BlackRock’s Spot Bitcoin ETF Breaks $5 Billion Asset Management Mark Amidst $339M ETF Inflow

In Brief

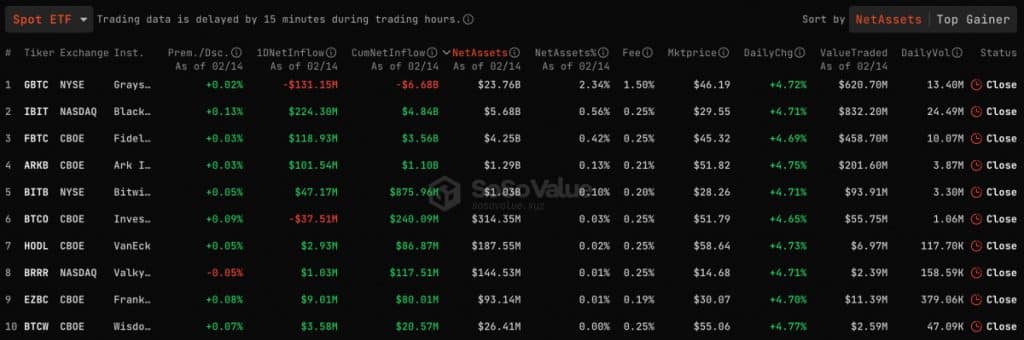

Blackrock’s IBIT surpassed $5 billion in asset management scale recording $224 million single-day net inflow, highest among 10 Bitcoin ETFs.

Investment company BlackRock‘s spot Bitcoin ETF — IBIT surpassed the $5 billion asset management scale, currently holding a total of $5.453 billion in Bitcoin (at the time of writing). This achievement marks IBIT as the first among other spot Bitcoin ETFs to surpass this financial benchmark.

Yesterday, the company’s investment product experienced its highest single-day net inflow, recording a substantial $224 million, being the largest single-day net inflow among the ten spot Bitcoin ETFs. Collectively, investment products reported a total net inflow of $339 million, continuing the positive trend for 14 consecutive trading days.

Following the BlackRock spot Bitcoin product, financial services corporation Fidelity‘s ETF FBTC recorded a single-day net inflow of around $118 million, while its cumulative historical net inflow reached $3.56 billion.

Simultaneously, the asset management company Grayscale ETF GBTC experienced a single-day net outflow of $131 million. The Bitcoin ETF BTCO, managed by the investment management company Invesco, also saw a single-day net outflow of $37.51 million. Notably, BTCO has reported net outflows on two specific trading days, namely February 9th and February 12th.

Currently, the collective net asset value of Bitcoin spot ETFs stands at $36.77 billion. The ETF net asset ratio, calculated as the market value proportionate to Bitcoin’s total market value, has reached 3.62%. Furthermore, the historical cumulative net inflow for the ETFs has now reached $4.23 billion.

Bitcoin’s Price Outlook

The positive sentiment regarding the flows into spot Bitcoin ETFs has been widely recognized by market participants as a significant driving factor behind Bitcoin’s recent surge.

Bitcoin surpassed the $50,000 mark on February 12th and continued the uptrend, propelling its market capitalization above $1 trillion just yesterday for the first time since November 2021. As of the current writing time, Bitcoin is trading at $52,347, reflecting a notable 17.25% increase over the past 7-day period, according to data sourced from CoinMarketCap.

The recent milestones reached by spot Bitcoin ETFs highlight the cryptocurrency’s resilient market presence, hinting at continuous positive momentum.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.