Virtual Bank

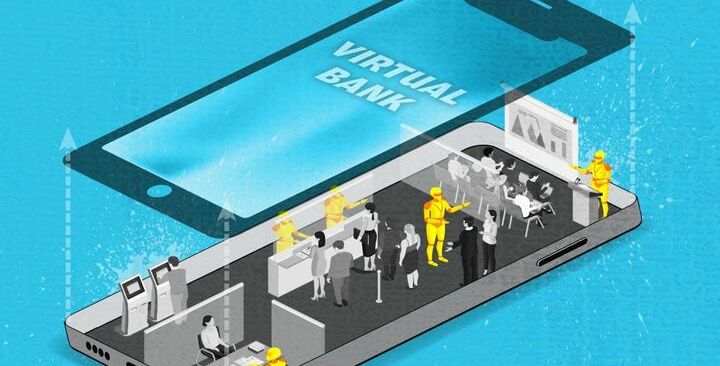

Virtual banks enable users to handle their banking through websites and mobile applications, doing away with the necessity for physical branches.

What is Virtual Bank?

“Virtual bank” is an online or digital financial institution that only deals with cryptocurrencies as opposed to conventional fiat money. Similar to standard banks, these banks provide a range of services, but their main areas of expertise are digital assets, blockchain technology, and the larger cryptocurrency ecosystem.

Understanding Virtual Banks

In the world of cryptocurrencies, virtual banks are financial organizations that don’t have actual offices and were created to meet the demands of the growing crypto community. Virtual banks can provide both security and accessibility while keep offering different services for doing business. Although these banks are quite unique and we can consider them “safe”, clients should be cautious while selecting a virtual bank and conduct needed research before using because otherwise, a small mistake can lead to the loss.

Virtual banks mostly working with the cryptocurrency, which includes altcoins like Ethereum and Bitcoin but of course you can trade with the coins like USDT which are connected to the fiat money as well. Moreover, they could provide blockchain-related services like staking, yield farming, and decentralized financial (DeFi) applications. Talking about safety, security is given a priority in virtual banking. For example there are several features like multi-signature wallets, cold storage of assets, and two-factor authentication that provide consumers with more control over their finances.

In comparison to traditional banks, transaction fees at virtual banks are typically lower. For people who trade or send and receive cryptocurrency on a regular basis or in big amounts, this could seem a nice thing as well as a possibility of doing international transactions without a headache and frequent visits to the bank. Why bank clients can send and receive digital assets across international borders with ease? Thanks to the cryptocurrencies that are not connected to any particular nation’s financial system.

It is important to note that the legislation that oversee virtual banks and cryptocurrency services differ depending on the country, and certain virtual banks could have to adhere to certain licensing and regulatory standards. To verify if a virtual bank or platform is suitable for them and their assets, future clients have to conduct due diligence.

Latest news about Virtual Banking

- Hong Kong’s WeLab Virtual Bank has secured a $260 million asset financing deal from Citigroup. This move highlights the growing influence and trust in virtual banks, as global banking giants like Citigroup recognize the potential in digital lending platforms like WeLab.

- The line between traditional finance and FinTech is becoming blurred due to advancements in blockchain and cryptocurrencies. FinTech companies are offering crypto-based financial services that surpass traditional banking systems in terms of speed, cost, and security. Digital wallets, for example, are expected to surpass 5 billion users by 2026, driven by the rise of “super apps” like Alipay and WeChat.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.