Blur’s Lending Protocol Blend Commands 82% of NFT Lending Market Share

In Brief

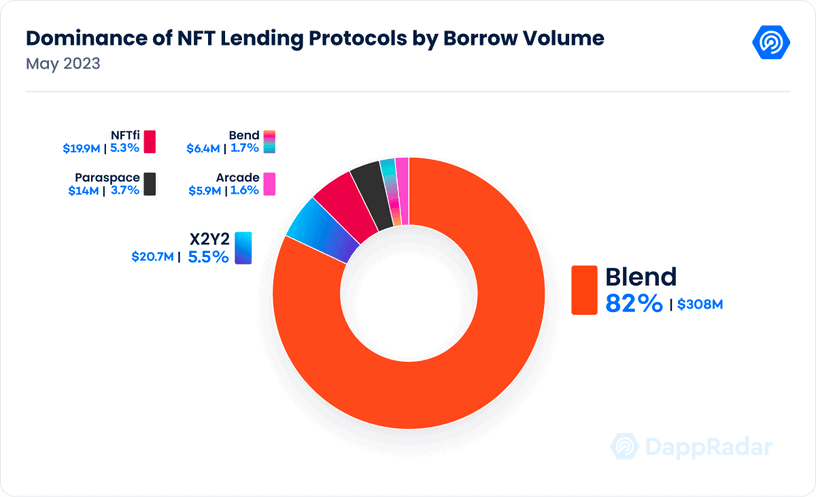

A DappRadar report revealed that Blur’s NFT lending platform Blend dominates 82% of the NFT lending market.

Blend has secured a loan volume of $308 million in the past 22 days.

Lending represents 46.2% of Blur’s trading activity.

Since its launch on May 3, Blur’s lending protocol Blend is currently leading the NFT lending market share with an 82% dominance, according to a new report by DappRadar. Blend is a peer-to-peer lending protocol built in partnership with VC firm, Paradigm.

Paradigm’s whitepaper introduces Blend as a “peer-to-peer perpetual lending protocol that supports arbitrary collateral, including NFTs.” This means that the collateral accepted by a lender can be any asset or form of value as long as it meets certain criteria set by the lender.

Currently, Blend supports loans backed by Miladys, Azukis, DeGods, and wrapped CryptoPunks, with lending support for CloneX announced on May 25.

Per DappRadar’s report, Blend saw a loan volume of 169,900 ETH ($308 million) in 22 days. Blend’s weekly loan volume even outperformed other centralized platforms by almost three times. Since its launch, Blend has secured 82% of the borrowing volume across all lending protocols.

On the first day of its launch, Blend reached $5.21 million in Total Value Locked (TVL). In just three weeks, the TVL has grown 360% to almost $24 million. This, in turn, fueled the overall TVL of Blur, which which rose from $119 million to $146 million. However, $19 million of the $146 million has been wash traded in the past week.

Blend’s success follows in the footsteps of Blur, which beat OpenSea in weekly trading volume shortly after launching in October last year, according to Dune Analytics data.

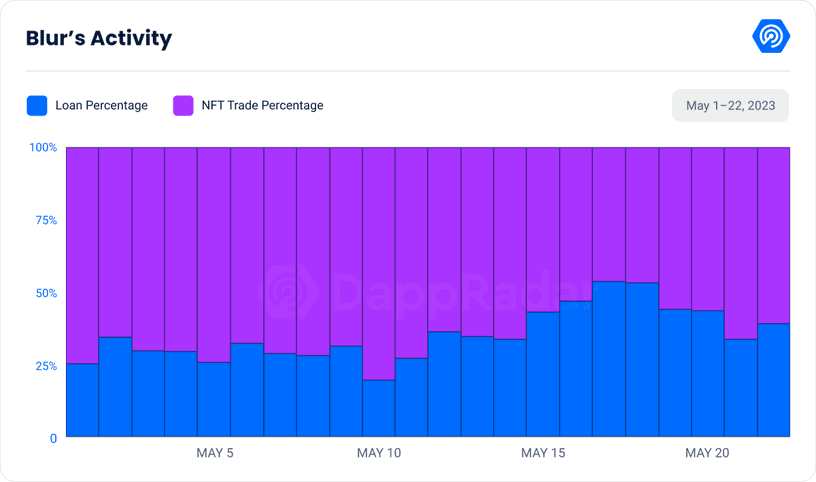

With Blur’s trading volume over the past seven days at $104.35 million, a 15.93% decline from the preceding week, DappRadar suggests that the platform is shifting from trading to lending. In the last seven days, 46.20% of Blur’s activity originated from NFT loans, transacted by an average of 306 unique daily users.

Blend’s number of daily unique users has also been growing. The platform registered 218 users on its first day and saw the number increase to 358 by May 22. Blend’s total loan volume over 22 days surpasses that of its competitors like NFTfi and BendDAO. Launched in 2020, NFTfi has facilitated a loan volume of $427 million, while BendDAO saw a total loan volume of $315 million since launching in April 2022.

Following Blend’s success, Binance also announced its Ethereum NFT lending program as the crypto exchange seeks to compete in the NFT lending market.

Read more:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via [email protected] with press pitches, announcements and interview opportunities.