5 Reasons Why Nvidia Will Reach a 2T Market Cap in 2030

In Brief

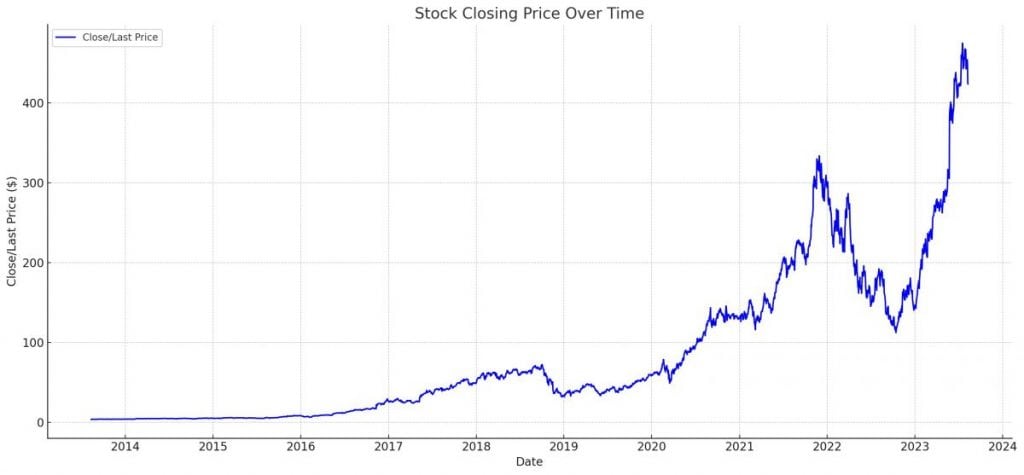

Nvidia, the first chipmaker to reach a market capitalization of $1 trillion, experienced significant growth between fiscal 2013 and 2023.

Analysts now expect Nvidia’s revenue and adjusted EPS to surge 58% and 34% this year, driving a stampede of bulls back to its stock.

If Nvidia’s valuations hold steady and it doubles its revenue and profits again, it could reach a $2 trillion market cap by 2030.

Nvidia, the first chipmaker to reach a market capitalization of $1 trillion, experienced significant growth between fiscal 2013 and 2023. The company’s revenue and adjusted net income grew at a CAGR of 20% and 28%, driven by the PC gaming and professional visualization markets. However, the pandemic and the rise of cloud-based services led to a decline in revenue from the gaming market. In fiscal 2023, Nvidia’s revenue remained flat, and adjusted EPS fell 25%. Analysts now expect Nvidia’s revenue and adjusted EPS to surge 58% and 34% this year, driving a stampede of bulls back to its stock. If Nvidia’s valuations hold steady and it doubles its revenue and profits again, it could reach a $2 trillion market cap by 2030. However, Nvidia’s stock is currently pricey at 218 times its trailing earnings and 37 times last year’s sales. If its growth slows to a 10% CAGR over the next seven years, its valuations could be cut in half, indicating that its market cap could stay around $1 trillion by the end of the decade.

Nvidia will achieve a significant milestone in 2030 when its market capitalization reaches $2 trillion. This accomplishment will be made possible by a number of factors, one of which is the significant purchase of Nvidia chips by well-known Chinese tech firms. Not only does the purchase of Nvidia chips by well-known Chinese tech firms increase Nvidia’s revenue, but it also cements the company’s position as the world’s top supplier of advanced computing solutions. Nvidia will be able to broaden its influence and carve out a significant place for itself in the rapidly developing Chinese technology market thanks to this strategic alliance.

1. Substantial Orders by Chinese Tech Majors

Four major Chinese tech entities – Baidu, ByteDance, Tencent, and Alibaba – jointly placed orders valued at $1 billion. The cumulative order encompassed around 100,000 Nvidia A800 chips, with delivery set for the end of the same year. These companies also scheduled another order, valued at $4 billion, for 2024 delivery. The substantial orders placed by these Chinese tech majors indicate their strong demand for Nvidia A800 chips, which are known for their high-performance capabilities. This partnership highlights the companies’ commitment to staying at the forefront of technological advancements and their anticipation of future growth in the industry. Chinese tech giants will order more and more.

2. Essential Role of Nvidia Chips in AI

The increasing significance of Artificial Intelligence in modern-day applications has created a surge in demand for powerful chips. Nvidia chips, such as the A800, are integral components when it comes to creating advanced AI models. The sheer magnitude of the order from China’s tech giants underlines the chips’ pivotal role in AI technology development. These chips are specifically designed to handle complex computations and accelerate AI algorithms, making them indispensable for training deep learning models. With China’s tech giants heavily investing in AI research and development, the demand for Nvidia chips is expected to continue rising in the foreseeable future.

3. Potential Export Restrictions

A looming concern for many companies internationally has been the potential of a new US export ban. This apprehension played a role in the Chinese companies’ decision to secure Nvidia chips in large quantities, ensuring that their AI advancements are not hindered by geopolitical developments. Many Asian companies have recognized the criticality of Nvidia chips in driving their AI advancements and are taking proactive measures to safeguard their progress. By stockpiling these chips, they aim to mitigate any potential disruption caused by the uncertain future of US export policies, thereby ensuring a smooth continuation of their technological advancements.

4. Features of the Nvidia A800

The A800 is a streamlined version of its counterpart, the A100. While the A800 has a reduced data rate in comparison, its demand remains unwavering due to the non-availability of the A100 model. Customers continue to rely on the A800 for its reliable performance and cost-effectiveness, despite the lower data rate. The A800’s popularity also stems from its compatibility with existing systems, making it a convenient choice for businesses in need of a reliable solution.

5. Dependency on Nvidia for LLM Training

Large Language Models (LLMs) represent the forefront of AI technology, and their training is heavily reliant on sophisticated chips. In the absence of Nvidia’s technology, the capabilities of companies to train these advanced models would be considerably compromised. Nvidia’s technology, such as their powerful graphics processing units (GPUs), provides the necessary computational power for training large language models. These GPUs are specifically designed to handle the complex calculations required for AI training, enabling companies to achieve faster and more efficient model training. Without access to Nvidia’s technology, companies would face significant challenges in harnessing the full potential of large language models and advancing AI research.

Nvidia’s valuation can be challenging to beat, but its dominance in the semiconductor industry stems from its software capabilities. Nvidia’s strong software platform has attracted cloud providers to upgrade to Nvidia chips. However, if revenue and earnings growth slow down to a 10% CAGR over the next seven years, it is unlikely to sustain its current valuations. To reach a $2 trillion valuation, Nvidia would need to trade at 21-times trailing sales, which relies on maintaining its premium valuation.

Read more about AI:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.