Top 15+ Crypto Brokers in 2023: Safe and Regulated

Crypto brokers are online platforms that act as intermediaries between buyers and sellers of cryptocurrencies, allowing them to easily trade digital assets. These platforms provide a user-friendly interface that allows traders to access a variety of cryptocurrency markets. Some offer a wide range of cryptocurrencies to choose from, and they often allow for easy conversion between different coins.

Usually, crypto brokers offer Contracts for Difference (CFDs), which allows traders to speculate on the price movements of cryptocurrencies without actually owning them. In this listicle, we’ll be exploring the top 15 crypto brokers and examining their features and benefits so that you can make an informed decision on which platform is right for you.

What are CFDs?

CFDs are typically offered by brokers and can be used to trade a variety of assets, including stocks, commodities, and cryptocurrencies. When you trade a CFD, you essentially enter into a contract with the broker. The contract specifies the difference between the price of the underlying asset at the time the contract is opened and the price at the time the contract is closed. If the price of the underlying asset increases during this period, the trader will make a profit. Conversely, if the price of the underlying asset decreases, the trader will incur a loss.

This form of trading allows traders to take advantage of both upward and downward price movements in the market and to use leverage, which means that they can control a larger position with a smaller amount of capital. However, this also means that losses can be amplified, so it’s important to trade cautiously.

CFDs are often used by traders as a way to hedge their positions in the market or to speculate on short-term price movements. They can also be used to gain exposure to assets that would be difficult or expensive to own directly, such as certain commodities or international stocks.

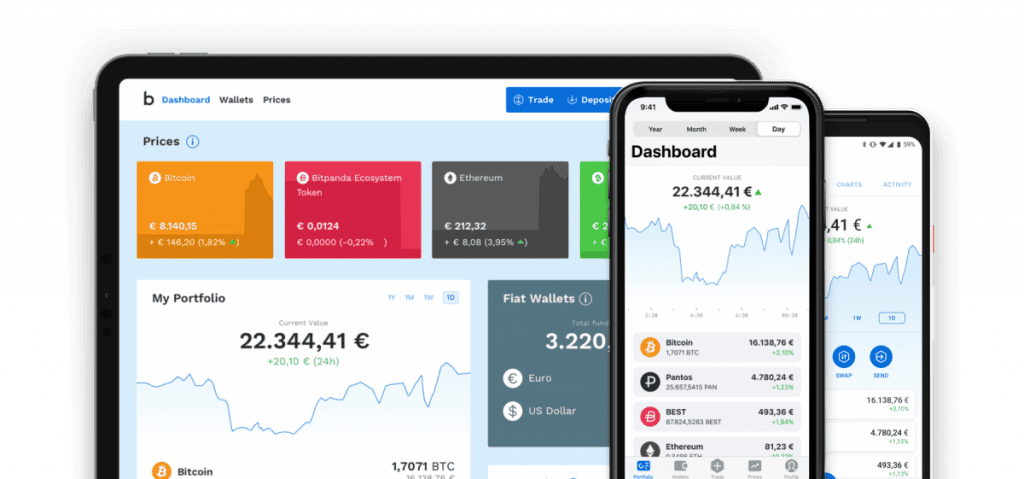

1. Bitpanda

Bitpanda simplifies wealth creation. Founded in 2014 in Vienna, Austria by Eric Demuth, Paul Klanschek and Christian Trummer, Bitpanda exists to help people trust themselves enough to build financial freedom for their future. The user-friendly, multi assets investment platform empowers both first-time investors and seasoned experts to invest in the cryptocurrencies, crypto indices, stocks*, precious metals and commodities they want — even outside of traditional trading hours, 24/7. With hundreds of team members from across the globe and over 4 million customers, the company is one of Europe’s most successful fintechs.

Safety

- A regulated platform that does things the right way, not the easy way. Bitpanda prioritises keeping your assets safe, incorporating multiple security measures to protect them from potential threats. Crypto assets are stored in highly-secure cold storage facilities that are examined by an external auditor.

- Your assets are yours. Regulated by financial authorities across the European Union, The Bitpanda Group diligently follows European laws and regulations. We operate our businesses based on various VASP registrations, as well as MiFID II, E-Money and PSD II licences amongst all our core markets and Finansinspektionen in Sweden, with more added all the time.

Simplicity

- Quick and simple registration with BankID available in Sweden.

- You can already open a free Bitpanda account and start investing in the digital assets of their choice within minutes

- 24/7 availability

- Bitpanda is currently offering trading in SEK through Visa and Mastercard, as well as EUR, USD, GBP, CHF, TRY, PLN, HUF, CZK, DKK.

All assets in one place

- Bitpanda now offers over 300 tradable cryptocurrencies, bringing the total number of tradable digital assets on the platform to more than 2600, including cryptocurrencies, commission-free fractional stocks, ETFs, commodities and precious metals.

Pros:

- Crypto

- Precious Metals

- Bitpanda Stocks as a simple, affordable and safe way of investing in stocks and ETFs available even outside trading hours

- Crypto Indices: The world’s first real crypto index – an easy, automated way to invest in the whole crypto market

- Bitpanda Commodities as a simple way to take advantages of short term price movements in the commodities market

- Bitpanda Spotlight: Get early access to hot, new crypto projects. For the innovators and trailblazers, the early adopters and trendsetters, Bitpanda Spotlight gives you access to new, hard to find and fast-moving crypto projects on a highly regulated and secure platform.

- Staking: Put your investment to work. Stake your coins on Bitpanda and earn extra rewards on top of your holdings. It’s safe, simple and hassle-free.

- Leverage: Bitpanda Leverage is a new way for our community to trade the markets on a short term horizon with 0% buy fees. Make short-term volatility work for you and trade in the crypto market whether prices go up or down.

- Bitpanda Cash Plus: Earn 2.68% and more on your cash. Earn high-yield returns for EUR, GBP, and USD and benefit from 24/7 availability.

Cons:

- Only available in Europe to European residents

Disclaimer: Bitpanda Stocks are contracts replicating an underlying stock or ETF.

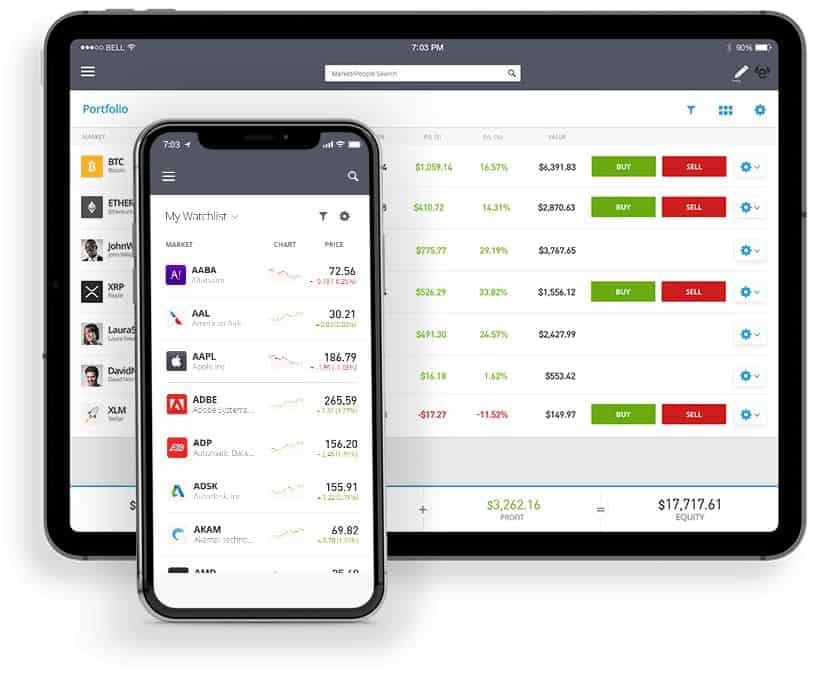

2. eToro

eToro is a popular multi-asset brokerage firm that enables investors to trade a variety of financial assets, including cryptocurrencies. Its crypto brokerage services allow traders to access over 60 digital assets, such as Bitcoin, Ethereum, Litecoin, and more. The platform also allows users to easily convert between different coins. Its user-friendly interface and social trading features make it a popular choice for both beginner and experienced traders.

One of eToro’s unique features is its social trading platform, which allows users to follow and copy the trades of other successful traders. This can be useful for investors who are new to the crypto market and want to learn from more experienced traders.

Pros:

- User-friendly platform with a wide range of assets to trade, including cryptocurrencies.

- CopyTrader feature allows users to automatically copy the trades of successful investors on the platform.

- Regulated by financial authorities, including the FCA and CySEC.

Cons:

- High fees compared to other crypto brokers.

- Limited range of cryptocurrencies available for trading.

- Limited functionality for advanced traders, such as the ability to set custom stop-loss and take-profit levels.

3. Uphold

Uphold is a digital money platform that allows users to buy, sell, and hold various assets, including cryptocurrencies. The platform offers a user-friendly interface and supports a wide range of cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and more. Uphold also allows users to exchange cryptocurrencies with fiat currencies, such as the US dollar and Euro, as well as other assets like gold and silver.

The platform serves 184+ countries across 200+ currencies (traditional and crypto) and commodities with frictionless foreign exchange and cross-border remittance for members around the world. Since launching in 2015, Uphold has powered more than US$4+ billion in transactions.

Pros:

- Offers over 250 cryptocurrencies, including popular options like Bitcoin, Ethereum, and Litecoin, as well as lesser-known altcoins.

- Supports multiple funding options, including bank transfers, credit/debit cards, and various cryptocurrencies.

- Commission-free trading for cryptocurrencies.

Cons:

- Users may experience slower processing times for transactions and transfers compared to other crypto brokers.

- Limited support for fiat currencies beyond USD.

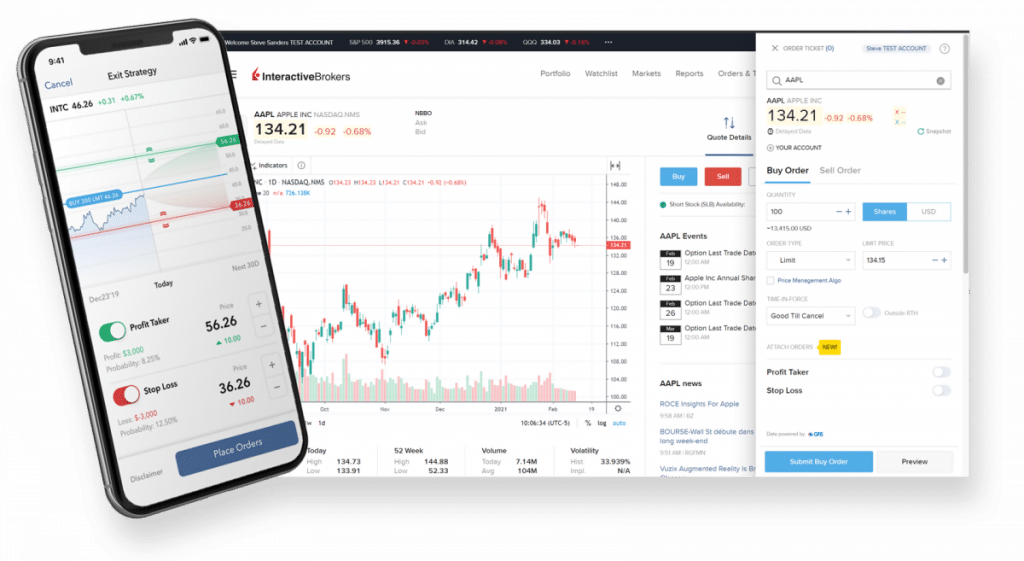

4. Interactive Brokers

Interactive Brokers is a popular brokerage firm that offers a wide range of investment services, including access to various cryptocurrency markets. The company is known for its low trading fees and advanced trading tools, making it a popular choice for experienced investors. With crypto custody and trade execution provided by Paxos Trust Company, Interactive Brokers offers access to Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

One of the main advantages of using Interactive Brokers for cryptocurrency trading is the low fees. The company charges a commission of just 0.12% of the total trade value, with a minimum commission of $1.50 per trade. Additionally, the platform’s advanced trading tools, including customizable charts and real-time market data, make it a popular choice for experienced traders.

Pros:

- Low commission.

Cons:

- Requires a minimum account balance of $10,000.

- Not for beginner investors.

- Access to a limited range of cryptocurrencies.

5. TradeStation

TradeStation is a popular online brokerage platform that offers a range of investment products, including stocks, options, futures, and cryptocurrencies. The platform is known for its advanced trading tools and features, making it a favorite among active traders and investors.

The platform’s cryptocurrency offering provides access to some of the most popular digital assets, including Bitcoin, Ethereum, Litecoin, and Bitcoin Cash. Users can trade these assets on TradeStation’s user-friendly platform, which includes real-time data, customizable charting tools, and advanced order types.

Pros:

- A wide range of investment products available, including stocks, options, futures, and cryptocurrencies.

- Competitive pricing for trading commissions and fees, with various pricing plans available to fit different trading styles and needs.

Cons:

- Can be overwhelming for beginners and may take some time to get used to.

- The functionality and features of its mobile app are limited compared to the desktop platform.

- Limited range of cryptocurrencies offered.

6. iTrust Capital

iTrustCapital offers a secure and regulated solution for individuals looking to invest in cryptocurrencies and precious metals using their retirement accounts. It offers 28 cryptocurrencies, including popular ones like Bitcoin, Ethereum, Avalanche, and more.

The platform operates on a no-custody model so that it never takes control of client assets, borrows against them, leverages them for profit, or allows its custody providers to do so. Instead, it uses a regulated, state-chartered trust company to hold self-directed IRAs and custody of client assets, ensuring that the platform adheres to industry standards and regulations. Last January, iTrust Capital raised $125 million in Series A.

Pros:

- Offers a self-directed IRA that allows users to invest in cryptocurrencies without the need for a custodian.

- Does not take custody of user assets

- User assets are stored with third-party institutional storage providers and regulated, state-chartered trust companies.

Cons:

- Offers a limited selection of cryptocurrencies.

- For US clients only.

7. IFC Markets

IFC Markets offers a crypto brokerage service that allows traders to speculate on the price movements of cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. The platform provides a range of trading instruments, including crypto CFDs and currency pairs involving cryptocurrencies.

The crypto brokerage service is integrated with IFC Markets’ other offerings, allowing traders to diversify their portfolios across multiple asset classes, including forex, commodities, and indices. The platform also provides access to a range of trading tools, including technical analysis indicators and customizable charts. IFC Markets’ crypto brokerage is regulated by the British Virgin Islands Financial Services Commission, ensuring a level of oversight and protection for traders.

Pros:

- Offers a diverse range of trading instruments, including cryptocurrencies, forex, stocks, and commodities.

- Provides a variety of trading platforms, including the popular MetaTrader 4 and 5.

- Offers flexible account types with different trading conditions to cater to the needs of different traders.

Cons:

- Not for beginners.

8. Eightcap

Based in Australia, Eightcap is a regulated online trading broker that provides access to over 100 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple, among others. Eightcap allows clients to trade CFDs on crypto through its MetaTrader 4 and MetaTrader 5 platforms. The broker offers competitive spreads and leverage of up to 1:30 for retail clients.

The brokerage offers fast and secure deposits and withdrawals through various payment methods, including credit/debit cards, bank transfers, and e-wallets. It also ensures the safety of clients’ funds by segregating them from its operational funds and using advanced encryption technology to protect clients’ personal and financial information.

Pros:

- Competitive pricing and low spreads.

- Multiple trading platforms available, including MT4 and MT5.

- Good selection of tradable instruments, including cryptocurrencies.

Cons:

- Limited educational resources for beginners.

- No negative balance protection.

- Limited customer support available on weekends.

9. Avatrade

AvaTrade is a regulated brokerage that offers CFD trading in various markets, including cryptocurrencies. With a robust and intuitive platform, traders can access a wide range of tools and features to analyze markets and execute trades with ease.

Regarding its crypto brokerage services, AvaTrade offers a range of popular cryptocurrencies, including Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash. Traders can also trade crypto against fiat currencies such as the US dollar, euro, and Japanese yen. The platform provides advanced charting tools, real-time market data, and a range of technical indicators to help traders make informed trading decisions. AvaTrade also offers competitive spreads and leverage up to 1:20 for crypto trading.

Pros:

- Offers a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, and AvaTradeGO, suitable for different levels of experience and preferences.

- Has a range of educational resources, including webinars, tutorials, and eBooks, to help traders improve their knowledge and skills.

Cons:

- Offers only over 50 cryptocurrencies.

- High minimum deposit requirement of $250.

- High inactivity fees and overnight financing fees.

10. Think Markets

Established in 2010, Think Markets offers CFD trading on forex, indices, precious metals and cryptocurrency. In addition to its wide range of financial markets, ThinkMarkets offers a crypto brokerage service where traders can access the cryptocurrency market with competitive spreads and deep liquidity. Traders can speculate on the price movements of various cryptocurrencies such as Bitcoin, Ethereum, and Litecoin using leverage.

The crypto trading platform is integrated into the ThinkTrader platform, providing traders access to real-time market data and advanced trading tools. ThinkMarkets’ crypto brokerage also offers a secure wallet for traders to store their digital assets.

Pros:

- Emphasis on trading education and financial literacy.

- 24/7 trading.

- Multiple charting tools, news feeds, and economic calendars

Cons:

- Limited payment options for deposits and withdrawals.

- Limited cryptocurrency options.

- No commission-free trading options for cryptocurrencies.

11. Admiral Markets

Admiral Markets is a broker that provides traders with the opportunity to engage in contracts for difference (CFD) product trading across various markets, including stocks, indices, commodities, forex, bonds, and cryptocurrencies.

The brokerage offers eight crypto options, including Bitcoin, Ethereum, Bitcoin Cash, Dash, Ripple, Monero, ZCash, and Litecoin, priced against their USD valuation. Despite its relatively small crypto offerings, the market for these products is highly liquid, with a spread of around 1%. Traders can apply leverage of up to 1:2, while professional traders can trade with up to 1:5 leverage.

Pros:

- Regulated by the FCA.

- Traders can apply leverage.

- Highly liquid.

Cons:

- Only offers eight cryptocurrencies.

- Charges a fee for opening and closing trades.

12. IC Markets

Yet another Australia-based CFD trading platform, IC Markets enables its clients to trade on multiple cryptocurrencies, such as Bitcoin, Ethereum, Polygon and Polkadot, among others. The company offers competitive spreads and low commissions to its traders.

IC Markets’ cryptocurrency CFD trading platform allows traders to speculate on the price movements of various cryptocurrencies without owning the underlying asset. This means that traders can easily go long or short on the cryptocurrency market, making it possible to profit from both rising and falling prices. The platform offers high leverage, which allows traders to increase their market exposure with a relatively small initial investment.

Pros:

- Offers a wide range of trading instruments, including cryptocurrencies.

- Low spreads and commissions for trading.

- Offers various trading platforms, including MetaTrader and cTrader.

Cons:

- Limited educational resources for beginner traders.

- Does not accept clients from some countries, such as the United States.

- Limited deposit and withdrawal options compared to other brokers.

13. Plus500

With subsidiaries in the UK, Cyprus, Australia, Israel, Seychelles, Singapore, Bulgaria, Estonia, the United States and Japan, Plus500 is a popular online trading platform that offers a wide range of financial instruments, including cryptocurrencies. It offers CFDs on several cryptocurrencies, including Bitcoin, Ethereum, Litecoin, Cardano and more.

Traders can buy or sell these cryptocurrency CFDs, depending on their market expectations. The platform offers competitive spreads on cryptocurrency CFDs and with up to 1:2 leverage starting with as little as €100 €.

Pros:

- Authorized and regulated by the Estonian Financial Supervision and Resolution Authority.

- Offers round-the-clock dedicated customer service in multiple languages.

- Funds are kept in segregated bank accounts in accordance with regulatory requirements.

Cons:

- A limited range of cryptocurrencies for trading.

- Does not support the popular MetaTrader 4 platform, which could be a disadvantage for experienced traders.

14. WeBull

Webull is a commission-free online brokerage that offers trading services for a variety of financial instruments, including cryptocurrencies. The platform supports more than 40 cryptocurrencies and users can trade Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Litecoin (LTC), and Dogecoin (DOGE) on its platform. Buying and selling cryptocurrencies can be done on the platform with a low minimum requirement of $1. The settlement process is instant, which means that the funds are immediately available for trading.

Webull also provides complimentary real-time data, customizable charts, and indicators to keep up with the cryptocurrency market. These tools and research resources are available on the platform, enabling traders to track and analyze the performance of different cryptocurrencies. The customizable charts and indicators allow traders to tailor their analysis to their trading strategy.

Pros:

- Low minimum for cryptocurrency trading at $1.

- Instant settlement, ensuring funds are always available for trading.

- Complimentary real-time data, customizable charts, and indicators to keep up with the crypto market.

Cons:

- Limited cryptocurrency selection compared to other brokers.

- No support for transferring cryptocurrency to an external wallet.

15. Caleb & Brown

An Australia-based firm, Caleb & Brown offers investors a personalized crypto service where they can speak to their broker anytime. It also offers access to cryptocurrencies like XRP and Theta that are not available on certain U.S. exchanges.

With a focus on security, the crypto brokerage only gives its users access to their tokens. Users can trade over 250 crypto assets while working with a personal cryptocurrency broker who can help make informed investment decisions.

Pros:

- Access to a personal crypto broker.

- Only users have access to their tokens.

- 24/7 global customer support.

Cons:

- Not much information on how investors can trade online.

16. Alpaca

Alpaca is a crypto trading platform that allows users to trade through API and the Alpaca web dashboard. This means that users can trade cryptocurrencies at any time of day, seven days a week, with the frequency of their choosing. As of November 18, 2022, cryptocurrency trading is only open to select international jurisdictions and several supported US regions.

With over 20 unique crypto assets available across 48 trading pairs. Currently, trading pairs are based on BTC, USD, and USDT, with plans to add more assets and trading pairs. Alpaca also offers free limited crypto data, as well as an advanced unlimited paid plan. Additionally, users can now access wallets on the web dashboard via the Crypto Transfers tab, which supports transfers for Bitcoin, Ether, Solana, and USDT (ERC20), but eligibility for this service is dependent on residency and applicable jurisdiction.

Pros:

- Users can trade cryptocurrencies at any time of day, seven days a week.

- Offers over 20 unique crypto assets across 48 trading pairs and free limited crypto data.

Cons:

- Requires a certain level of technical expertise to trade through API.

- Wallets are only available to users who are eligible based on residency and applicable jurisdiction.

- Not for beginners.

Crypto brokers cheatsheet

| Crypto broker | Fee | Pros | Cons |

|---|---|---|---|

| Bitpanda | A Bitpanda account can be created and maintained for free. On Bitpanda, there are 1.49% premiums for both buying and selling bitcoin. | – Bitpanda offers a simple, affordable, and safe way to invest in crypto, precious metals, and commodities. – It also provides early access to new projects, staking, leverage, and Bitpanda Cash Plus, offering high-yield returns and 24/7 availability. | Only available to residents of Europe |

| eToro | 1% fee for both open and close transactions. | – User-friendly platform with a wide range of assets to trade, including cryptocurrencies. – CopyTrader feature allows users to automatically copy the trades of successful investors on the platform. – Regulated by financial authorities, including the FCA and CySEC. | – High fees compared to other crypto brokers. – Limited range of cryptocurrencies available for trading. – Limited functionality for advanced traders, such as the ability to set custom stop-loss and take-profit levels. |

| Uphold | 1.5% on BTC and ETH in the U.S., U.K., and Europe; 1.8% in other parts of the world. | – Offers over 250 cryptocurrencies, including popular options like Bitcoin, Ethereum, and Litecoin, as well as lesser-known altcoins. – Supports multiple funding options, including bank transfers, credit/debit cards, and various cryptocurrencies. – Commission-free trading for cryptocurrencies. | – Users may experience slower processing times for transactions and transfers compared to other crypto brokers. – Limited support for fiat currencies beyond USD. |

| Interactive Brokers | ≤ 100,000 0.18% * Trade Value 100,000.01 – 1,000,000 0.15% * Trade Value 1,000,000 0.12% * Trade Value Minimum per order USD 1.75, but no more than 1% of Trade Value | Low commission. | – Requires a minimum account balance of $10,000. – Not for beginner investors. – Access to a limited range of cryptocurrencies. |

| TradeStation | Maker: 10 – .35% Taker: .11 – .60% | – A wide range of investment products available, including stocks, options, futures, and cryptocurrencies. – Competitive pricing for trading commissions and fees, with various pricing plans available to fit different trading styles and needs. | – Can be overwhelming for beginners and may take some time to get used to. – The functionality and features of its mobile app are limited compared to the desktop platform. – Limited range of cryptocurrencies offered. |

| iTrust Capital | 1% transaction fee for the buying and/or selling of cryptocurrencies | – Offers a self-directed IRA that allows users to invest in cryptocurrencies without the need for a custodian. – Does not take custody of user assets – User assets are stored with third-party institutional storage providers and regulated, state-chartered trust companies. | – Offers a limited selection of cryptocurrencies. – For US clients only. |

| IFC Markets | Information unavailable | – Offers a diverse range of trading instruments including cryptocurrencies, forex, stocks, and commodities – Provides a variety of trading platforms, including the popular MetaTrader 4 and 5 – Offers flexible account types with different trading conditions to cater to the needs of different traders | – Limited regulatory oversight compared to some other brokers – Not for beginners. |

| Eightcap | Information unavailable | – Competitive pricing and low spreads. – Multiple trading platforms available including MT4 and MT5. – Good selection of tradable instruments including cryptocurrencies. | – Limited educational resources for beginners. – No negative balance protection. – Limited customer support availability on weekends. |

| Avatrade | None | – Offers a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, and AvaTradeGO, suitable for different levels of experience and preferences. – Has a range of educational resources, including webinars, tutorials, and eBooks, to help traders improve their knowledge and skills. | – Offers only over 50 cryptocurrencies. – Minimum deposit requirement of $250. – High inactivity fees and overnight financing fees. |

| Think Markets | Swap ($) = Volume * Swap Rate (pips) * Pip Value * Number of nights = 1200.01*3=$0.6 Spread ($) = Spread in pips * Pip Value * Volume = 1,7000.011=$17 Cumulative Costs ($) = Swap + Spread = 0.6+17=$17.6 Cumulative Costs (%) = (Cumulative Costs / Total Investment) * 100 = (17.6/22,532.18) *100= 0.08% Cumulative Effect of Costs on Return (without fees) = (Profit / Total Investment) * 100 = (2425.13/22,532.18) *100=10.76% Cumulative Effect of Costs on Return (with fees) = ((Profit + Cumulative Costs) / Total Investment) * 100 = ((2,425.13+17.6)/22,532.18)*100=10.84% Reduction of profit = Cumulative Effect of Costs on Return (with fees) – Cumulative Effect of Costs on Return (without fees) = 10.84%-10.76%=0.08% | – Emphasis on trading education and financial literacy. – 24/7 trading. – Multiple charting tools, news feeds, and economic calendars. | – Limited payment options for deposits and withdrawals. – Limited cryptocurrency options. – No commission-free trading options for cryptocurrencies. |

| Admiral Markets | Information unavailable | – Regulated by the FCA. – Traders can apply leverage. – Highly liquid. | – Only offers eight cryptocurrencies. – Charges a fee for opening and closing trades. |

| IC Markets | No commission on Standard accounts but instead applies a spread markup of 1 pip above the Raw inter-bank prices received from our liquidity providers. IC Markets Raw Spread account shows the raw inter-bank spread received from its liquidity providers. On this account, it charges a commission of $7 per standard lot round turn. | – Offers a wide range of trading instruments including cryptocurrencies. – Low spreads and commissions for trading. – Offers various trading platforms including MetaTrader and cTrader. | – Limited educational resources for beginner traders. – Does not accept clients from some countries such as the United States. – Limited deposit and withdrawal options compared to other brokers. |

| Plus500 | None | – Authorised and regulated by the Estonian Financial Supervision and Resolution Authority. – Offers round-the-clock dedicated customer service in multiple languages. – Funds are kept in segregated bank accounts, in accordance with regulatory requirements. | – A limited range of cryptocurrencies for trading. – Does not support the popular MetaTrader 4 platform, which could be a disadvantage for experienced traders. |

| WeBull | A 100bps markup is built into the price of the crypto you are buying/selling. | – Low minimum for cryptocurrency trading at $1. – Instant settlement, ensuring funds are always available for trading. – Complimentary real-time data, customizable charts, and indicators to keep up with the crypto market. | – Limited cryptocurrency selection compared to other brokers. – No support for transferring cryptocurrency to an external wallet. |

| Caleb & Brown | 5% on all trades | – Access to a personal crypto broker. – Only users have access to their tokens. – 24/7 global customer support. | Not much information on how investors can trade online. |

| Alpaca | 0.125 – 0.50% depending on 30-day trading volume | – Users can trade cryptocurrencies at any time of day, seven days a week. – Offers over 20 unique crypto assets across 48 trading pairs and free limited crypto data. | – Requires a certain level of technical expertise to trade through API. – Wallets are only available to users who are eligible based on residency and applicable jurisdiction. – Not for beginners. |

FAQs

Consider security, reputation, fees, trading platforms, and customer support. Look for a broker with a good track record and a strong security system to protect your funds. Make sure to research the broker’s fee structure and the trading platforms they offer, and choose a broker that provides quality customer support.

They typically make money by charging fees on trades or by taking a spread on the buying and selling price of cryptocurrencies. They may also earn money through other services, such as offering margin trading or earning interest on user deposits.

It varies by jurisdiction. Some countries have implemented regulations to oversee the operation of crypto brokers, while others have yet to do so. Research the regulations in your jurisdiction and choose a broker that operates in compliance with these regulations.

Many crypto brokers offer the ability to buy cryptocurrencies with fiat currency. However, the availability of this service may depend on the broker and the jurisdiction in which they operate. There may also be fees associated with buying cryptocurrencies with fiat currency, so be sure to research the broker’s fee structure before making a transaction.

Potential risks include hacking or theft, market volatility, and losing your investment. Some brokers may not be reputable or may engage in fraudulent activities. To minimize these risks, it’s important to choose a reputable broker with strong security measures, to understand the risks associated with trading cryptocurrencies, and to only invest funds that you can afford to lose.

Conclusion

With the ability to easily convert between different coins and the option to trade Contracts for Difference (CFDs), these crypto brokers offer a number of benefits for those looking to enter the world of cryptocurrency trading.

On the other hand, keep in mind that CFD trading does come with risks, and traders should carefully consider their investment objectives and risk tolerance before entering into any trades. It’s also essential to use a reputable broker and to understand the terms and conditions of the CFD contract before making any trades.

Read more:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.