Wall Street Meets Blockchain: Backed’s Tokenized Stocks Change Investing in Tech Giants Microsoft, Tesla, and GameStop

In Brief

Backed introduces tokenized stocks, bridging the gap between DeFi and traditional finance, offering exposure to S&P 500 companies to non-US investors, utilizing blockchain technology.

Backed, a leader in real-world asset tokenization has introduced tokenized stocks, which is significantly changing the financial environment. This innovation fills the gap between DeFi, driven by blockchain technology, and traditional finance. A new line of tokenized stocks backed one-to-one by the stocks of well-known corporations, including Microsoft, GameStop, MicroStrategy, Tesla, and Alphabet (Google), has been announced by Backed.

These tokenized stocks, denoted by tickers like bMSFT, bGME, bMSTR, bTSLA, and bGOOGL, provide S&P 500 company exposure to qualified non-US investors while maintaining asset self-custodial and on-chain. Through this action, investment possibilities will become more easily accessible, adaptable, and productive by utilizing blockchain technology.

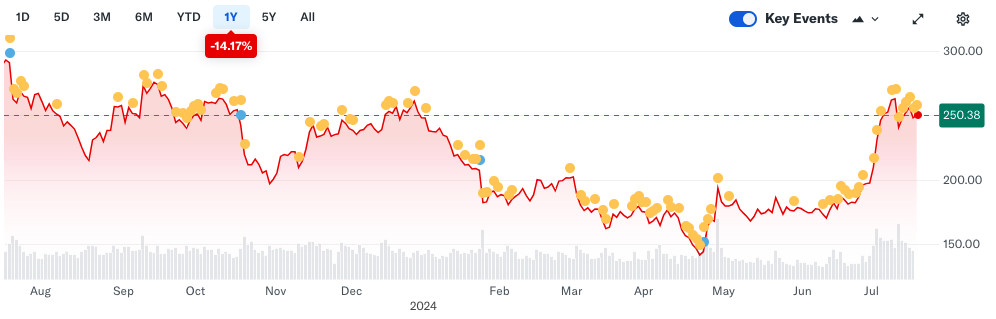

Photo: Tesla, Inc. (TSLA)

With Backed’s method, investors may trade on-chain with confidence, knowing that every tokenized stock is completely backed by its corresponding stock. Because of the one-to-one backing, the performance of the underlying stock directly affects the tokenized asset’s value. The ability to trade these assets on blockchain infrastructure around the clock is a major benefit that might result in more liquidity and more effective price discovery.

Tokenized Equities Bridging Traditional Finance and Blockchain

Beyond stocks, Backed’s proposal also includes tokenized government and corporate bonds. The goal of this all-encompassing strategy is to build a financial ecosystem that is more integrated and inclusive. These assets can be utilized in capital markets and as collateral for loans in the domain of decentralized finance, creating new avenues for financial innovation.

Using a blockchain and tokenization, real-world assets are digitally represented, with each token denoting a portion of a share. Retail investors who do not have the funds to purchase entire shares of high-value firms might profit from fractional ownership. Operating under the Swiss DLT Act, Backed’s protocol offers these digital assets a strong legal foundation.

Tokenized stock introductions might democratize access to big U.S. corporations for foreign investors, with major consequences for global market access. Regulating compliance is still vital, though, with Backed operating under an EU prospectus that has been allowed and refraining from selling tokens to Americans or to anybody in countries where doing so is illegal.

The shift to tokenized assets offers financial institutions and portfolio managers the chance to create new plans and even profit from market arbitrage between off-chain and on-chain marketplaces. This may result in markets that are more effective and creative investment plans that combine assets based on blockchain technology with conventional financial concepts.

The effect on developing nations is especially huge since tokenized assets may open doors to international financial markets for those in areas where access to US stocks is restricted. This may promote greater financial inclusion and perhaps aid in the growth of the economy.

Even with the bright future, adopting this new financial paradigm with prudence is required. Risks for investors include market volatility, regulatory uncertainty, and technical weaknesses. The protection of tokenized assets, changing legal frameworks, possible manipulation of the market, and issues with liquidity are the main issues that must be resolved.

Expanding the Tokenization Ecosystem

New financial services and products should proliferate as the tokenization ecosystem develops. Tokenized index funds, or exchange-traded funds that blend traditional and tokenized assets, for example, may provide investors with a new way to invest in a wide variety of assets. These hybrid products potentially offer greater returns and more effective portfolio management.

Tokenized assets’ programmable nature creates opportunities for automated financial procedures. Dynamic portfolio rebalancing, automated dividend reinvestment programs, and even intricate derivative structures may all be implemented with smart contracts. This technology might eliminate human mistakes in financial transactions and drastically save operating expenses.

Furthermore, the tokenization of equities may result in more effective business practices. Blockchain technology has the ability to increase shareholder involvement and lower administrative expenses for businesses by streamlining processes like voting on shareholder resolutions and paying dividends.

Interoperability and Cross-Chain Functionality

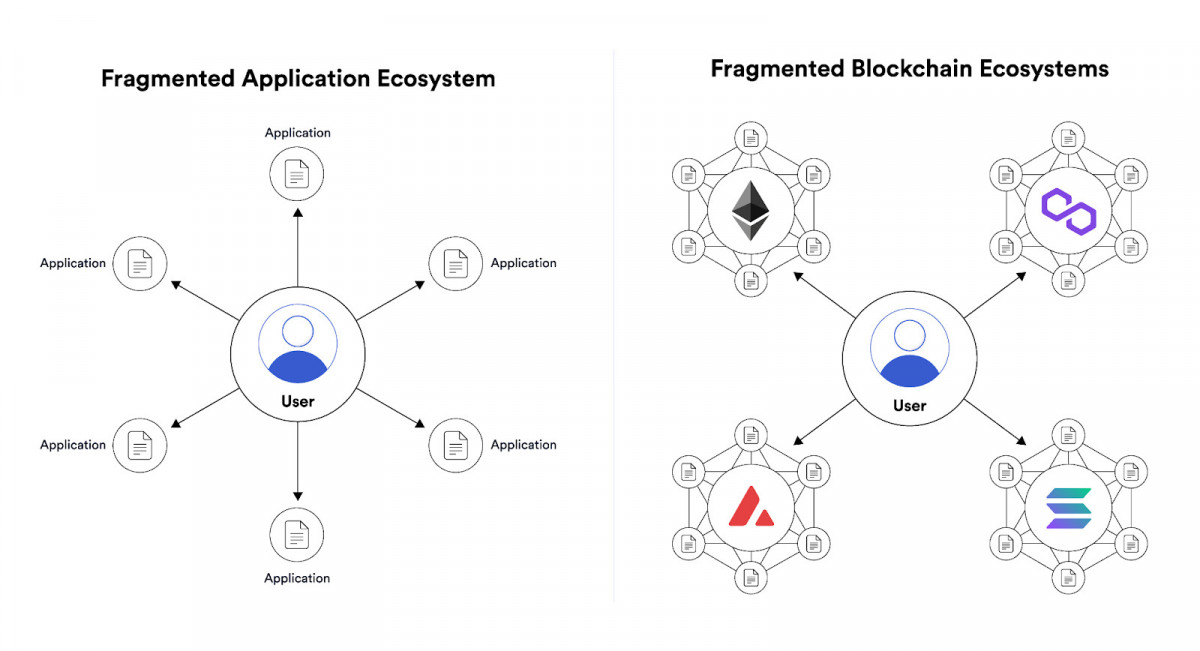

Interoperability across various blockchain networks will become more crucial as the market for tokenized assets develops. Transparently transferring tokenized assets between different blockchain ecosystems may improve liquidity and open up new trading avenues. Investors may be able to take advantage of the distinctive qualities of several blockchains while still being exposed to the assets they have selected, thanks to cross-chain capabilities.

Photo: Chainlink

The development of increasingly sophisticated financial products may also be aided by this compatibility. Tokenized equities from one blockchain and decentralized lending protocols from another, for instance, might be combined by a dApp to create previously unimaginable new investing strategies.

Regulatory Challenges and Opportunities for Tokenized Securities

There are both potential and obstacles in the constantly changing regulatory environment for tokenized securities. Adoption may be hampered by regulatory ambiguity, but progressive nations may be able to capitalize on this to become centers of tokenized finance.

It will be up to regulators to decide how to categorize these new assets, safeguard investors, and stop market manipulation in a round-the-clock trading environment. The responses to these queries will determine how tokenized finance develops in the future and may also have an impact on more established financial markets.

Tokenization Beyond Stocks

Although tokenized stocks have been the main topic of this essay, tokenization techniques may be used with a variety of assets. Tokenization may be used for tangible assets like art, commodities, real estate, and even intangibles like intellectual property rights.

This more extensive use of tokenization has the potential to completely alter the way we perceive ownership and value transfer. Tokenized real estate, for example, has the potential to change the real estate industry by increasing accessibility and liquidity for property investment. Tokenized art may also open up new financial options for artists and let collectors own portions of priceless works.

In summary, Backed’s introduction of tokenized equities marks a critical turning point in the development of financial markets. Through the integration of blockchain technology with traditional banking, it opens the door to a financial future that is more flexible, efficient, and inclusive.

This tendency will change how we engage with financial assets and the global financial environment. The development of a completely tokenized financial system is still in its early stages, but it has the potential to usher in a new era in global finance with features like 24/7 trading, fractional ownership, enhanced market access, and interaction with DeFi protocols. The way this technology is embraced, governed, and incorporated into the larger financial ecosystem will be determined in large part over the next few years.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.