JPMorgan’s Latest Report Unveils U.S. Crypto Regulations Impacting Regional Banks and Non-Compliant Stablecoins

In Brief

US crypto regulations are reportedly against central bank digital currency, regional bank adoption, and non-compliant stablecoins like Tether, according to a JPMorgan research report.

Emerging U.S. crypto regulations appear to be leaning against the introduction of a central bank digital currency (CBDC), discouraging regional banks from adopting cryptocurrencies, and being wary of non-compliant stablecoins such as Tether (USDT), according to a recent research report published by JPMorgan.

This change in regulation occurs at a time when several nations are aggressively investigating and creating their own CBDCs, while the United States seems to be proceeding more cautiously. According to the research, regulatory measures in the United States are opposed to a Fed coin, to U.S. institutions interacting with cryptocurrency, to non-compliant stablecoins like Tether (USDT), and to classifying any tokens other than Bitcoin (BTC) and Ether (ETH) as securities.

The Clarity for Payment Stablecoins Act is predicted to strengthen U.S. compliance stablecoins while posing a challenge to the dominance of non-compliant stablecoins like Tether. The act has a better chance of passing before the November 2024 presidential election. Stablecoins are a subset of cryptocurrencies that are linked to a stable asset, such as gold or the US dollar, in order to reduce price volatility.

In between, the Senate and the President still need to work more on the FIT21, which was enacted by the House of Representatives last month, according to JPMorgan.

CBDC Anti-Surveillance State Act was also approved by the House of Representatives. Its purpose is to obstruct a U.S. CBDC and prohibit Federal Reserve banks from using it for monetary policy objectives or to provide specific goods to customers. Its chances in the Senate are still unclear, though.

The Conflict Over CBDCs: A Worldwide Split

The controversy surrounding CBDCs has expanded to a worldwide scale, with many nations adopting radically divergent stances. While other countries are moving on with their plans for digital currencies, the United States has vague plans to embrace a CBDC.

The CBDC Anti-Surveillance State Act, presented in February 2024 by Republican Senators, forbids the Federal Reserve from providing a CBDC to private citizens directly. Representative Tom Emmer expressed similar worries in September 2023 when he presented a similar measure in the House, stating that a CBDC may undermine Americans’ right to financial privacy and turn it into a tool for CCP-style monitoring. This legislation mirrors the same concerns.

The differences also apply to the presidential contenders. Donald Trump, the former president, has sworn never to permit the establishment of a CBDC, branding it as a terrible threat to freedom that would provide the federal government total power over your finances.

On the other hand, it seems like the Federal Reserve is being careful. Vice Chair for Supervision Michael S. Barr said in a speech in September 2023 that the Fed is still in the investigative stage and “a long way off” from making any judgments on creating a CBDC.

Developments in CBDC Worldwide

While the United States struggles with its position on CBDCs, a number of other nations have already made great progress with their digital currency projects.

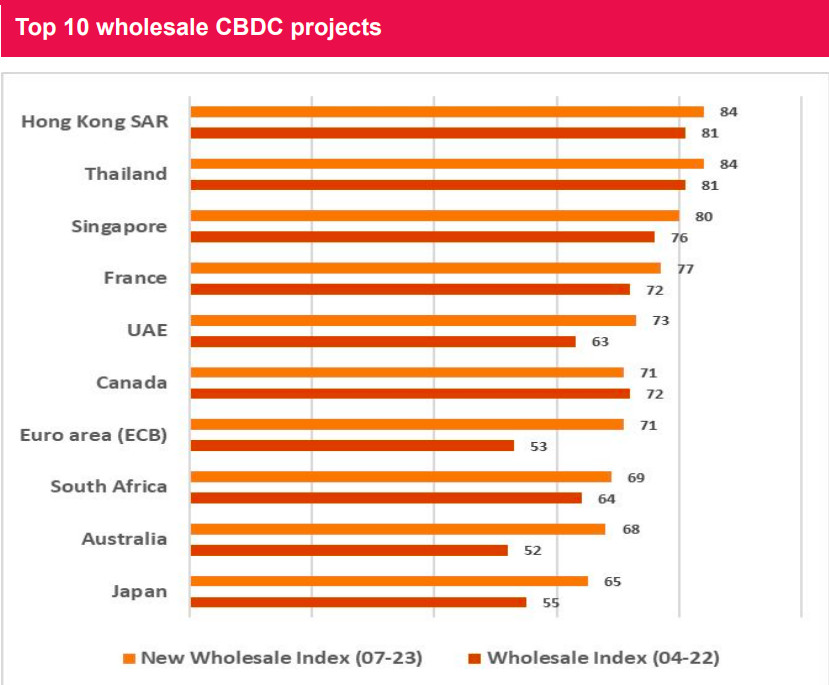

Photo: PwC

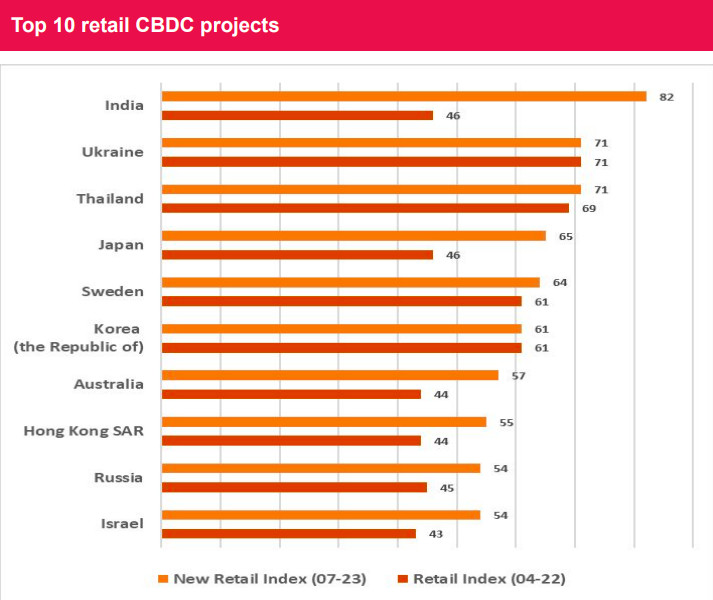

Photo: PwC

The Sand Dollar initiative in the Bahamas has taught other governments planning to issue CBDCs important lessons. In order to foster confidence regarding data safety and cybersecurity, the Central Bank has underlined the need to grow the merchant network, guarantee compatibility with the conventional banking system, recruit banks and credit unions to participate, and give user education first priority.

The Eastern Caribbean Community Bank (ECCB) has been aggressively marketing its DCash CBDC application in the area by boosting marketing efforts and making it available for download via online retailers.

China’s ambitious e-CNY initiative has advanced significantly, with partner institutions and the central bank investigating a variety of use cases. These include making financial product purchases possible, generating money through the issuing of corporate bonds, making salary payments to public sector workers easier, and testing the use of e-CNY cross-border for tourists from mainland China in Hong Kong. Furthermore, China has introduced SIM card-based hardware wallets with NFC capabilities in partnership with major banks and telecom providers, enabling transactions even in the absence of an internet connection.

Although the Central Bank of Nigeria has made attempts to encourage its usage, the acceptance of eNaira in Nigeria has been slower than anticipated. These include opening up access to those without internet or bank accounts, allowing eNaira for remittances from the diaspora through international money transfer providers, onboarding revenue collection agencies, and aggressively advertising the CBDC through partnerships with businesses and public awareness campaigns.

These countries are currently investigating real-world CBDC applications, which will spur more innovation and industry-wide cooperation. The road to widespread acceptance is still difficult, though, since there are still obstacles to overcome, including those related to user education, expanding merchant networks, and maintaining interoperability with conventional banking systems.

Digital Currencies and Their Future: the Innovation and Regulation Points

The discussion between proponents and doubters of digital currencies is becoming more heated as the environment changes. Proponents contend that CBDCs and stablecoins subject to strict regulations can advance financial inclusion, boost the effectiveness of payments, and cut expenses related to established financial institutions. However, detractors bring up issues with privacy, the dangers of monitoring, and the possibility of government overreach.

It seems that the goal of US regulatory policy is to balance risk mitigation with responsible innovation promotion. Financial stability, responsible innovation, and the protection of consumers and investors are among the top concerns outlined in Biden’s Order. However, the President’s 2023 Economic Report has recently included criticisms that point to a possible change in the administration’s position on cryptocurrency.

With the 2024 presidential election drawing near, there will probably be a lot of discussion on where US crypto rules will go. Whatever the result, it is obvious that the world of digital currencies is going through a transitional phase, and maintaining a sustainable development trajectory will depend on striking the correct balance between innovation and regulation.

The debate surrounding virtual currencies is far from over, and the coming years will play a crucial role in shaping the future of this groundbreaking technology. The world is watching with great interest as countries struggle with the complexity of stablecoins and CBDCs, hoping that in the future, digital currencies will live up to their promise of empowering economies while reducing risks and unforeseen effects.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.