The Current State of GameFi in 2024. News, Updates, and Play-to-Earn

In Brief

Gaming Finance (GameFi) is a new Web3 sector that merges traditional gaming with Decentralized Finance, attracting millions of users worldwide.

What is GameFi?

An exciting and relatively new sector of the Web3 space, Gaming Finance (GameFi), has emerged at the intersection of traditional gaming and Decentralized Finance (DeFi). By combining the immersive gaming experience with the yield-farming opportunities of DeFi, this sector has captivated millions of users worldwide.

GameFi is All About Having Fun While Earning Monetary Rewards

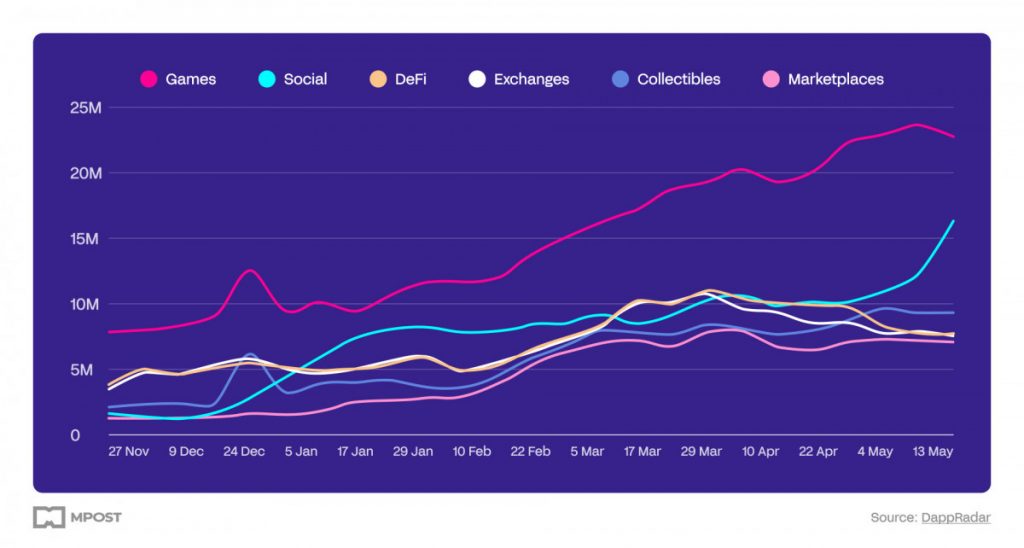

Who doesn’t like harvesting rewards and watching their portfolios grow? Now that the process can be engaging and just as enjoyable as the result, Web3 gaming has more than doubled in the last six months and is continuing to grow steadily. Currently, the sector hosts tens of millions of Unique Active Wallets (UAWs) interacting with their smart contracts, far surpassing any other category of dApps.

GameFi projects can offer their users various ways to gain yields: by receiving rewards for completing in-game milestones, competing with other players for prizes in skill-based competitions, creating and monetizing their in-game economies, doing exercises, and others.

How to Earn While Playing?

The Web3 gaming industry has developed several economic models that allow players to monetize their in-game time.

Games built on the Play-to-Earn (P2E) model allow players to earn tokens from activities like completing levels and challenges. Alternatively, players can acquire in-game skins, cosmetics, landscapes, etc., to trade or sell them on dedicated marketplaces. The potential for real earnings from playing boosts engagement and incentivizes users to participate more actively in the platform’s ecosystem.

Some GameFi projects have taken on the goal of promoting healthy habits and fitness among their users. The Move-to-Earn (M2E) model incentivizes users to be physically active. By rewarding players with tokens for completing their daily exercise milestones, such platforms try to mitigate the negative results of modern sedentary lifestyles and contribute to the health of their user base, all while providing them with real rewards.

Another recently proposed model is Tap-to-Earn (T2E). Here, users can earn rewards by completing simple repetitive actions such as completing assignments or pressing a button. The straightforward design of this model makes it easily accessible, though it is underwhelming in terms of user engagement.

In addition to the discussed economic models, multiple platforms offer gamers a pathway to gain bonus passive income through the staking of their assets obtained from playing. By providing liquidity on gaming marketplaces, users can take part in a form of GameFi yield farming.

How the Web3 Landscape is Shaping the Evolution of GameFi

By integrating elements of well-established sectors of Web3 and new cutting-edge tech and infrastructure, the on-chain gaming industry is becoming more secure, optimized, and user-centric.

For example, issuing players rewards as non-fungible tokens (NFTs) is now a staple of GameFi. This form of asset ownership is immutable and allows users to trade them on the respective platform and third-party marketplaces easily. Pioneered by the Ethereum-native CryptoKitties, utilizing NFTs to represent acquired assets has become a standard of the industry.

Another major factor contributing to GameFi is the emergence of zero-proof (zk) technologies. They allow gaming platforms to overcome the restraints of network gas costs while retaining the high level of security inherent to the blockchain. Powered by zk-Proofs, dApps can guarantee the fairness of all player results by eliminating the possibility of cheating. Now, projects like ZkNoid are emerging, allowing players to compete in all-zk games without cheaters or bots.

A large factor restraining the mass adoption of Web3 gaming is the complexity of managing private keys and signing multiple transactions. The Account Abstraction provides a path to significantly improve the UX. By allowing users to sign a transaction only once and not worry about private keys or gas, this technology promises to be a breakthrough in GameFi’s growth.

Automating DeFi is one of the significant trends of Web3, and it didn’t bypass GameFi, which requires multiple smart contract interactions to be done regularly and reliably. To streamline operations, game publishers have begun integrating new infrastructure solutions like PowerAgent to reliably perform essential operations and abstract even more complexities from their users.

Finally, by adding interoperability layers like Chainlink CCIP, gaming platforms provide cross-chain functionality to their platforms and provide players with a seamless and interconnected UX.

GameFi Projects You Can Explore

So, let’s say you want to join the action, invest in GameFi, and start earning by playing games. Where to start? Let’s explore some well-established platforms that are spearheading the Web3 gaming realms.

STEPN

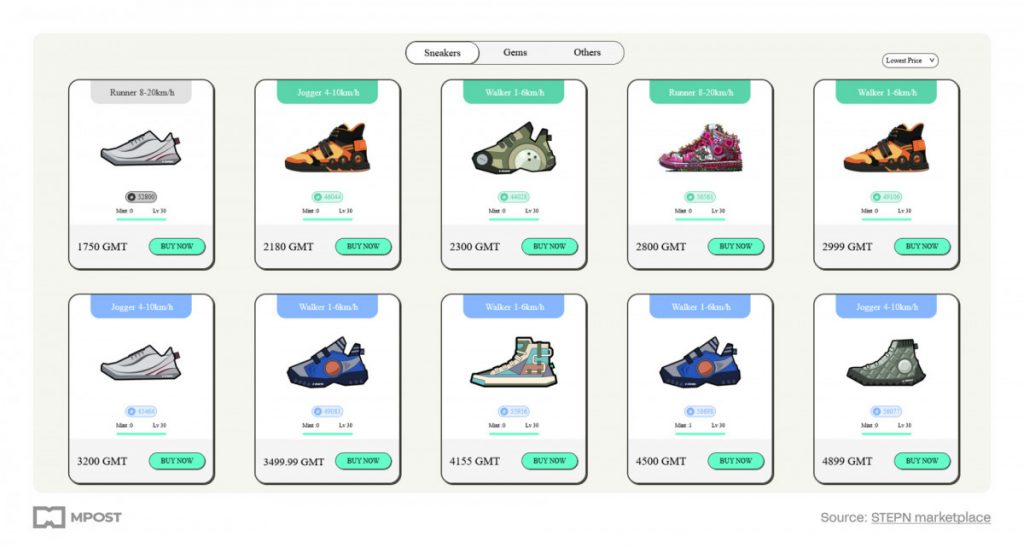

Launched in early 2022 on the Solana network, this activity tracker pioneered the Step-to-Earn model by gamifying fitness. By equipping special NFT sneakers, STEPN pays players $GST or $GMT (options vary depending on the particular sneaker) for walking, jogging, or running outdoors, though a strong GPS signal is required.

With unique sneaker minting, leveling, and enhancement mechanics, players can upgrade the attributes of their sneakers to boost the yields they receive or sell them on the STEPN marketplace. Fully upgraded sneakers start selling at approx. $400 with some epic sneakers with unique skins, reaching prices up to $4,500! Earning possibility is there if you are ready to “walk the mile.”

AstarFarm

Built to provide a gamified DeFi experience on the Astar blockchain, it took the term “yield farming” literally. Players can stake $ASTR to get seeds and plant them on their fields.

Depending on the locking period, different crops can grow with different selling prices, and each seed can yield up to 5 crops. However, the growing plants can be eaten by bugs, rendering them worthless, which introduces a certain risk to investment.

The planted seeds go through 3 stages of growth and, if successful, can be harvested and sold in the in-game marketplace.

For staking and playing AstarFarm, users enjoy ARPs ranging from 10% to 20%, depending on their locking period.

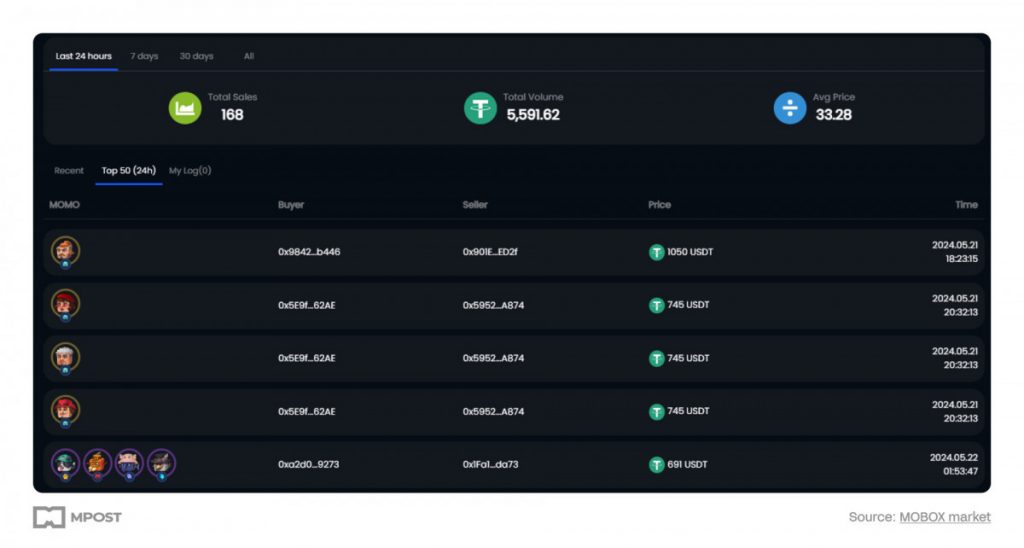

The MOBOX ecosystem

This sprawling gaming platform, built on the BNB chain, hosts various games of different genres, allowing players to earn from a combination of yield-farming and NFT-farming.

The platform’s NFTs (MOBOs) can be acquired through mystery boxes. Users can stake them to farm $MBOX tokens or sell them on the platform’s market. If you’re lucky enough to get some rare MOBOs, they can be sold at pretty high prices.

Players can also get $MBOX prizes for free by winning various in-game competitions and tournaments. Additional staking of the acquired tokens can further boost APRs on MOBOX.

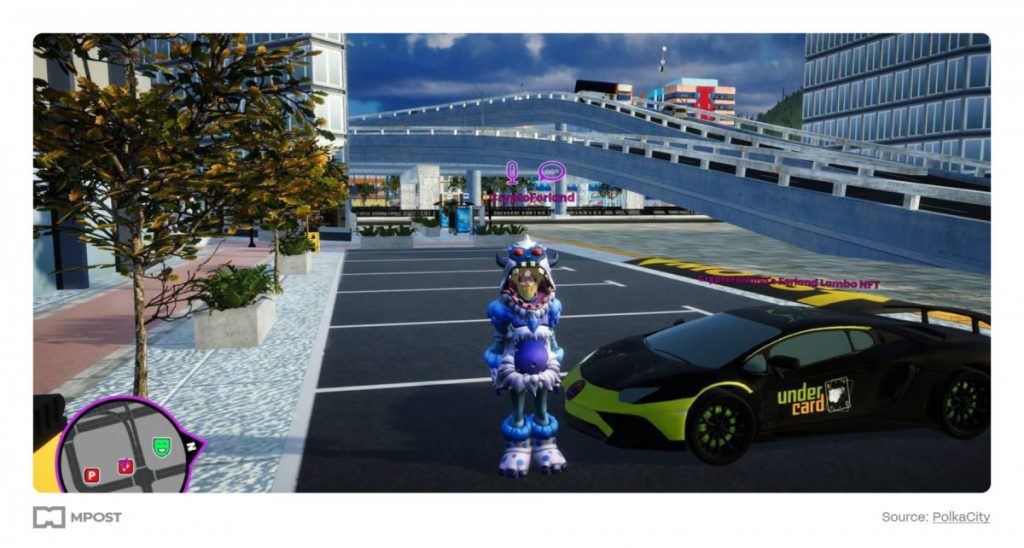

PolkaCity

Powered by Metachain, it’s an NFT marketplace and the world’s first AR NFT multichain social platform and game where players can fully emerge. When joining PolkaCity, players choose and customize their avatar and can start exploring the metaverse, interact with other players, and participate in many activities and games.

Players can purchase in-game assets like real estate, transportation, accessories, and more to tap into their earning potential. Depending on the asset, it can be purely cosmetic or functional, providing a return on investment. For example, owning a Polka City Bank will give users 25% of multichain bridge fees and 25% of $POLC loan fees from this bank branch.

GameFi: The Bridge That Will Drive DeFi Mass Adoption

As GameFi evolves and continues to push boundaries, it has the potential to be a major contributor to Web3 mass adoption. With billions of gamers globally, GameFi presents an interactive gateway into a realm of new dimensions of ownership and the opportunity to earn real rewards while doing what they love. This may lead them to discover the benefits of blockchain technology and engage deeper into DeFi and the broader space for the long term.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Anthony is a blockchain analyst and writer with an academic background in biochemistry. He works as researcher and content creator in the PowerPool protocol, covering ecosystem updates, new DeFi/dePin/AI products, and analysis of various web3 protocols.

More articles

Anthony is a blockchain analyst and writer with an academic background in biochemistry. He works as researcher and content creator in the PowerPool protocol, covering ecosystem updates, new DeFi/dePin/AI products, and analysis of various web3 protocols.