The World’s Most Crypto-Friendly States in 2024

In Brief

Countries are embracing cryptocurrency businesses, recognizing their potential to boost economic growth, and actively fostering conducive environments to establish themselves as leaders in this emerging industry.

The list of nations that are welcoming to cryptocurrency businesses is growing quickly, and several are actively working to make their environments conducive to these businesses. Recognizing that cryptocurrencies have the potential to boost economic growth, these countries are attempting to establish themselves as frontrunners in this new industry.

Important Elements of Crypto-Friendly Laws

The allure of a nation as a center for the cryptocurrency industry is influenced by many aspects. Among them are:

- Clarity in regulations

- Tax laws (corporate and capital gains taxes)

- A welcoming environment for businesses

- Blockchain technology infrastructure and support

- Quantity of cryptocurrency businesses that are registered

- Acceptance of cryptocurrencies in the wider economy

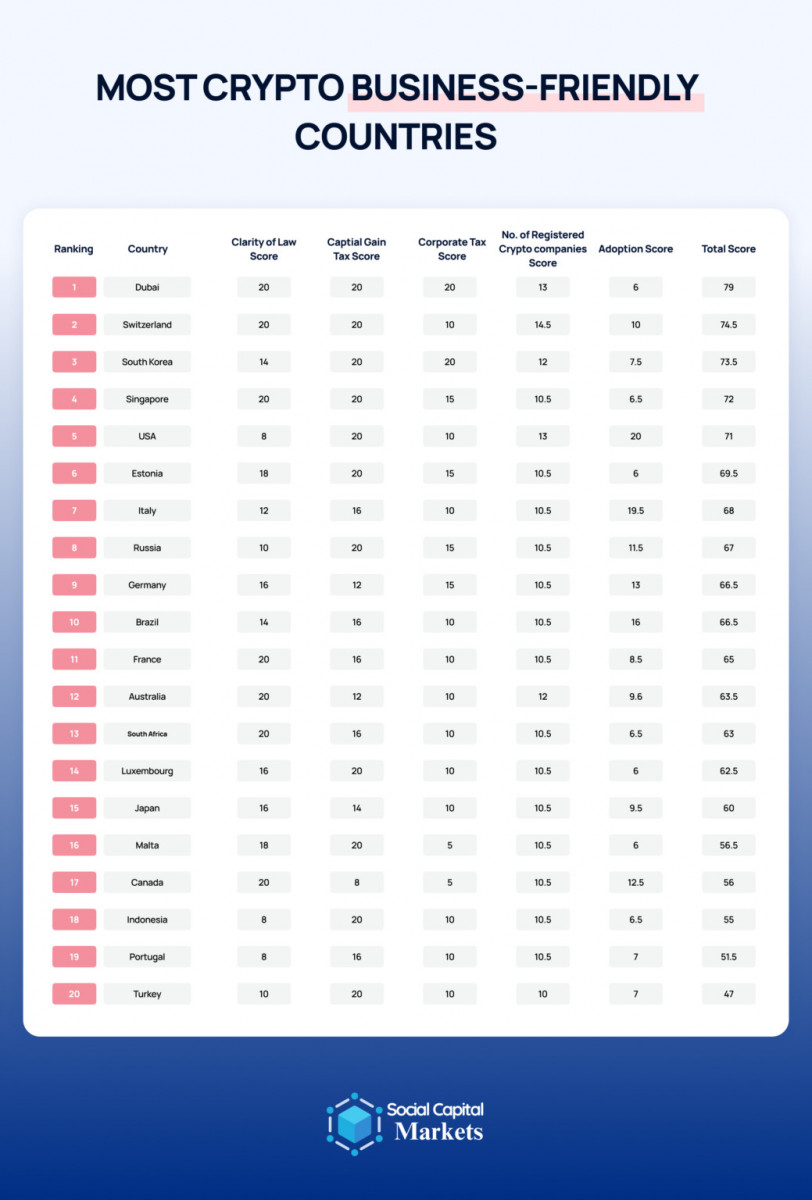

Photo: Social Capital Markets

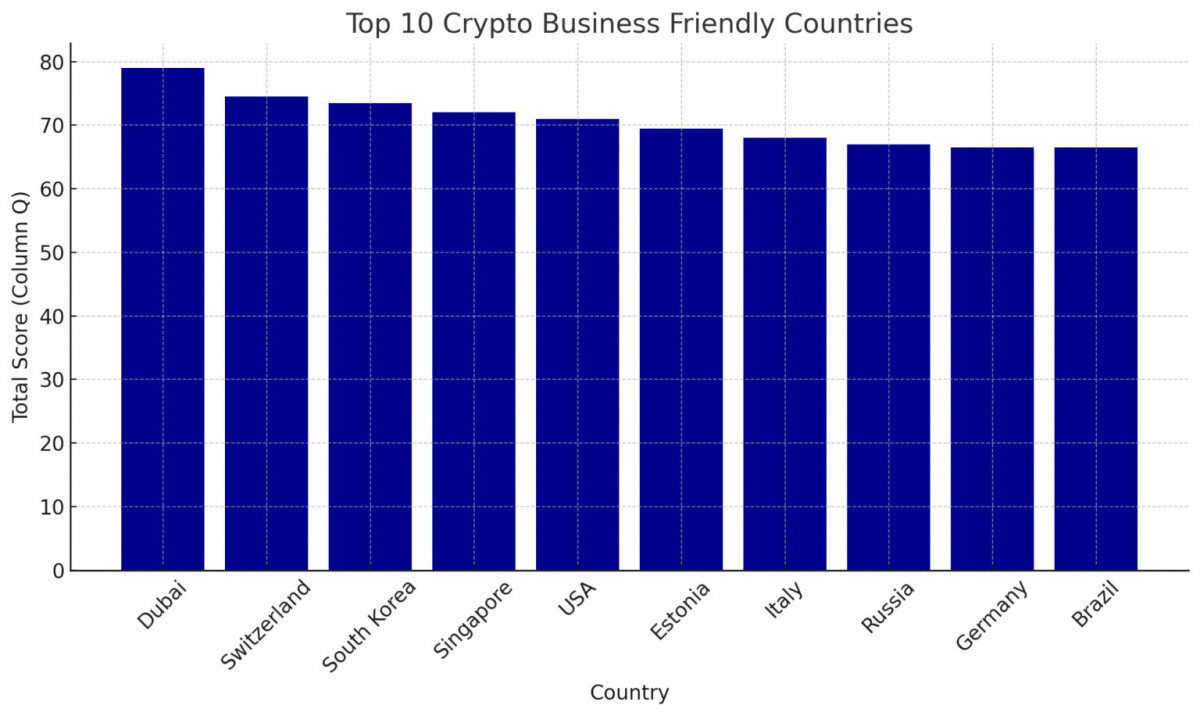

Leading Crypto Business Hubs in 2024

Photo: Social Capital Markets

Dubai

In recent years, Dubai has been a pioneering center for cryptocurrency. Through organizations like the Dubai Financial Services Authority (DFSA) and the Dubai Multi Commodities Centre (DMCC), the emirate has created policies that are both helpful and clear. Due to its low corporation tax rate of 9% for taxable revenue over AED 375,000 and the absence of capital gains tax, Dubai’s attitude toward crypto firms is especially alluring.

Dubai’s dedication to developing a strong cryptocurrency ecosystem is evidenced by the establishment of the Virtual Asset Regulatory Authority (VARA). With more than 550 crypto firms registered, Dubai is quickly rising to the top of the global crypto scene.

Switzerland

Switzerland is well known for being a crypto-friendly country with Zug, that is sometimes referred to as “Crypto Valley.” Particularly in the canton of Zug, the Swiss Financial Market Supervisory Authority (FINMA) offers rules that are helpful and unambiguous. More than 900 crypto firms have registered in the nation as a result of the regulatory clarity.

Switzerland’s tax rates for cryptocurrency service providers are very favorable, which adds to their popularity. The country has a corporation tax rate that varies from 12% to 21% and a capital gains tax of 7.8%. Furthermore, more than 400 businesses in the nation use cryptocurrency as payment, demonstrating the widespread acceptance of cryptocurrencies in the economy.

Singapore

Singapore has established itself as one of Asia’s leading business hubs for cryptocurrency startups. The Monetary Authority of Singapore (MAS) mandates that enterprises seek a license in order to operate in the nation and offers clear guidelines for cryptocurrency operations. Support for the cryptocurrency industry in Singapore also includes the Cryptocurrency and Blockchain Association, which helps small and medium-sized businesses in this field.

Singapore is a desirable location for cryptocurrency businesses due to its flat corporation tax rate of 17% on chargeable revenue and lack of capital gains tax. The nation’s $8.9 million investment in blockchain research and development is proof of its dedication to the technology.

United States

As state laws differ, the US creates a challenging environment for cryptocurrency firms. With more than 474 registered crypto organizations and more than 5,000 businesses accepting cryptocurrencies as payment, this country continues to be a prominent participant in the cryptocurrency field despite this patchwork legislative framework.

The United States is a desirable location for many cryptocurrency enterprises due to its 21% corporate income tax rate and the absence of a federal capital gains tax. States, however, differ greatly in how clear their rules are, which results in a confusing regulatory landscape.

South Korea

The country of South Korea is quickly becoming known for being crypto-friendly. With organizations like the Korea Financial Intelligence Unit (KFIU) supervising digital asset transactions and services, the nation’s regulatory framework is still being developed. Although the legal climate is changing, South Korea has demonstrated a strong commitment to creating a welcoming environment for cryptocurrencies.

The country has decided to delay the imposition of capital gains tax on cryptocurrency transactions, and corporate taxation on cryptocurrency enterprises will not take effect until 2025. South Korea is attempting to establish itself as a major player in the Asian cryptocurrency sector, with more than 376 registered firms.

Estonia

Despite recent legal changes, Estonia has established itself as a nation that is receptive to cryptocurrencies. Between 2021 and 2022, the country enforced stringent Anti-Money Laundering (AML) and Terrorist Financing Prevention Act laws, which resulted in a decrease in the quantity of cryptocurrency enterprises that were granted licenses. With no capital gains tax and a 20% withholding income tax, Estonia nevertheless offers crypto businesses advantageous tax treatment.

Germany

Germany has been at the forefront of adopting blockchain technology for a variety of digital changes as a result of its recognition of its potential. With no long-term capital gains tax on cryptocurrency revenue for individuals or organizations, the nation’s stance on cryptocurrencies is largely positive. However, firms must pay a 15% income tax, and the short-term capital gains tax can range from 0% to 45%, depending on the gains.

Germany is a desirable place for enterprises due to its clear and well-established regulations around cryptocurrency, even with its higher tax rates than in some other jurisdictions. The fact that over 700 establishments in the nation accept cryptocurrency as payment and that it is recognized as a legitimate form of money adds to its allure.

Italy

The EU’s Markets in Crypto-Assets Regulation (MiCA) framework has led to the recent tightening of rules in Italy pertaining to cryptocurrency enterprises. Throughout spite of these modifications, 73 authorized cryptocurrency service providers are still operational throughout the nation. Although higher than some other nations, Italy’s capital gains tax rate of 26% and corporate income tax rate of 24% are nonetheless competitive in the European Union.

Russia

Russia’s advantageous tax laws have made it a desirable location for cryptocurrency businesses. The corporate income tax is fixed at a flat rate of 20%, and there is no capital gains tax in the nation on cryptocurrency transactions. The legalization of cryptocurrencies in Russia, where more than 500 establishments accept them as payment, makes it easier for crypto enterprises to operate in the market.

Brazil

Brazil is trying to make a name for itself in the cryptocurrency space. In 2022, the nation established a framework for the cryptocurrency industry, with the Central Bank serving as the governing authority. Although the regulatory landscape is constantly evolving, this offers chances for companies aiming to penetrate a less constrained market.

However, certain enterprises may face difficulties due to Brazil’s tax rates. The nation levies a short-term capital gains tax with a range of 15% to 22.5%, as well as a corporate income tax of up to 25%.

The Future of Crypto Business Hubs

Regulating cryptocurrency is a major priority for many G20 governments, but competition among non-G20 countries to recruit cryptocurrency enterprises is fierce.

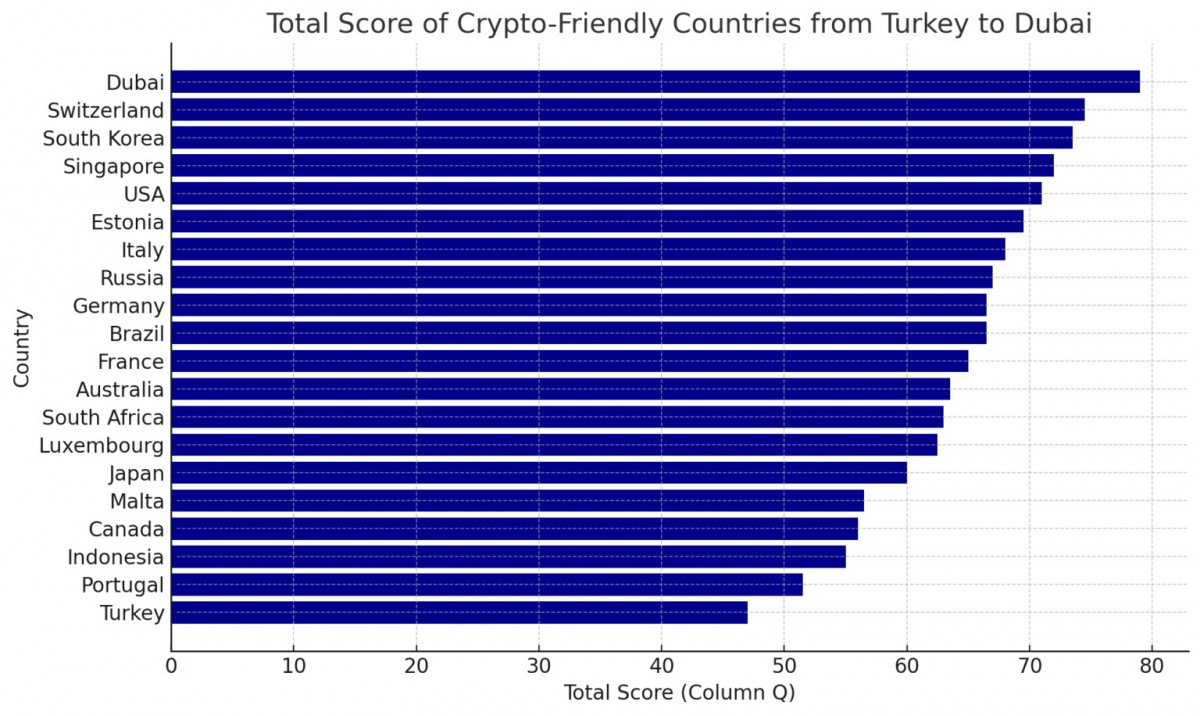

Photo: Social Capital Markets

Countries will probably keep refining their strategies for policing and assisting the cryptocurrency sector, which will mean that the landscape of crypto-friendly states will keep shifting. When it comes to choosing the best locations for cryptocurrency enterprises, elements like tax laws, regulatory clarity, and general business climate will continue to be vital.

Recognizing the potential of blockchain and cryptocurrency technologies to spur economic development and creativity, nations are competing to become the world’s premier centers for cryptocommerce. Emerging players like South Korea and Dubai are gaining momentum quickly, while traditional centers like Singapore and Switzerland continue to draw cryptocurrency enterprises.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.