SEC Declares First Trust SkyBridge Bitcoin ETF Filing as ‘Abandoned’

In Brief

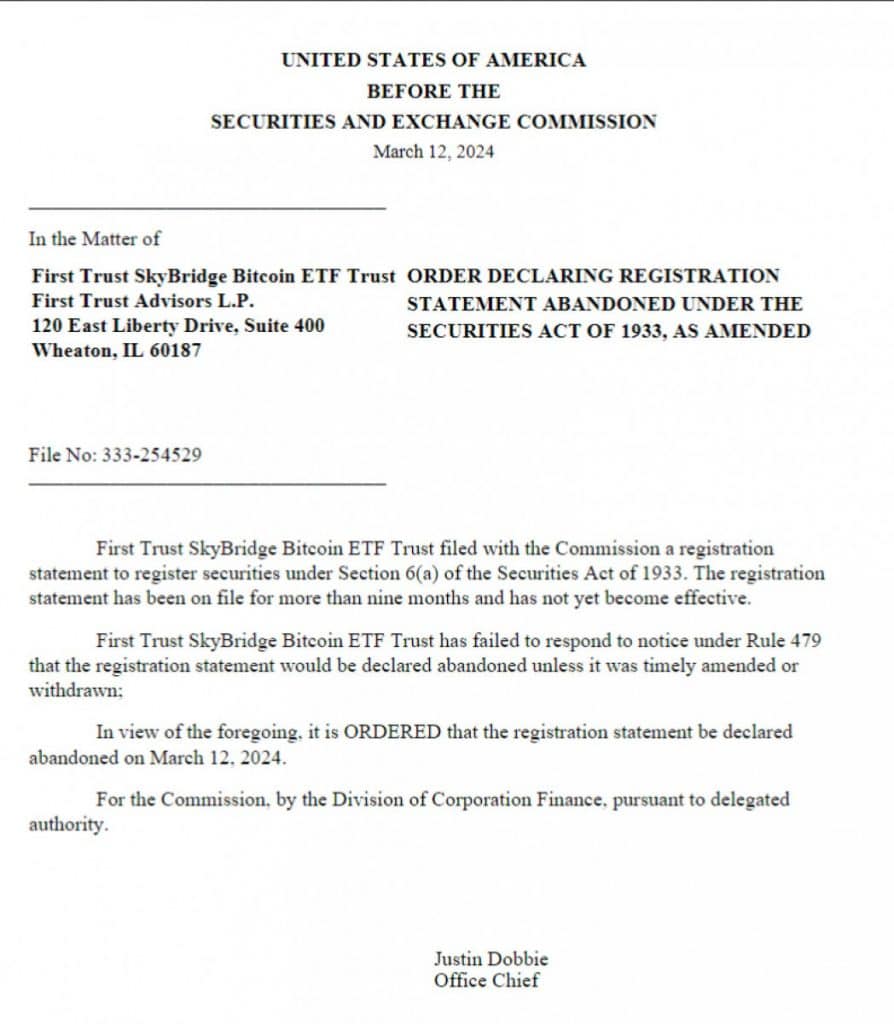

First Trust Advisors and SkyBridge Capital received an order from the US SEC to mark their Bitcoin ETF application as abandoned.

First Trust Advisors and SkyBridge Capital, the hedge fund managed by digital assets investor Anthony Scaramucci, received an order from the United States Securities and Exchange Commission (SEC) to mark their Bitcoin exchange-traded fund (ETF) application as abandoned.

According to the SEC notice, the registration statement is required to be deemed abandoned due to the lack of response from the First Trust SkyBridge Bitcoin ETF to previous communications from the agency.

First Trust and SkyBridge initially applied for a spot in Bitcoin ETF in March 2021. The application, along with numerous other unsuccessful ones, faced rejection by the SEC in January 2022. However, the two firms chose not to resubmit an application following the investment company BlackRock‘s spot Bitcoin ETF application, which, after some modifications, became one of the initial spot Bitcoin ETFs to receive approval.

In the post on social media platform X, Eric Balchunas, ETF analyst at Bloomberg, expressed uncertainty about why First Trust and SkyBridge opted not to submit a new application following BlackRock’s successful application, mentioning the companies’ potential.

Spot Bitcoin ETF Surpass Record $1B Net Inflows

Meanwhile, yesterday marked another day of notable inflows for the recently approved spot Bitcoin ETFs. Net spot Bitcoin ETF inflows surpassed $1 billion, as reported by data from BitMEX Research. Notably, BlackRock’s IBIT product, which surpassed 200,000 BTC in assets under management earlier this week, experienced a record inflow of $849 million. The cumulative net inflows into Bitcoin ETFs since January 11th have amounted to $4.1 billion.

Spot Bitcoin ETFs currently dominate over 90% of the market share for daily trading volume among ETFs providing Bitcoin exposure, reaching an all-time high. In contrast, Bitcoin futures ETFs now represent just 10% of the market share.

Bitcoin maintains its position above $73,000, currently being traded at $73,261, reflecting a growth of over 2% in the last 24 hours as of the writing time, according to data from CoinMarketCap.

In light of the strong performance of spot Bitcoin ETFs, the decision by First Trust Advisors and SkyBridge Capital to abandon their spot Bitcoin ETF application comes as a surprising development.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.

More articles

Alisa, a dedicated journalist at the MPost, specializes in cryptocurrency, zero-knowledge proofs, investments, and the expansive realm of Web3. With a keen eye for emerging trends and technologies, she delivers comprehensive coverage to inform and engage readers in the ever-evolving landscape of digital finance.