Powering the Digital Gold Rush: Inside the Rise of U.S. Bitcoin Mining and Its Far-Reaching Impact on Energy Markets

In Brief

American miners are increasingly dominating the global Bitcoin mining sector, influenced by factors like expansion, energy consumption, regulatory issues, and future paths.

One noteworthy development in the global Bitcoin mining sector is the growing dominance of American miners. It’s critical to look at a number of factors related to the U.S. Bitcoin mining industry, such as its expansion, energy consumption, regulatory issues, and possible future paths, in order to completely comprehend this complicated scenario.

Growing Dominance of U.S. Bitcoin Miners

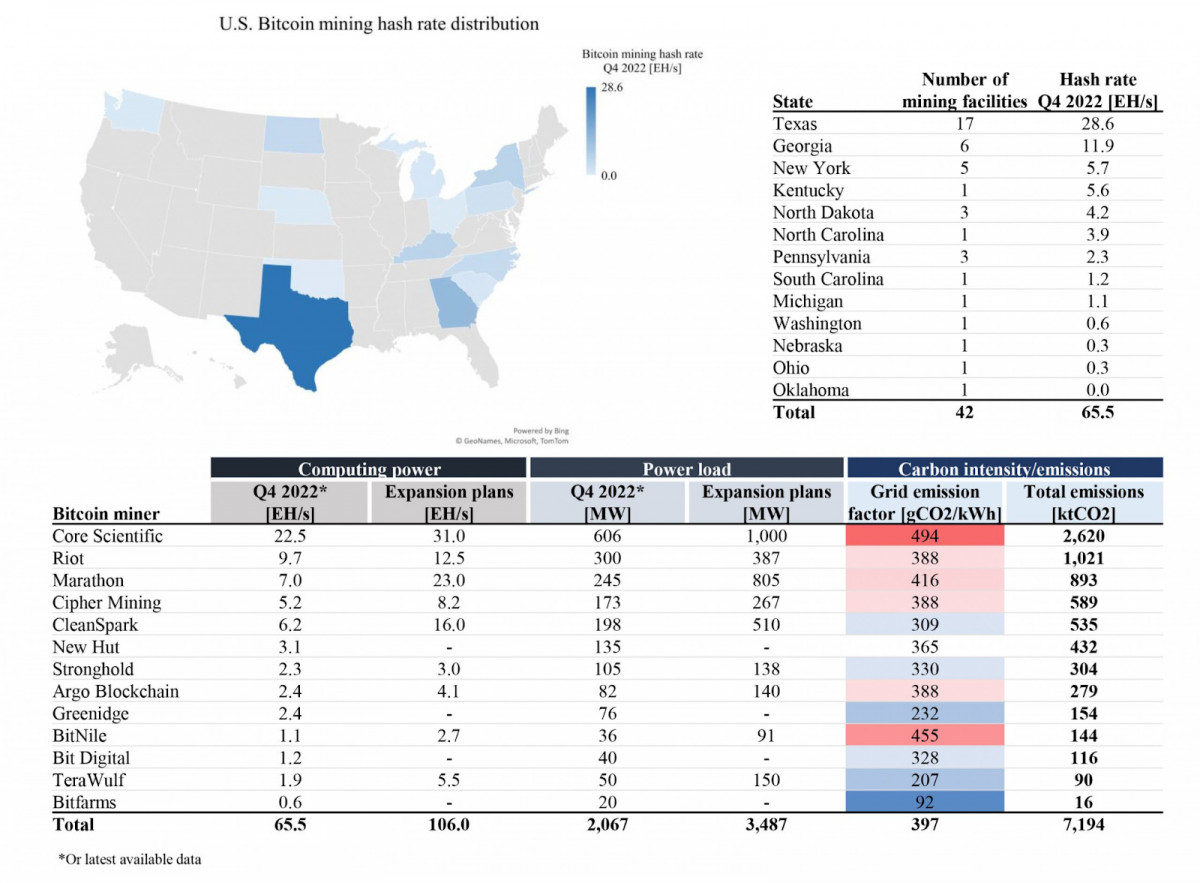

Recent claims from financial organizations such as JPMorgan claim that miners of Bitcoin that are listed in the United States have attained an unprecedented 26.6% of the world’s hashrate, setting a record. This number is an impressive rise over earlier times, having increased by 2.4% since the end of June and by a noteworthy 5.6% since the most recent Bitcoin halving event.

One important measure of the network’s security and the volume of mining activity is the hashrate, which is the total computing power used for Bitcoin mining and transaction processing.

The mining capacity in the United States has grown at an especially impressive rate. U.S.-listed miners increased their operations by 17 exahashes per second (EH/s) in June alone, the biggest amount ever. Businesses leading this growth include Riot Platforms, Bitfarms, and CleanSpark, illustrating how quickly mining activities are growing in the US.

Photo: EIA

This increase in capacity is indicative of the United States’ growing appeal as a location for Bitcoin mining activities, which is fueled by elements including the availability of renewable energy sources, capital market accessibility, and clear regulations in some states.

The increasing governmental crackdown on mining activities in China, which was formerly the leading force in worldwide mining, has contributed to the emergence of U.S. Bitcoin miners. U.S. miners were prepared to fill the hole left by China’s declining percentage of the global hashrate, using their resources and infrastructure to take a bigger chunk of the market.

Energy Consumption and Environmental Concerns of Mining

The rapidly expanding Bitcoin mining business in the United States has drawn more attention to the energy consumption patterns and ecological impact of this sector. According to estimates from the U.S. Energy Information Agency (EIA), the yearly global power consumption for cryptocurrency mining ranges from 0.6% to 2.3%. However, the specific number is still unknown, which is why further research is being done to get more accurate information on how much energy the business uses.

Because Bitcoin mining uses a lot of energy, politicians and environmentalists are unsure if this energy-intensive process is compatible with efforts to mitigate climate change. Some Bitcoin mining operations in states like Texas, which has become a center for the industry in the United States, get their electricity straight from fossil fuel power plants, which could put at risk attempts to lower carbon emissions.

Photo: MIT Climat Portal

The capacity of Bitcoin mining operations to engage in energy markets, which may have an impact on consumer power pricing and change the dynamics of regional energy ecosystems, further complicates the situation.

The EIA is creating a new study that will demand disclosure from businesses in the field in order to solve the dearth of accurate data about the energy usage of cryptocurrency mining. This project comes after an earlier attempt to evaluate the energy footprint of mining was halted by a federal court in Texas as a result of legal action brought by a nonprofit group and a Bitcoin corporation.

With the new study, data collecting will hopefully be more thorough and comply with the law. This might provide important insights into the actual energy expenses associated with mining cryptocurrencies.

Peak electricity consumption on the state’s primary power system is predicted by the ERCOT to almost quadruple by 2030. The majority of the new big loads scheduled to connect to the grid in the upcoming years are likely to be from mining. Discussions over the long-term viability of cryptocurrency mining and its possible effects on energy pricing and grid stability have been triggered by this predicted rise in energy consumption.

Industry Reaction and the Regulatory Environment for Crypto Mining

Rising public discussion and regulatory attention have been drawn to the rising significance of Bitcoin mining in the United States. Proponents of openness in the mining sector contend that reliable grid operations and the advancement of decarbonized power systems depend on having access to precise data on energy use.

Local groups and legal organizations have expressed worry about how mining activities affect nearby towns, citing things like noise pollution and higher domestic power costs.

The cryptocurrency mining sector has tried to emphasize the possible advantages of its activities in response to these worries. Demand response is a tactic used by certain miners to support their claim that their facilities can swiftly reduce power use during moments of peak demand, hence providing grid flexibility.

Additionally, they highlight how the sector may use extra renewable energy that would otherwise go to waste, which might help sustain the expansion and stability of renewable energy initiatives.

Technological Progress and Enhanced Efficiency

An increasing emphasis has been placed on efficiency gains and technology developments as the U.S. Bitcoin mining sector grows. To lessen their impact on the environment and operating expenses, mining firms are investing in more energy-efficient technology and investigating creative cooling solutions.

Some businesses are experimenting with immersion cooling methods, which can save energy costs and prolong the lifespan and performance of mining equipment.

The use of renewable energy sources for mining activities is also gaining popularity. Certain mining corporations have formed alliances with suppliers of renewable energy or made investments in their own renewable energy ventures, including wind or solar farms. These programs seek to solve environmental issues and may provide mining companies with a more reliable and affordable energy source.

Impact on the Broader Cryptocurrency Ecosystem

Beyond the mining industry specifically, the rising dominance of American Bitcoin miners has an impact on the larger cryptocurrency ecosystem. The greater proportion of hashrate that American-based businesses own enhances the general security and robustness of the Bitcoin network. However, it also calls into question the geographical distribution of mining power and how it affects the network’s decentralization, which is a fundamental aspect of Bitcoin’s architecture.

The performance of Bitcoin mining companies that are listed in the United States has also caught the interest of investors and market experts. According to JPMorgan’s study, since the end of June, the total market value of the 14 Bitcoin miners registered in the United States that the bank monitors has increased by 29%.

In comparison to their proportionate part of the four-year block reward, these equities are currently trading at historically high prices, indicating that the market sees potential in the industry beyond traditional mining activities.

According to some experts, the impressive performance of mining stocks may be related to the possibility of using mining infrastructure for applications like AI and HPC. By diversifying their sources of income, mining businesses may be able to attract more investors by offering them more stability and development prospects.

Similar optimism over the AI/HPC possibility was voiced by broker Bernstein in a study published last week. The statement stated that recent agreements pertaining to AI, such as CORZ 12-year contract with CoreWeave and Coatue Management’s $150 million investment in HUT 8 (HUT), have emerged as important drivers for the space

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.