Top 20 Crypto Payment Solutions for Web3 Economy in 2023

Crypto payment solutions have become a key driver of the Web3 economy in recent years. Unlike traditional payment methods, crypto payment solutions operate on decentralized networks, using blockchain technology to enable secure, transparent, and fast peer-to-peer transactions. These solutions enable individuals and businesses to conduct transactions using cryptocurrencies, such as Bitcoin, Ethereum, and stablecoins.

Benefits of crypto payment solutions

One of the main advantages of crypto payment solutions is their borderless nature. With traditional financial systems, international transactions can be time-consuming and expensive due to intermediaries and currency conversions. Crypto payments bypass these obstacles, enabling instantaneous cross-border transfers with minimal fees. Crypto transactions are typically processed instantly—a feature that is particularly attractive for businesses with global operations, enhancing efficiency and reducing costs.

Crypto payment solutions also prioritize security and privacy as the underlying blockchain technology ensures that transactions are recorded on an immutable and tamper-proof ledger, mitigating the risk of fraud and chargebacks. Users can make transactions pseudonymously so that sensitive financial information is protected from potential data breaches.

Key companies and developers

Several companies and developers are actively involved in building crypto payment solutions. One prominent player is CoinGate, which has created a user-friendly e-commerce plugin that allows merchants to accept cryptocurrency payments effortlessly. BitPay, on the other hand, offers a prepaid card that supports multiple cryptocurrencies. Coinpayments boasts an industry-low transaction fee of 0.5% and can be integrated into major e-commerce platforms worldwide, including WooCommerce, Shopify, Magento, Prestashop, Opencart, and more.

With each company’s unique strengths, these developers contribute to the growth and advancement of crypto payment solutions. Here are the top 20 crypto payment solutions for the web3 economy in 2023.

Coinbase Commerce

Coinbase Commerce is a user-friendly crypto payment gateway that enables businesses to accept multiple cryptocurrencies as payment. It offers seamless integration with popular e-commerce platforms, making it convenient for merchants to tap into the world of digital assets.

Commerce Features offered by Coinbase include powerful business tools designed to enhance payment processes. With Custom Checkouts, businesses can select and accept cryptocurrencies from a growing list of supported assets. The platform offers Flexible Invoices, simplifying billing and invoicing for customers in cryptocurrencies. The Turnkey API allows businesses to create custom workflows and personalized experiences. Coinbase Commerce also provides Business Reporting tools, enabling transaction reporting for smooth accounting and reconciliation processes. It can be integrated with Jumpseller, Primer, Shopify and WooCommerce.

Pros:

- Supports 10 of the most popular cryptocurrencies.

- Charges a flat 1% transaction fee.

- Merchants can choose to convert crypto payments into fiat currency instantly.

Con:

- As a centralized service, reliance on Coinbase Commerce exposes merchants to potential service disruptions.

MoonPay

MoonPay is a prominent crypto payment plug-and-play solution that simplifies the process of buying and selling cryptocurrencies for businesses and their customers. As an all-in-one on-and-off ramp platform, MoonPay allows web3 businesses to integrate an express checkout widget into their websites or applications without the need for complex technical expertise.

The platform supports more than 80 cryptocurrencies, making it easy for customers to purchase digital assets using various payment methods, including credit and debit cards, Apple Pay, and Google Pay. MoonPay is integrated with leading platforms Magic Eden, Sorare, OpenSea, OKX, Uniswap and more, allowing customers to purchase NFTs and crypto using debit/credit card.

Pros:

- Accept all major payment methods, including Visa, Mastercard, Apple Pay, Google Pay, SEPA, Faster Payments, Wire Transfers, Open Banking and ACH.

- Offers developer-friendly APIs, enabling easy integration into websites and applications.

- Supports customers in 160+ countries.

Con:

- API integration requires some technical expertise.

BitPay

BitPay is a widely recognized crypto payment service provider catering to merchants and consumers. It offers secure and efficient payment processing solutions for various industries, from e-commerce to charitable organizations.

This crypto payment solution simplifies the online payment process without collecting sensitive customer information or using cards. Customers can send cryptocurrencies directly to a payment address, and BitPay converts them to the preferred currency for settlement. Merchants can use online payment buttons or the BitPay Checkout app for convenient cryptocurrency through iOS or Android smartphones or tablets. BitPay also develops and maintains plugins for many of the world’s most popular eCommerce platform including OpenCart, Wix, WooCommerce, Shopify, ZenCart and more.

For US citizens, BitPay offers a prepaid card that allows users to convert their cryptocurrencies into fiat and spend them at any merchant accepting debit cards.

Pros:

- BitPay enables businesses to accept a wide range of cryptocurrencies including 5 USD-pegged stablecoins.

- Settles transactions in fiat currencies to merchants’ bank accounts on the next business day.

Cons:

- Implements Know Your Customer (KYC) procedures for users, which may be a drawback for privacy-oriented individuals.

- Merchants can only receive settlements in fiat currencies or stablecoins.

- Only accepts ERC-20 coins.

Binance Pay

Binance Pay is a mobile payment solution offered by Binance. It charges zero fees and allows users to send, receive, and spend cryptocurrencies as well as shop and pay with crypto on Binance Marketplace.

With this crypto payment solution, users can also book hotels with cryptocurrencies, create and send gift cards, participate in Launchpad and more. The key feature of Binance Pay is Payment Priority Order, which lets users choose which of the 70+ cryptocurrencies they want to spend, in the order they prefer.

Pros:

- Supports over 70 cryptocurrencies

- Can be integrated with other Binance products and services, enhancing overall convenience for users.

Cons:

- Being operated by a centralized exchange, users need to trust Binance’s security measures and policies.

- Binance Pay may not be available in all regions, limiting accessibility for some users.

CoinGate

CoinGate is a comprehensive cryptocurrency payment gateway that enables online merchants and individuals to accept, store, and spend various cryptocurrencies easily. Established in 2014, CoinGate has become a trusted name in the crypto payments industry, offering a range of user-friendly solutions for both online and in-store transactions with support for over 70 cryptocurrencies.

The platform offers various plugins and APIs for popular e-commerce platforms like WooCommerce and Magento, streamlining the adoption of cryptocurrencies as a payment method. It also enables businesses to collect payments, send billing invoices, convert payouts to fiat currency or keep the cryptocurrency.

Pros:

- CoinGate allows businesses to accept over 70 cryptocurrencies.

- Provides simple APIs and shopping cart plugins for smooth integration into existing platforms.

Con:

- Settlements in fiat currency may not be instantaneous, potentially affecting cash flow for merchants.

PayPal (Checkout with Crypto)

Paypal’s Checkout with Crypto introduces a new and convenient way for U.S. customers with Personal and Premier PayPal accounts to make select online purchases with crypto. This feature allows users to use their crypto balance as a payment option during checkout.

Building upon PayPal’s existing capabilities to buy, hold, and sell cryptocurrencies, Checkout with Crypto enables users to also convert their crypto holdings to fiat currency at the time of checkout. This process ensures certainty of value and eliminates additional transaction fees, making it a user-friendly and cost-effective option for cryptocurrency transactions. The feature automatically appears in the PayPal wallet for customers with sufficient cryptocurrency balances to cover eligible purchases, providing a streamlined and secure checkout experience.

Pros:

- PayPal’s straightforward interface simplifies the process of buying and selling cryptocurrencies for beginners.

Cons:

- PayPal Purchase Protection doesn’t apply to any crypto transactions.

- Crypto transaction fees may be higher compared to dedicated crypto exchanges.

- Not available in all regions.

Blockonomics

Blockonomics offers simple API integration and shopping cart plugins for major e-commerce platforms like Shopify, Wix, WordPress, Squarespace and more, making it easy for stores to accept Bitcoin payments. The platform is decentralized and non-custodial, providing an extra layer of security and privacy.

With real-time price conversion options during checkout, merchants can display prices in fiat currency and get paid in Bitcoin. It also offers a wallet watcher that allows merchants to track multiple wallets and addresses, and receive email notifications when transactions occur.

Pros:

- Blockonomics does not hold user funds.

- Provides easy-to-use plugins for major e-commerce platforms, streamlining the adoption of cryptocurrencies for merchants.

- Merchants can display prices in fiat currency, with the option for real-time conversion into cryptocurrencies during checkout.

Cons:

- Only supports Bitcoin.

- Does not offer buyer protection for transactions.

NOWPayments

NOWPayments is a non-custodial crypto payment gateway that enables businesses to accept a wide range of cryptocurrencies through various integrations. With support for over 160 cryptocurrencies, including major options like Bitcoin, Ethereum, and Ripple, NowPayments offers extensive payment options for users and merchants.

The platform’s user-friendly interface and straightforward integration options, such as plugins for popular e-commerce platforms like WooCommerce and Magento, make it accessible for businesses of all sizes to embrace cryptocurrencies for online transactions. As a non-custodial solution, the platform does not hold user funds. To further accommodate users’ preferences, NOWPayments offers the option to receive payments in various cryptocurrencies or convert them to fiat currency

Pros:

- Supports over 160 cryptocurrencies.

- Does not hold user funds, enhancing security and control over funds.

- Personal account manager 24/7.

Cons:

- High network activity on certain cryptocurrencies like BTC may lead to delays in transaction confirmations.

BTCPay Server

BTCPay Server is an open-source, self-hosted payment gateway that enables merchants to accept Bitcoin without intermediaries. As a self-hosted solution, BTCPay Server provides a higher level of security for merchants, as they retain complete control over their funds and customer data.

When a customer proceeds to checkout, they receive an invoice to pay directly from their wallet. Through its self-hosted and automated invoicing system, the platform then tracks the invoice’s status through the blockchain and notifies merchants when the payment is confirmed, allowing them to process the order. BTCPay Server can be integrated into nine platforms including WooCommerce, Shopify, Magento, Zapier, Prestashop and more.

Pros:

- Free to use.

- There is no third-party between a merchant and a customer.

- The open-source code benefits from a dedicated community of developers, ensuring continuous improvement and support.

Cons:

- Integrating self-hosted BTCPay Server may require technical expertise.

- As an open-source project, customer support relies on a network of contributors and users.

SpectroCoin

SpectroCoin is a versatile crypto payment gateway that offers a wide range of financial services, including crypto wallets, debit cards, and merchant solutions. It allows merchants to receive Bitcoin payments. The platform also provides reporting tools for transaction tracking, simplifying accounting and reconciliation processes.

The crypto payment gateway comes with instant pre-order forms, enabling order creation directly from the merchant’s account and offers payment gateway modules for WooCommerce, Magento, PrestaShop, OpenCart, Drupal, WHMCS, Zen Cart and other platforms SpectroCoin also supports multiple receiver pre-orders, allowing orders to be sent to multiple clients and enabling instant or future payments. Additionally, SpectroCoin provides Point of Sale (POS) URLs, enabling the creation of payment links for employees without the need for access to the owner’s account.

Pros:

- An all-in-one platform for crypto storage, spending, and merchant integration.

- Debit cards enable users to spend cryptocurrencies at millions of locations worldwide.

- Robust security features to protect user funds and data.

Cons:

- High receipt issuance and chargeback/dispute fees for merchants.

Coinify

Offering a plug-and-play crypto payment solution, Coinify enables merchants to accept crypto payments and settle in fiat in the local currency. The platform supports more than 20 cryptocurrencies, including Bitcoin, Ethereum, and Litecoin, giving users flexibility in their payment choices. Coinify’s payment gateway extends to both e-commerce websites and brick-and-mortar stores.

One of the key features of Coinify’s crypto payment gateway is its compliance with regulatory standards to ensure a secure and transparent payment experience. It works with all crypto wallets and is supported in over 180 countries.

Pros:

- Merchants can choose between receiving settlements in fiat currency or keeping funds in cryptocurrencies.

- Full regulatory compliance.

- Quick bank settlement.

Con:

- Charges fees for transactions and currency conversions.

Sheepy

Sheepy is a B2B crypto payment solution, enabling merchants to accept major digital assets and efficiently handle fiat conversions through its user-friendly dashboard. Businesses are granted complete autonomy in deciding whether to convert, retain, or request payouts according to their preferences. Getting started with Sheepy is simple—users can quickly register an account, integrating and testing its payment gateway without no fuss. Through Sheepy, businesses can conveniently receive funds directly into their bank accounts, settling in fiat, cryptocurrency, or a combination of both. The platform offers transparent and straightforward pricing, featuring fixed transaction fees, no setup costs, and zero minimum monthly commitments while its monthly transactions and daily settlements are unlimited.

Its invoicing and checkout process can be customized with advanced settings, encompassing product details, fees, taxes, and other pertinent business information. Integrating Sheepy’s payment gateway is possible through APIs, widgets, or leading e-commerce plugins. To protect users, Sheepy implements security measures, including cold wallets storage, two-factor authentication, and a secure API with request signing, safeguarding both user transactions and data.

Pros:

- Customizable invoicing and checkout process.

- Robust security measures.

- Unlimited monthly transactions and daily settlements.

Cons:

- No publicly available information on the cryptocurrencies it supports.

- No publicly available information on which e-commerce platforms it can be integrated with.

OpenNode

OpenNode offers a user-friendly interface and extensive integration options that enable businesses to integrate Bitcoin payments into their websites and applications. Merchants using OpenNode’s crypto payment gateway can accept Bitcoin and receive payments in either Bitcoin or various local currencies like EUR, GBP, USD, and more. The platform offers the flexibility to automatically convert between Bitcoin and major currencies at the time of the transaction, using locked exchange rates for price certainty, or on-demand as per the merchant’s preference.

With access to over 190 source currencies, merchants can create Bitcoin payment requests in the currency of their choice. OpenNode enables them to convert settled funds to or from Bitcoin at any time, free of charge. When merchants deposit local currency, OpenNode converts it to Bitcoin at the time of payout’s initiation, providing them with the certainty of the Bitcoin price.

Merchants can accept Bitcoin payments from anywhere using payment buttons, hosted checkouts, e-commerce plugins, or OpenNode’s powerful API. The platform also facilitates professional, itemized billing invoices that businesses can easily track. For in-person payment acceptance, merchants can convert any device into a functional point of sale.

Pros:

- Merchants can choose from 190+ source currencies to create Bitcoin payment requests.

- Easily convert settled funds to or from Bitcoin at any time.

- Extensive integration options.

Con:

- Only supports conversion from USD, EUR, AUD for now.

CoinPayments

CoinPayments is a crypto payment gateway that enables businesses and individuals to accept and process a wide range of cryptocurrencies. With over 175 cryptocurrencies supported for payments, CoinPayments allows merchants to offer diverse payment options to their customers.

The platform’s comprehensive suite of tools includes shopping cart plugins for major e-commerce platforms, making it easy for businesses to integrate crypto payments into their online stores. CoinPayments also offers various APIs and developer tools such as invoice builder, a mobile app and PoS tools for seamless integration into custom applications.

Pros:

- Supports more than 175 cryptocurrencies for payment.

- Shopping cart plugins and various merchant tools.

- 0.5% transaction fee.

.

Cons:

- No fiat currency support.

- Charges network fees.

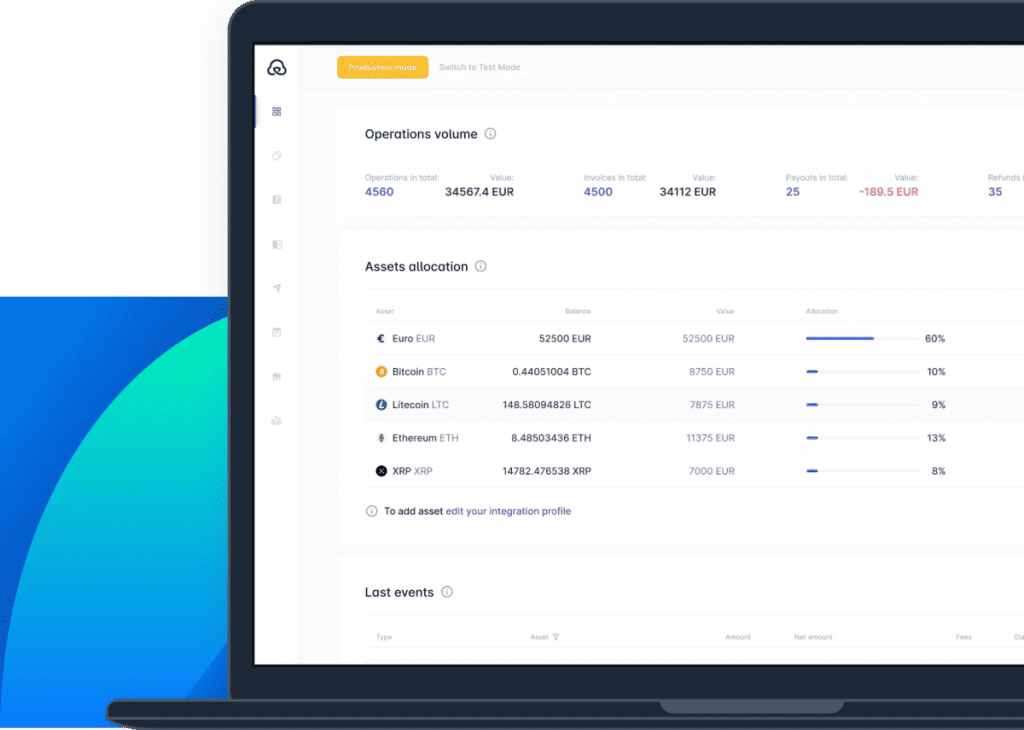

B2BinPay

An all-in-one merchants solution, B2BinPay enables businesses to accept crypto payments and exchange them into fiat, altcoins or stablecoins. With support for over 87 cryptocurrencies, merchants can accept payments in Bitcoin, Ethereum, Litecoin, Ripple and more.

The platform’s user-friendly interface and developer-friendly APIs make integration straightforward, allowing businesses to incorporate crypto payments into their websites and applications. B2BinPay provides various secure settlement options; wire transfers in USD, EUR and GBP are available via SWIFT and SEPA along with settlements in all the main cryptocurrencies and stablecoins. Quick settlements in stablecoins including USDT, USDC, and BUSD are also available.

Pros:

- Supports 87 cryptocurrencies.

- 24/7 support.

Cons:

- Charges transaction fees for processing payments.

- Limited fiat currency support.

SpicePay

SpicePay is a popular choice among freelancers, entrepreneurs, and small- to mid-sized businesses worldwide, offering a reliable crypto payment solution to accept and process online blockchain payments. By eliminating institutional middlemen, SpicePay ensures fast and low-fee transactions, providing cost-effective options for businesses.

To get started, users can simply create an account profile, followed by integrating the functionality into their websites. While basic developer skills are required, those without the expertise can benefit from SpicePay’s complimentary developer assistance.

Pros:

- Fast transactions with minimal fees

- Merchants in the EU can access funds in less than 24 hours, as opposed to 72 hours with payments by credit card.

- Free developer assistance in integrating SpicePay’s functionality.

Cons:

- Requires basic developer skills.

- Users may encounter technical challenges during integration or setup, which could require additional time and effort to resolve.

- No publicly available information about supported cryptocurrencies.

Simplex

Simplex is an EU-licensed crypto payment infrastructure provider that facilitates crypto-to-fiat and fiat-to-crypto transactions through various payment methods, backed by a 100% chargeback guarantee and leading conversion rates. In September 2021, Nuvei, a prominent global payment technology provider, completed the acquisition of Simplex, expanding its range of fintech solutions.

One of Simplex’s most advanced integration options is the Wallet API Integration, which includes essential API calls, such as “Get Quote” for retrieving current prices for orders involving supported cryptocurrencies, fiat, and payment methods. The “Initiate Payment” API allows partners to share user and transaction data before proceeding to the payment checkout stage. The checkout initiation can be implemented in two ways: a new window, redirecting users to a separate page for transaction completion, or a widget that appears as a pop-up on partners’ pages, allowing users to finalize the transaction without leaving the site.

Pros:

- Ensures merchant protection with its 100% chargeback guarantee.

- Provides partners with versatile integration methods, including the powerful Wallet API Integration, catering to different technical capabilities.

Cons:

- The Wallet API integration require partners to possess specific technical capabilities.

Banxa

Banxa is a global fiat-to-crypto payment gateway that enables merchants to accept payments in over 100 cryptocurrencies from customers in 180+ countries.

Apart from the payment gateway solution, Banxa extends its offerings to encompass several other valuable services. This includes a fiat-to-crypto onramp, enabling users to purchase cryptocurrencies using fiat currency through credit cards, bank transfers, and local payment methods. It also has an NFT checkout feature that allows merchants to directly sell NFTs to customers in fiat currency. For corporate clients, Banxa provides a comprehensive corporate onboarding service to seamlessly integrate its payment gateway into existing systems.

Pros:

- Allows merchants to accept payments in over 100 cryptocurrencies from customers in 180+ countries.

- Supports over 100 cryptocurrencies.

- Top-notch security.

Cons:

- High minimum transaction limits for some currencies.

- The integration process for Banxa can be complex.

Wyre

Wyre is a leading crypto payment infrastructure provider that offers a range of services catering to individual, business, and enterprise clients. For dashboard users, their user-friendly dashboard enables the buying, holding, exchanging, and withdrawing of funds in supported currencies.

Users can withdraw crypto to their bank accounts, exchange fiat currency to DAI (a stablecoin), and receive a Wyre ERC-721 compliance token upon verification. For its partners, Wyre provides API solutions for seamless fiat on and off-ramping, institutional-scale liquidity conversion, AML/KYC onboarding, and cross-border API payments.

Pros:

- Recognized as a leading infrastructure provider in the crypto industry.

- Places a strong emphasis on compliance and security.

- Offers a diverse portfolio of services.

Con:

- Users with limited technical expertise may find the platform’s integration challenging to navigate.

Uphold

Uphold’s crypto payment gateway API offers a seamless and efficient solution to automate your business payment flows. With this powerful API, users can easily facilitate payouts to vendors, employees, and other recipients in multiple currencies, ensuring smooth and hassle-free transactions.

One of the key features of Uphold’s API is the ability to create and connect Uphold wallets, allowing users to transfer funds to their businesses with ease. This functionality streamlines the payment process, making it convenient for businesses to manage their financial transactions and facilitate secure crypto payments. Uphold’s API provides a reliable and user-friendly interface, making it a valuable tool for businesses looking to optimize and automate their payment processes while embracing the benefits of cryptocurrencies.

Pros:

- Facilitates payouts to vendors, employees, and other recipients in multiple currencies.

- With Uphold’s API, users can create and connect wallets, facilitating smooth fund transfers to their businesses.

- Its crypto payment API enables businesses to offer cryptocurrencies as a payment option.

Cons:

- Integrating Uphold’s API may require some technical expertise.

Crypto payment solution cheatsheet

| Crypto Payment Solution | Features | Transaction Fees | Pros | Cons |

| Coinbase Commerce | Coinbase Commerce | Flat 1% | User-friendly interface, trusted platform for crypto payments | Merchants may experience potential service disruptions on a centralized service. |

| MoonPay | Wide range of supported cryptocurrencies | $3.99 or 4.5%, whichever is higher. | Global reach, user-friendly interface | API integration requires some technical expertise. |

| BitPay | Accepts Bitcoin for online purchases | 1-2% + 25¢ per transaction. | Pioneer in the industry, efficient payment processing | Merchants can only receive settlements in fiat currencies or stablecoins. |

| Binance Pay | Integrated with Binance’s ecosystem | None | Can be integrated with other Binance products and services | Binance Pay may not be available in all regions |

| CoinGate | Accepts over 50 cryptocurrencies | 1% | Provides simple APIs and shopping cart plugins | Settlements in fiat currency may not be instantaneou |

| PayPal (Checkout with Crypto) | Allows payments with cryptocurrencies and conversion to fiat | None | Large user base, widespread acceptance for payments | Limited cryptocurrency support, not available in all regions |

| Blockonomics | Accepts Bitcoin for online payments | 1% | Transparent and simple pricing, secure transactions | Limited to Bitcoin transactions |

| NOWPayments | Accepts various cryptocurrencies for online payments | 0.5% | Wide range of supported coins, easy integration | May have limitations for some cryptocurrencies |

| BTCPay Server | Open-source and self-hosted platform for payments | None | High level of privacy and control over payments | Requires technical expertise for self-hosting, may need maintenance |

| SpectroCoin | Wide range of supported cryptocurrencies for payments | Info unavailable | Multi-functional platform, global reach | May have limited regional availability |

| Coinify | Accepts Bitcoin and other cryptocurrencies for payments | None | Secure and compliant platform, wide cryptocurrency support | Charges fees for transactions and currency conversions. |

| Sheepy | B2B crypto payment solution with fiat infrastructure | None | Global reach | No publicly available information on the cryptocurrencies it supports. |

| OpenNode | Accepts Bitcoin for online payments | 1% | Simple and user-friendly, efficient payment processing | Limited to Bitcoin transactions |

| CoinPayments | Accepts over 1,800 cryptocurrencies for payments | 0.5% fee for incoming payments | Diverse cryptocurrency support, user-friendly interface | No fiat currency support, charges network fees. |

| B2BinPay | Fiat-to-crypto onramp and cross-border payment API | 0.4% on all the incoming coin deposits | Seamless fiat on and off-ramping, AML/KYC onboarding | Limited fiat currency support.Limited fiat currency support. |

| SpicePay | Accepts various cryptocurrencies for online payments | 1% | User-friendly dashboard, fiat-to-crypto onramp | Limited information available |

| Simplex | Enables crypto-to-fiat and fiat-to-crypto transactions | 1% | Strong emphasis on compliance and security | May require identity verification |

| Banxa | Global fiat-to-crypto payment gateway | Info unavailable | Multiple currency support | Limited regional availability, possible fees |

| Wyre | Regulated Money Service Business offering crypto solutions | $5 minimum fee or 3.9% + $0.30, whichever is greater | Multiple currency payouts, seamless fund transfers | May require technical expertise |

| Uphold | Crypto payment gateway API to automate business payments | $0.50 + 3% per transaction ($500 monthly minimum) | Multiple currency support, seamless fund transfers | Limited cryptocurrency support, potential technical complexity |

FAQs

It is a technology that facilitates the acceptance of cryptocurrencies as a payment method for goods and services. It acts as an intermediary between the merchant and the customer, handling the transaction process securely. When a customer chooses to pay with cryptocurrencies, the payment solution converts the crypto amount into the merchant’s preferred fiat currency in real-time. The funds are then settled into the merchant’s account, providing them with the option to either hold the cryptocurrency or convert it to fiat. The gateway ensures a seamless and efficient payment experience while reducing the risk of price volatility for both parties.

First, evaluate the supported cryptocurrencies to ensure it aligns with your customers’ preferences and market demand. Next, examine the transaction fees and any additional costs associated with settlements or currency conversions. A user-friendly interface and seamless integration with your existing e-commerce platform are necessary for providing a smooth checkout experience for customers. Security features, such as non-custodial wallets and two-factor authentication, should be a priority to safeguard user funds and data. Finally, consider the level of customer support and the platform’s track record in terms of uptime and reliability.

They can be safe to use for online transactions, provided that they implement robust security measures. It is crucial to opt for reputable and well-established gateways that have a proven track record of protecting user funds and data. Non-custodial solutions, where the gateway does not hold user funds, offer an added layer of security. Look for platforms that utilize industry-standard encryption and employ secure authentication methods to prevent unauthorized access. Customers should also be made aware of best practices for securing their cryptocurrency wallets and transactions.

Yes, one of the significant advantages of crypto payment solutions is their ability to facilitate cross-border transactions efficiently. Traditional international transactions often involve delays and high fees due to currency conversions and intermediary banks. With cryptocurrencies, cross-border payments become faster and more cost-effective. The decentralized nature of cryptocurrencies also eliminates the need for intermediaries, reducing the risk of delays and potential errors. This makes crypto payment tools an attractive option for businesses with a global customer base or international suppliers.

Price volatility is a significant concern, as cryptocurrencies’ values can experience significant fluctuations, potentially resulting in losses for merchants if not converted to fiat promptly. Security risks, such as hacking attempts and phishing scams, pose a threat to users’ funds and personal information. Also, the regulatory landscape surrounding cryptocurrencies is evolving, and compliance requirements may vary depending on the region. Users and merchants should stay informed about local regulations and potential tax implications related to crypto transactions to ensure legal compliance.

Conclusion

With the growing support from renowned e-commerce platforms, crypto payment solutions offer practical benefits that are hard to ignore. Crypto’s volatility, once considered a risk, has been managed through stablecoins pegged to fiat currencies, providing stability for everyday transactions. However, it is important for users to remain aware of the potential risks that come with using these payment solutions. Unlike traditional banking systems, crypto transactions lack the central authority that can assist in retrieving funds in case of theft or loss due to human error.

Security is another major issue, as cyberattacks targeting cryptocurrency exchanges and wallets are rampant, leading to substantial financial losses for users. Without proper security measures and user education, individuals may become vulnerable to phishing scams or other fraudulent activities.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.