May 2024 Sees Global Decline in Bitcoin ATMs: Canada and US Lose Hundreds of Machines Even as Europe and Australia Expand

In Brief

Bitcoin ATMs worldwide have declined for the first time since July 2023, primarily due to the closure of over 300 US-based ATMs, accounting for 80% of the network.

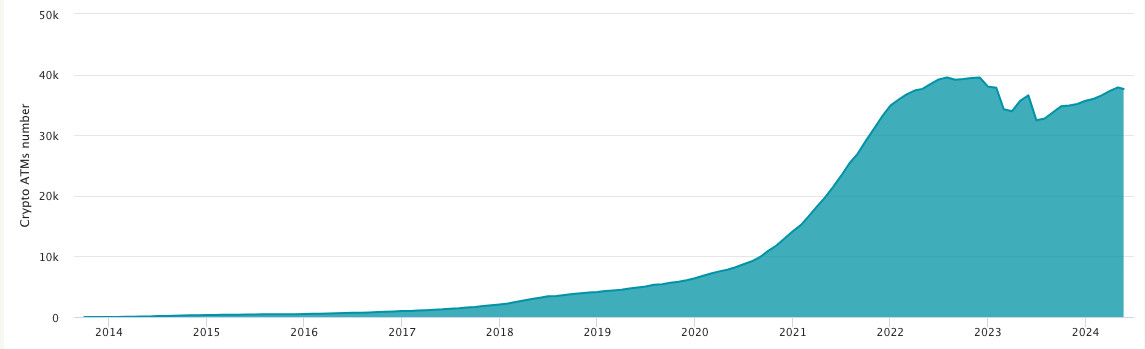

Following a 10-month expansion run, the number of Bitcoin ATMs in operation worldwide has declined for the first time since July 2023. The closure of more than 300 Bitcoin ATMs in the US, which make up more than 80% of the global Bitcoin ATM network, was the main factor contributing to this reduction.

Photo: Bitcoin ATM Installations Growth, Coin ATM Radar

As of May 2024, there are 37,621 Bitcoin ATMs globally, according to data from Coin ATM Radar. Notably, 28 machines were withdrawn from Canada, the second-largest country for Bitcoin ATMs; in contrast, the United States witnessed a more substantial fall with the removal of 302 units. The installation of new machines in Australia, Switzerland, and numerous European nations somewhat offset the overall loss.

The Rise of Bitcoin ATMs

Bitcoin ATMs first emerged in 2013 as a convenient way for people to buy cryptocurrencies with cash. The first machine opened in October in a Vancouver coffee shop, allowing customers to purchase Bitcoin after going through basic KYC verification.

From those humble beginnings, Bitcoin ATMs quickly spread across the globe as the flagship cryptocurrency gained mainstream attention and adoption. They provided an easy “on-ramp” for regular people to get involved in crypto without having to learn complex exchange platforms right away.

An ATM that accepts cash or debit cards to buy Bitcoin and other cryptocurrencies is known as a Bitcoin ATM. Since certain ATMs are bi-directional, users may also exchange their Bitcoin holdings for cash.

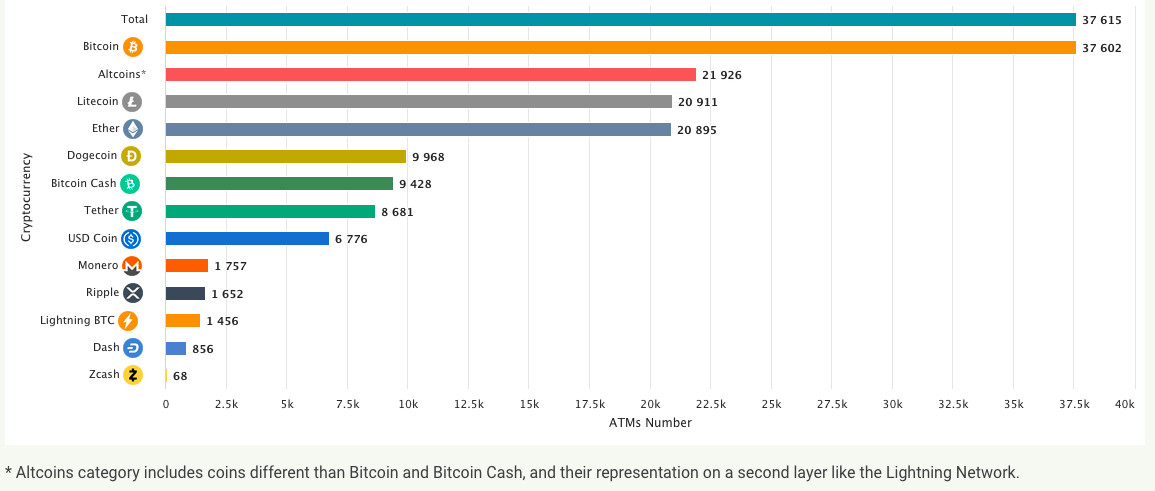

Photo: Crypto ATM Supported Cryptocurrencies, Coin ATM Radar

Bitcoin ATMs are run by independent businesses like CoinHub and Coinme, much like traditional ATMs. For this, all you have to do is input cash or a credit card to get a crypto wallet credit equal to the amount of Bitcoin you paid for. In the case of selling, the procedure is reversed.

Bitcoin ATMs provide an easy on-ramp for new crypto users, allowing people to get involved without having to set up an exchange account first. Their widespread availability also makes crypto more accessible to the unbanked population.

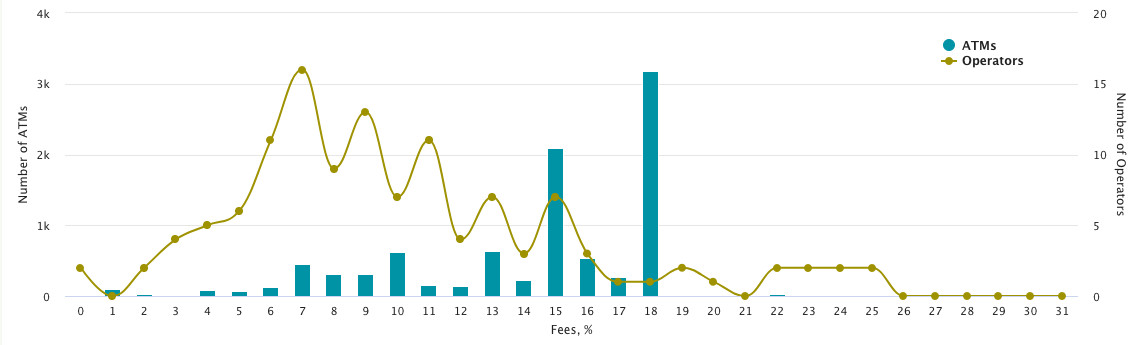

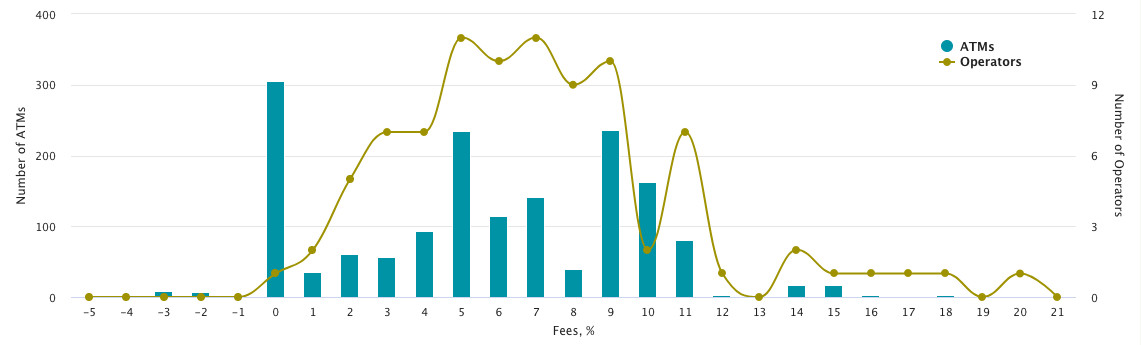

However, critics argue that Bitcoin ATMs charge excessive fees of up to 20% per transaction. Online exchanges generally have much lower fees under 1%. There are also concerns around know-your-customer (KYC) and anti-money laundering (AML) compliance.

Photo: Buy Fee Size at Bitcoin ATMs, Coin ATM Radar

Photo: Sell Fee Size at Bitcoin ATMs, Coin ATM Radar

The Bitcoin ATM Landscape

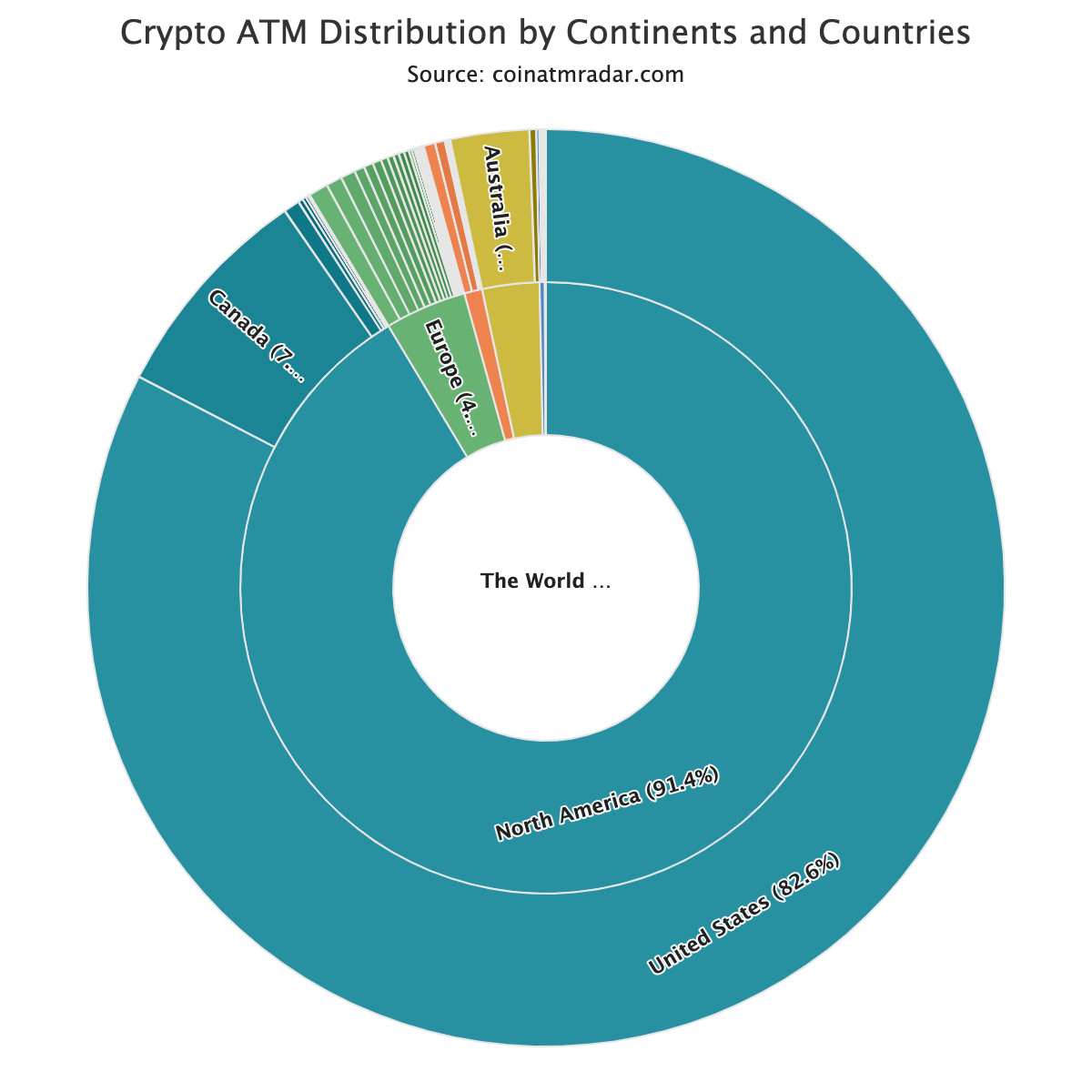

The United States is by far the world’s largest Bitcoin ATM market, with 31,089 active machines as of May, representing 82.6% of the global total. This is not surprising, given the country’s advanced economy and openness to financial innovation.

Canada ranks second with 2,909 Bitcoin ATMs (7.7% globally), followed by Australia with 1,041 (2.8%). No other country has crossed the 1,000-machine milestone yet.

Within the United States, the distribution of Bitcoin ATMs is fairly spread out based on population density. However, the largest operator Bitcoin Depot has a strategy of targeting lower-income areas according to investor commentary. This has raised concerns that Bitcoin ATMs are taking advantage of underbanked communities with their high fees.

Photo: Crypto ATM Distribution by Continents and Countries, Coin ATM Radar

Meanwhile, in Australia, the Bitcoin ATM network has grown rapidly from just a handful of machines a few years ago. The growth has triggered some regulatory concerns around tax compliance from the Australia Tax Office. There have been calls to increase oversight and licensing requirements for operators.

Europe as a whole has a relatively small but consistently growing Bitcoin ATM presence of around 1,000 machines, led by Spain, Austria and Poland. The UK banned crypto ATMs altogether in 2022 over lack of regulation and failure to uphold anti-money laundering standards. Other markets like South Africa have only start being penetrated by Bitcoin ATMs in the last couple of years. The long-term growth potential remains large if regulatory hurdles can be overcome.

Reasons for the US Decline

So why exactly did over 300 Bitcoin ATMs go offline in the US last month? Authorities have not provided a full public explanation yet, but we can analyze some of the potential key factors:

Crackdown on Fraud and Money Laundering

The possibility of using Bitcoin ATMs for illegal purposes, including money laundering, fraud, and extortion schemes, is a significant problem. In the US, law enforcement organizations have been aggressively seeking out and taking down devices that are engaged in these kinds of operations.

Last year, a group in Ohio was arrested for operating over 50 unlicensed Bitcoin ATMs that were allegedly used for money laundering of criminal proceeds and receiving stolen property. Similar stings targeting unlicensed operators have happened in other states as well.

The anonymous nature of crypto transactions, combined with Bitcoin ATMs’ historically lax compliance compared to traditional banking, make them an attractive tool for criminal enterprises. Some analysts have compared Bitcoin ATMs to payday lenders in terms of preying on lower-income and financially underserved communities.

As the crypto ecosystem becomes more mainstream, regulators will inevitably demand tighter KYC, AML and licensing requirements for Bitcoin ATM operators. Those unable or unwilling to beef up compliance may be forced to shut down their machines, especially if tied to any illicit activity.

Security Vulnerabilities of Bitcoin ATMs

In early 2023, a major Bitcoin ATM manufacturer called General Bytes had a security breach that allowed hackers to drain $1.5 million in Bitcoin from their operators’ ATMs worldwide.

While this was an isolated incident, it emphasized the need for tight security protocols and insurance policies for machines that hold temporary crypto funds in digital wallets. Other unreported vulnerabilities in different manufacturers’ machines may have led to some ATM network shutdowns as a precaution.

Bitcoin ATM operators will likely face increasing compliance costs for cybersecurity audits and penetration testing to verify their machines are secure from hacking threats. This could thin out smaller operators without resources for robust security programs.

Operational Challenges

Running a Bitcoin ATM business can be operationally intensive, especially for larger networks spread across multiple locations. Between labor costs for manpower to load cash and service machines, compliance costs, security costs, real estate overhead for premium locations, and more – profits can be elusive.

When major operator Cash Cloud filed for bankruptcy in early 2023 after its exposure to the crypto winter impacted finances, it demonstrated some of the business model challenges the industry faces. Other smaller operators may be scaling back unprofitable locations or shutting down completely as costs mount.

Market Consolidation

The Bitcoin ATM market is still relatively new and fragmented compared to traditional financial services. There could be a shakeout happening where smaller players are going out of business and selling their ATM portfolios to larger, better-capitalized companies like Bitcoin Depot.

Bitcoin Depot itself has been performing well, stating in its annual report that revenues have no correlation to Bitcoin’s price volatility. This is because many customers use ATMs for non-speculative purposes like remittances rather than trading, providing a stable fee income stream.

If the market continues consolidating around just a handful of major operators with strong compliance and security programs, we may see closures of smaller ATM portfolios as they get absorbed into the larger networks.

The ATMs Shutdown Impact on Bitcoin

The shutdown of hundreds of Bitcoin ATMs may seem like a bearish signal for the crypto industry at first glance. However, a closer analysis reveals this may not necessarily be the case. For one, Bitcoin ATMs represent a relatively small on-ramp for crypto compared to centralized and decentralized exchanges that handle much higher trade volumes. The impact of ATM shutdowns on overall Bitcoin demand and liquidity should be minimal.

Additionally, as Bitcoin Depot highlighted, a significant portion of Bitcoin ATM usage is for real-world finance rather than speculation. Remittances, bill payments, and other use cases are largely disconnected from Bitcoin’s price volatility.

Bitcoin has bounced back strongly in 2024 after last year’s lows amid the banking crisis and growing institutional adoption. While the ATM shutdowns could dent retail adoption in certain regions temporarily, it doesn’t appear to be a driving factor for Bitcoin’s price and momentum overall.

Photo: Bitcoin price 2023-2024

The Outlook for Bitcoin ATMs

Despite the recent declines, Bitcoin ATMs are unlikely to disappear soon. They remain a convenient way to access crypto, especially for unbanked users.

That said, the industry is shifting. Regulators will increase scrutiny around KYC/AML and companies will need to improve compliance to stay in operation. There may be further consolidation as well.

In the long run, Bitcoin ATMs will likely morph from niche machines into more robust digital kiosks supporting a range of crypto and traditional financial services to stay competitive. No matter what, the US will remain the heart of the Bitcoin ATM industry for the foreseeable future, given its crypto-friendly stance. However, the business will tighten up and evolve to comply with growing regulatory standards worldwide.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.