Vampire Attack on LIDO: A New Threat in the Crypto Arena

In Brief

The crypto community on Twitter is abuzz with thoughts of launching a “vampire” attack on the Lido Ether staking protocol.

The crypto community on Twitter is buzzing with the idea of launching a “vampire attack” on the Lido Ether staking protocol. The term “vampire attack” first emerged in the DeFi scene during the infamous event on August/September 2020 when Sushiswap successfully drained liquidity from Uniswap by offering additional rewards in its native Sushi token. This audacious strategy, if implemented, could revolutionize the ether staking landscape.

A Potential Attack Plan

A hypothetical attack on LIDO may unfold as follows:

- Instead of using the current Liquid Staking Derivatives (LSD) projects that leverage the stETH staking Ether collateral model to issue their own stablecoin, the attackers might accept stETH deposits, internally convert it to the native ETH token, and mint their own staking Ether. Additionally, they might promise to issue a new protocol native token as an incentive for users.

- The main obstacle to implementing this plan might be the current 44-day waiting period for the rise of a new validator, which acts as a protective advantage for Lido.

- This “queue” for validation could be bypassed by the protocol by front-loading the initial mass of validators with a 44-day queue using investor money. After this period, the protocol could launch a public vampire attack on Lido, or pay stakers income from an earlier raised round from investors.

Prospects of Success

Successfully orchestrating this kind of attack could lead to the creation of a competitor to the $2B-valued Lido protocol. They could gain access to the rapidly growing Ether staking market, currently standing at 22 million Ether.

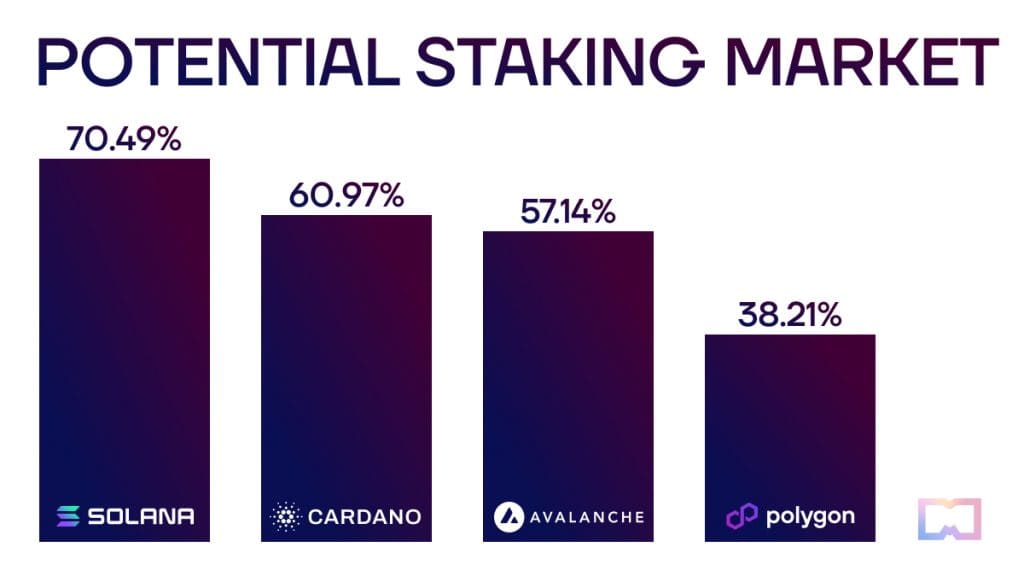

Considering the staking market of other Layer-1 (L1) blockchains:

- Solana stands at 70.49%

- Cardano at 60.97%

- Avalanche (Avax) at 57.14%

- Polygon (Matic) at 38.21%

The total addressable market (TAM) for such a product might range from 45.6 million ETH to 84 million ETH.

The Competition

Several projects are vying for a share of this market, including Ether.fi and Swell. As observers on the sidelines, the crypto community eagerly anticipates a potential Sushiswap/Uniswap-level attack on Lido. Given the stakes involved, this event might present lucrative opportunities for savvy investors. As with any crypto endeavor, due diligence and caution are key in navigating this exciting yet volatile landscape.

Read related posts:

- PUMA introduces a Metaverse experience along with a virtual fashion show at NYFW

- Manchester City Football Club drops NFTs with Puma to mark a historical moment

- Puma and Salvatore Ferragamo take a step into NFTs

- Nike is set to launch its Web3 platform, .SWOOSH

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.