Metaverse Fundraising Report for August: Trends in Gaming, DAO, NFT

In Brief

Web3 startups have raised a total of $1 billion in funding.

In August, decentralized social network startups raised $45m

With more than $186m raised in August, NFT startups continue to attract investors’ interest

The total amount of Metaverse-related investment reached roughly $105b in the first five months of 2022.

Metaverse Post introduces a fundraising report for August 2022 that focuses on tech companies specializing in Web3, Metaverse, gaming, NFTs, and more.

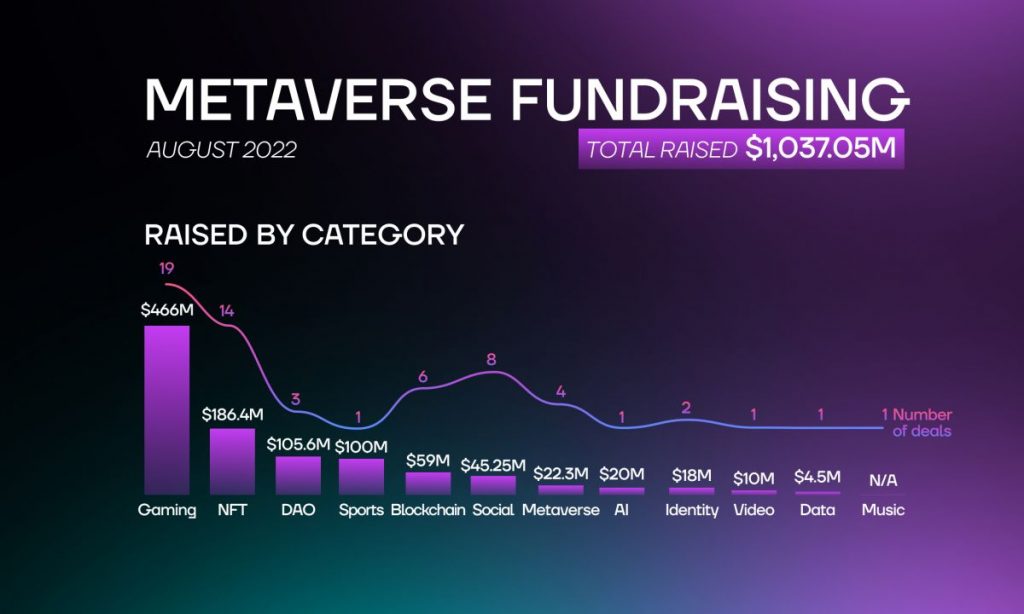

In August, the investments were targeted at twelve categories. Unlike July, which saw virtual fashion and Avatar-related fundings, August features music, AI, data, video, DAO, and sports categories.

VCs and angel investors were generally active despite the bear market, with Web3 startups having raised a total of $1.037 billion. Just like in the previous month, gaming companies received the most investors’ attention, followed by NFT and DAO-related startups.

Gaming Industry Trends

Web3 gaming industry keeps attracting investors. July saw the companies raise a total of $150 million. In August, blockchain-based game startups received approximately $466 million.

Gym Class

Gym Class, a VR basketball application, raised $8 million in a seed round led by Andreessen Horowitz (a16z) and backed by Y Combinator. The game has reached nearly a million downloads on Meta Quest App Lab and plans to launch on the Meta Quest Store in fall 2022.

AO Labs

AO Labs raised $4.5 million in a round led by Yield Guild Games. Among seventy other investors are the CEO of YGG Gabby Dizon, Balaji Srinivasan and Sandeep Nailwal of Polygon, Jeff “Jiho” Zirlin of Sky Mavis, and Kyu Lee of Com2uS. The startup will use the funds to build a community-driven Web3 gaming platform, Spacebar.

PlayZap Games

Web 3 Gaming platform PlayZap Games raised an undisclosed amount in a seed round led by KuCoin Labs. The Singapore-based startup will use the funds to further develop the gaming platform, both the desktop and mobile versions.

Halliday

Halliday raised $6 million in a seed round led by a16z. Among other participants are Hashed, SV Angel, Immersion Partners, a_capital, and Sabrina Hahn. The company will provide ownership of blockchain gaming assets with later payment.

MetaverseGo

MetaverseGo, a mobile gaming platform based in the British Virgin Islands, raised $4.2 million in a seed round led by Galaxy Interactive. Among other participants are Delphi Digital, Dragonfly Capital, Ascensive Assets, Infinity Ventures Crypto, Mechanism Capital, Akatsuki, Shima Capital, Com2uS, BitScale Capital, Mentha Partners, Yield Guild Games (YGG), BreederDAO, and Emfarsis. The startup plans to use the funds for software development, strategic hires, and partnerships with telecommunication providers.

Yin Yang Games

Yin Yang Games, an Istanbul-based NFT game developer founded in 2021, raised $1 million in an investment round. The round was led by Gelişim Group. The company, which currently counts 21 employees, plans to use the funding to develop “Reincarnation,” an NFT card game.

Lysto

Lysto, a gamer infrastructure startup, raised $12 million in pre-Series A funding round. Beenext, Hashed, and Square Peg led the round. Among other participants are Better Capital and Tiger Global, as well as several angel investors. Additionally, a partner at Square Peg, Tushar Roy, joined the board of directors. The startup builds verification tools for gamers and plans to continue developing the platform.

Luxon

Web3 gaming platform Luxon, developed by game publisher Line Games, raised $5.8 million. The round was led by Blocore, with GuildFi and FTX Ventures, among other investors. The startup plans to use the funds to help developers and users transition to Web3.

Gunzilla Games

Frankfurt-based Gunzilla Games, founded in 2020, raised $46 million in an early-stage funding round led by Republic Capital. The company will use the funds to build GunZ, a platform that enables users to possess their in-game assets. It’s worth noting that the funding follows the announcement of a new AAA Battle Royale 2.0 third-person shooter, dubbed “Off The Grid.”

Murasaki

Game development company Murasaki raised €1.5 million in a seed round led by Japanese VC firm Incubate Fund. Among other investors are Mint Ventures and Skyland Ventures. The startup will use the funds to work on its second futuristic game, Cyberstrella.

MatchboxDAO

Gaming ecosystem MatchboxDAO raised $7.5 million in a seed round. Among the investors are Starkware, ReadyPlayerDAO, Formless Gamma, Geometry Research, Neon DAO, Road Capital, and Bonfire Union.

Rusk Media

Digital entertainment company Rusk Media raised $9.5 million in an extended Series A round led by DAOL Investment and Audacity Ventures. Existing investors InfoEdge Ventures (IEV), Mistry Ventures, and Survam Partners also participated in the round. The funds will be used for the launch of a blockchain-based UGC-led gaming platform.

Gallium Studios

Gallium Studios, founded by the creators of The Sims, Sim City, and Spore, raised $6 million. The company will build a memory game Proxi and use the funds to help develop simulation games that utilize blockchain technology.

Inworld AI

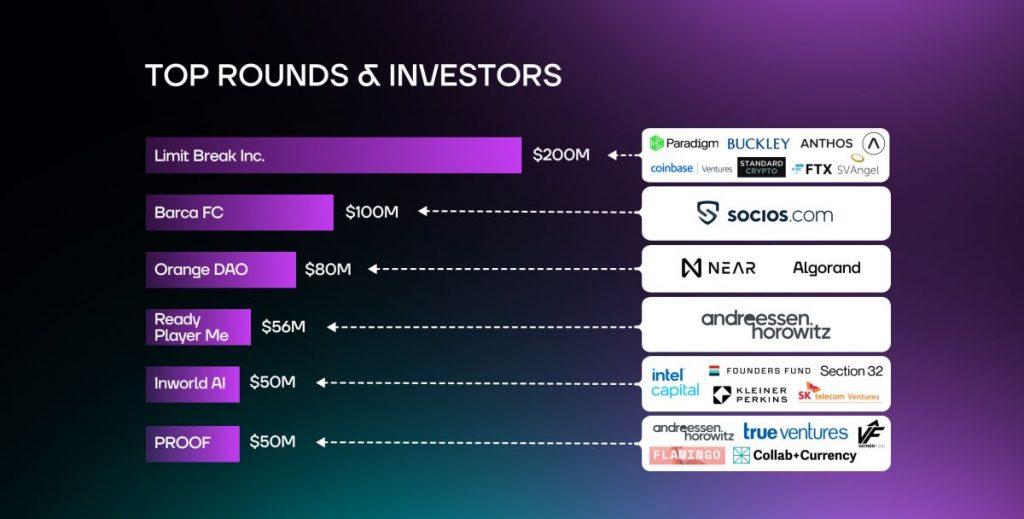

Inworld AI, a platform that enables the creation of AI-driven virtual characters, raised $50 million in a Series A round led by Intel Capital and Section 32. Among other investors are Founders Fund, Accelerator Investments LLC, Kleiner Perkins, SK Telecom Venture Capital, BITKRAFT Ventures, CRV, Microsoft’s M12 fund, Micron Ventures, The Venture Reality Fund, LG Technology Ventures, NTT Docomo Ventures, and First Spark Ventures. The startup will use the funds to develop richer immersive virtual worlds.

Ready Player Me

Tallinn-based startup Ready Player Me raised $56 million in a Series B round led by a16z. The platform is currently working with Web2 and Web3 brands and plans to create avatars for multiple environments.

Yesports

Yesports raised $3.8 million in a strategic round led by Spartan Capital. Among other participants are investors Tess Capital, Jsquare, NGC Ventures, Rising Capital, and BR Capital. The startup plans to use the funds to build and expand its Web3 engagement platform.

Xterio

Game developer Xterio raised $40 million in a round led by FunPlus, XPLA, Makers Fund, and FTX Ventures. Among other investors are Animoca Brands, HashKey, Infinity Ventures Crypto, Foresight Ventures, and Matrix Partners. The company will use the funds to develop, publish, and distribute Web2 and Web3 games.

Limit Break Inc.

Limit Break Inc. raised $200 million in a round led by Paradigm Ventures, Buckley Ventures, and Standard Crypto. Other participants are Coinbase Ventures, Anthos Capital, FTX, SV Angel, and Shervin Pishevar. The company, known for its DigiDaigaku NFT collection, will use the funds to develop a free-to-own game.

Blockchain Industry Trends

Proof of Impact

Proof of Impact, a platform for ESG and impact data intelligence, raised $6 million in Pre-Series A funding. The round was led by Rakuten Capital and saw the participation of Franklin Templeton Blockchain Fund, Advaita Capital, Five T, and Blockrocket VC. Additionally, existing investors Franklin Templeton Advisors, Asiri, CV VC, Working Capital Fund, and Oxford Angel Fund also participated in the round. Proof of Impact plans to use the funds to accelerate go-to-market efforts focused on private credit and private equity fund managers and extend its core product.

Web3Port

Accelerator of Web 3 projects Web3Port (former ICPort) raised $1 million in a seed funding round at a $20 million valuation. Among the investors are SNZ Holding, KuCoin Ventures, HashKey, FBG, AZDAG, Spark Digital Capital, Web 3.0 SEA Alliance, 7 O’Clock Capital, MH Ventures, BetterverseDAO, Bing Ventures, and the founder of Fenbushi Capital, Bo Shen. The startup plans to develop products and marketing and accelerate its expansion into the global market.

Cookie3

Poland-based Cookie3, a Web3 startup that analyses smart contracts, NFTs, and tokens, raised $2.5 million in seed and strategic rounds. The round was led by Spartan Group, Big Brain Holdings, and Hartmann Capital. Among other participants are Orange DAO, LD Capital, Square, Damo Labs, Block54, Gravity Team, and Master Ventures.

Fortress Blockchain Technologies

Fortress Blockchain Technologies raised $22.5 million in a seed funding round led by Ayon Capital. Among other participants are Soaring Investment Management, Scott Purcell of Fortress, and several angel investors. The startup will use the funding to build a strong sales team.

EtherMail

EtherMail raised $3 million in a seed round led by Greenfield One and Fabric Ventures. The startup plans to introduce its native utility token next year and will use the funds to expand the team and accelerate solution testing.

Thirdweb

A platform for Web3 application developers Thirdweb raised $24 million in a Series A round led by Haun Ventures. Among other participants are Coinbase, Shopify, Shrug VC, and Joseph Jacob of Kleiner Perkins. The startup will use the capital to develop its product and expand business, marketing, and sales teams.

Social Industry Trends

What seems to be a new trend, the social networking sector remains on investors’ radars. In July, decentralized social network startups and applications raised $43 million. In August, social startups raised approximately $45,25. million.

Satellite IM

Satellite IM, a decentralized communications platform founded in 2020, raised $10.5 million in a seed round. The round was led by Framework Ventures and Multicoin. Among other investors are IDEO CoLab, Solana Ventures, Hashed, and Pioneer Square Labs Ventures. The company, which enables peer-to-peer private messaging, plans to release its desktop application later this summer.

Blockify Inc

Smart and social Web3 platform Blockify Inc. raised $2.2 million in a seed round. The startup plans to accelerate the product launch and bring new features to the platform.

BovineVerse

Metaverse gaming platform BovineVerse raised $1.9 million in a private round. Among the investors are ZeroVo, 7 O’clock Labs, Monday Capital, Block Pulse, MG Capital, and Bkex. The startup will use the funding for tech and product development, market expansion, and building the community.

GitPOAP

Contributor recognition platform GitPOAP raised $4.2 million in a seed round led by Libertus Capital and Inflection.xyz. Among other participants are POAP, Avalanche VC, Protocol Labs, and notable angel inventors. The startup will use the funding to expand the team and build deeper integrations.

Quivr

Decentralized social platform Quivr raised $3.55 million in a seed round led by Infinity Ventures Crypto. Among other investors are C2 Ventures, Sfermion, FBG Capital, and Jason Zeng of Tencent. The funds will be used to launch the platform and let users create their social graphs.

Stacked

Stacked, a Web3 version of Twitch, raised $12.9 million in a Series A round led by Pantera Capital. Z Venture Capital and GFR Fund. The funding will be used for hiring marketing and sales teams and the expansion to Southeast Asia, Latin America, and India.

CommDotApp

Crypto-native messaging application CommDotApp raised $5 million in a seed round led by CoinFund. Among other investors are Electric Capital, LongHash Ventures, Shima Capital, Slow Ventures, and Eniac Ventures. The startup will use the funds to build a new chat platform for Web3 communities.

“Web3 promises to put users in control of their own data and identity, but too often this comes at the expense of the user experience. Comm’s keyserver approach drives a decentralized network that delivers a user experience customers are used to while preserving the privacy and sovereignty benefits of web3,”

said the Founder and CEO of CoinFund, Jake Brukham.

Koop

Koop, a creator focused Web3 community protocol, raised $5 million in a seed round led by Variant Fund and 1confirmation. Among other participants are Palm Tree Crew, Ethereal Ventures, Day One Ventures, DeFi Alliance, Volt Capital, Cooper Turley, former Coinbase CTO Balaji Srinivasan, and Liu Jiang.

DAO Industry Trends

CreatorDAO

Decentralized community CreatorDAO raised $20 million in a seed funding round. A16z and Initialised Capital led the round. Among other investors include Audacious Ventures, 6th Man Ventures, Abstract Ventures, MGU Capital, SV Angel, Hack VC, Fika Ventures, Kygo’s Palm Tree Crew, Liquid 2 Ventures, M13, Fuel Capital, Goldhouse, Soma Capital, Alliance DAO, Shima Capital, Olive Capital, Position Ventures, Alchemy Ventures, and angel investors. The DAO invests in creators and provides the tech, capital, and operational support in exchange for a percentage of their future earnings.

Mural

DAO-focused startup Mural raised $5.6 million in a seed funding round. Among the investors are 186 Ventures, Barry Silbert’s Digital Currency Group, Mike Novogratz’s Galaxy Ventures, and Firstminute Capital. The company will use the funds to expand the team and work with brands globally.

Orange DAO

Orange DAO, which plans to back Web3 startups through a venture fund, raised $80 million in a round led by Near and Algorand. Additional funding comes from DAO members that became limited partners.

NFT Industry Trends

In July, NFT startups raised approximately $105,4 million. August shows such companies keep gaining investors’ attention, having raised more than $186,4 million.

OneOf

OneOf, a green Web3 company that supports musicians, brands, and athletes, raised $8 million in a strategic round. Among the investors are Amex Ventures, Mirabaud Lifestyle Impact and Innovation Fund, Sangha Capital, Snow Hill Ventures, and Chain Link Crypto Fund. The startup plans to accelerate the development of its sustainable NFT marketplace.

Capsid

Sustainable NFT ecosystem Capsid raised $3 million in a seed round. Among the participants are Distributed Global, 32-Bit Ventures, Google alumni, Mask Network, Spring Wind VC, and several angel investors from Huobi, Google, YGG, MetaCartel, Binance, and Crust Networks.

Buzzmint

Buzzmint, a London-based platform for utility-led NFT or token projects, raised an undisclosed amount in a seed funding round led by Ayre ventures. The startup enables brands to easily create tokens of their digital assets and sell them.

Pinata

Pinata, a media distribution platform with a focus on NFTs, first launched in 2018, raised $21.5 million. The round was co-led by Pantera, Offline Ventures, and Greylock. Among other investors are OpenSea, Alchemy, and Volt Capital.

Fair.xyz

Minting platform Fair.xyz, which allows creators to launch collections in minutes, raised $4.5 million in a round led by Eden Block. Among other investors are OpenSea, First Minute Capital, and NFX.

Fractional

NFT company Fractional, which recently rebranded to Tessera, raised $20 million in a Series A round led by Paradigm. The company plans to hire new experts specializing in marketing, as well as devs and engineers.

Unlockd

Unlockd, an NFT-backed loan startup, raised $4.4 million in a seed round led by Blockchain Capital. Among other investors are Spartan Group, Sfermion, and Play Ventures. The company plans to use the funds for product and development.

Invisible Universe

Internet-first animation studio Invisible Universe raised $12 million in a Series A round led by Seven Seven Six. Among other investors are Dapper Labs, Cosmis Venture Partners, Ganges, Franklin Templeton, Initialized Capital, 75 & Sunny, Schusterman Family Investments, and Wheelhouse. The startup will soon launch a community driven NFT project that permits holders to influence the storytelling of an animated series.

Distributed Finance

Distributed Finance raised $2.5 million in a seed round led by Borderless Capital. Among other participants are The Algorand Foundation, Big Brain Holdings, Fun Fair Ventures, and Eterna Capital. Part of the seed funding was used to acquire the NFT marketplace Rand Gallery.

MintStars

NFT subscription platform for models and creators MintStars raised an undisclosed amount by Polygon Studios.

NFT Genius

NFT Genius, a startup that builds marketplace technology, raised $10.5 million in a Series A round led by Spartan Labs, Dapper Labs, Fundamental Labs, and Commonwealth Asset Management. Among other participants are One Football, Spartan, and Unibanco.

Animoca Brands Japan

Animoca Brands Japan raised $45 million from MUFG Bank, Ltd. The companies reportedly plan to partner for NFT-related business opportunities.

Tokenproof

Tokenproof raised $5 million in a seed round led by Penny Jar Capital. Among other participants are Corazon Capital, Canonical Crypto, 6th Man Ventures, and several angel investors: Sebastien Borget, Keith Grossman, Mark Cuban, and Patricio Worthalter.

“Eliminating the unnecessary risk of connecting or carrying a digital wallet is crucial for mainstream use of NFTs. We are dedicated to delivering the security and privacy users deserve while making it seamless for companies to unlock the possibilities of NFTs and connect with people in compelling and creative ways.”

said Founder and CEO of tokenproof, Alfonso (Fonz) Olvera.

PROOF

NFT Collective PROOF, founded by Kevin Rose, raised $50 million in a Series A round led by a16z. Among other investors are True Ventures, Flamingo DAO, Collab+Currency, VaynerFund, and SV Angel. Existing investor Seven Seven Six also joined the round.

Metaverse Industry Trends

In the first five months of 2022, the overall value of Metaverse-related investment reached approximately $95-$105 billion, as stated in “The Metaverse Overview” by Cryptomeria Capital.

In August, Metaverse investments reached a total of $22.3 million. It’s worth noting that this very fundraising report divides Metaverse-related investments from gaming and Augmented Reality ones.

Everdome

UAE-based Metaverse company Everdome raised $10 million. The funding was provided by GEM Digital Limited, an investment firm located in the Bahamas. Everdome will use the funds for the Metaverse technological expansion, the game’s VR capabilities, and team growth.

Dimension X

Dimension X, a provider of a Metaverse Creator platform, raised $600.000 in a pre-seed round led by Startup Ignition Ventures. The company will use the funds to hire immersive devs, designers, and product strategists.

MBD Financials

MBD Financials raised $10 million in a round led by LDA Capital. The company will use the funds to accelerate the product’s roadmap and launch an NFT marketplace, a token, and digital identity services.

INDEX GAME

Hong Kong-based Metaverse agency INDEX GAME received $1.7 million from The Sandbox. The startup develops Metaverse, GameFi, and Web3 play-to-earn content.

AI Industry Trends

MarqVision

IP protection platform MarqVision raised $20 million in Series A funding. Previous investors Softbank Ventures, Y-Combinator, and Bass Investment were joined by DST Global Partners and Atinum Investments. The startup designed to protect human creativity and innovation will use the funds to continue advancing its product development.

Data Industry Trends

Coherent

Blockchain data startup Coherent, founded by a former Coinbase software engineer Cortright, raised $4.5 million in a seed round co-led by Matchstick Ventures, Foundry Group, and Kindred Ventures. Among other participants are Coinbase Ventures, Chapter One, Alchemy, and Dan Romero of Coinbase. The company plans to hire two engineers in the nearest future.

Identity Industry Trends

Qui Identity Inc.

Identity startup Qui Identity Inc. raised $5 million in a round led by Round 13 Digital Asset Fund. OMERS (Ontario Municipal Employees Retirement System), Weston Family-owned, and Wittington Ventures are among other investors. The company aims to help users control their identities online.

.bit

Open-sourced decentralized identity protocol .bit closed $13 million in a Series A round. Among the investors are CMB International, HashKey Capital, GGV Capital, QingSong Fund, GSR Ventures, and SNZ.

Sport Industry Trends

Barca Studios

Barca Studios has received $100 million from socios.com. Football club Barcelona plans to accelerate its Web3, blockchain, and NFT strategies.

Video Industry Trends

TVCoins

Video streaming and monetization platform TVCoins raised $10 million in a seed round led by Roumell Asset Management, LLC. Another significant investor in the round was The Hoerner Planning Group, LLC.

Music Industry Trends

MetaBeat

K-POP music content IP platform MetaBeat raised an undisclosed amount in a strategic round led by Neo Global Capital Ventures, AC Capital, and KuCoin Labs. Among other investors are BCi, Finngram, DigiFinex, Alphanonce, NexusOne, and Alchemic Investments. The company plans to use the funds to broaden its network globally.

Notable investors

As a result, among the most active investors in August are:

- Paradigm Ventures, Buckley Ventures, and Standard Crypto led Limit Break Inc.’s investment round, having raised $200 million for a new free-to-own game.

In August, San Francisco-based investment firm Paradigm Ventures led the funding round of Limit Break Inc., which plans to develop a free-to-own game. Additionally, the firm led Tessera’s (former Fractional) Series A funding round, which raised $20 million.

The company invests in crypto and Web3 startups, such as crypto platforms, financial firms, and NFT marketplaces. For instance, in July this year, Paradigm Ventures invested in the NFT marketplace Magic Eden.

Buckley Ventures is a venture capital firm founded by Josh Buckley. It focuses on Web2 and Web3 tech companies and has previously invested in Figma, Lattice, and Clearbit.

Standard Crypto is a San Francisco-based venture capital firm that specializes in crypto and Web3. It has previously invested in Polygon, Yuga Labs, Party DAO, OpenSea, and other major tech companies.

- Layer-1 blockchains Near Protocol and Algorand have invested $80 million in Orange DAO, which will provide Web3 startups with venture funding.

The companies aim to bring more entrepreneurs into Web3 by providing funds to the DAO comprised of Y Combinator Alumni.

- Socios invested $100 million in Football Club Barcelona to accelerate its Web3, blockchain, and NFT strategies. Additionally to the investment, Socios’ owner and technology provider Chiliz acquires a 24.5% of stake in the Football Club’s digital content creation and distribution hub.

Socios is a blockchain-based fan engagement platform that permits football fans to purchase or “hunt” fan tokens, vote on team polls, participate in games, and more.

Interested in learning more? Here are some additional guides to check out:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at [email protected]

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at [email protected]