BlackRock Recruiter Says The Asset Giant Controls Politicians While BlackRock is Set to Launch Bitcoin ETF

In Brief

In the video footage created by OMG News’ undercover reporter, BlackRock recruiter Serge Varlay tells about how the asset manager “buys” politicians and more.

In the same period, BlackRock officially files for a spot in Bitcoin ETF, and digital asset marketplace EDX Markets goes live.

Both events take place following the United States Securities and Exchange Commission going after cryptocurrency exchanges Binance and Coinbase.

On June 20, The O’Keefe Media Group uploaded a video featuring BlackRock recruiter Serge Varlay discussing the world’s biggest asset manager’s work mode.

The footage was taken during several meetings of Varlay and OMG News’ undercover journalist. The recruiter did not know or suspect that he was being recorded and shared important information with the journalist.

Varlay says, “BlackRock manages $20 trillion. It’s incomprehensible numbers,” and tells the reporter, “Every day, I decide how someday’s life is going to be shaped.” He also discusses the power of BlackRock on politicians:

“It’s not through who the president is. It’s who’s controlling the wallet of the president.”

“Who’s that?” asks the reporter.

“Hedge funds, BlackRock, the banks. These guys run the world,” replies Serge, “Campaign financing. You can buy your candidates. All these financial institutions, they buy politicians.” Varlay also points out that “senators are cheap” and can be “bought” for $10,000.

More than that, Serge tells the reporter how the United States government relies on BlackRock for its economic simulation and computational power.

Varlay says that “Ukraine is good for business,” hoping that his date—the undercover reporter, “knows that.” “We don’t want the conflict to end as a country. The longer this goes on, the weaker Russia is. Russia blows up Ukraine’s grain silos. The price of wheat is gonna go mad up. So what are you gonna do if you’re a trading firm? The moment that news hits, within a millisecond, you’re going to pump trades into whomever the wheat suppliers are. Into their stocks.” Serge goes on to explain that bad news is good for news channels’ business too.

Moreover, the BlackRock recruiter has shared some trading tips with the reporter: “If you want to invest smart, there’s a tracker that tracks all politicians and where they have their stocks. If we think the stock price is going to tank, we’re gonna sell so that we sold high, it tanks, and we buy it back.”

After O’Keefe Media Group’s video and press release with comments were published, Serge Varlay deleted his LinkedIn profile picture. BlackRock declined the publisher’s request for comment.

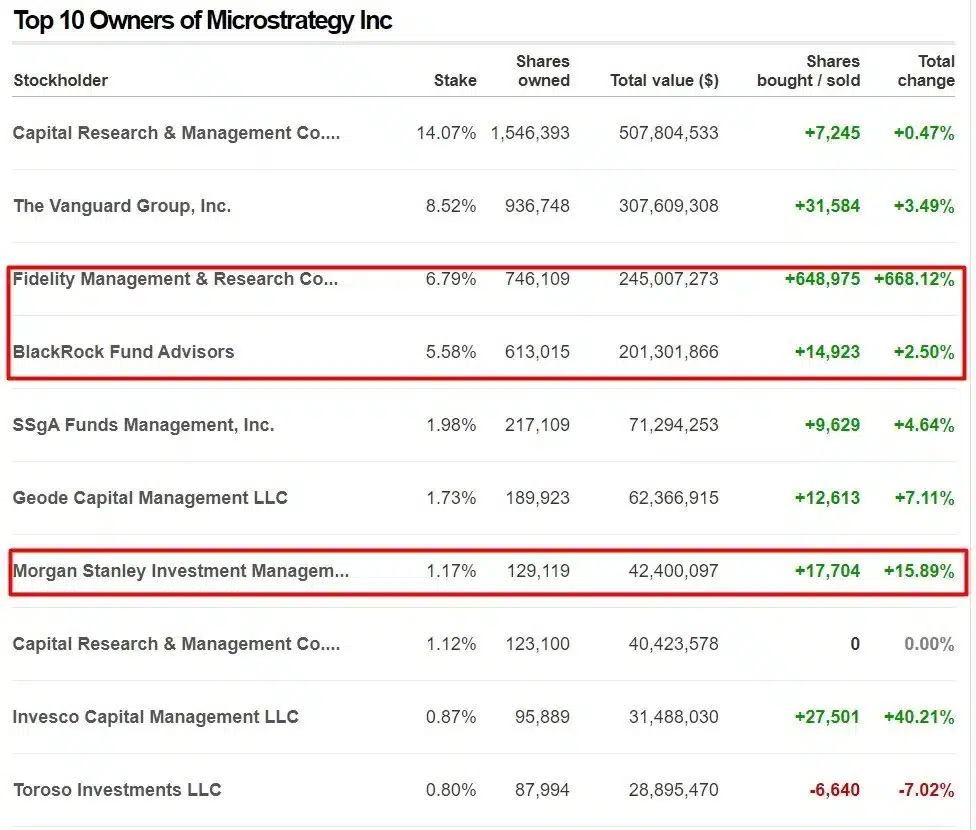

It’s worth noting that BlackRock is a company that has recently started purchasing Bitcoin at low levels. Along with other powerful banks, such as Fidelity Management, Bank of America, and Morgan Stanley, the asset manager acquired stocks of MicroStrategy, the largest holder of Bitcoin.

According to Coindesk, BlackRock started working with the cryptocurrency exchange Coinbase last year in order to make crypto available to institutional investors. This is to say that while the United States Securities and Exchange Commission was actively going after cryptocurrency exchanges, the largest government-affiliated banks, and funds were accumulating crypto.

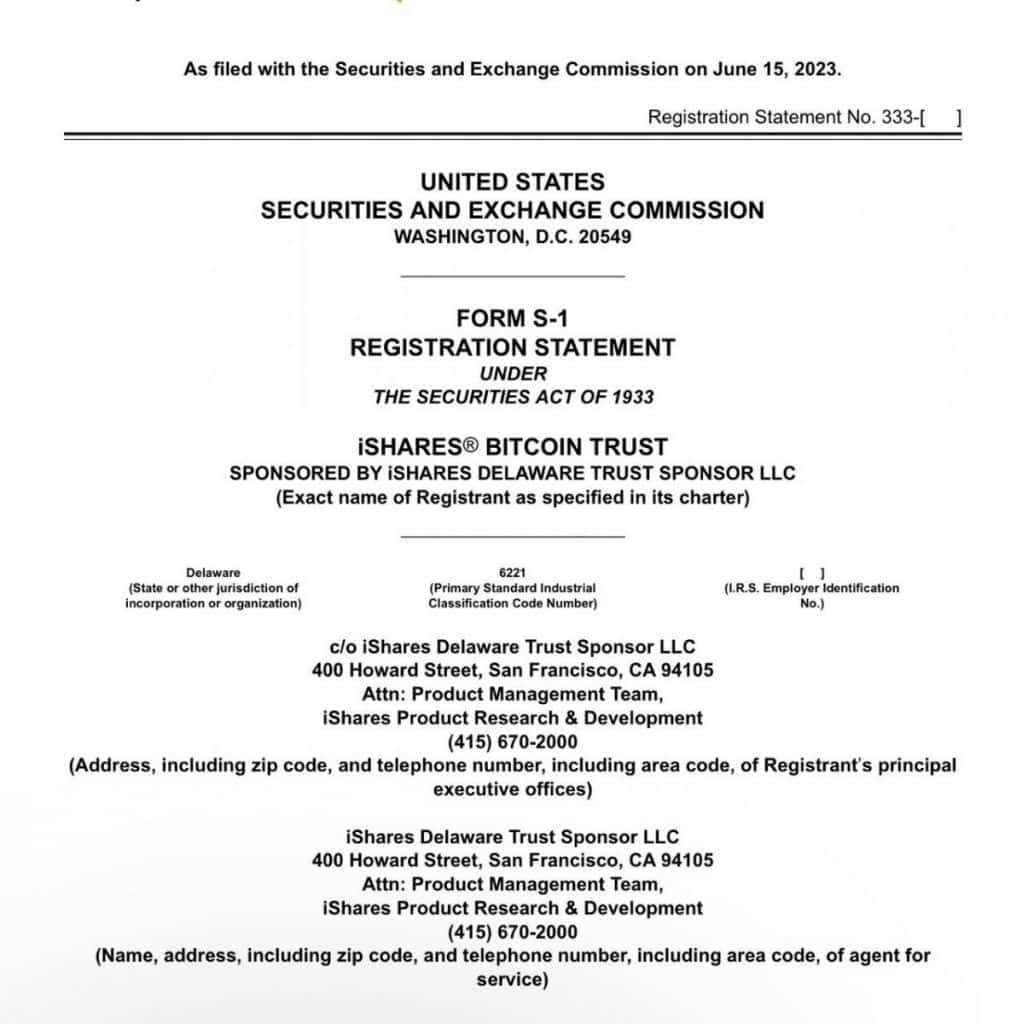

On June 15, BlackRock officially filed for a spot in Bitcoin ETF.

Following this, on June 20, EDX Markets went live. The platform is a new digital asset marketplace designed to meet the needs of both crypto-native firms and the world’s largest financial institutions. EDXM aims to provide safe, fast, and efficient trading of digital assets, as well as leverage “best practices from traditional financial markets on a purpose-built crypto platform.”

Several large cryptocurrency exchanges, including Binance and Coinbase, have recently faced problems with the United States Securities and Exchange Commission. However, thanks to what Serge Varlay has shared on BlackRock and its control of politicians, we can now imagine why the United States government was after Binance and Coinbase.

Read related posts:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at [email protected]

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at [email protected]