FTX Leadership VS Sam Bankman-Fried over $220M Deal

In Brief

FTX tried to sell the platform after filing for bankruptcy but the top bid was just $1 million, representing a 99.5% drop in value.

The bankruptcy filing of FTX resulted in an astonishing 99.5% reduction in its value, with the highest offer being a mere $1 million.

FTX’s legal team has initiated a lawsuit against former CEO Sam Bankman-Fried, co-founder Zixiao Wang, and former senior executive Nishad Singh over the $220 million acquisition of stock-clearing platform Embed. The lawsuit alleges a lack of due diligence and misconduct.

According to the filing made by FTX on May 17, the company acquired Embed for $220 million through its U.S. subsidiary, claiming to have conducted minimal due diligence on the platform.

The founder and former CEO of Embed, Michael Giles, reportedly conducted more extensive due diligence on non-binding indications of interest compared to other entities. Despite submitting a final bid, none of the other 12 entities proceeded with the acquisition after conducting thorough due diligence.

FTX’s lawyers argue that Giles received $157 million in connection with the acquisition but made a final bid of only $1 million, subject to reductions at closing.

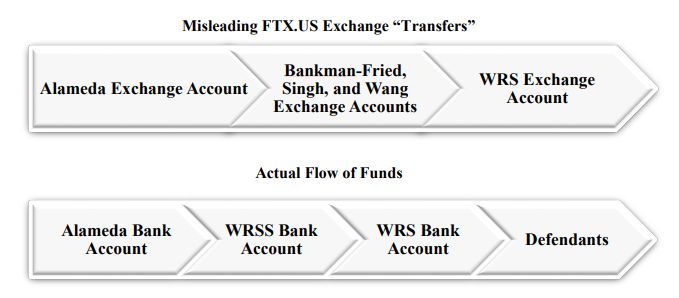

FTX.US Exchange “Transfers”

The insiders at FTX, including Bankman-Fried, are accused of engaging in fraudulent activities by using customer funds to acquire Embed and conceal its financial issues. They are also alleged to have taken advantage of FTX’s poor record-keeping to perpetrate the fraud. The lawyers claim that the defendants were aware of the company’s insolvency when approving the deal.

Furthermore, the lawyers assert that misleading records were created to hide Alameda’s role in funding the Embed acquisition. They claim that FTX entities, along with Singh, Wang, and Zhang, transferred funds to Bankman-Fried, Singh, and Wang, with the records later altered to conceal these transactions.

FTX aims to disallow the claims made by the defendants and recover the lost funds resulting from avoidable transfers. They request that these claims be labeled as “avoidable fraudulent transfers and obligations, and preferences.”

Since filing for Chapter 11 bankruptcy on November 11, FTX’s new leadership has been focused on recovering owed funds and considering a relaunch of the company.

Read more related articles:

- CFTC unveils new charges against Sam Bankman-Fried, FTX, and Alameda

- Dfinity sues Meta over trademarking the infinity logo

- As Sam Bankman-Fried’s FTX empire comes crumbling down, Solana faces immense public scrutiny and pressure

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.