Bitcoin Spot ETFs Record Net Outflow of $158M on 9th Day, GBTC Outflows Reach $429M

In Brief

Bitcoin spot ETFs saw a net outflow of $158 million on the 9th day, with Grayscale Bitcoin Trust ETF reaching outflows worth $429 million.

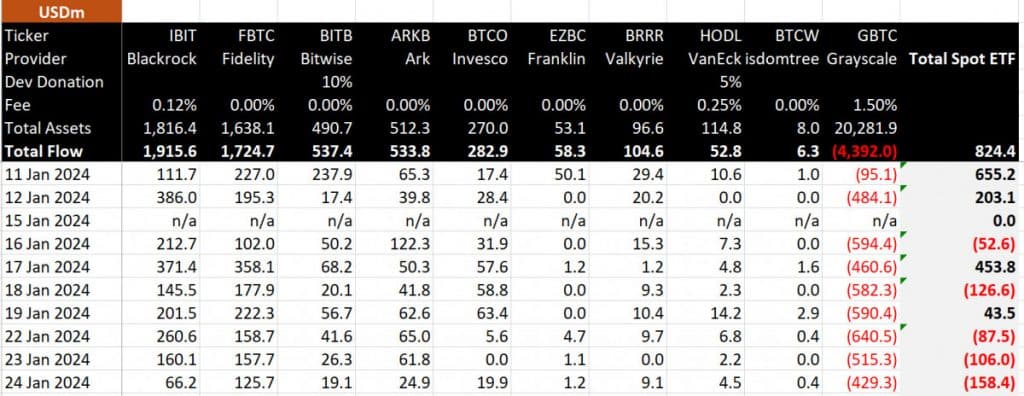

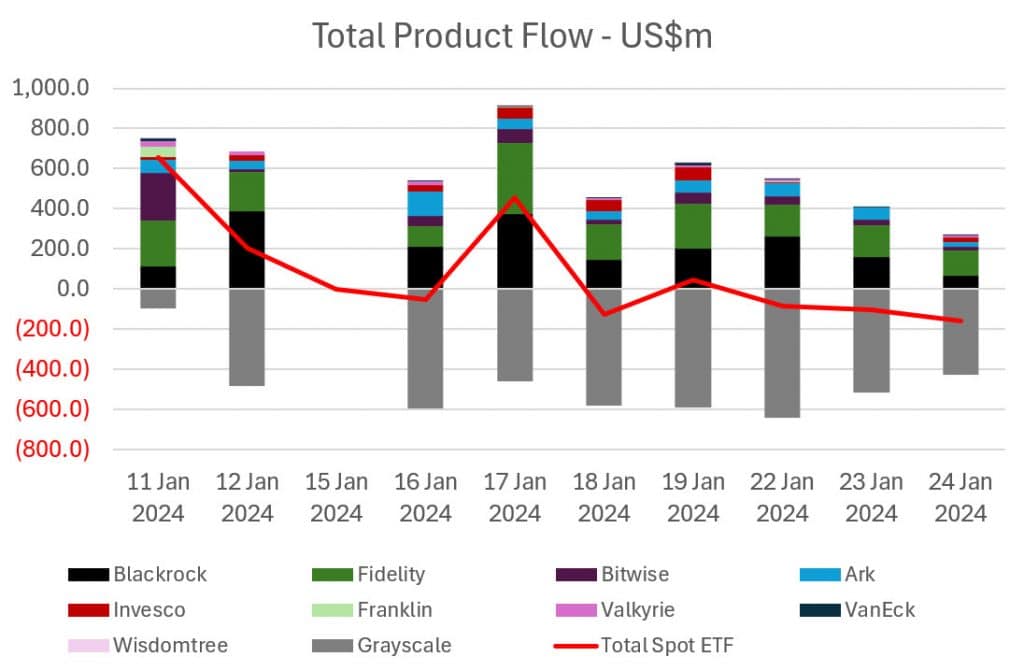

On the 9th day, the Bitcoin spot ETF witnessed a net outflow of $158 million, according to BitMEX Research data. BlackRock had a lackluster performance on Day 9, with a modest increase of $66 million, while Fidelity outperformed with a gain of $126 million.

As of the 9th day, BlackRock remains in the lead in the overall race, accumulating a total flow of +$1,916 million, followed by Fidelity at +$1,725 million, and Bitwise at +$537 million. In terms of Bitcoin, after 9 days, BlackRock holds the top spot with +45,594 BTC, followed by Fidelity with +41,007 BTC.

Ark secured the third position with +12,685 BTC, while Bitwise trails closely with +12,354 BTC.

Grayscale Bitcoin Trust ETF’s Market Struggles Continue

Despite converting to an ETF and gaining approval from the US Securities and Exchange Commission (SEC), Grayscale Investments’ Bitcoin Trust continues to experience net outflows. Analysts note that the fund’s considerable asset advantage over rivals has shrunk. However, many still believe it may take some time before the Grayscale fund loses its position as the largest spot Bitcoin ETF.

Since its conversion to an ETF on January 11, the Grayscale Bitcoin Trust ETF (GBTC) has witnessed substantial net outflows. Notably, on Tuesday, it recorded $515 million in net outflows, bringing the total to nearly $4 billion. As of midday Wednesday, GBTC’s assets stood at approximately $21 billion.

In contrast, competing Bitcoin ETFs offered by BlackRock and Fidelity have seen consistent net inflows, with their asset bases growing to approximately $1.85 billion and $1.6 billion, respectively.

FTX played a significant role in the trend of outflows from the Grayscale Bitcoin Trust, selling 22 million shares and completely divesting from GBTC, amounting to nearly $1 billion.

GBTC’s net outflows were anticipated by some due to its 1.5% fee, even though the fee was reduced from 2% upon its conversion to an ETF. The fee remains notably higher compared to competitors, whose expense ratios range from 0.19% to 0.39%.

“The significant outflow from Grayscale’s GBTC fund has contributed to this decline. Investors in GBTC, who bought the fund at a substantial discount to NAV over the past year to position for its eventual ETF conversion, are now exiting the bitcoin space entirely rather than transitioning to more cost-effective spot Bitcoin ETFs,” stated Nikolaos Panigirtzoglou, Managing Director at J.P. Morgan.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victor is a Managing Tech Editor/Writer at Metaverse Post and covers artificial intelligence, crypto, data science, metaverse and cybersecurity within the enterprise realm. He boasts half a decade of media and AI experience working at well-known media outlets such as VentureBeat, DatatechVibe and Analytics India Magazine. Being a Media Mentor at prestigious universities including the Oxford and USC and with a Master's degree in data science and analytics, Victor is deeply committed to staying abreast of emerging trends. He offers readers the latest and most insightful narratives from the Tech and Web3 landscape.

More articles

Victor is a Managing Tech Editor/Writer at Metaverse Post and covers artificial intelligence, crypto, data science, metaverse and cybersecurity within the enterprise realm. He boasts half a decade of media and AI experience working at well-known media outlets such as VentureBeat, DatatechVibe and Analytics India Magazine. Being a Media Mentor at prestigious universities including the Oxford and USC and with a Master's degree in data science and analytics, Victor is deeply committed to staying abreast of emerging trends. He offers readers the latest and most insightful narratives from the Tech and Web3 landscape.