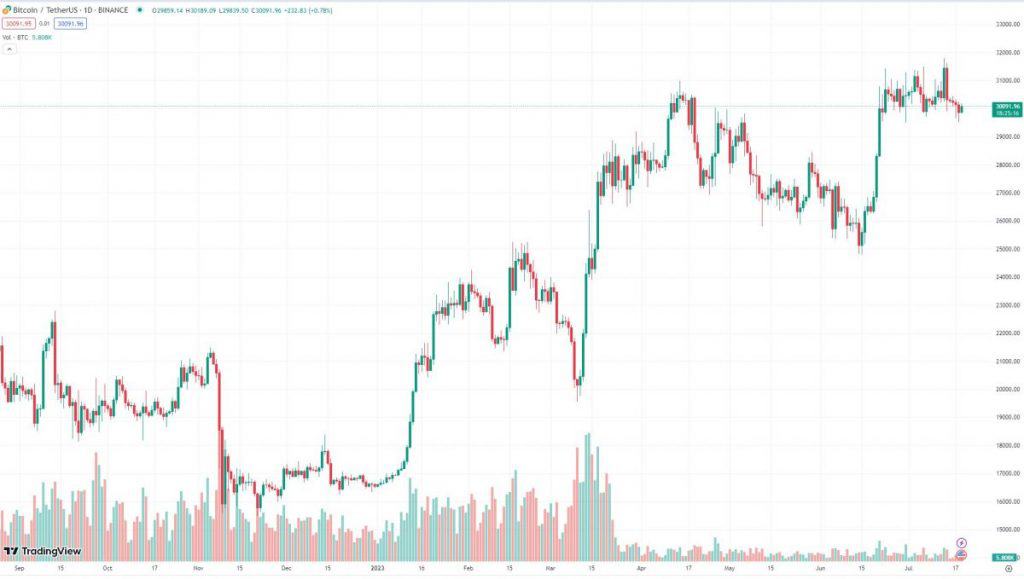

Bitcoin (BTC)

Bitcoin, the pioneering cryptocurrency, has witnessed significant success over the years. However, it has become increasingly overrated in recent times. Let’s take a closer look at the advantages and disadvantages of Bitcoin:

Pros

- Well-established and recognized brand within the cryptocurrency market.

- High liquidity, facilitating easy buying, selling, and trading.

- Widely accepted by businesses as a form of payment.

- Limited supply, contributing to its scarcity and potential value.

Cons

- High transaction fees and slow confirmation times during peak periods.

- Volatile price fluctuations make it risky for short-term investors.

- Environmental concerns due to its energy-intensive mining process.

- Dominance in the market potentially hinders the growth of other innovative cryptocurrencies.

Ethereum (ETH)

Ethereum is a blockchain platform that introduced smart contracts and decentralized applications (DApps). Despite its significant contributions, Ethereum is not immune to overvaluation.

Pros

- Smart contracts enable the development of diverse, decentralized applications.

- Second-largest market capitalization, ensuring stability and widespread adoption.

- An active developer community is fostering continuous innovation and upgrades.

- Potential for scalability improvements with Ethereum 2.0.

Cons

- Scalability issues and high gas fees during network congestion.

- Competition from other blockchain platforms offering superior solutions.

- Regulatory concerns surround Ethereum’s classification as a security.

- Overhyped expectations for Ethereum 2.0, which may face delays and challenges.

Ripple (XRP)

Ripple is a digital payment protocol designed for fast and low-cost transactions. Despite its promising technology, Ripple has faced criticism and skepticism.

Pros

- Efficient cross-border transactions, reducing costs and settlement times.

- Partnerships with major financial institutions for real-world use cases.

- RippleNet’s expanding network enhancing its potential for global adoption.

- Ripple’s native cryptocurrency, XRP, providing additional utility.

Cons

- Legal and regulatory uncertainties due to ongoing litigation with the SEC.

- Dependency on traditional banking systems, limiting decentralization.

- Concerns regarding the large XRP supply held by Ripple Labs.

- Lack of transparency and decentralized governance compared to other cryptocurrencies.

Litecoin (LTC)

Litecoin, often referred to as the silver to Bitcoin’s gold, was created as a faster and more scalable alternative. However, its overrated status raises questions about its long-term viability.

Pros

- Faster block generation and lower transaction fees compared to Bitcoin.

- Proven track record as one of the earliest altcoins.

- Adoption by payment processors and merchants for everyday transactions.

- Segregated Witness (SegWit) implementation improving scalability.

Cons

- Limited differentiation from Bitcoin in terms of technology.

- Relatively low market capitalization compared to other major cryptocurrencies.

- Vulnerability to market trends and changes in investor sentiment.

- Lack of significant partnerships or unique value propositions.

Cardano (ADA)

Cardano is a blockchain platform aiming to provide a secure and scalable infrastructure for decentralized applications. While it enjoys a strong community following, it faces challenges as an overrated cryptocurrency.

Pros

- Innovative research-based approach backed by peer-reviewed academic work.

- Focus on scalability, security, and sustainability through layered architecture.

- The strong development team and partnerships for real-world implementation.

- Staking rewards providing passive income for ADA holders.

Cons

- Long development timelines and delayed rollout of key features.

- A limited number of fully functional DApps compared to other platforms.

- Uncertainty surrounding regulatory compliance and its impact on Cardano’s future.

- Competition from other blockchain platforms offering similar solutions.

Polkadot (DOT)

Polkadot is a multi-chain platform enabling interoperability and information sharing between different blockchains. While it offers unique features, it has also gained attention as an overrated cryptocurrency.

Pros

- Interoperability allows seamless communication between different blockchains.

- Scalable and customizable framework for building specialized chains.

- Strong community support and active ecosystem development.

- Potential to facilitate the decentralized web (Web 3.0) and DeFi applications.

Cons

- A relatively new project, still in its early stages of development.

- Competition from other interoperability-focused projects like Cosmos and ICON.

- Governance and decision-making processes posing long-term challenges.

- Uncertain regulatory environment for cross-chain communication protocols.

Chainlink (LINK)

Chainlink is a decentralized oracle network connecting smart contracts with real-world data and external APIs. Despite its unique value proposition, Chainlink’s overvaluation raises concerns.

Pros

- Bridging the gap between blockchain technology and real-world data sources.

- Wide range of applications, including DeFi, insurance, and supply chain management.

- Growing adoption by major companies and blockchain projects.

- Strong partnerships and integration with leading blockchain platforms.

Cons

- Reliance on external data sources raises security and trust concerns.

- Competition from other Oracle providers and potential alternatives.

- Market volatility and speculation driving price fluctuations.

- Uncertainty surrounding the future demand for decentralized oracles.

Stellar (XLM)

Stellar is a blockchain platform designed for fast and low-cost cross-border transactions. While it aims to empower financial inclusion, it has also been subject to overrated claims.

Pros

- Focus on facilitating remittances and improving cross-border payment systems.

- Partnerships with various organizations, including IBM and Deloitte.

- Scalable and energy-efficient consensus algorithm (Stellar Consensus Protocol).

- Integration with existing financial infrastructure, making adoption easier.

Cons

- Competition from other payment-focused cryptocurrencies like Ripple and XRP.

- Limited use cases beyond cross-border payments and remittances.

- Dependence on partnerships and regulatory compliance for growth.

- Uncertain market demand for a decentralized payment network like Stellar.

Uniswap (UNI)

Uniswap is a decentralized exchange (DEX) protocol built on the Ethereum blockchain. As one of the leading decentralized exchanges, it has experienced both hype and criticism.

Pros

- Enabling permissionless and trustless token swaps directly from wallets.

- Users provide liquidity through automated market-making (AMM).

- Open-source nature, allowing for community-driven improvements and innovation.

- Integration with other DeFi protocols and smart contracts.

Cons

- Vulnerability to front-running and impermanent loss for liquidity providers.

- Regulatory scrutiny surrounding decentralized exchanges and DeFi platforms.

- User experience challenges for newcomers and less tech-savvy individuals.

- Competing DEX protocols offering similar functionalities and lower fees.

Dogecoin (DOGE)

Dogecoin originated as a meme cryptocurrency but gained attention due to its enthusiastic community. However, its overrated status and lack of substantial development raise concerns.

Pros

- Strong community support and social media presence.

- Low transaction fees and fast confirmation times.

- Memorable and recognizable branding.

- Accepted as a form of payment by certain merchants.

Cons

- Lack of active development and innovation compared to other cryptocurrencies.

- Overreliance on social media trends and market sentiment.

- Inflationary supply with no maximum cap on the number of coins.

- Vulnerability to market manipulation and pump-and-dump schemes.

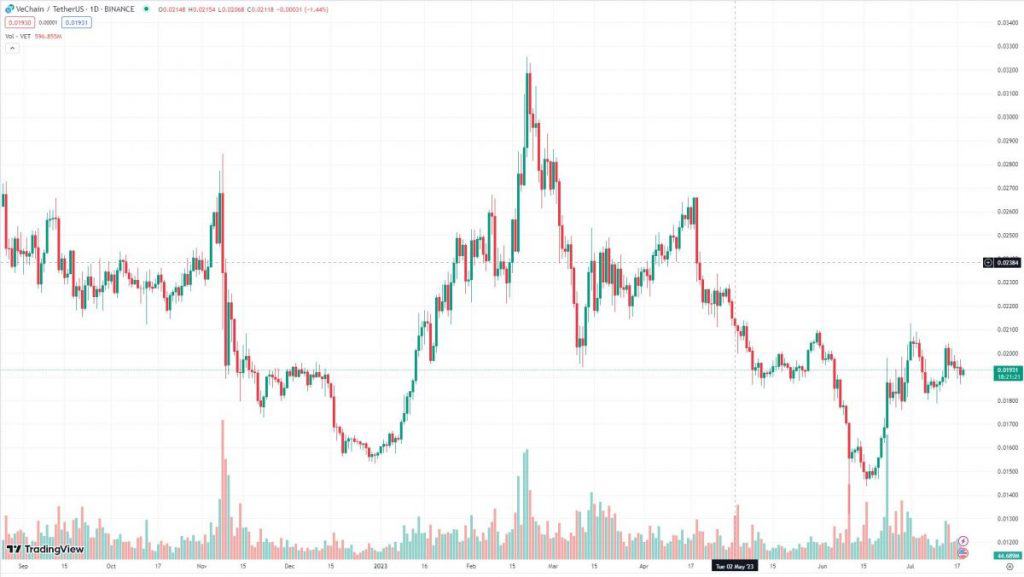

VeChain (VET)

VeChain aims to enhance supply chain management and improve product authenticity using blockchain technology. While it has promising use cases, overvaluation concerns persist.

Pros

- Real-world adoption by major companies for traceability and authenticity verification.

- Public and permissioned blockchain solutions tailored for specific industries.

- Strong partnerships and collaborations with global enterprises.

- Focus on compliance and regulatory requirements.

Cons

- Competition from other supply chain-focused blockchain platforms.

- Dependency on enterprise adoption and industry-specific use cases.

- Potential challenges in scaling the network to accommodate increased demand.

- Uncertainty regarding the long-term viability of supply chain-focused cryptocurrencies.

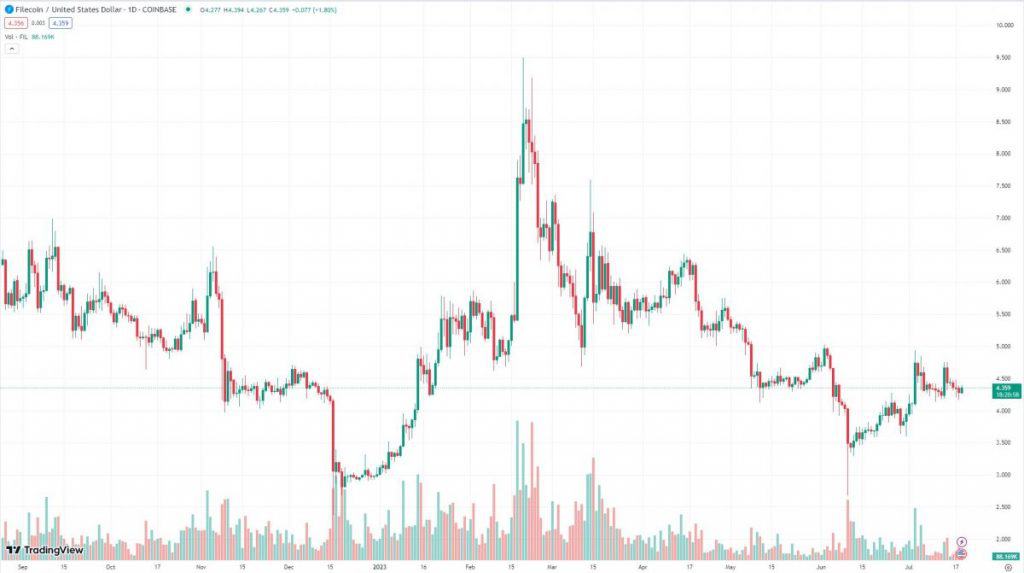

Filecoin (FIL)

Filecoin is a decentralized storage network enabling users to rent out their excess storage capacity. Despite its innovative approach, Filecoin’s overrated status poses risks.

Pros

- Utilizes blockchain technology to create a decentralized marketplace for storage.

- Incentivize network participants to provide storage and retrieve data.

- Potential for increased efficiency and lower costs compared to centralized storage.

- Strong backing by reputable venture capital firms and investors.

Cons

- Complexity and technical barriers for everyday users.

- Uncertain demand and competition from centralized cloud storage providers.

- Relatively high storage costs compared to traditional options.

- Regulatory concerns surrounding data privacy and compliance.

Theta (THETA)

Theta is a blockchain-based streaming platform focused on decentralizing video delivery. While it has gained attention, its overrated status raises questions about its long-term prospects.

Pros

- Reduces the cost of video delivery and enhances streaming quality.

- Innovative use of blockchain and peer-to-peer technology.

- Partnerships with major media and entertainment companies.

- The Theta token rewards viewers and content creators.

Cons

- Competition from centralized streaming platforms with established user bases.

- Scalability challenges for widespread adoption and high-resolution content.

- Dependency on partnerships for content acquisition and distribution.

- Regulatory uncertainty surrounding copyright and licensing in the streaming industry.

Tron (TRX)

Tron is a blockchain platform focused on content sharing and decentralized applications. While it boasts a large user base, it has also faced criticism for overhyped claims.

Pros

- High throughput and scalability for handling a large number of transactions.

- Acquisition of BitTorrent, expanding user base and content distribution capabilities.

- Partnerships with entertainment companies and content creators.

- Incentives for content creators and users through TRX token rewards.

Cons

- Allegations of plagiarism and lack of originality in whitepaper and codebase.

- Centralization concerns arise due to the concentration of superdelegates.

- Criticism for promoting controversial projects and speculative tokens.

- Regulatory challenges and uncertainty surround the gaming and gambling industries.

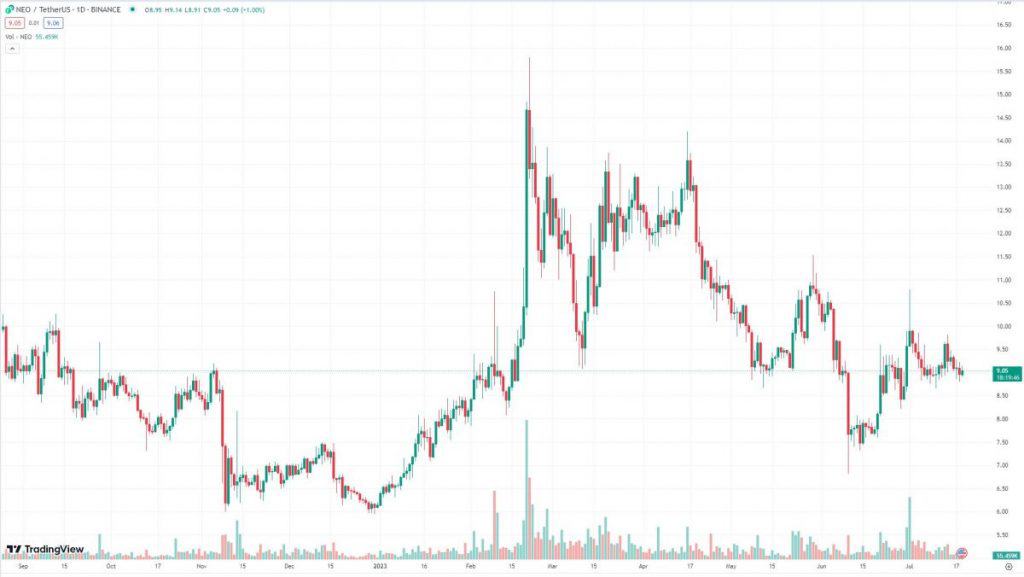

Neo (NEO)

Neo, often known as the “Chinese Ethereum,” aims to digitize assets and create a smart economy. Despite its ambitions, it faces challenges as an overrated cryptocurrency.

Pros

- Advanced smart contract functionality and support for multiple programming languages.

- Strong presence in the Chinese blockchain community and government partnerships.

- Focus on compliance and regulatory-friendly solutions.

- Active developer community and continuous upgrades.

Cons

- Competition from other blockchain platforms targeting the same market segment.

- The uncertain regulatory landscape in China and its impact on NEO’s future.

- Limited adoption and use cases compared to Ethereum.

- Overvaluation concerns due to speculative trading and market hype.

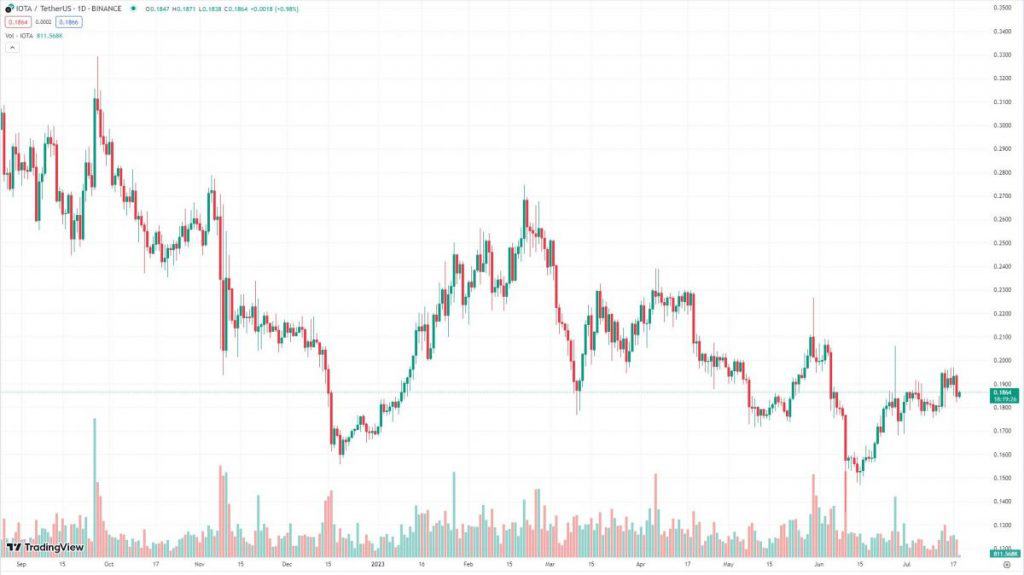

IOTA (MIOTA)

IOTA is a distributed ledger technology designed for the Internet of Things (IoT) ecosystem. While it offers unique features, it has also faced criticism and overrated claims.

Pros

- Scalable and feeless transactions are enabling microtransactions between IoT devices.

- Focus on security and tamper-proof data integrity.

- Partnerships with major companies in the IoT and mobility sectors.

- Development of a decentralized identity (DID) framework.

Cons

- Technical challenges and vulnerabilities, including the infamous “Coordicide.”

- Slow adoption, and limited real-world use cases.

- Dependency on the success and growth of the IoT industry.

- Regulatory concerns surrounding data privacy and IoT security.

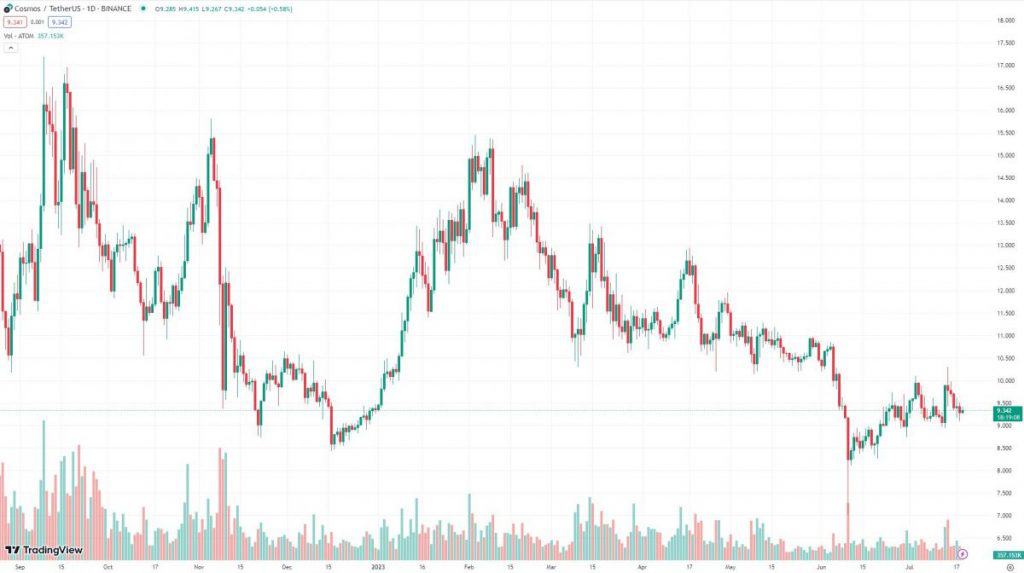

Cosmos (ATOM)

Cosmos is a blockchain ecosystem aiming to enable interoperability between different blockchains. Despite its unique value proposition, it faces scrutiny as an overrated cryptocurrency.

Pros

- Interoperability hub connecting various blockchains through the Cosmos Network.

- Tendermint’s consensus algorithm provides fast and secure transaction processing.

- Active community and growing ecosystem of interconnected blockchains.

- Potential to address the scalability and performance limitations of individual chains.

Cons

- Competition from other interoperability-focused projects like Polkadot and ICON.

- Uncertainty regarding the demand for cross-chain communication protocols.

- Challenges in coordinating governance and decision-making across multiple chains.

- Overvaluation risks due to speculative trading and market sentiments.

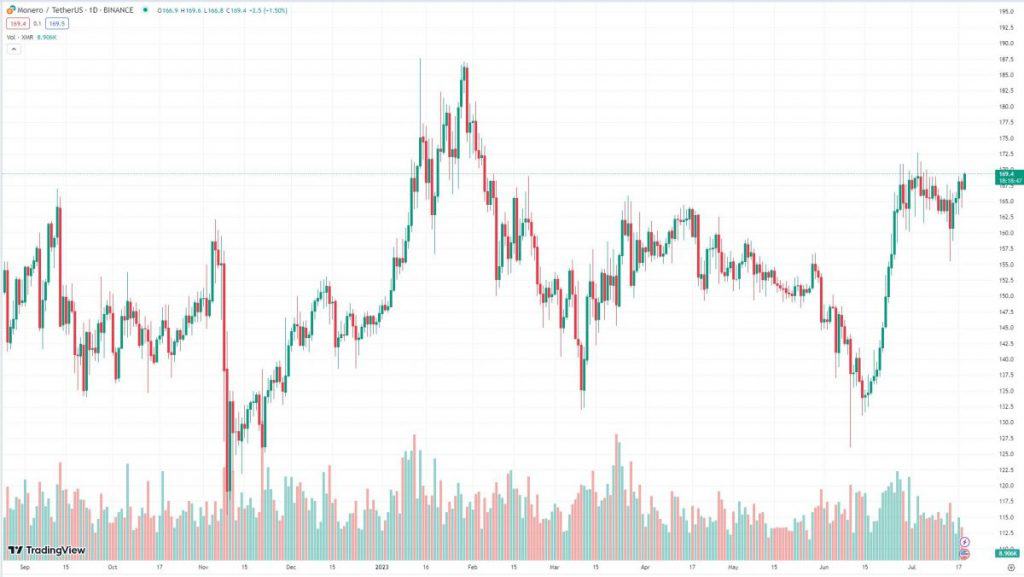

Monero (XMR)

Monero is a privacy-focused cryptocurrency aiming to provide anonymous and untraceable transactions. While it has gained popularity, it has also been labeled as overrated.

Pros

- Privacy features ensure confidential transactions and user anonymity.

- Strong community support and active development.

- Adoption by darknet markets and privacy-conscious users.

- Constant focus on improving security and obfuscation techniques.

Cons

- Regulatory concerns due to potential illicit uses of privacy-focused cryptocurrencies.

- Relatively low liquidity compared to other major cryptocurrencies.

- Dependence on third-party wallets and services for user-friendly interfaces.

- Overhyped claims of complete privacy and anonymity.

Zcash (ZEC)

Zcash is another privacy-oriented cryptocurrency utilizing zero-knowledge proofs for enhanced privacy features. However, its overrated status has led to skepticism.

Pros

- Advanced privacy and anonymity feature through zero-knowledge proofs.

- Transparent and shielded transactions are catering to different user preferences.

- Strong encryption and security measures.

- Active development and research community.

Cons

- Complexity and technical barriers for average users.

- Limited adoption and acceptance by merchants.

- Concerns regarding the trusted setup and governance model.

- Regulatory scrutiny and compliance challenges.

Conclusion

As the cryptocurrency market evolves, caution and thorough research are essential for investors. The top 20 overrated cryptocurrencies in 2023 have pros and cons but face challenges and uncertainties. Evaluating each coin’s fundamentals, technology, adoption, and market trends is crucial before making any investment decisions.

While some overrated coins may eventually prove their worth, investors should remain vigilant and avoid falling prey to hype and market speculation. Diversification and a long-term perspective are key to navigating the ever-changing landscape of cryptocurrencies.

FAQs

These overrated coins are valuable. However, their perceived value may be inflated, and caution is advised when considering investments in them.

Investing in cryptocurrencies carries risks, and it is crucial to assess your risk tolerance and seek advice from a financial advisor before making any investment decisions.

Identifying overrated cryptocurrencies requires careful analysis of their fundamentals, technological advancements, adoption rates, and market sentiment. Relying solely on hype and speculation should be avoided.

The value of cryptocurrencies is influenced by various factors and market dynamics, making it challenging to predict future performance accurately.

Several factors contribute to the overvaluation of a cryptocurrency, including media hype, market sentiment, speculation, a lack of understanding, and inflated expectations.

Read more related topics:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.