Digital Lending

What is Digital Lending?

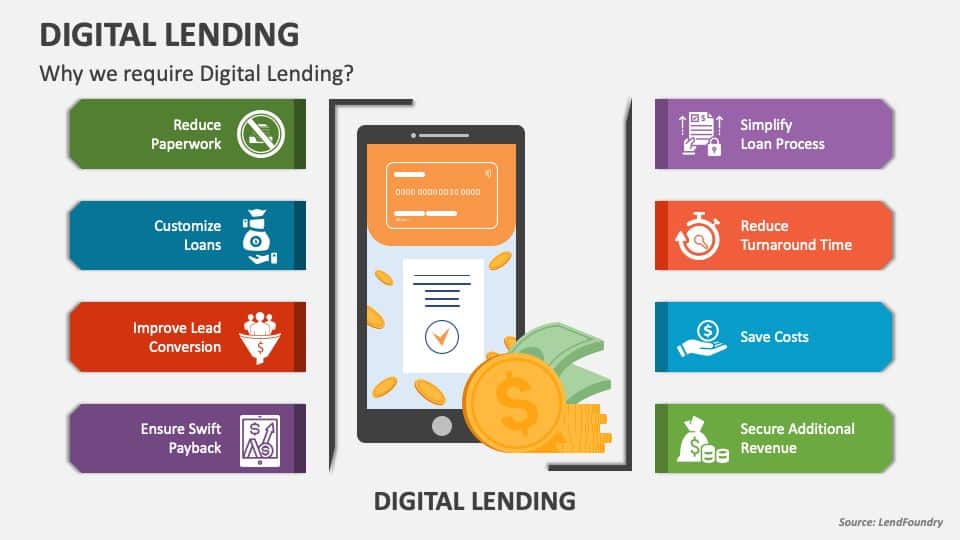

Through online platforms, anyone may apply for and be approved for getting a loan through digital lending, a sort of loan acquisition approach that eliminates the need for the visits to banks or other financial institutions by yourself, so basically it simplifies our lives. With this approach bank clients may apply for loans online, get them, and manage their repayments all at once. Thanks to its simplicity and flexibility, this type of financing has grown in popularity among younger people, some older people still remain conservative if we are talking about financial operations. The wide usage of smartphones and the expanding choice of credit options have led to this important improvement in digital lending recently.

Understanding of Digital Lending

With only a few clicks on the computer, you may quickly and easily apply for a loan application procedure. The loan application is handled and authorized in a matter of hours since the applicant submits the required paperwork and personal information and then after a certain verification by the bank, the loan money is immediately deposited into the borrower’s bank account. Fintech businesses’ ability to provide fast loans services by using real-time data is one of the main benefits of digital lending.

Bank customers can have a more smooth and simple borrowing experience as a result of all of this. Digital lending has been important in advancing financial development that has removed many of the barriers and inefficiencies usually associated with getting loans offline.

Latest news about Digital Lending

- Hong Kong’s WeLab has secured a $260 million asset financing deal from Citigroup, with Citigroup potentially playing the sole senior underwriter’s role. This move highlights the growing influence and trust in virtual banks, as global banking giants like Citigroup recognize the potential in digital lending platforms like WeLab. WeLab’s recent performance, with a 37% YoY loan growth, has bolstered its position, holding nearly 90% of Tesla’s car loan share in Hong Kong. With backing from Sequoia Capital and business magnate Li Ka-shing, WeLab boasts a market dominance, holding nearly 90% of Tesla’s car loan share in Hong Kong. Despite the tumultuous Asian credit landscape, WeLab’s resilience and strategic prowess have made it a popular choice for online lending.

- Deutsche Bank has filed for a crypto custody license with the Federal Financial Supervisory Authority (BaFin), as part of its strategy to increase fee revenue at its corporate banking unit. The bank plans to launch a digital asset custody platform for institutional clients in 2020, offering insured custody services for vetted digital assets, enabling clients to buy and sell digital assets through partnerships with prime brokers, issuers, and trusted exchanges. The platform will also provide value-added services, including taxation, valuation services, fund administration, lending, staking, voting, and an open-banking platform for third-party providers. The bank also plans to offer an institutional-grade hot/cold storage solution with robust insurance-grade protection to secure clients’ funds.

FAQ

Digital lending platforms refer to online platforms or apps that use data-driven procedures and technology to offer loans and financial services to both consumers and enterprises. These platforms’ accessibility, speed, and ease of use have contributed to their rise in popularity.

Since regulatory supervision is usually carried out at the federal or state level, the organizations in charge of digital lending differ depending on the nation and the area, but mostly it’s controlled by Financial Regulatory Authorities.

A variety of borrowers, including individuals and small enterprises, may quickly and conveniently access financial services through digital lending platforms. So it basically saves our time that is the most valuable resource recently.

« Back to Glossary IndexDisclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.