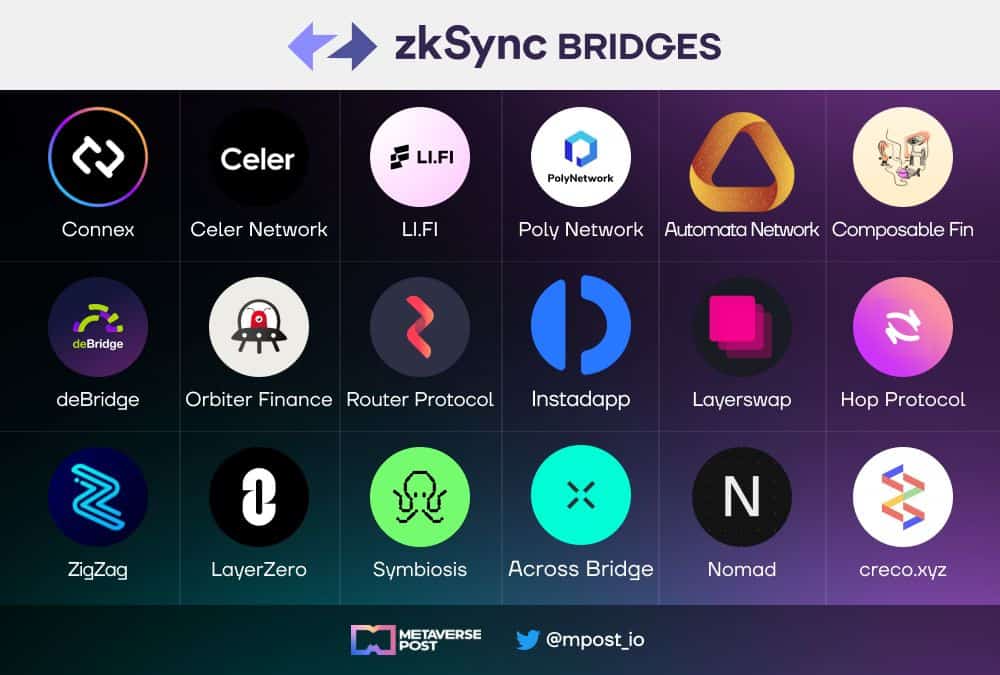

15+ Best Bridges ZkSynс Ecosystem in 2023

Bridge solutions have become the cornerstone of our efforts to build a more connected and effective decentralised ecosystem. The ZkSync ecosystem, which offers some of the most cutting-edge and successful bridge solutions available today, is one of the leaders in this field.

This article examines in depth the top bridges within the ZkSync ecosystem, highlighting their special qualities, advantages, and contributions to the development of a cogent crypto-world.

1. Connex

Connext has emerged as a pioneering force in the blockchain arena, providing a modular protocol tailored for the secure transfer of funds and data between different chains. Let’s delve deeper into understanding its core components and the role it plays in enabling developers to craft cutting-edge crosschain applications (xApps).

At its core, Connext is a visionary solution allowing applications to engage with multiple blockchain domains (be it blockchains or rollups) concurrently. This means that developers, utilizing the power of Connext, can construct xApps that effortlessly interact with multiple chains at once.

Key Components of the Connext Protocol:

- Smart Contracts:

- Role & Significance: Serving as the bridge between the protocol and a diverse range of users, Connext’s smart contracts are indispensable.

- Functional Areas:

- xCall Contracts: Handling and directing calls related to the crosschain transfer of funds.

- Asset Registration Contracts: Entrusted with the job of managing the cataloging of assets.

- Liquidity Provisioning: Ensuring seamless liquidity management for routers and stableswap LPs.

- The Connext Contract:

- Functionality: Primarily responsible for dispatching and managing messages associated with the movement of funds across different chains. This contract looks after the custody of funds intended for canonical assets, swift liquidity, and stable swaps.

- Technical Specification: The Connext contract is built upon the Diamond pattern. What this means is that it consists of various Facets, each designed to delineate logical boundaries for groups of functionalities. Interestingly, all these Facets share the contract storage and can be independently upgraded, offering a mix of modularity and scalability.

- Offchain Agents: Although not elaborated upon in the information provided, offchain agents are typically responsible for tasks that don’t need to be executed on the blockchain, saving on costs and speeding up processes.

In essence, Connext is not just a protocol; it’s a testament to the evolving blockchain landscape that is increasingly leaning towards interoperability and multi-chain functionalities. For developers eyeing the horizon of crosschain applications, Connext presents an opportunity that’s hard to overlook.

2. Celer Network

Celer has carved a niche in the world of blockchain by facilitating multi-blockchain interoperability with a distinct approach. Here, we break down the mechanics of Celer’s Inter-chain Message System for better comprehension.

Celer’s solution for multi-blockchain communication hinges on two main components:

- Smart Contracts: Deployed on each chain, they handle and structure messages for cross-chain delivery.

- State Guardian Network (SGN): A Tendermint-based blockchain, SGN validates messages. When a user or dApp sends a cross-chain message, it’s directed to a Message Bus smart contract. The SGN then verifies this message and produces a stake-weighed multi-signature attestation. An Executor then relays this attestation to the destination chain, completing the communication.

In essence, Celer ensures seamless communication between blockchains, making inter-chain interactions efficient and streamlined.

Celer’s system, with its unique blend of smart contracts and the State Guardian Network, offers an innovative solution to the challenges of multi-blockchain interoperability. This structured and secure process ensures that cross-chain communications, be it a simple message or invoking complex smart contract functions, are executed seamlessly and efficiently. In an era where integration and interaction between multiple blockchains are increasingly crucial, Celer’s approach stands out as both visionary and practical.

3. LI.FI

Navigating the intricate landscape of numerous blockchain ecosystems can be daunting. Enter LI.FI, the game-changer that distills this complexity into a singular API.

What does LI.FI bring to the table?

- Comprehensive Middleware: LI.FI acts as the bridge between the DeFi infrastructure and dApps. It seamlessly integrates DEXs, DEX aggregators, and cross-chain bridges, ensuring a centralized source for all essential data and efficient order routing.

- Bridge Aggregation Protocol: Beyond just aggregation, LI.FI boasts DEX connectivity and cross-chain data messaging, making it a versatile tool for varied blockchain needs.

- Focus on Development: With the heavy lifting handled by LI.FI, developers can channel their energies into enhancing their unique offerings.

In essence, LI.FI isn’t just a tool—it’s the ultimate gateway for any cross-chain swapping and bridging needs in today’s blockchain world.

Read more: Understanding ZK Rollups and Optimistic Rollups: Layer 2 Scaling Solutions for Ethereum

4. Poly Network

Poly Network stands at the forefront of blockchain innovation, embodying a global cross-chain protocol crafted to usher in a new era of blockchain interoperability and lay the foundation for Web3.0 infrastructure.

Key features and achievements of Poly Network:

- Extensive Connectivity: Going beyond the ordinary, Poly Network has successfully integrated over 35 distinct blockchains. This impressive roster includes industry giants like Ethereum, Polygon, Arbitrum, and BNB Chain, as well as emerging names such as Aptos, Optimism, Neo, Metis, and Gnosis Chain.

- Monumental Asset Transfers: Since its inception, Poly Network hasn’t just connected chains – it’s facilitated the smooth transfer of assets across them. To date, it has enabled the cross-chain movement of assets surpassing a staggering $16 billion USD.

In a nutshell, Poly Network is not just bridging blockchains; it’s pioneering a seamless, interconnected future for the decentralized world of Web3.0.

5. Automata Network

In a world of exposed blockchain transactions, Automata Network emerges as the beacon of privacy, aiming to revolutionize the transparency-centric nature of Web3. Its mission is clear: to craft a middleware layer that not only prioritizes privacy but also ensures security and ease of integration.

Core Offerings:

Automata Network’s suite of products is both diverse and targeted:

- 1RPC: Tailored for streamlined requests.

- 2FA Guru: A robust two-factor authentication solution.

- NFTFair: Aiming at fairness in the burgeoning world of NFTs.

- AnyDAO: Decentralized autonomous organizations made simple.

- XATA: Addressing the blockchain’s ever-present vulnerabilities.

Defining Features:

- Do-not-track privacy: A commitment to user confidentiality.

- Native Integration: Seamless assimilation with existing systems.

- Universal Compatibility: A nod to inclusivity, ensuring wide-reaching applicability.

Why Automata Stands Out:

The inherent openness of blockchain often feels like storing wealth in a see-through vault. Automata recognizes this challenge and, through its middleware design, places developer experience at its core. By minimizing integration hassles and fostering a welcoming environment for builders, Automata aims to encourage blockchain initiatives to embrace privacy protocols. The end goal? A safer, private, and more user-friendly Web3.

6. Composable Finance

Composable Finance is an innovative platform designed for cross-chain and cross-layer integration, addressing the ongoing challenge of disparate decentralized finance (DeFi) protocols.

Composable introduces a dual-faceted strategy for enhanced interoperability: Firstly, it emphasizes multi-layer (L2/L2) compatibility, effectively linking various Ethereum Layer 2 frameworks and sidechains. Secondly, through a dedicated parachain, Composable enables concurrent execution of smart contracts. This ensures swift and seamless communication between protocols across diverse blockchains, powered by both Ethereum’s layer 2 and Polkadot. This holistic approach positions Composable as a vanguard in hyper-liquidity infrastructure for DeFi assets.

XCVM is not just another virtual machine; it’s a game-changer. This unique system facilitates:

- Unified Smart Contracting: With XCVM, developers get a single, user-friendly interface, enabling the creation of applications that can seamlessly communicate with multiple chains within the ecosystem.

- Trustless Communication: By marrying smart contracting and trustless interaction, XCVM paves the way for enhanced composability, fostering a new realm of blockchain possibilities.

Read more: A Beginner’s Guide to the zkSync Ecosystem

7. deBridge

The linchpin of deBridge‘s operations rests on a meticulous network of independent validators. These validators, chosen by the deBridge governance, not only uphold the blockchain infrastructure but also operate deBridge nodes. Every transaction coursing through the deBridge smart contracts on various blockchains is signed by these nodes, ensuring impeccable security and transparency.

Security Mechanisms:

At the heart of deBridge’s trustworthiness lies its delegated staking and slashing mechanics. These serve a dual purpose: solidifying the protocol’s security framework and erecting stringent economic barriers to prevent validator collusion.

Key Offerings of deBridge Protocol:

- Decentralized Exchanges: Facilitates the seamless transfer of varied data and assets in a decentralized manner.

- Cross-Chain Mastery: Pioneers in ensuring interoperability and composability of smart contracts across multiple blockchains.

- Fluid Swaps: Enables efficient cross-chain swaps, promoting liquidity and flexibility.

- NFT Bridging: Forges paths for NFT interoperability, allowing for the movement and bridging of Non-Fungible Tokens across different platforms.

8. Orbiter Finance

In the dynamic realm of Layer 2 infrastructure, Orbiter Finance stands out as a pioneering decentralized bridge, tailored for transferring Ethereum-native assets. With an emphasis on affordability and speed, Orbiter is transforming the way we understand and use cross-rollup transfers.

Supported Integrations:

Orbiter boasts a broad spectrum of compatibility, facilitating cross-rollup transfers among a multitude of platforms including Ethereum, StarkNet, zkSync, Loopring, Arbitrum, Arbitrum Nova, Optimism, Polygon, BNB Chain, ZKSpace, Immutable X, dYdX, Metis, and Boba.

Highlight Features of Orbiter Finance:

- Unparalleled Safety: Distancing itself from the vulnerabilities of other cross-L1 bridges, Orbiter takes pride in its rollup safety technique, ensuring impeccable security.

- Cost-Efficient & Swift: Transfers via Orbiter are characterized by their directness – occurring between the ‘Sender’s’ and the ‘Maker’s’ EOA (externally owned address) on both originating and destination networks. This eliminates the need to engage with contract addresses, ensuring lightning-fast transactions.

- Dedicated to Ethereum-native Assets: Orbiter eliminates the complexity of asset minting. Instead, it champions a fully decentralized approach to liquidity support. This not only makes processes more streamlined but also strengthens the decentralized ethos of the platform.

9. Router Protocol

Router Protocol aspires to play a central role in the blockchain revolution. It’s not just about creating another solution; it’s about ensuring that the rapidly expanding user base, potentially reaching a billion users, can seamlessly integrate with the blockchain realm. The challenge lies in the inter-chain barriers that historically have fragmented the ecosystem and stymied collaborative growth.

Router Protocol is more than just a technology offering; it’s a testament to foresight in a rapidly-evolving blockchain domain. By proactively addressing the looming challenges of fragmentation, Router Protocol seeks to preserve the foundational spirit of Web3: openness, integration, and collaboration.

10. Layerswap

In a dynamic digital world where time is crucial, Layerswap stands out as the go-to solution for swiftly bridging assets across Centralized Exchanges (CEXes), blockchains, and wallets. As of now, it grants users the convenience of effortlessly transferring cryptocurrencies between 17 exchanges and 20 blockchains. Add to that its capability for cross-chain transfers, and it’s clear why Layerswap is emerging as a leader in its domain.

Further cementing its prowess, Layerswap integrates seamlessly with various wallets, DEXes, and dApps, ensuring a smooth transaction experience for its users.

Read more: ZK-SNARKs vs ZK-STARKs: How Do ZK-Proofs Differ?

Why Layerswap?

- For CEX Users: Dive directly into the world of blockchains to engage with novel apps/projects, procure NFTs, indulge in gaming, or secure assets within L2 networks, DEX, or personal wallets.

- For Web3 Projects: Facilitate users with the ease of depositing funds directly from CEXes and different blockchains.

- For Crypto Newbies: A beginner-friendly gateway into the universe of web3 projects.

- For All: Enjoy the luxury of prompt and cost-effective cryptocurrency transfers.

11. Hop Protocol

In the rapidly evolving crypto space, Hop emerges as a rollup-to-rollup token bridge engineered for scalability. It offers users the unique advantage of instantly sending tokens across rollups or sidechains, eliminating the typical wait times associated with network challenge periods.

How Does It Work?

At the core of Hop’s mechanism are market makers, known as Bonders. These Bonders are pivotal as they provide the required liquidity on the destination chain, charging a nominal fee for the service.

When a user initiates a token transfer, Bonders offer a credit in the form of hTokens. These hTokens can then be exchanged for their corresponding native tokens using an Automated Market Maker (AMM) on the recipient chain.

The Role of hTokens:

hTokens are more than just a credit medium; they serve a dual purpose. Firstly, they enable the Hop protocol to efficiently mint & burn tokens, facilitating smoother inter-chain transfers. Secondly, they expedite the inherent exit duration of each scaling solution. This accelerated process aids Bonders in optimizing their capital use. As a result, Bonders can free up the capital they fronted on a daily basis.

12. LayerZero

LayerZero stands as a groundbreaking omnichain interoperability protocol, streamlined to facilitate lightweight message transmissions across various blockchains. Its defining feature lies in providing reliable message delivery combined with an adjustable trust factor.

Understanding LayerZero Endpoints:

The lifeline of LayerZero’s operation revolves around its Endpoints. These are specifically designed to oversee the process of message transmission, its subsequent verification, and the final acknowledgment of receipt. Here’s how they function:

- Versioned Messaging Libraries: These libraries form the backbone of Endpoints, allowing them to comprehend and process the messages accurately.

- Proxy System: This acts as the pathway for messages, directing them to the appropriate library version, ensuring the message is interpreted and processed correctly.

When a message navigates its way to an Endpoint, it is then ushered to the appropriate User Application library version. This step is crucial to guarantee that the message is decoded and acted upon using the latest standards and protocols.

13. Symbiosis

Symbiosis stands as a pioneering cross-chain AMM DEX, orchestrating a harmonious integration of liquidity from diverse networks. Whether it’s L1s or L2s, EVM or non-EVM platforms, Symbiosis paves the way for uncomplicated token swaps and fluid asset migration between networks.

Capabilities and Offerings:

- Versatile Trading: At the heart of Symbiosis is its powerful capability to facilitate cross-chain trading. Users can effortlessly exchange tokens irrespective of their native networks, providing unparalleled trading flexibility.

- Liquidity Provision: Beyond just trading, Symbiosis extends the opportunity for its users to bolster various protocols by contributing liquidity. This ensures a seamless and efficient trading experience for all users.

- Reward Programs: Loyalty doesn’t go unnoticed at Symbiosis. By partaking in liquidity provisions, users are eligible for enticing rewards, further enhancing their trading journey.

- Participation in Governance: The Symbiosis ecosystem is democratic at its core. The Symbiosis DAO allows users to have a say in the direction and decisions of the platform, promoting a community-driven approach.

14. Across Bridge

Across stands at the frontier of cross-chain bridges, tailored specifically for L2s and rollups. It harnesses the robust security of UMA’s optimistic oracle, ensuring seamless and trustworthy transfers.

Why Across Stands Out:

- Capital Efficiency at its Best: For a cross-chain bridge, capital efficiency isn’t just a metric; it’s the backbone. Across has redefined this efficiency, ensuring that assets are maximally utilized, resulting in cost savings for users and enhanced returns for liquidity providers.

- Unified Liquidity Pool: Across’s unique design incorporates a singular liquidity pool, streamlining operations. This design not only reduces fragmentation but also optimizes the bridge’s overall functionality.

- Strategic Asset Allocation: With security as a cornerstone, the majority of the LP assets are held on the L1 mainnet. This ensures that assets are not only safeguarded but also used in the most efficient manner.

- Rebalancing Bots: To maintain optimal balances across destinations, Across employs protocol bots. These bots utilize the canonical bridge, ensuring assets are perfectly poised across networks.

- Interest Rate Fee Model: The fee model of Across isn’t arbitrary. It’s closely tied to the overall utilization of assets in its liquidity pool. This ensures that pricing remains consistent and fair for users.

15. Nomad

Enter Nomad, an avant-garde interoperability protocol crafted with optimism at its core. Designed to be the linchpin in cross-chain communication, Nomad is not just a bridge, but the highway connecting various blockchain ecosystems.

Why Choose Nomad?

- Bridging Tokens: With Nomad, transferring tokens across chains is as seamless as a breeze.

- Universal Token Deployment: Asset issuers are empowered to cast their tokens across different blockchains, expanding their reach and accessibility.

- Enhanced DAO Governance: Nomad enables DAOs to streamline cross-chain governance proposals, ensuring cohesion and unity in decision-making.

- Native Cross-Chain Applications: Developers can harness Nomad to craft cross-chain applications (xApps), breaking the barriers of single-chain limitations.

The Nomad Vision: In the grand tapestry of blockchains, Nomad envisions being the thread weaving them together. Its mission is to fortify multi-chain interactions, ensuring they’re secure, efficient, and user-centric.

Conclusion

The ZkSync ecosystem has undeniably paved the way for more efficient, secure, and versatile bridge solutions in the blockchain world. As we’ve explored, its array of bridges offers solutions tailored to various needs and functions, ensuring that users, developers, and projects can seamlessly interact and transfer value across diverse platforms. The continued development and adoption of such bridges underscore the maturing nature of the decentralized space, moving us closer to a unified and interconnected blockchain realm. As the ZkSync ecosystem expands and evolves, it’s evident that its bridges will play a pivotal role in shaping the future of inter-blockchain interactions.

FAQ

ZkSync is a layer-2 scaling solution for Ethereum, using zkRollups technology. It aims to bring a higher throughput and low gas fees without compromising on the security of the Ethereum network.

Bridges play a pivotal role in enabling seamless interaction between ZkSync and other blockchain platforms. They allow for the transfer of tokens, data, and other assets across various blockchains, ensuring interoperability and fluidity within the decentralized space.

ZkSync’s bridges leverage zkRollups technology, which provides a balance of security and efficiency. This ensures fast transaction speeds, lower fees, and security on par with Ethereum’s mainnet.

Yes, there are fees associated with using the bridges, but they are typically much lower than Ethereum mainnet fees. The exact fee can vary based on the specific bridge and the current network conditions.

The bridges within the ZkSync ecosystem utilize the security of Ethereum’s mainnet due to the zkRollups architecture. This means that while they provide scalability benefits, they do not compromise on the security aspects.

Most ERC-20 and ERC-721 tokens can be bridged in the ZkSync ecosystem. However, it’s always a good idea to check the specific bridge’s documentation or platform to see supported tokens.

Read more:

- Top 10 DeFi projects zkSync

- Exploring the New ConsenSys zkEVM: The Power of Zero-Knowledge Proofs

- History of Zero-Knowledge Proofs: From Cryptography to Blockchain

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.