Institutional Demand for Digital Assets Surges as Hedge Funds See Explosive Growth in Cryptocurrency Adoption

In Brief

PwC and AIMA’s analysis shows nearly half of conventional hedge funds have invested in digital assets, reflecting the increasing acceptance of cryptocurrencies in the financial environment.

According to a thorough analysis by PwC and the Alternative Investment Management Association (AIMA), almost half of conventional hedge funds have already made an investment in digital assets. The rising acceptance and allure of cryptocurrencies in the wider financial environment is reflected in this trend, which represents a shift in these financial giants’ investing strategies.

The poll offers insights into the shifting perspectives and approaches taken by hedge funds with regard to digital assets, and it serves as the foundation for the 6th Annual Global Crypto Hedge Fund Report. The survey, which was carried out in the second quarter of 2024, included answers from around 100 hedge funds that represented conventional and cryptocurrency-oriented organizations in six different geographic locations. With an estimated $124.5 billion in assets under management (AUM) among various funds, there is a sizable sample size available for examination.

47% of Traditional Hedge Funds Now Have Crypto Exposure

The report’s most startling result is the rise in conventional hedge funds that have exposure to digital assets. From 29% in 2023 and 37% in 2022, the percentage has increased to 47% in 2024—a notable increase. This increased trend indicates that traditional financial institutions are becoming more confident in cryptocurrencies as a feasible asset class.

Photo: Kitco

This growing interest in digital assets is the result of several causes. The United States’ introduction of spot Ethereum (ETH) and Bitcoin (BTC) exchange-traded funds (ETFs) has changed the game by allowing institutional investors to purchase regulated financial instruments that expose them to cryptocurrencies. This evolution has given the asset class greater credibility and given traditional hedge funds a more recognizable investment vehicle.

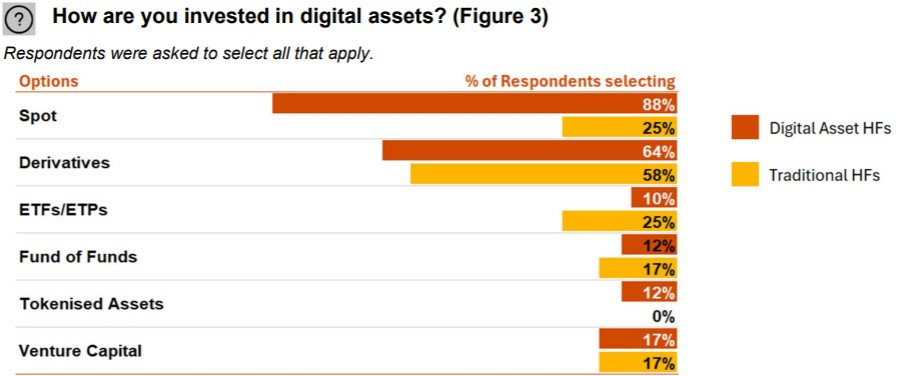

The poll also provides insight into the investing approaches hedge funds use in the realm of digital assets. By adding a range of cryptocurrency-related investing strategies to their portfolios, traditional hedge funds are diversifying their holdings more and more. The two most often used strategies among traditional hedge funds, according to 33% of respondents, were market neutral and discretionary long-only.

It’s interesting to note that traditional hedge funds’ approach to working with digital assets has changed significantly. Spot trading was formerly the most popular approach; it peaked at 69% last year, but it is currently only at 25%. On the other hand, there has been a notable increase in derivative trading, which increased from 38% in 2023 to 58% in 2024.

This change reflects the complexity with which hedge fund tactics are becoming more sophisticated. Derivatives provide a means of gaining exposure to digital assets without really possessing them, acting as a hedge against volatility and any downside risks.

The report also demonstrates how hedge funds are becoming more interested in tokenization. A quarter of conventional hedge funds last year were either committed to tokenization or were investigating it, compared to around 33% of hedge fund responses. This pattern implies that hedge funds are considering blockchain technology’s wider uses in traditional finance, rather than just cryptocurrencies per se.

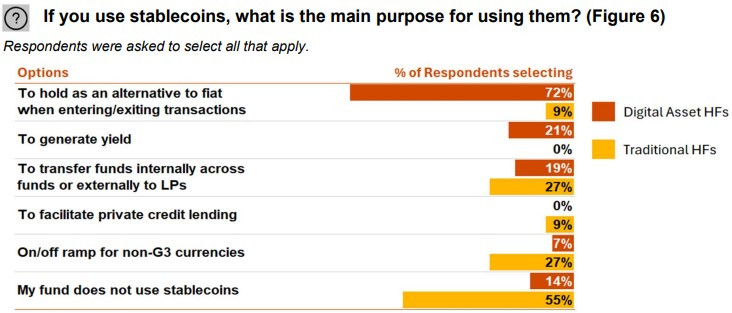

Stablecoins Gain Traction as 72% of Hedge Funds Prefer Them Over Fiat for Transactions

In the tokenization space, stablecoins have become a particularly interesting topic of discussion. When entering and leaving transactions, a sizable majority of respondents (72%) said they preferred to use stablecoins rather than fiat currency. This preference highlights how stablecoins are becoming more and more important in streamlining transactions within the cryptocurrency ecosystem and closing the divide between traditional and digital banking.

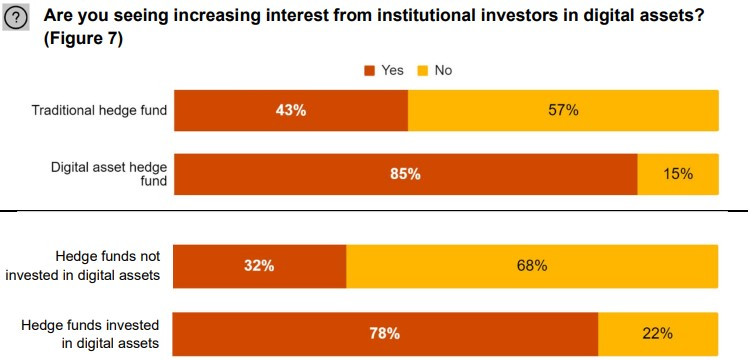

Not only are hedge funds becoming more interested in digital assets, but so are the clients of these firms. According to the poll, institutional investors’ interest in digital assets has surged, as reported by two-thirds of hedge fund managers. With 78% of hedge funds reporting increased interest from institutional customers, this trend was especially noticeable for those hedge funds that had already made investments in digital assets.

Photo: Kitco

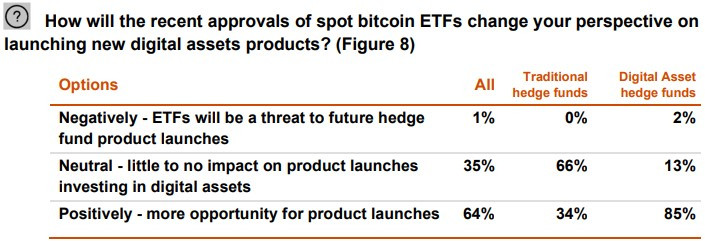

This heightened institutional interest has been sparked by the introduction of spot Bitcoin ETFs. According to the study, 64% of participants think that these approvals would open up additional doors for the next product releases and improved tactics. Hedge funds that specialize in digital assets felt this way even more, with 85% of them seeing the approvals as a chance to provide new goods and services.

It’s important to note, though, that conventional hedge firms are still being more circumspect about how Bitcoin ETFs may affect their approaches. According to two-thirds of traditional hedge funds, their present digital asset strategies do not include Bitcoin ETFs. Although conventional hedge funds are aware of the increasing significance of digital assets, it appears that they are still carefully considering the best way to incorporate these new investment vehicles into their current portfolios.

Photo: Kitco

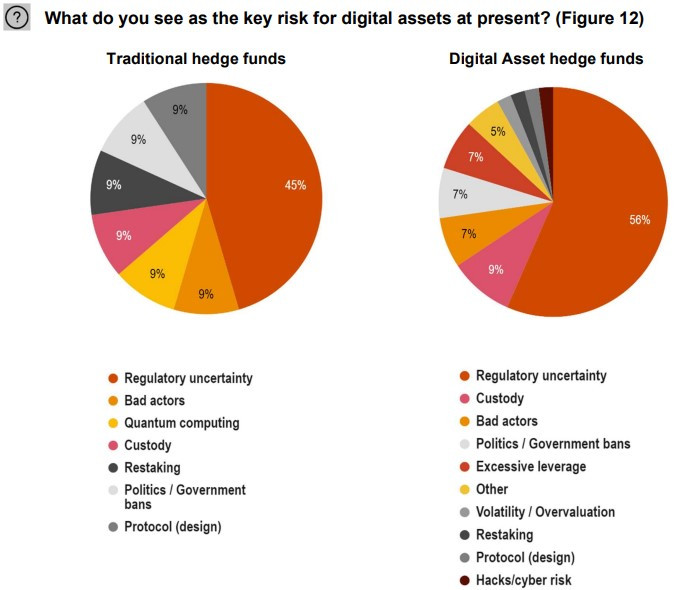

There are still obstacles to the broad integration of digital assets into conventional hedge fund strategies, despite the increasing interest and adoption of these techniques. According to the poll, the most common excuse given for not investing in digital assets was a lack of legislative certainty. This emphasizes how more precise legal frameworks are still required in order to give institutional investors entering the cryptocurrency market security and predictability.

Another major obstacle that 38% of funds that are not already invested in digital assets noted was the absence of digital assets from investing mandates. This emphasizes how institutional attitudes and rules need to change more broadly in order to take into account cryptocurrencies’ expanding influence in the financial system.

Photo:

In general, the poll offers perceptions on the proportional magnitude and range of conventional hedge funds in contrast to their digital asset-oriented competitors. While typical hedge funds had an average AUM of $3.14 billion, the average AUM for all respondents was $1.5 billion.

It’s crucial to remember, too, that not every conventional hedge fund is jumping at the chance to use digital assets. According to the poll, 76% of those who do not presently own digital assets say they are not likely to do so in the next three years, up from 54% in 2023. This implies that many established players remain extremely cautious even in the face of increased demand.

There are several reasons to exercise caution. Reputational risk, infrastructural deficiencies, and volatility are additional considerations, in addition to regulatory uncertainties and investing mandate limits. These worries draw attention to the continuous difficulties the cryptocurrency sector has in winning over established banking institutions.

Photo: Kitco

The 6th Annual Global Crypto Hedge Fund Report concludes by presenting an image of a changing financial environment. The fact that over half of conventional hedge funds are now experimenting with cryptocurrency is a noteworthy turning point in the acceptance of digital assets in the mainstream of finance. Even if there are still obstacles and doubts, the general trend indicates that traditional financial institutions’ interactions with cryptocurrencies are becoming more sophisticated and widely accepted.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.