Average Directional Index (ADX)

What is Average Directional Index (ADX)?

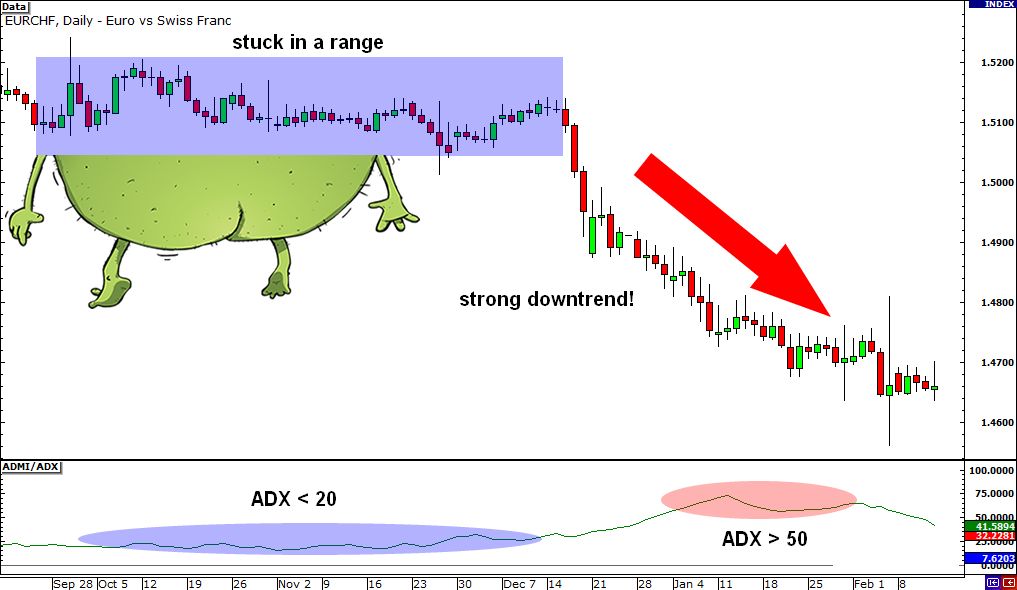

The ADX, or Average Directional Index, is a technique for measuring the overall strength of a trend. It is based on the premise that trading when the market is moving in the direction of a strong trend enhances the chances of profit while decreasing the risk significantly.

Understanding Average Directional Index (ADX)

The ADX indicator was established by Welles Wilder for daily commodity charts, but it is now utilized to determine the strength of trends by technical traders and financial professionals in a wide range of markets.

The Average Directional Movement Index (ADX) is a non-directional indicator that evaluates trend strength regardless of price movement. The Directional Movement System, which consists of the DMI+ and DMI- indicators, as well as the ADX, attempts to assess the strength of price movement in both positive and negative directions. ADX is represented by a single line with measurements ranging from 0 to 100. The indicator is (mostly) displayed in the same window as the ADX-calculating two-directional movement indicator (DMI) lines.

Read related articles:

« Back to Glossary IndexDisclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.