Bitcoin Ordinals Cumulative Fee Revenue Surpasses $300 Million, Reflects Growing Demand

In Brief

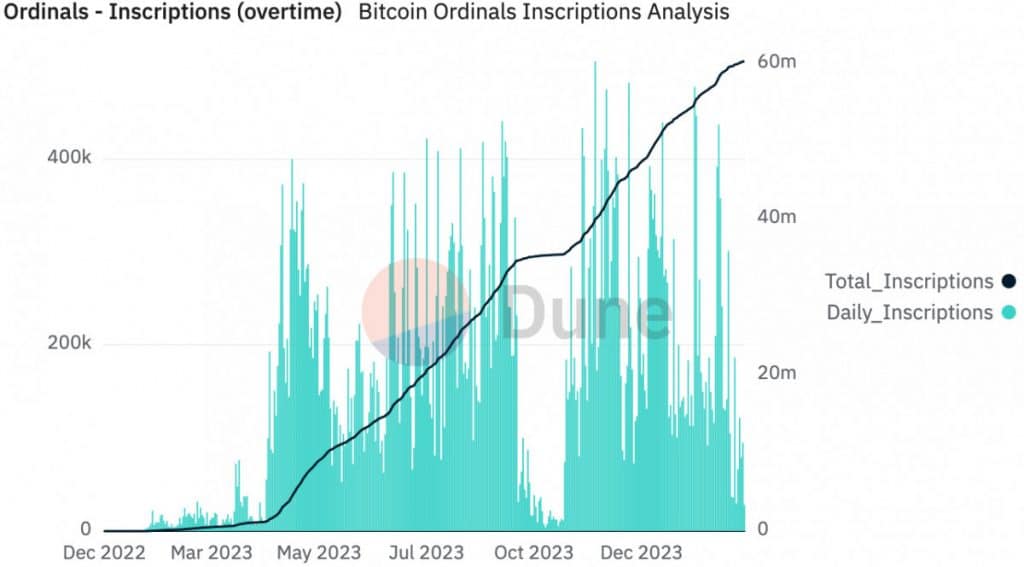

Bitcoin Ordinals’ transaction fee revenue surpassed $300 million for the first time, after processed transactions reached 60,258,105.

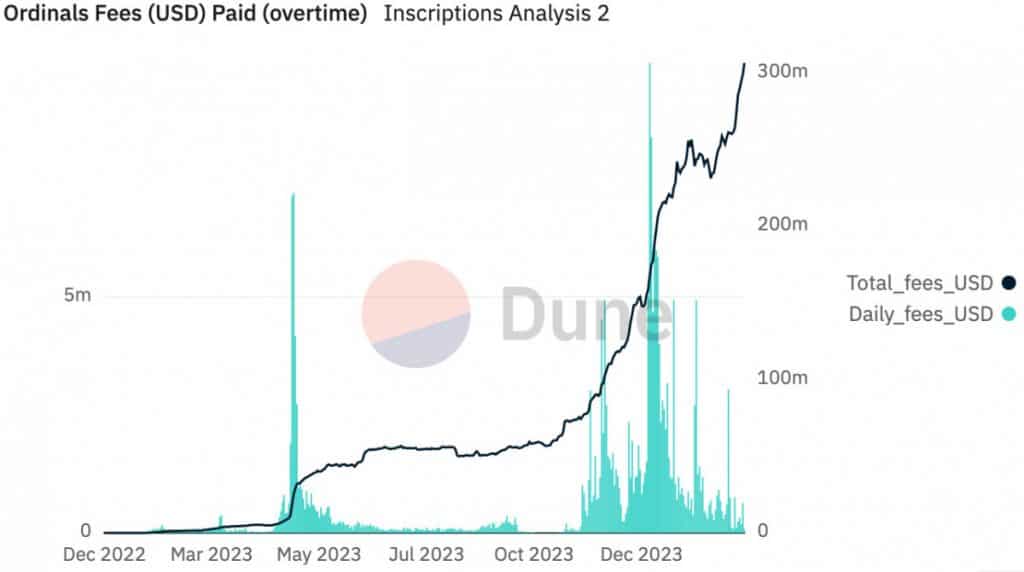

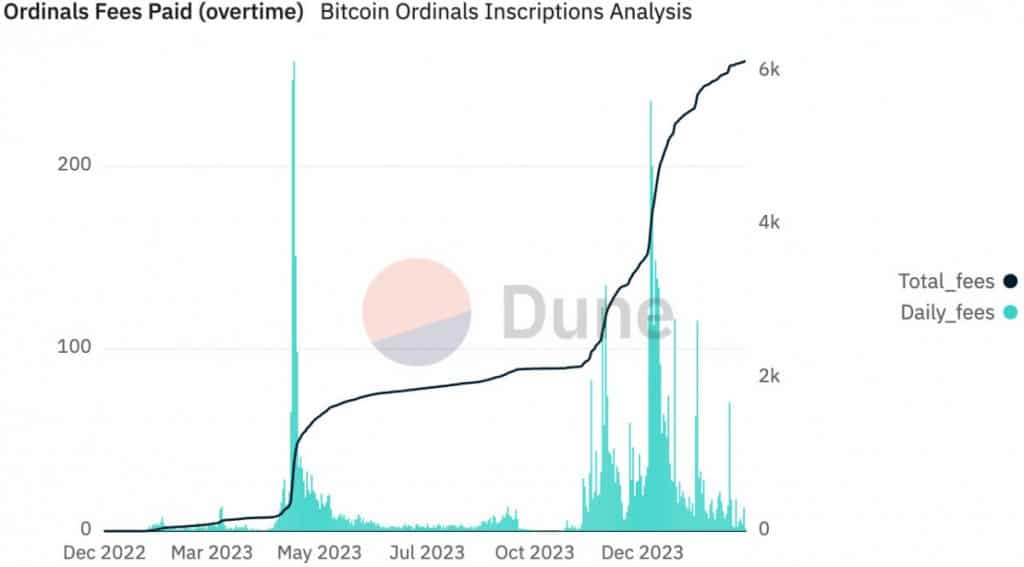

Bitcoin Ordinals’ cumulative fee revenue from transaction processing surpassed $300 million for the first time. According to data provided by Dune Analytics, the current count of processed transactions has reached 60,258,105, resulting in a cumulative fee income of around 6,131.78 Bitcoin, equivalent to $306.5 million.

The Ordinals Protocol enables users to embed various data types, including images and videos, into individual satoshis within the Bitcoin Blockchain. Ordinals Protocol, originating from developer Casey Rodarmor‘s concept, incorporates Ordinals, a numbering mechanism for satoshis, and Inscriptions for embedding satoshis with arbitrary content, establishing Bitcoin-native Digital Artifacts.

Additionally, Bitcoin Ordinals operate seamlessly without alterations to the Bitcoin protocol, eliminating the need for additional layers, and are designed to be backward compatible with the network.

Since Ordinals launch on the Bitcoin mainnet last year, a burgeoning community of users, developers, and enthusiasts has minted over 200,000 ordinal NFTs, reflecting a collective enthusiasm for the potential of native Bitcoin NFTs.

Currently, 94% of inscriptions predominantly consist of text, with the remaining 6% encompassing a diverse range of content types, including images, models, applications, videos, and other data.

Bitcoin Ordinals Follow Surge in Bitcoin Prices

The Bitcoin Ordinals milestone signifies the first time where the cumulative fee revenue from Ordinals has surpassed $300 million. Notably, this achievement could potentially be linked to the recent surge in Bitcoin prices, surpassing the $50,000 range and reflecting a 4.2% increase over the 24-hour period as of the writing time.

The recent upswing follows heightened investor interest in Bitcoin ETFs and the anticipation surrounding the impending Bitcoin halving event slated for April 18, 2024. Historically, Bitcoin halving events have been associated with positive market sentiment, often leading to sustained increases in Bitcoin’s value.

Furthermore, the transaction fees linked to Ordinals activity on the Bitcoin chain present a significant revenue opportunity for miners, especially advantageous post-halving as it is expected as there will be a reduction in block rewards coupled with an increase in the mining difficulty of the Bitcoin network. To date, miners have received over $200 million in transaction fees related to Bitcoin Ordinals, accounting for approximately 20% of their total revenue from transactions involving these assets, according to the Grayscale report.

The new milestone of Bitcoin Ordinals in cumulative fee revenue marks a significant development in the realm of native Bitcoin NFTs, reflecting market dynamics and the growing demand for this digital asset.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.