Yuga Labs TwelveFold Bitcoin NFT Auction Generates $16.5M Despite Controversy

In Brief

Yuga Labs’ debut Bitcoin Ordinal collection sold out on Monday.

It generated $16.5 million worth of BTC from 288 bidders.

The highest bid was 7.1159 BTC (about $159,500).

On Monday, Yuga Labs concluded its debut Bitcoin Ordinals collection TwelveFold. Despite criticism from the Bitcoin community and Ordinal developer Casey Rodarmor about how the auction was held, a total of 288 successful bidders collectively spent $16.49 million worth of BTC on the collection of 300 pieces of generative 3D artwork. A Yuga Labs spokesperson told Decrypt that the 24-hour auction saw 3,246 total bids.

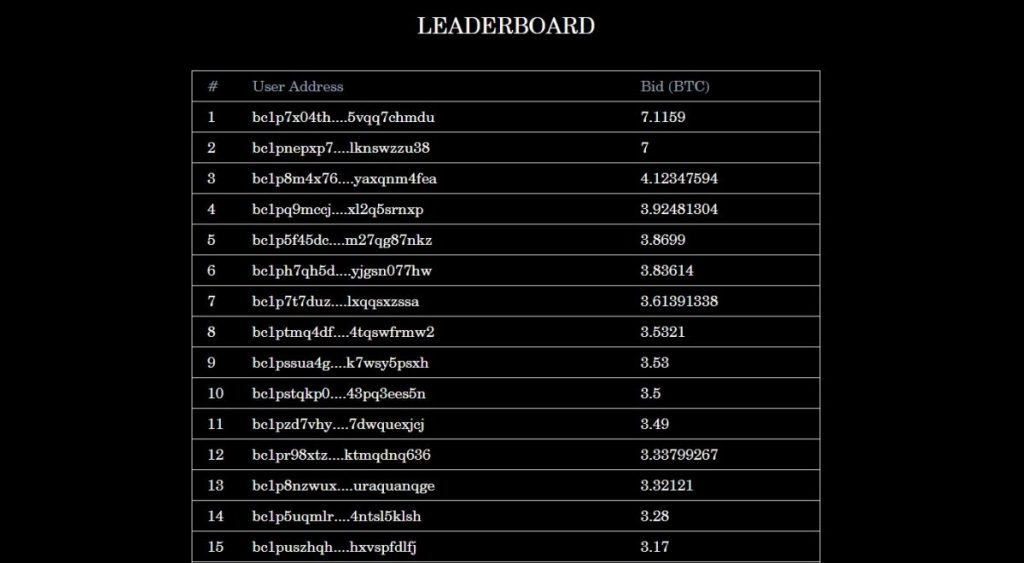

According to the auction’s leaderboard of the 288 bids, the highest bidder spent 7.1159 BTC (about $159,500), while the lowest bidder spent 2.2501 BTC (about $50,348).

The top 288 successful bids will receive their inscription in the coming days, while the last 12 pieces in the 300-piece collection are reserved for contributors and distributed through Yuga Labs’ philanthropic programs.

Prior to the conclusion of the auction, Yuga Labs drew the ire of the Bitcoin community regarding the TwelveFold bidding process. Potential bidders had to deposit the full amount of their bids in BTC to participate in the auction, with Yuga promising to return unsuccessful bids within 24 hours auction’s conclusion. All valid bids ranked below the top 288 bidders have since been returned in full.

Twitter user @veryordinally first raised concerns that this bidding process could set a precedent for scammers. He also said that the over-the-counter (OTC) trading of Bitcoin NFTs is an even worse model, but a billion-dollar player like Yuga Labs should have set a higher bar with a trustless model.

With the sell-out success of Yuga’s first collection on Bitcoin, it appears that the controversy surrounding the bidding process did not deter bidders.

The rise in the adoption of Bitcoin Ordinals and the TwelveFold bidding model highlights the lack of infrastructure supporting this nascent sector in the NFT market. Scarce City, a Bitcoin-based auction platform, employs a similar bidding mechanism to that of Yuga Labs’, whereby users must deposit a percentage of their bid as collateral, and deposits are returned to unsuccessful bidders.

Last week, Galaxy Research published a report predicting that the emerging Bitcoin Ordinal market could grow to $4.5 billion by 2025. Researchers also say that market infrastructure will be developed by Q2 this year. For now, wallets have been developed to meet the demands for user-friendly solutions in the Bitcoin Ordinals space.

Related posts:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.