The Rise and Fall of Oracle’s Advertising Ambitions: A $2 Billion Dream Crumbles

In Brief

Oracle has announced the closure of its advertising division, citing declining sales and evolving market dynamics, following a decade-long effort to dominate the digital advertising market.

Software and cloud computing company Oracle has announced the shutdown of its advertising division after a ten-year endeavor to become a major force in the digital advertising space. The move was made in response to diminishing sales and changing market dynamics in the advertising technology space, as disclosed at the company’s fiscal 2024 Q4 earnings call.

The Rise of Oracle Advertising

Oracle started making inroads into the advertising space in 2012 when it went on a bold acquisition binge. Oracle invested billions of dollars over the period of around six years to build a strong marketing and data cloud in an effort to take on market giants like Salesforce and Adobe.

The company’s acquisition strategy included a wide range of topics within the ecosystem of marketing and advertising technologies. In its early years, Oracle bought B2B marketing automation solution Eloqua, cross-channel marketing software business Responsys, and social media publishing software provider Vitrue. Data-focused acquisitions like data management platform BlueKai and offline purchase data supplier Datalogix came after this.

Oracle expanded its portfolio to include cross-device graph vendor Crosswise, social bookmarking and content recommendation widget AddThis, and A/B testing and customization platform Maxymiser. By acquiring Moat and expanding into contextual targeting with the acquisition of Grapeshot, the corporation also made large expenditures in digital analytics and measurement.

Oracle made these purchases in order to expand its capabilities in digital measurement, cross-channel marketing, data management, and social media marketing. The company’s plan was to build an extensive toolkit for marketing and advertising by utilizing its current advantages in business software and data management.

The Turning Point for Shutting Down the Platform

Oracle’s advertising goals faced challenges in 2018 despite the substantial investments and early promise. Two key events happened back then.

First, Facebook (now Meta) said that it will no longer let Oracle and other third-party data suppliers sell targeted data directly through its platform. Oracle Advertising’s income suffered greatly from this decision, which was made in reaction to the Cambridge Analytica controversy since it restricted the company’s capacity to utilize its data assets inside one of the biggest digital advertising ecosystems.

Second, stringent consent requirements for data collection and processing were imposed with the introduction of the GDPR in Europe. Company’s data-driven advertising approach faced serious obstacles as a result of this legislative shift, especially for AddThis and other companies without integrated permission processes.

Oracle was compelled by these changes to reconsider how it collected and used data, particularly in the European market. Oracle shut down its AddThis audience data business in Europe in 2019 as part of a move to reduce its advertising activities there.

Oracle discovered that its data practices were bringing the company under more and more scrutiny and legal issues. In 2020, a complaint about third-party cookie tracking was made against the corporation in Europe. A similar class-action lawsuit was then brought in the United States in 2022.

The Decline of Oracle Advertising

Oracle’s financial filings showed how these issues added up over time. Oracle Advertising was supposedly bringing in almost $2 billion a year by 2022. But this number started to drop quite quickly. Oracle Advertising’s revenue in the fiscal year 2024 dropped to about $300 million, according to CEO Safra Catz’s statement during the Q4 earnings call. This indicates a startling $1.7 billion drop in sales in only two years.

Catz made the announcement that they had chosen to leave the advertising sector in Q4 after revenue from the industry had dropped to around $300 million in the fiscal year 2024.

What Has Triggered the Shutdown?

A number of variables played a part in Oracle Advertising’s downfall and eventual closure. Privacy laws, such as the GDPR in Europe and comparable laws in other countries, have a big effect on Oracle’s capacity to gather and profit from user data. Platform modifications, most notably Facebook’s move to limit access to third-party data, made it more difficult for Oracle to provide advertisers with effective targeting options.

Additionally, there’s been a rising trend among marketers to rely less on third-party data providers and give priority to first-party data. One of Oracle’s biggest technological challenges was handling the intricacy of integrating and maintaining data from several acquired organizations.

Oracle’s position in the industry is further complicated by the fact that many traditional digital advertising methods have had to be reevaluated in light of the main browsers’ approaching phase-out of third-party cookies.

Effects on the Marketing Sector

There are several ramifications for the larger ad tech and martech industries from Oracle’s decision to leave the advertising market. A small number of powerful companies in the digital advertising market now hold even more sway as a result of the closure. It also emphasizes the need for more privacy-compliant advertising options across the board for the business.

Photo: Marketing Technology Landscape, Chiefmartec

Advertisers and publishers should reconsider their partnerships with data brokers and third-party data suppliers in light of Oracle’s difficulties. There will probably be a quicker move in the industry toward solutions that make use of contextual targeting and first-party data.

Oracle Advertising’s closing will probably result in a large number of layoffs. Between 1,001 and 5,000 workers were mentioned on Oracle Advertising’s LinkedIn page; however, precise statistics have not been made public. Numerous experts, such as engineers and data scientists, are currently looking for new jobs in the sector.

Oracle’s Prospects After the Shutdown

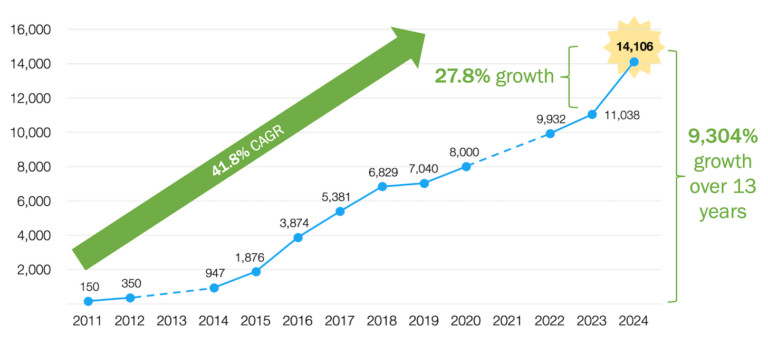

Oracle is concentrating its attention on other growth areas, namely cloud computing and artificial intelligence, as it leaves the advertising sector. Oracle revealed overall revenue of $53 billion for the fiscal year, up 6% year over year, and a profit of $10 billion, up 24% from the prior year, on the same results call when the advertising stoppage was disclosed.

Safra Catz expressed strong optimism about Oracle’s future, predicting double-digit revenue growth for this fiscal year. She anticipates that both Oracle’s sales and its remaining performance obligation (RPO) will climb even higher in fiscal year 2025, driven by robust demand for AI technologies.

Additionally, the business has revealed intentions to move its headquarters to Nashville, Tennessee, in order to be nearer to the healthcare sector, which is rapidly adopting AI and experiencing tremendous digital change.

How Do Industry Experts React?

Arielle Garcia believes that Oracle’s move is only another illustration of the mounting strain on the surveillance advertising framework. She outlined the financial and legal difficulties Oracle has had since 2018, including the consequences of Meta’s partner category elimination as well as the continuing litigation pertaining to privacy.

Zach Edwards sees the shutdown as a warning to the sector. He underlined that businesses operating data markets while adhering to data privacy standards will probably run into financial difficulties. Edwards also pointed out that some people, especially those with delicate histories and interests, would view Oracle’s decision to close its advertising subsidiaries as a net benefit for privacy.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.