PayPal, Visa, Mastercard, and Stripe Pursue Stablecoin Initiatives Amid Growing Market Interest

In Brief

PayPal, Visa, Mastercard, and Stripe are exploring stablecoin functionalities and infrastructure due to the growing stablecoin market, which now has over $120 billion in circulation.

PayPal launched its Ethereum-based stablecoin, PYUSD, in 2023, aligning with Central Bank Digital Currencies (CBDCs).

Visa is testing a USDC global settlement program, while Mastercard has a dedicated team handling payment infrastructure.

This trend highlights the growing acceptance of digital currencies within the conventional financial ecosystem and the potential for new entrants to create services around stablecoins.

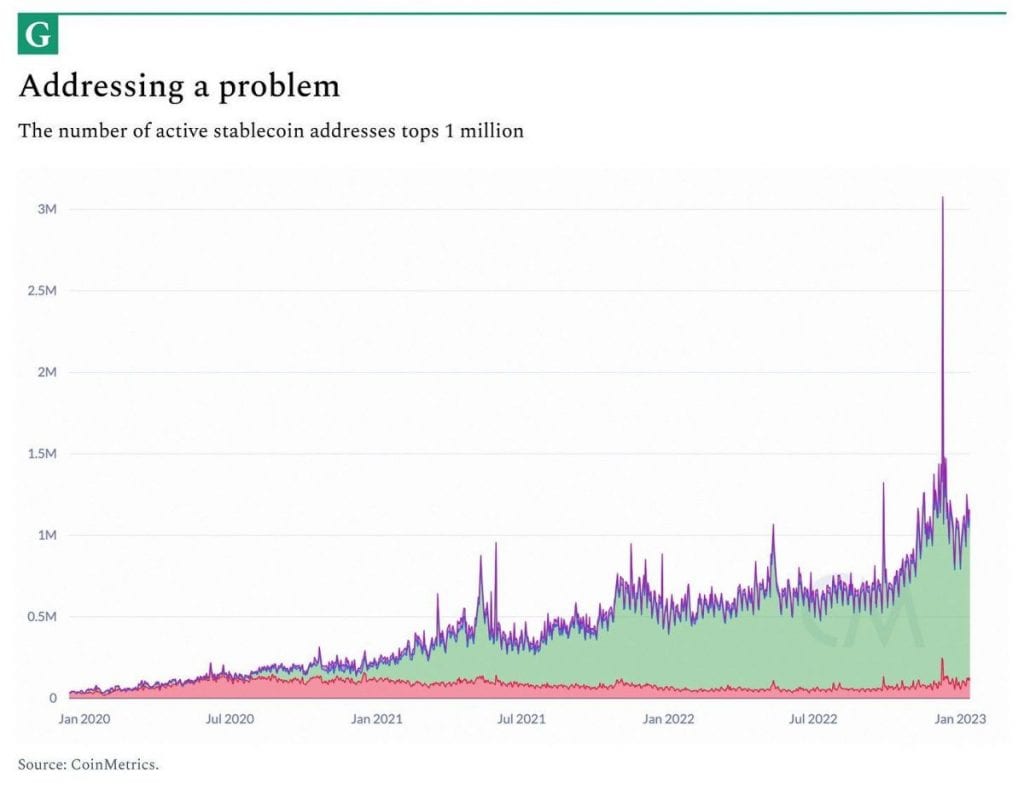

Leading payment processing companies including PayPal, Visa, Mastercard, and Stripe are exploring stablecoin functionalities and infrastructure. Their interests are buoyed by a noticeable growth in the stablecoin market, which now sees over $120 billion in circulation, representing a twentyfold increase since 2020.

| Related: Top 7 Companies That Adopted GPT-4 |

PayPal, on August 7th, 2023, launched its Ethereum-based stablecoin, PYUSD, issued by Paxos, a company also responsible for the BUSD Binance stablecoin. Due to United States regulations, PYUSD is designed to align more closely with Central Bank Digital Currencies (CBDCs) rather than conventional stablecoins. This move, as PayPal plans, should foster more extensive use as the company integrates the stablecoin into its platform and the widely-used Venmo transfer application.

Visa is currently in the testing phase of a USDC global settlement program, utilizing the Ethereum platform. Details about the pilot can be found here. Mastercard has also expressed interest in this direction. Stripe, for its part, has assembled a dedicated team to handle payment infrastructure revolving around stablecoins, as explained here.

The underlying motivation for this growing interest among financial giants stems from the perceived product-market fit for stablecoins, which is a relatively rare occurrence within the cryptocurrency field. Statistics reveal that there are more than a million daily active wallets engaging with stablecoins. Furthermore, issuers have discovered an attractive economic model where tokens are sold, and the received dollars are invested at a 5% rate in US treasuries. For instance, Tether reported $850 million in profit during the last quarter under this model.

This emerging trend also paves the way for new entrants to create services around stablecoins, giving rise to opportunities in various sectors. Notable examples include neobanks such as Eco and DolarApp, cross-border B2B payment solutions like Cedar, and infrastructure solutions provided by companies like Bridge.

The embrace of stablecoins by significant financial players such as PayPal, Visa, Mastercard, and Stripe underscores the increasing validation and acceptance of digital currencies within the conventional financial ecosystem. With the ongoing exploration and pilot projects, there is a growing sense of anticipation among industry watchers and participants as to how these initiatives will shape the future landscape of digital payments and financial services.

PayPal Reports $1 Billion in Cryptocurrency Holdings

Recently, PayPal has reported nearly $1 billion in cryptocurrency holdings, with a 30% growth since Q4 2022. The company’s adjusted profits and revenue increased, but shares slid due to a reduced operating margin expansion forecast. Payment providers like PayPal, Stripe, Mastercard, and Visa are crucial in driving crypto adoption. PayPal allows customers to buy, hold, sell, receive, and send crypto assets, using sale proceeds during checkout. The company relies on third-party trusts like Gemini and Coinbase Custody for the custody and safekeeping of crypto assets. Venmo, a PayPal subsidiary since 2013, enables users to send Bitcoin, Ethereum, Litecoin, and Bitcoin Cash to others or external wallets. PayPal halted stablecoin development earlier this year due to an investigation by New York regulators into its partner, Paxos.

Established payment providers can help expand crypto adoption beyond the existing user base. MetaMask wallet holders in the U.S. can purchase crypto using PayPal, while PayPal debit card users can buy crypto on Coinbase. Stripe enables crypto companies to purchase crypto with fiat currency and provides an in-game widget for gamers to fund wallets. Mastercard has developed infrastructure and standards to certify transactions between customers and businesses on blockchain networks. Visa has announced a project to promote mass stablecoin adoption on public blockchains and partnered with Circle to enable USDC transactions on select credit cards.

Mastercard Partners with Stables to Push Stablecoin in APAC

US-based Mastercard has entered a strategic partnership with Australian fintech startup Stables to advance stablecoin adoption in the APAC region. The partnership aims to enable users of Stables’ platform to make payments for goods and services using their USD Coin (USDC) anywhere Mastercard is accepted. The service is set to go live in the second quarter of the year and will design a stablecoin-only digital wallet to support payment integration. Users can save and spend in USDC, but at the Point-of-Sale (POS), the digital currency will be converted to fiat before being used for actual payment. Mastercard is committed to innovative payment solutions that give cardholders the freedom to spend their assets where, how, and when they want. Stables is building a solution for the Web3 sector using Mastercard’s global network and cyber and intelligence tools, including CipherTrace and Ekata, with trust and security at the core.

The collaboration between Mastercard and Stables is beneficial to both companies, as it helps the former create a major conduit to advance its push into the crypto ecosystem. On the part of Stables, the new offering will help its brand gain exposure, riding on the global positioning of Mastercard. The USDC payment service will be launched in Australia initially but plans to expand to other countries in the near future.

Despite the FUD surrounding Circle, USDC, and the exposure to the three US banks that collapsed recently, Stables representatives are confident in the future of USDC. They believe stablecoins will play a pivotal role in the new financial system and will be core to bridging the worlds of traditional and decentralized finance. Users can top up their mobile wallets with fiat and other forms of payments, including bank transfers, to ease their mind.

The facts at hand highlight a practical and calculable trend, steering away from speculative scenarios, and firmly placing stablecoins at the forefront of modern financial innovation.

Read more:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.