AaveDAO votes 501,000 to 12 in favor of new GHO stablecoin

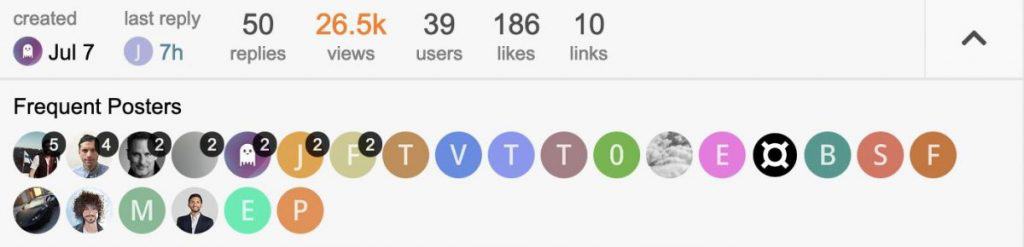

The AaveDAO turned out in digital droves last weekend to greenlight GHO–the DeFi protocol’s forthcoming new stablecoin. Governance introduced the proposal with a blog post on July 7, opening the matter up to a spirited conversation, critical instead of recent stablecoin collapses.

However, the official vote lasted from July 28 to July 31 and proved that members love the idea. 501,000 Aave tokens were deployed in favor of the proposition, with only 12 cast in denial. Conversely, 17 tokens were counted as abstaining. Sure, there were some whales, but overall this vote was relatively well-distributed–the largest single holder cast 183,000 tokens in favor. That sum on its own wouldn’t have been enough to secure GHO’s initiation.

The people, in this instance, have spoken—all systems GHO.

What is Aave?

Founded in 2017 after a $16 million ICO round, Aave is a non-custodial DeFi market platform where users can borrow and lend various cryptocurrencies for their benefit. Prioritizing passive income, the open-sourced protocol’s site says they’ve got over $9 billion in liquidity locked across seven networks and thirteen markets. According to DeFi Llama, they’re the third largest protocol of this variety in the space–trailing Lido and MakerDAO.

What is GHO?

GHO will be an overcollateralized stablecoin pegged to the US dollar. GHO will be Aave’s latest token, but not their first. Kraken says that Aave already uses two crypto tools: “aTokens, issued to lenders so they can collect interest on deposits, and AAVE tokens, which are the native token of Aave.”

“What makes Aave protocol unique is that it allows users to earn interest in real-time because deposits are tokenized as Aave interest-bearing tokens (shortly aTokens) pegged at a 1:1 ratio to underlying assets,” adds data firm Nomics. “Interest is also paid in aTokens, but they are converted back to the asset when lenders withdraw their funds.”

Aave users will mint GHO against their collateral within the wide range of cryptocurrencies supported by Aave. “People who borrow GHO against crypto assets will still earn interest on the underlying collateral used to mint the stablecoin,” Decrypt said.

GHO will empower AaveDAO to generate more funds for its treasury and community through transaction fees and interest collected on loans taken out in the stablecoin. “When users repay a borrowing position or are liquidated, the GHO lent will be burned from the protocol,” Decrypt also said.

Community Feedback

The DAO’s formal Snapshot proposal highlighted notable discussions, including “potential pitfalls around DAO-set interest rates, the importance of supply caps, the value that a peg stability module could bring, [and] the necessity for properly vetting potential facilitators.”

“I do want to call out that borrowing interest rates cannot be controlled by the DAO,” wrote user O_expxresearch in the forum. “They need to be variable or fixed but be completely market-driven.” The user pointed out that pegged currencies can’t have all three of the following at once: free flow of capital, independent monetary policy, and peg stability.

“UST wanted to achieve all three which led to significant capital imbalances,” they wrote. Aave Companies has since said they’ll create this policy based on external market conditions.

Both the DAO and the crypto community at large contended with GHO through the lens of now-infamous stablecoins like TerraUSD (UST).

“Many Aave proponents were quick to point out that the flawed mechanism of UST, which was uncollateralized, eventually led to its depegging,” Cointelegraph wrote.

“Unlike algorithmic stablecoins, whose designs have been called into question following the collapse of Terra, crypto-backed stablecoins are assets collateralized by a basket of other digital assets,” Blockworks added. “Yet like its algorithmic cousin, GHO will be created by users when they supply the required collateral. When a user repays a borrow position, the GHO protocol governing the stablecoin burns that user’s GHO.”

What’s Next

Following the groundbreaking GHO approval, the price of AAVE tokens spiked for a second, climbing from around $95 to $108. After that, prices hovered in the triple digits for a bit, but now they’re back down to $95, according to CoinMarketCap at the time of writing.

The GHO proposal’s introduction states that last weekend’s vote was just a preliminary round intended to secure community approval and kickstart dialogue. The vote also served safelist Aave’s V2 Ethereum Market as the first facilitator for GHO. V3 is coming soon, they said.

“The next step is voting on the genesis parameters of GHO,” Aave tweeted. “Look out for a proposal next week on the governance forum.”

The community will also decide if they’re willing to support the company on costs and work required to launch the stablecoin–perhaps its social over-collateralization.

We’d put another GHO pun here, but there shouldn’t be any shortage in the coming weeks. Stay tuned.

Read related posts:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Vittoria Benzine is a Brooklyn-based art writer and personal essayist covering contemporary art with a focus on human contexts, counterculture, and chaos magic. She contributes to Maxim, Hyperallergic, Brooklyn Magazine, and more.

More articles

Vittoria Benzine is a Brooklyn-based art writer and personal essayist covering contemporary art with a focus on human contexts, counterculture, and chaos magic. She contributes to Maxim, Hyperallergic, Brooklyn Magazine, and more.