SEC Approves Spot Bitcoin ETFs in Historic Move for Digital Asset Industry

In Brief

The U.S. SEC today approved the issuance of Spot Bitcoin ETFs, concluding months of anticipation and verifying approval rumors.

U.S. Securities and Exchange Commission (SEC) today approved the issuance of Spot Bitcoin Exchange-Traded Funds (ETFs), concluding months of anticipation within the digital asset sector. Over a dozen firms submitted applications to the SEC, seeking approval for these investment products.

After a weeks of tumultuous period, the regulatory body has finally granted approval to all applicants.

SEC’s approval marks a significant milestone for the industry, paving the way for major asset management firms, including BlackRock, Grayscale, and Valkyrie, to launch their own Bitcoin-focused ETFs — a development poised to reshape the digital asset investment landscape.

While Bitcoin futures ETFs have been accessible to U.S. investors for some time, the SEC has exhibited reluctance towards approving a spot ETF, specifically designed to mirror the real-time price movements of Bitcoin.

The decision is being hailed as a game-changer for the industry, as Bitcoin is expected to gain broader acceptance as an investment asset following the introduction of the Spot ETF. The ripple effect may extend to other digital assets, exposing them to similar investment opportunities.

🚨BREAKING🚨

— James Seyffart (@JSeyff) January 10, 2024

Bitcoin ETFs Likely Approved by the SEC

It certainly looks like the #Bitcoin ETF Approval order had hit the SEC website but the link is no longer working. That said, this document looks accurate to me.https://t.co/NhJueWNPJ0 pic.twitter.com/W0ipnlg3j1

The road to approval was not that smooth. It kicked off back in July 2013 when Cameron and Tyler Winklevoss pitched the idea of the Winklevoss Bitcoin Trust. The SEC officially said a big “NO” to their proposal in March 2017, worrying about Bitcoin’s unpredictable market swings and risks for investors. This rejection established a pattern for turning down different Bitcoin ETF proposals in the years that followed.

Today’s pivotal development also follows Grayscale Investments’ securing a significant triumph against the SEC. A federal appeals court overturned the rejection of Grayscale’s application to transform its Bitcoin trust into an ETF, citing the commission’s failure to provide a clear rationale for the disparate treatment of similar products. Notably, ETFs holding Bitcoin futures had received approval in 2021.

“The approval of spot Bitcoin ETFs in the United States is a monumental step forward for GBTC investors and all those who realize the potential for crypto to transform our future. Today’s historic outcome is a testament to GBTC’s investors for their unwavering patience and support, and to the entire Grayscale team and our partners for their hard work and dedication,” said Grayscale CEO Michael Sonnenshein, in a press release.

“I am happy to confirm that the Grayscale team has received necessary regulatory approvals to uplist GBTC to NYSE Arca, and we will share a press release with additional information shortly” ~ Grayscale spokesperson

— Frank Chaparro (@fintechfrank) January 10, 2024

Fee Race to Watchout For

With the secured approval for Spot Bitcoin ETF issuance, the imminent focus shifts to trading. Experts in the industry predict an early Thursday morning commencement of trading, envisioning significant upward momentum in Bitcoin prices and other assets following this regulatory approval.

“Investors today can already buy and sell or otherwise gain exposure to bitcoin at a number of brokerage houses, through mutual funds, on national securities exchanges, through peer-to peer payment apps, on non-compliant crypto trading platforms, and, of course, through the Grayscale Bitcoin Trust,” wrote SEC Chairman Gary Gensler in a official statement.

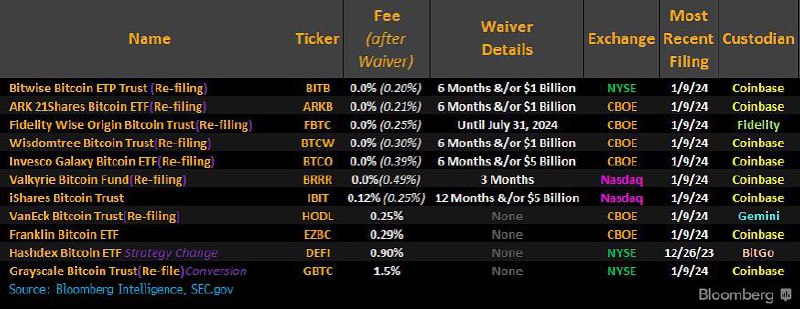

BlackRock and Ark Investments have already lowered fees for their upcoming Bitcoin exchange-traded funds (ETFs). According to a recent S-1 filing, BlackRock has revised its fee structure, reducing it to 0.25% for the first 12 months or until the fund accumulates $5 billion in assets, down from the previously established 0.30%.

Likewise, Ark Investments and 21Shares had adjusted their fees to 0.21% from the previous 0.25%, with a reduced rate of 0.12% for the initial $5 billion. Additionally, the company will waive the entire fee for the first six months after the fund’s listing or until assets reach $1 billion, whichever comes first.

True, now the race begins, but that’s going to be more normal tracking of flows volume new launches etc unlike this emotional roller coaster many of us have been held hostage by for 6mo, and especially last two days. We’re free now. https://t.co/rY1xZF8YVe pic.twitter.com/6FtPnc4Mmg

— Eric Balchunas (@EricBalchunas) January 10, 2024

CBOE also announced the imminent commencement of trading for Spot Bitcoin ETFs starting tomorrow. The exchange confirmed that six out of the eleven pending ETFs are slated to initiate trading on Thursday.

It will specifically list the Invesco Galaxy Bitcoin ETF (BTCO), Franklin Bitcoin BTF (EZBC), ARK 21Shares Bitcoin ETF (ARKB), VanEck Bitcoin Trust (HODL), Fidelity Wise Origin Bitcoin Fund (FBTC) and WisdomTree Bitcoin Fund (BTCW). Notably, CBOE had previously announced the pending SEC approval for these investment products.

Looks like the first "request for acceleration" (which is a request to launch on same day as everyone else, in this case 1/11, which the SEC told issuers to put in today) has dropped. We were expecting them at 4pm, but earlier is fine (ARK is always the first in this stuff), it's… pic.twitter.com/HEi6jB56qY

— Eric Balchunas (@EricBalchunas) January 10, 2024

This regulatory development not only opens new avenues for investors but also underscores the growing legitimacy and mainstream recognition of digital assets within the broader financial landscape.

“While we approved the listing and trading of certain spot bitcoin ETP shares today, we did not approve or endorse bitcoin. Investors should remain cautious about the myriad risks associated with bitcoin and products whose value is tied to crypto,” added SEC’s Gensler.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Kumar is an experienced Tech Journalist with a specialization in the dynamic intersections of AI/ML, marketing technology, and emerging fields such as crypto, blockchain, and NFTs. With over 3 years of experience in the industry, Kumar has established a proven track record in crafting compelling narratives, conducting insightful interviews, and delivering comprehensive insights. Kumar's expertise lies in producing high-impact content, including articles, reports, and research publications for prominent industry platforms. With a unique skill set that combines technical knowledge and storytelling, Kumar excels at communicating complex technological concepts to diverse audiences in a clear and engaging manner.

More articles

Kumar is an experienced Tech Journalist with a specialization in the dynamic intersections of AI/ML, marketing technology, and emerging fields such as crypto, blockchain, and NFTs. With over 3 years of experience in the industry, Kumar has established a proven track record in crafting compelling narratives, conducting insightful interviews, and delivering comprehensive insights. Kumar's expertise lies in producing high-impact content, including articles, reports, and research publications for prominent industry platforms. With a unique skill set that combines technical knowledge and storytelling, Kumar excels at communicating complex technological concepts to diverse audiences in a clear and engaging manner.