Central Bank

What is Central Bank?

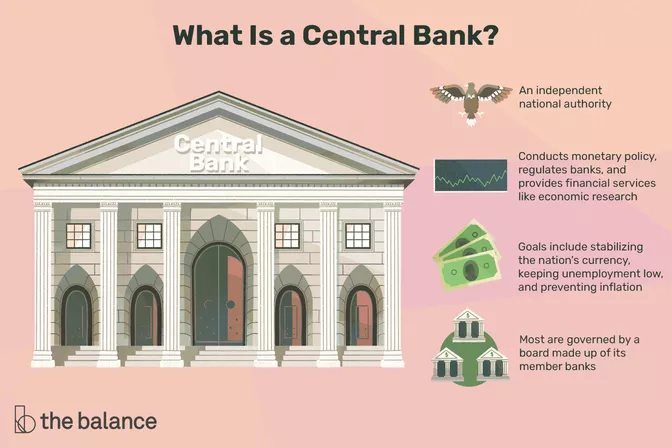

A central bank is a financial institution that has exclusive control over the production and distribution of money and credit for a country or group of countries. In modern economies, the central bank is normally in charge of monetary policy formulation and member bank regulation.

Central banks are, by definition, non-market or even anti-competitive entities. Although some are nationalized, many central banks are not government organizations and are thus frequently praised for their political independence. Even if the government does not legally own a central bank, its rights are established and guaranteed by legislation.

The fundamental trait that distinguishes a central bank from other banks is its legal monopoly status, which allows it to issue banknotes and currency. Private commercial banks can only issue demand liabilities like checking deposits.

Understanding Central Bank

Although their tasks vary depending on the country, central banks’ duties (and the reason for their existence) often fall into three categories.

First, central banks regulate and manipulate the national money supply by issuing currency and establishing loan and bond interest rates. Central banks often raise interest rates to restrict growth and avoid inflation; they cut interest rates to stimulate growth, industrial activity, and consumer spending. They administer monetary policy in this way to lead the country’s economy and attain economic goals such as full employment.

Most central banks today set interest rates and conduct monetary policy with an annual inflation target of 2-3%.

Second, they control member banks by imposing capital requirements, reserve requirements (which govern how much money banks can lend to consumers and how much cash they must maintain on hand), and deposit guarantees, among other things. They also make loans and give services to a country’s banks and government, as well as maintain foreign exchange reserves.

Finally, a central bank serves as an emergency lender to distressed commercial banks and other institutions, as well as, on occasion, the government. When a government wants to raise money, the central bank can provide a politically appealing alternative to taxation by purchasing government debt obligations, for example.

Read related articles:

« Back to Glossary IndexDisclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.