Banking as a Service (baas)

What is Banking as a Service (baas)?

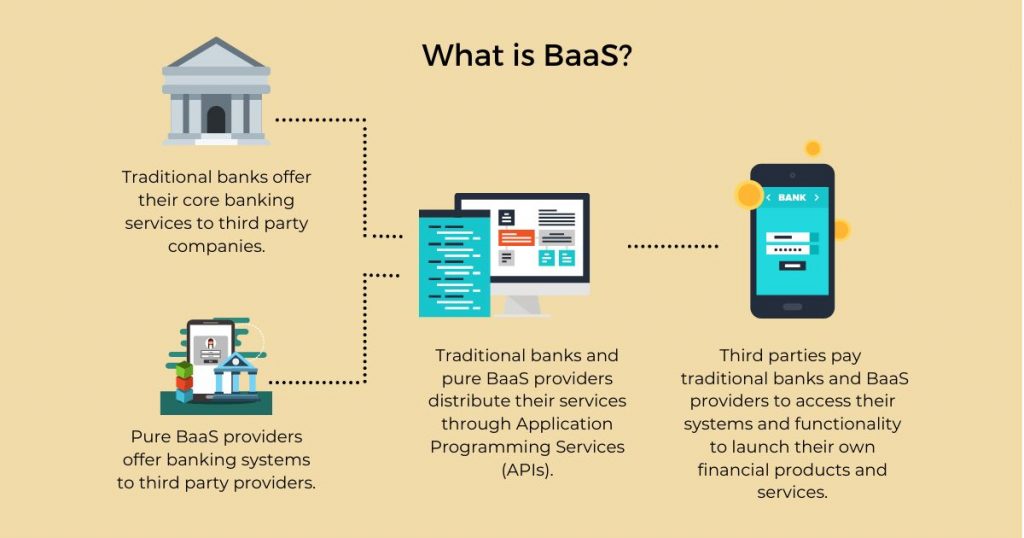

Banking as a Service (BaaS) is a procedure that digital banks and third parties utilize to connect their own business infrastructure to a bank’s system via APIs, allowing the digital banks or third parties to offer full-service banking directly through their own non-bank business offerings. When purchasing a product or service, the brand’s end client can easily acquire financial services from the same source. FinTech payments including obtaining product finance, loans, and credit cards through a seller’s website are examples of embedded bank services.

Understanding Banking as a Service (baas)

BaaS is built on a software API link between banks and non-banks, including FinTech firms. Financial services are seamlessly embedded in the online interactions of brands and their customers by BaaS providers. In a BaaS system, authentication and online security are critical.

The incorporated BaaS financial services can be co-branded or deployed as white label banking (where the bank’s branding is not visible).

The banking industry’s financial institutions are licensed and regulated. Know Your Customer (KYC), anti-money laundering (AML), OFAC sanctions lists, and data privacy and security are all part of these requirements. RegTech should be included in the Banking as a Service process for it to function properly and for banks to remain in regulatory compliance. RegTech can also aid in the detection of online fraud.

Read related articles:

« Back to Glossary IndexDisclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.