Real-World Assets and DeFi Pave the Way for Credit Union Evolution

In Brief

The research explores the integration of real-world assets (RWAs) with blockchain technology and decentralized finance, highlighting its potential impact on credit unions in the US.

The idea of tokenizing real-world assets (RWAs) with blockchain technology and decentralized finance (DeFi) is revolutionizing both conventional finance and blockchain. Because of their focus on its members, credit unions in the United States are in a good position to welcome this change. This research reveals a future where openness, liquidity, and community-driven principles come together as it examines the complexities of RWAs, how they integrate into DeFi, and how they affect credit unions.

Recognizing Assets in the Real World (RWAs)

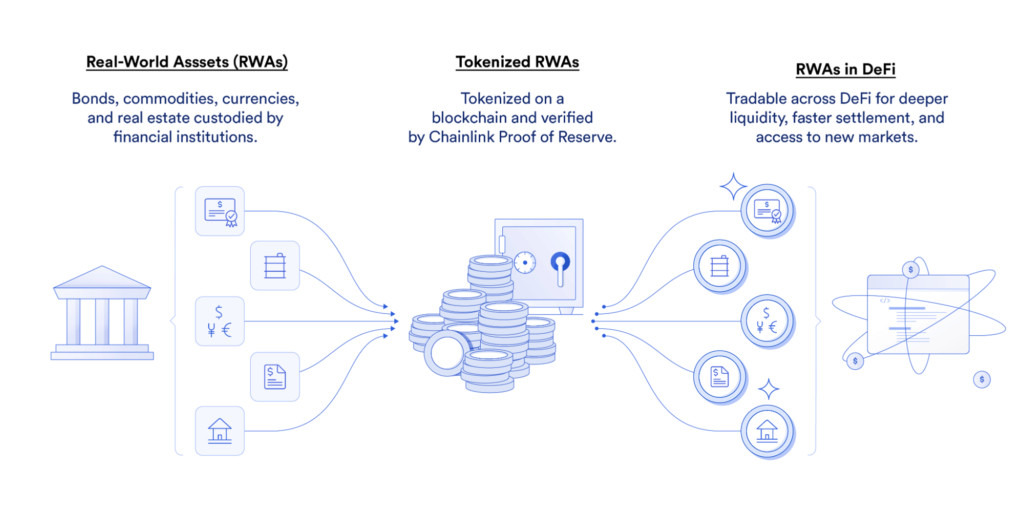

Real-world assets (RWAs) are actual items that are present beyond blockchain systems and have value derived from the real world. These adaptable assets come in a variety of forms, such as real estate, paintings, government bonds, tokenized securities, intellectual property rights, fixed-income goods, and commodities such as precious metals.

Tokenization is the act of converting these physical assets into digital representations, or “tokens,” on a ledger. Each token represents the fundamental asset’s fractional shareholding, providing a new degree of accessibility and liquidity.

RWAs’ Ascent in Decentralized Financial Services

A major step in bridging the gap between conventional banks and blockchain technology is the integration of RWAs into the decentralized finance (DeFi) system. Organizations may make use of the built-in advantages of blockchain technology, like greater access for investors, lower middleman costs, and more openness, by tokenizing real-world assets.

The capacity of RWAs in DeFi to improve liquidity for often illiquid assets, such as housing and art, is one of its most prominent benefits. These assets may be tokenized to create fractional ownership units that are lower in size, opening up previously closed markets to a wider spectrum of investors. The democratization of investing possibilities holds the capacity to fundamentally transform our understanding of and interactions with tangible assets.

Photo: Medium

Moreover, the automated handling of shareholder rights enforcement, income distribution, and compliance procedures is made possible by the use of smart contracts in DeFi protocols. Operational costs may be greatly decreased by doing away with the need for middlemen, which improves the efficiency and affordability of the investing environment.

Credit Unions and the DeFi Ethos Alignment

Credit unions are naturally aligned with the decentralized ideology that forms the foundation of DeFi, as they are member-owned cooperative financial organizations. Credit unions function on the tenet of one member, one vote, which promotes a feeling of community ownership and democratic government, in contrast to conventional for-profit banks.

The CEO of BankSocial, John Wingate, emphasizes this connection by pointing out the exact alignment between the philosophies of credit unions and decentralized finance (DeFi).

The alignment of credit unions’ essential ideals of openness, accessibility, and member-driven decision-making with the tokenization of RWAs is made possible by this philosophical concord.

Overcoming Tokenization Obstacles

Although tokenizing RWAs is a very promising idea, there are a number of obstacles credit unions must overcome before it can be widely used. The regulatory ambiguity over token categorization as securities is one of the main worries.

Kyle Hauptman acknowledges this challenge and says credit unions are concerned about participation being viewed as a security. Hauptman does, however, also draw attention to the NCUA’s attempts to offer clarification on use cases for tokenization, citing the organization’s advice papers on distributed ledger technology and digital assets.

The complexity of the existing loan participation process, which may be time-consuming and opaque, presents another difficulty. Hauptman thinks that by using smart contracts to automate payments and offer real-time loan status updates, tokenizing loans might simplify this procedure. The way credit unions handle and engage in loan portfolios may be completely transformed by this enhanced efficiency and openness.

Regulatory Obstacles and Their Remedies for RWAs

The implementation of tokenized RWAs is still beset by laws and regulations, as credit unions struggle with issues related to the legality of tokens and the possibility of regulatory monitoring.

Industry insiders, however, think that these worries might be allayed by presenting tokenization’s installation, monitoring, and auditing procedures. Adopting industry best practices and working closely with compliance teams are essential steps in guaranteeing regulatory compliance.

The managing partner of de Risk Partners, Ravi de Silva, stresses the significance of building a strong framework that prioritizes data security and privacy and synchronizes tokenization procedures with relevant rules. According to De Silva, the establishment of such a framework is necessary to guarantee the confidentiality and security of client information.

Credit unions may effectively negotiate the dynamic tokenization landscape and facilitate its wider adoption by taking proactive measures to resolve regulatory concerns and maintaining transparent contact with regulatory agencies.

Credit Union Use Cases for Tokenization

Notwithstanding the difficulties, a number of credit unions have already started looking at tokenization solutions, indicating the potential advantages of this technology in a range of contexts.

Compliance with Anti-Money Laundering (AML)

Significant potential for AML regulation arises from the tokenization of RWAs. According to Ravi de Silva, tokenization can provide effective analysis of transactional data, enabling credit unions to more efficiently identify suspicious or fraudulent actions. This underlines the potential of tokenization in controlling compliance issues.

Credit unions may monitor and analyze transactional data more effectively and efficiently by utilizing tokenization, which will help them spot any money laundering activity. This promotes a more open and safe financial environment in addition to bolstering compliance efforts.

Identity Verification and Administration

Tokenization is being investigated by credit unions for authentication and verification, which is an essential component of contemporary financial services. For example, BankSocial is collaborating with many credit unions to tokenize identification in order to enable interoperability between fintechs and systems.

Credit unions are using their verified product for DeFi use cases, deposits for interoperability between bank accounts and other institutions, and networks and fintechs, according to John Wingate.

Credit unions may improve data quality, speed up authentication procedures, and enable smooth interoperability across different financial service providers by tokenizing identity information on an unchanging, secure blockchain.

Loan Tokenization and Participation

Credit unions are investigating the tokenization of loans as a way to improve efficiency and transparency in order to address the shortcomings of the present loan participation procedure. According to Kyle Hauptman, smart contracts will eventually automatically pay the purchasing credit union its fair part, reducing the need for human reconciliation and boosting transparency.

Credit unions may create a more transparent and effective lending ecosystem, save operating expenses, and expedite the loan participation process by tokenizing loans.

The Prospects for Credit Unions and Tokenized RWAs

The monetary sector is about to undergo a massive transition as tokenized RWA adoption picks up steam, and credit unions are ideally positioned to be key players in this development.

Credit unions may improve transparency, increase liquidity, streamline operations, and eventually provide their members access to a more efficient and inclusive financial environment by embracing tokenization.

The market will eventually decide how successful these businesses are, according to James Seyffart, Research Analyst at Bloomberg Intelligence. He recognizes this potential by saying, “We’re in the very early innings for all of this.”

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.