Metaverse Fundraising Report for September: Trends in Infrastructure, Gaming, NFT

In Brief

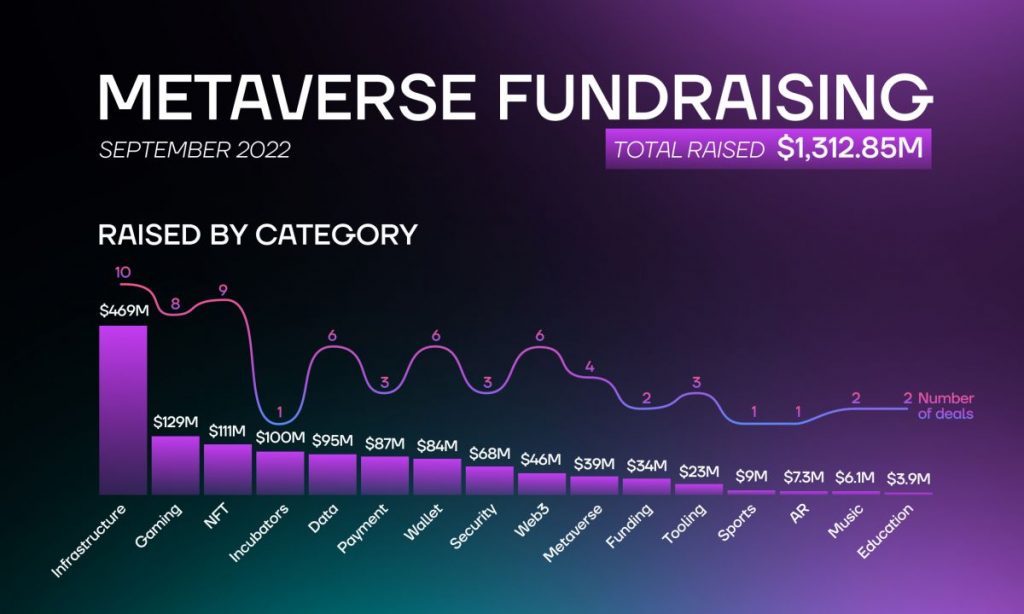

In September, Web3 startups raised a total of $1.3 billion in funding

Infrastructure startups raised $469 million

The gaming category has raised $129 million, losing drastically in volume

NFT startups continue to attract investors’ interest despite the current bear market

- Gaming Industry Trends

- Metaverse Industry Trends

- NFT Industry Trends

- AR Industry Trends

- Music Industry Trends

- Identity Industry Trends

- Sports Industry Trends

- Education Industry Trends

- Data Industry Trends

- Security Industry Trends

- Payment Industry Trends

- Wallet Industry Trends

- Funding Industry Trends

- Incubator Industry Trends

- Tooling Industry Trends

- Web3 Industry Trends

- Infrastructure Industry Trends

- Notable Investors

Metaverse Post introduces a fundraising report for September 2022 that focuses on tech companies specializing in Web3, Metaverse, gaming, NFTs, and more.

In September, investors paid attention to 16 categories. If August saw AI, DAO, video, and social-related startup fundings, September would bring a new category of interest in metaverse investments—education.

Venture Funds and angels were active and invested a total of $1,312.85 million despite the bear market and the macroeconomic look with fiat currencies stumbling.

This month, the report pays special attention to infrastructure startups, as the category has received a limit-breaking $469 million. It’s worth noting that August saw the gaming sector receive a staggering $466 million, but in September, the investments dropped to $129 million. Additionally, VCs invested in Security, Data, and an Incubator.

Gaming Industry Trends

The gaming industry raised a total of $466 million in the previous month. In September, it received just $129 million, which could point toward the possible decreasing enthusiasm of investors. However, in July this year, blockchain-based game startups received approximately $150 million, and the category was leading among the month’s investments.

African gaming community Metaverse Magna raised $3.2 million at a $30 million valuation. Among the investors are game developer Wemade, VC firm Gumi Cryptos Capital, HashKey, Taureon, Tess Ventures, AFF, LD Capital, Polygon Studios, IndiGG, and angel investor Casper Johansen. The startup plans to build Africa’s biggest gaming DAO.

Web3 game developer Internet Game raised $7 million in a seed round. Among the participants are Rus Yusupov, ParaFi Capital, Dragonfly Capital, Collab+Currency, Dephi Digital, Uniswap Ventures, crypto influencer Gmoney, Milk Road, Ready Player DAO, and co-founder of Magic Eden, Zedd.

Decentralized gaming ecosystem Gameplay Galaxy raised $12.8 million in a seed round led by Blockchain Capital. Merit Circle, Com2uS, Mysten Labs, and Solana Ventures participated in the round. The startup plans to build new games with innovative Web3 capabilities.

Web3 games studio Revolving Games raised $25 million in a Series A round. The investors are Animoca Brands, Pantera Capital, Polygon, Kenetic Capital, Sarmayacar, Dapper Labs, Perm Capital, DWeb3 Capital, and Rockstar Games co-founder Dan Houser. The company will develop decentralized gaming experiences.

Videogaming firm Random Games raised $7.6 million in a seed round led by Resolute Ventures and Uneven. Among other participants are 2 Punks Capital, Asymmetric, IGNIA, ID345, Polygon, and David Jones. The company plans to use the funds for the development of its group.

NFT gaming studio and marketplace Vulcan Forged raised $8 million in a Series A round led by SkyBridge Capital. The startup plans to accelerate the growth of Vulcan Forged Metascapes.

Play-And-Earn chess platform Immortal Game raised $15.5 million. The round was backed by Kim Ventures, TCG Crypto, Alien, Moonier Ventures, Spice Capital, Kraken, Blockwater Capital, Thirty Five Ventures, and Sparkle Ventures. The startup plans to use the funding to build a next-gen online chess experience.

Independent game developer Theorycraft raised $50 million in a Series B round led by Makers Fund. A16z and NEA backed the round. The company plans to expand the team for their first game, dubbed Loki.

Metaverse Industry Trends

In August, the Metaverse sector raised $22.3 million, while September saw an investment of $39 million. The leader of this category is London-based Hadean, which is building a highly innovative Metaverse infrastructure technology.

Dubai-based trading Metaverse platform MetaFi raised $3 million at a $25 million valuation. Among the investors at this stage are DoublePeak Group, Megala Ventures, Maven Capital, OKX Blockdream Ventures, Magnus Capital, and Mintable Go! Fund, Legion Ventures, SL2 Capital, X21 Digital, Good Games Guild, MetaGaming Guild, and Athena Ventures. The startup will use the funds to build the “Trading Metaverse.”

HELIX Metaverse developer Hypersonic Laboratories raised $3.5 million in a pre-seed round. SamsungNext, GSR, and angles investors Alex Chung and Scott Belsky participated in the round.

Indonesia-based SerMorpheus, which helps brands bridge to the Metaverse, raised $2.5 million in a seed round led by Intudo Ventures. 500 Global, Caballeros Capital, Febe Ventures, AlphaLab Capital, and BRI Ventures backed the round. The startup plans to use the funding to build the infrastructure and recruit talent.

Hadean raised $30 million in a Series A round led by Molten Ventures. 2050 Capital, Aster Capital, Alumni Ventures, InQTel, and Entrepreneur First backed the round. The London-based startup plans to build a record-breaking Metaverse infrastructure technology.

NFT Industry Trends

In terms of artworks and PFP collections, the NFT market bubble might seem to burst. However, blue-chip NFT projects continue adding special utility and hiring C-level Web2 executives in order to enhance their strategies. For instance, the NFT project Doodles has recently hired a Chief Brand Officer, Pharrell Williams, and a new CEO, Julien Holguin of Billboard. In September, the company raised $54 million for product development.

Generally, the investment volume of this category went down from $186.4 million in August to $111 million in September.

Dust Labs raised $7 million in a strategic seed round. Among the participant are Chapter One, Foundation Capital, Solana Ventures, FTX, Magic Eden, Hello Moon, Big Brain Holdings, Metaplex Foundation, Jump Crypto, Jupiter, Hyperspace, MystenLabs, and Cymbal.

Solana-backed fine art marketplace Exchange Art raised $3.2 million in a seed round. Layer One Ventures, Big Brain Holdings, Cultur3 Capital, Vandelay Financial Group, and angel investor Cozomo de Medici are among the investors.

B+J Studios, which builds blockchain-based solutions for mainstream consumer and institutional-grade use cases, raised $10 million in a Series A round. Among the investors are Brevan Howard Digital, Foundation Capital, Big Brain Holdings, Republic Capital, Starting Line, and Solana Labs executives.

NFT project Doodles raised $54 million in a round led by Seven Seven Six, a VC firm founded by Reddit co-founder Alexis Ohanian. Among other participants are Acrew Capital, 10T Holdings, and cryptocurrency exchange FTX. The company plans to use the funding to hire a team of creatives, engineers, business executives, and marketers. Additionally, the team will invest in “product development, acquisitions, proprietary technology, media, and collector experiences.”

Socially-powered NFT investment app Sintra raised $2 million in a seed round led by Leminscap. FTX, Chorus One, CMCC Global, and Big Brain Holdings backed the round. The app is currently in a public beta release.

Video-focused NFT platform Glass raised $5 million in a seed round led by TCG Crypto and 1kx.

“We believe creators will now have a platform to build a direct connection with their closest fans in ways that differentiate from Instagram, YouTube, and other incumbent video mediums,”

said TCG Crypto Partner, Jarrod Dicker.

Open-source software company Smart Token Labs raised $6 million in a round led by Liang Xinjun. HashGlobal, Bodl, and Fenbushi Capital participated in the round.

Coral, which aims to create the Web3 version of Apple’s app store, raised $20 million in a strategic round led by FTX Ventures and Jump Crypto. Multicoin Capital, Anagram Crypto, and K5 Global and among other participants.

Latin American-based NFT marketplace Minteo raised $4.3 million in a seed round. Among the investors are OpenSea, Fabric Ventures, Dune Ventures, Big Brain Holdings, CMT Digital, Impatient VC, SevenX Ventures, Susquehanna Private Equity Investments, FJ Labs, G20 Ventures, Zero Knowledge, Alliance DAO, and several angel investors.

AR Industry Trends

Capsule Corp Labs has raised $7.3 million in a round led by Omnes Capital, Revam, Digital Finance Group, and Ternoa. The startup partners with developers of Augmented NFT solutions.

Music Industry Trends

RELICSxyz raised $1.1 million in a round co-led by Palm Tree Crypto and Coop Records. Among the investors are Noise DAO, LongHash Ventures, 2PinksCapital, Narcissus Ventures, angel investors DegenDaVinci, MarkyMetaverse, Sparkart, and others.

Arpeggi Labs raised $5 million in a seed round led by a16z. Among other participants are 1confirmation, Palm Tree Crew, WndrCo Ventures, the Audius Foundation, 3LAU, Wyclef Jean, Disco Fries, Electric Feel Ventures, Louis Bell, Joe Zadeh, Shayne Coplan, Paul Veradittakit, Cooper Turley, and Steve Aoki. The startup will use the funds to build an open-source music creation and publishing.

Identity Industry Trends

Name service network Space ID closed its seed round led by Binance Labs. The startup plans to continue the development of the .bnb Domain Name Service.

Sports Industry Trends

Web3 platform for daily fantasy sports contests HotStreak raised $9 million in a Series A round led by Polychain Capital.

Education Industry Trends

Educational Web3 projects are a great way to increase the adoption of new technologies and enhance the professional level of industry experts.

Educational cryptocurrency application for teenagers and parents, Stack, raised $2.7 million from Madrona, Santa Clara Ventures, The Venture Collective, and several angel investors. The startup will soon release iOS and Android apps.

LearnWeb3, an educational platform for Web3 developers, raised $1.25 million in a seed round led by IOSG Ventures, Balaji Srinivasan, and Harsh Rajat.

Data Industry Trends

Web3 Relationship Aggregator KNN3 Network raised $2.4 million in a seed round led by HashGlobal and former co-founder of Fosun International, Liang Xinjun. Among other participants are Mask Network, Eniac Venture, Atlas Capital, Tess Venture, Stratified Capital, Fundamental lab, Incuba Alpha, MetaWeb Venture, Zeuth Venture, Cogitent Venture, Impossible Finance, RSS3, ShowMe, and Yan Xin & Potter Li.

Real-time data infrastructure Goldsky raised $20 million in a seed round led by Dragonfly Capital and Felicis. Among other participants are Amplify Partners, Lux Capital, and several angel investors.

Messari raised $35 million in a Series B round led by Brevan Howard Digital, with participation from Morgan Creek Digital, FTX, Point72 Ventures, Kraken, Uncork Capital, Underscore VC, and Coinbase Ventures.

Decentralized SQL database Kwil raised $9.6 in a round led by FTX and Digital Currency Group.

Decentralized Data platform Space and Time raised $20 million in a strategic round led by Microsoft’s venture fund M12. Framework Ventures, HashKey, SevenX Ventures, Foresight Ventures, Blizzard, and Polygon, are among other investors. The startup will use the funds to provide businesses with funding through smart contract technology.

Bitquery raised $8.5 million in a seed round led by Binance Labs. Susquehanna, dao5, DHVC, INCE Capital, and several angel investors participated in the round. The startup plans to expand its data coverage to support more blockchains.

Security Industry Trends

September was a successful month for security startups, which have raised a total of $67.8 million. Frauds in the cryptocurrency sphere increase drastically, so the necessity of such projects becomes obvious.

The investors’ list in this category includes NFT marketplace OpenSea, Uniswap, a16z, Visa, Google Ventures, Coinbase Ventures, and Dragonfly Capital, which has participated in two companies’ rounds of the sector.

Crypto startup Sardine raised $51.5 million in a Series B round led by a16z. Among other new and existing investors are XYZ, Nyca Partners, Sound Ventures, Activant Capital, Visa, Google Ventures, Vikram Pandit, Eric Schmidt, The General Partnership, ING Ventures, ConsenSys, Cross River Digital Ventures, NAventures, Alloy Labs, and Uniswap Labs Ventures.

Security startup Blowfish raised $11.8 million in a round led by Paradigm. The investors’ list includes Uniswap, Dragonfly, Hypersphere Ventures, 0x Labs, and several angel investors. The platform helps Web3 users identify malicious transactions in real-time.

Harpie, an on-chain firewall platform that prevents hacks and scams, raised $4.5 million in a seed round led by Dragonfly Capital. Coinbase Ventures and OpenSea backed the round.

Payment Industry Trends

Digital payment provider Strike raised $80 million in a Series B round led by Ten31. Among other participants are Washington University in St. Louis and the University of Wyoming Foundation.

DolarApp raised $5 million in a round backed by Y Combinator and Kaszek Ventures. The startup builds dollar USDc accounts for Latin American countries and plans to launch virtual payments with Apple Pay and Google Pay.

Neutronpay raised $2.2 million in a seed round led by Hivemind Ventures. Among other participants are Republic, Ride Wave Ventures, Cavalry Asset Management, Studio, Iterative, Fulgur Ventures, Hivemind Ventures, and angel investors Lisa Shields and Bill Crowley. The startup enables businesses and consumers to send and receive payments on Bitcoin’s Lightning Network.

Wallet Industry Trends

Open-source crypto wallet OneKey raised $20 million in a Series A round led by Dragonfly Capital and Ribbit Capital. Among other investors are Framework Ventures, Sky9 Capital, Ethereal Ventures, Coinbase Ventures, Folius Ventures, and Santiago R. Santos.

NEAR-based eco-wallet Sender Wallet raised $4.5 million in a private round led by Pantera Capital. The round also saw participation from Jump Crypto, Amber Group, Crypto.com Capital, WOO Network, D1 Ventures, SevenX Ventures, Eniac Ventures, Smrti Labs, Puzzle Ventures, Shima Capital, GFS Ventures, Octopus Network, Ref Finance, and Paras.

Noncustodial wallet Omni raised $11 million in a seed round at a $50 million valuation. Among the investors are Spartan Group, Shima Capital, GSR Ventures, Daedalus Angels, Eden Block, OP Crypto, Kosmos Ventures, PrimeBlock Ventures, Lattice Capital, Figment Capital, and Chorus One. The company plans to expand its integrations and services.

London-based provider of a multi-wallet Web3 email platform, Mailchain raised $4.6 million in a seed round led by Crane Venture Partners and Kenetic Capital. Among other participants are Acequia Capital, Eterna Blockchain Fund, Maex Ament, Kestrel0x1, Charles Songhurst, Sarah Drinkwater, and Nick Ducoff. The startup plans to onboard users, communities, and protocols.

Venture studio MPCH Labs raised $40 million in a Series A round led by Liberty City Ventures. Among other participants are Animoca Brands, QCP Capital, Mantis VC, Human Capital, Global Coin Research, Polygon Studios, LedgerPrime, Finality Capital, Oak HC FT, and Quantstamp.

Portfolio performance tracking platform Binocs raised $4 million in a seed round led by Bennett. Among the participants are Arkam Ventures, Accel, Premji Invest, Blume Ventures, Saison Capital, and Better Capital.

Funding Industry Trends

Norwegian Presale, which helps to manage presale deals in Web3, raised $3.8 million from Kraken, SNÖ, Skyfall Ventures, and Weekend Fund.

Global VC firm MetaWeb Ventures raised $30 million. NEAR Foundation, Dragonfly Capital, Sequoia Capital, Octopus Network, GSR Markets, Seven X, Mentha Partners, SNZ, Infinity Labs, ViaBtc, Puzzle Ventures, Newman Capital, and JDAC participated in the funding round. Among the investors are notable entrepreneurs Illia Polosukhin, Swahn Shi, Bo Shao, Mark Wang, and others.

Incubator Industry Trends

Hong Kong-based blockchain incubator PANONY raised $100 million in a Series A round led by NGC Ventures. The company will use the funding to launch new offerings and expand its network, and jurisdictions.

Tooling Industry Trends

Usko Privacy, which helps users stay on budget and control data, raised $1.8 million. Among the participants are Ocean Azul Partners, Miami Angels, Pareto Holdings, and several angel investors.

Messaging protocol Hyperlane raised $18.5 million in a seed round led by Variant. Among other investors are Galaxy Digital, CoinFund, Circle, Kraken Ventures, Figment, Blockdaemon, and NFX.

Rated Labs raised $2.5 million in a seed round led by 1confirmation, Semantic, and Placeholder, with participation from cherry.xyz, Decontrol Park Capital, and angel investors.

Web3 Industry Trends

Spice AI, a platform that helps developers build data-driven applications, raised $13.5 million in a seed round led by Madrona, Blackbird Ventures, Alumni Ventures Blockchain Fund, Basis Set Ventures, IEX Fund, Joe McCann’s new Asymmetric fund, and Protocol Labs. The CEO of GitHub Thomas Dohmke also participated in the round and joined the board.

People-oriented blockchain discovery engine Thirdwave Labs raised $7 million in a seed round led by Framework Ventures. Animoca Brands, Play Ventures, Shima Capital, Hustle Fund, and Oceans Ventures backed the round.

Discover-to-earn awards platform Smoothie raised $1.2 million from LongHash Ventures, YouBi Capital, GHAF Capital Partners, CyberConnect, King River Capital, Stateless Ventures, Sneaky Ventures, HiveHatch, and angel investor Balaji Srinivasan. The startup plans to build a product hunt for Web3.

Real-time accounting platform Integral raised $8.5 million in a round led by Coinbase Ventures, Anchorage Digital, Dapper Labs, and Electric Capital.

Headquarters, which helps Web3 teams be accountable by automating their financial activities and reporting, raised $5 million in a pre-seed round. Among the investors are crypto.com Capital, Forge Ventures, and MassMutual Ventures.

Web3 accounting platform Tactic raised $11 million in a round led by Ramnik Arora of FTX Ventures. Among other participants are Lux Capital, Coinbase Ventures, Founders Fund, Ramp, Elad Gil, and Dylan Field. The startup aims to simplify financial operations for businesses in Web3.

Infrastructure Industry Trends

Software startup and venture studio Community Labs raised $30 million from Lightspeed Venture Partners, Bain Capital Crypto, Arweave, Blockchain Capital, Distributed Global, and Road Capital.

Web3 infrastructure company Mysten Labs, which develops the Sui L1 blockchain, raised $300 million in a Series B round led by FTX Ventures. Among other participants are a16z crypto, Jump Crypto, Apollo, Franklin Templeton, Coinbase Ventures, Binance Labs, Circle Ventures, Greenoaks Capital, Lightspeed Venture Partners, Sino Global, Dentsu Ventures, and O’Leary Ventures. The startup plans to use the funds to continue building the core infrastructure and accelerate the adoption of the Sui ecosystem.

New York-based Slide, which develops UX infrastructure for decentralized apps, raised $12.3 million in a seed round led by Framework Ventures and Polychain Capital. Other investors include Coinbase Ventures, Circle, Outlander Ventures, and angel investors Ani Pai and Balaji Srinivasan. The startup facilitates the use of the blockchain for users and plans to fully launch by the end of the year.

Blockchain payment platform Bitmama raised $2 million in the pre-seed round. Among the participants are Unicorn Growth Capital, Launch Africa, Adaverse, Tekedia Capital, Greenhouse Capital, ODBA, Five35 Ventures, Chrysalis Capital, Enrich Africa, Thrive Africa Community, AngelList, and several angel investors.

Digital assets software company Ownera raised $20 million in a Series A round. Among the participants are J.P. Morgan and LRC Group. The round also features Draper Goren Holm, tokentus Investment AG, The Ropart Group, Accomplice Blockchain, Polymorphic Capital, and Archax.

Diamond Standard Co., which develops regulator-approved diamond commodities, raised $30 million in a Series A round from Left Lane Capital and Horizon Kinetics.

Swiss crypto platform Portofino Technologies raised $50 million from Valar Ventures, Global Founders Capital, and Coatue Management.

Token management platform Magna raised $15.2 million in a seed round led by Tiger Global and Tusk Venture Partners. Among other participants are Circle Ventures, Y Combinator Continuity, Galaxy Digital, Asymmetric, Alchemy Ventures, Solana Ventures, Blockchain Founders Fund, Ava Labs, Polygon, Protocol Labs, AV Blockchain Fund, Olive Tree Capital, ProtoFund, Plug and Play Ventures, Balaji Srinivasan, Ryan Selkis, and notable angel investors.

Web3 onboarding platform AIKON raised $10 million in a Series A round led by Morgan Creek Digital with the participation of Up2 Opportunity Fund, Hestia Investments, and Yugen Partners. Avalanche Fund and Blizzard joined the round as strategic investors and partners.

Next-generation L1 blockchain Aptos received investment from Dragonfly Capital.

Notable Investors

In September, FTX Ventures invested over $300 million in nine Web3 companies. The VC firm led the round of Mysten Labs, the developer of the Sui L1 blockchain. This month, FTX also paid attention to data startups; the fund invested in Messari, Kwil, and VerifyVASP, which develops travel rule solutions for secure and immediate Data Sharing.

FTX also participated in the strategic funding round of NFT software builder Dust Labs, socially-powered NFT investment app Sintra, and NFT project Doodles, which raised a total of $54 million. Furthermore, FTX Ventures led the round of Web3 accounting platform Tactic and Web3 wallet Coral.

NGC Ventures, one of the largest investment firms in Asia, led the Series A funding round of Hong Kong-based blockchain incubator Panony with a $100 million investment.

Ten31 led the Series B round of digital payment provider Strike, which raised a total of $80 million. It’s worth noting that Ten31’s aims to connect DeFi and conventional banking. The company’s portfolio lists such startups, as Start9 Labs, Swan Bitcoin, IBEX, Impervious, Hoseki, and Fedi.

Read related posts:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at [email protected]

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at [email protected]