May 2025 in Crypto: Projects That Mattered Across Blockchains

In Brief

In May, blockchain teams were focusing on testing testnets, opening ecosystems, and securing funding without much hype. These prominent players, with minimal hype, demonstrated significant progress in their field.

If you’ve been scanning the blockchain landscape this May, you will have noticed plenty of marketing noise. AI buzzwords stapled onto half-baked roadmaps, the usual rollup clone pile-on, you know the drill. But behind that noise, some teams are just getting on with it: shipping testnets, opening up ecosystems, and landing serious funding without fanfare. We’ve been keeping tabs on what’s been moving the field.

The projects below aren’t necessarily new, but they all made a mark this May. Some launched a fresh update, others hit real traction or quietly pulled off something hard. We picked some of the most prominent players with the least hype factor as their core mover. Whether or not to follow these is, of course, up to you – consider it merely our take on where real work is (or at least seems to be) getting done. Let’s dig in.

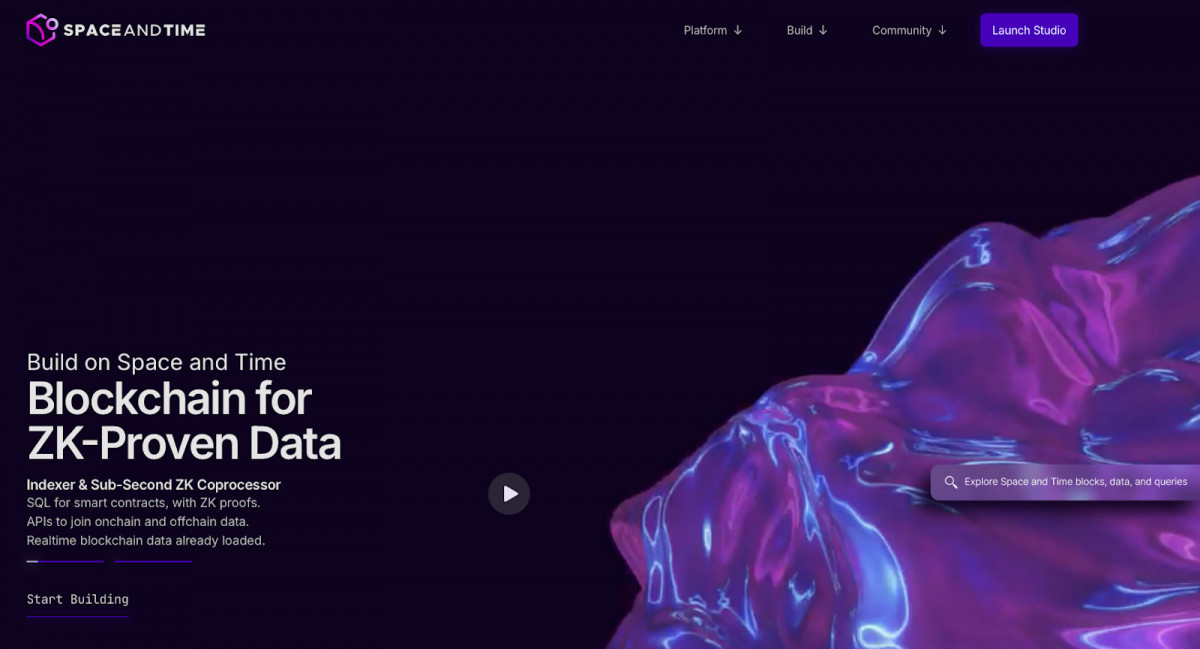

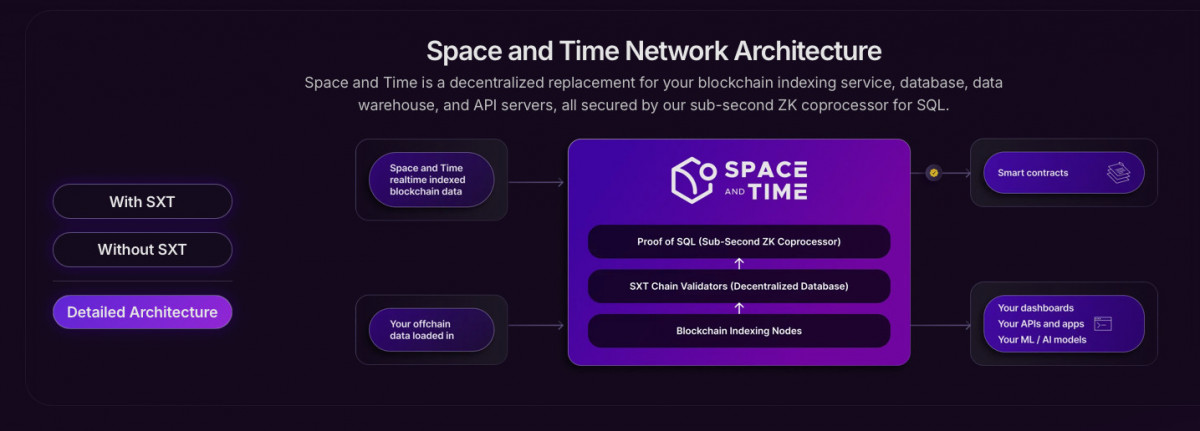

Space and Time

Web3’s relationship with off-chain data has always been a bit fragile. Either you trust some centralized API, or you build your own clunky workaround. Space and Time is trying to fix that – by decentralizing databases and making every query provable using zero-knowledge cryptography. Basically: run a SQL query, get a result plus a ZK-proof that says “this data wasn’t tampered with.”

Source: Space and Time

That’s the pitch, and in May, it finally became reality. The project launched its public mainnet on May 8, complete with its native token $SXT and a validator network ready to go. This wasn’t some stealth deploy either – Microsoft, Chainlink, Google Cloud, and Polygon are already plugged in at various levels, and the team claims over 30 validators were running during testnet. The tech’s legit, and the partner list screams “serious enterprise play.”

Source: Space and Time

What caught our attention is how unambiguous the project is about what it’s for. This is not a “come build anything on our L1” kind of chain. It’s for devs and data people – projects that need to verify external data, run big off-chain computations, or feed smart contracts with results they can trust.

Source: Space and Time

Token-wise, $SXT is your ticket for querying, staking, and governing the network. They haven’t posted a super granular breakdown yet, but based on launch comms, it’s utility-heavy – pay for requests, earn as a validator, vote on upgrades, all that.

Of course, we’re still early here. We don’t know how the economics shake out at scale – how much queries will cost, whether devs will find the UX livable, or even how often apps truly need this kind of bulletproof data verification. But in its corner of the Web3 world, this feels substantial.

So, our read on Space and Time: not flashy, not mass-market – but for the data-heavy corners of crypto that are tired of trusting their guts or Google; could be a quiet backbone in the making.

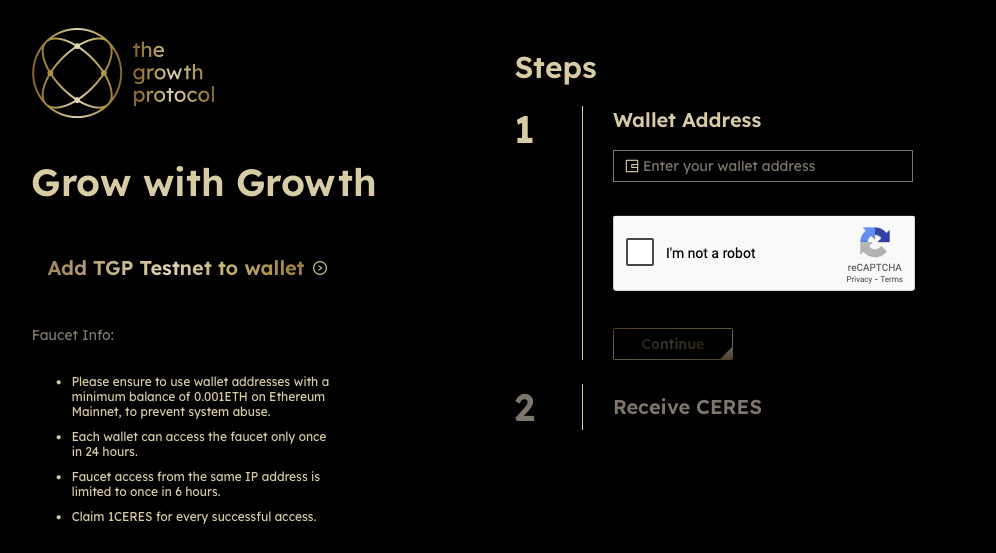

Growth Protocol

Advertising and blockchain – yeah, we know. Feels like one of those pairings that should stay in the “bad ideas” folder with 2018 whitepapers and tokenized soda machines. But every now and then someone swings at it again, and this time, Growth Protocol might actually be connecting with the ball.

Source: Growth Protocol

Their pitch is straightforward enough: smart contracts running campaigns and settling payments directly between advertisers, publishers, and (in theory) users. No middlemen and no sketchy ad networks involved. Sounds like vaporware from a half-forgotten ICO, right? But here’s where it gets interesting – they actually launched. Mainnet hit on May 21, and they weren’t just standing there with a “coming soon” banner. Two mobile games from Nazara – one of the big dogs in Indian gaming – were already live with campaigns on day one.

Source: Growth Protocol

The claim: 150,000+ daily active users on launch. That’s a head-turning number for a brand new chain; though we’d be lying if we said we weren’t wondering how many of those were real people, how many were bots, and how many just showed up for the token crumbs. The team hasn’t shown its hand on tokenomics yet, but based on what’s visible, there’s clearly some incentivization happening under the hood.

Source: Growth Protocol

Underneath it all, the chain runs on Avalanche tech – or more specifically, a custom subnet of it. That gives it the raw throughput you’d want for an ad network that’s actually doing stuff at scale: think real-time settlement of impressions, clicks, conversions, and all the data exhaust that comes with it. Emin Gün Sirer himself gave it a nod, calling it a “real example of blockchain utility,” which, coming from him, is either an endorsement or a challenge.

Source: Growth Protocol

What we think is happening (since full docs are still MIA) is a native token driving transactions and rewards, possibly with options for advertisers to burn or stake for visibility boosts. Campaigns may still be priced off-chain in fiat, but on-chain settlement looks fully crypto-native. The whole thing gestures at a larger vision – maybe something like NFT-based ad units or “tokenized goals” down the line. And the whole train seems to be headed towards programmable ad inventory.

Of course, none of this answers the big questions. First: is the activity sticky, or just inflated by launch rewards? We’ve seen many “active networks” vanish the moment incentives dry up. And second – the harder one – will actual advertisers buy in? Transparency is great n all, but so far, blockchain has mostly delivered more friction, not less, and that’s not what the ad world wants.

Still, we’ll give credit where it’s due: this thing is live, already embedded in games, and pushing past the typical Web3 echo chamber. Not exactly polished, and it’s definitely not simple – but for all the hand-wavy “blockchain meets adtech” attempts we’ve watched fizzle out, this one seems to have actual momentum.

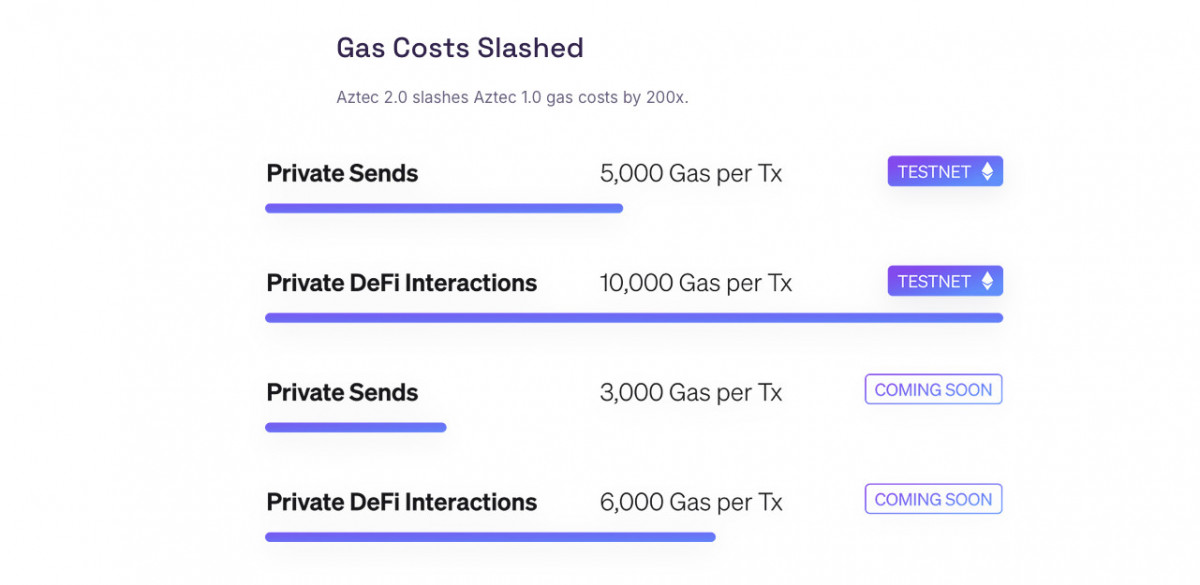

Aztec

Aztec’s always been the quiet one in the zero-knowledge crowd. While everyone else was hyping benchmarks and trading blog-post drama, they were just quietly building. And then May rolls around, and finally – public testnet is here. For anyone who’s been waiting on a real shot at private smart contracts on Ethereum, this was the one to watch.

Source: Aztec.network

Now, if Aztec sounds familiar, that’s because it is. They had an earlier run with Aztec Connect – a sort of privacy layer for dApps, where you could do encrypted DeFi transactions. That got sunsetted back in 2023 when they decided to start fresh and aim bigger. What they’ve rolled out now is the culmination of that pivot: a full-blown zkRollup where everything – smart contracts, state, interactions – is encrypted by default. Not partially private, not “stealth mode” toggles. Everything.

Source: Aztec.network

This testnet is the first time devs can properly get their hands dirty. You can write contracts in Noir (their custom-built language), deploy dApps that actually don’t leak user data, and start stress-testing what Ethereum feels like when it forgets your business. It’s not exactly mainnet-ready – performance still has that early-testnet shakiness – but you can feel the rails being laid down for something serious.

Source: Aztec.network

That said, there’s some history here, and not all of it neat. Shuttering Aztec Connect spooked more than a few devs – it raised that quiet worry: if one privacy system can disappear, what’s stopping another? And then there’s the obvious heat that full encryption brings. This isn’t some “we obfuscate metadata” play. It’s straight-up end-to-end encrypted Ethereum. That’s powerful… and also regulatory kryptonite if handled wrong. Aztec’s going to have to tread carefully if they want this to be more than a niche for cypherpunks and privacy diehards.

On the backer side, though, they look pretty stacked. a16z, Paradigm – the usual top-tier suspects. No token yet – and no hints about when one might arrive – but it’s hard to imagine this going mainnet without something to secure and incentivize the network.

Make no mistake though: Aztec isn’t chasing the same dragon as most rollups. This isn’t about gas wars or memecoin throughput. It’s not trying to out-Bedrock Optimism or undercut fees on Base. It’s primarily built for things like encrypted voting, privacy-preserving DAOs, and institutional logic that absolutely cannot go on a public ledger.

Final take: this is a big deal for Ethereum privacy. It’s early, sure, and not without its baggage. But it’s real, it’s here, right now.

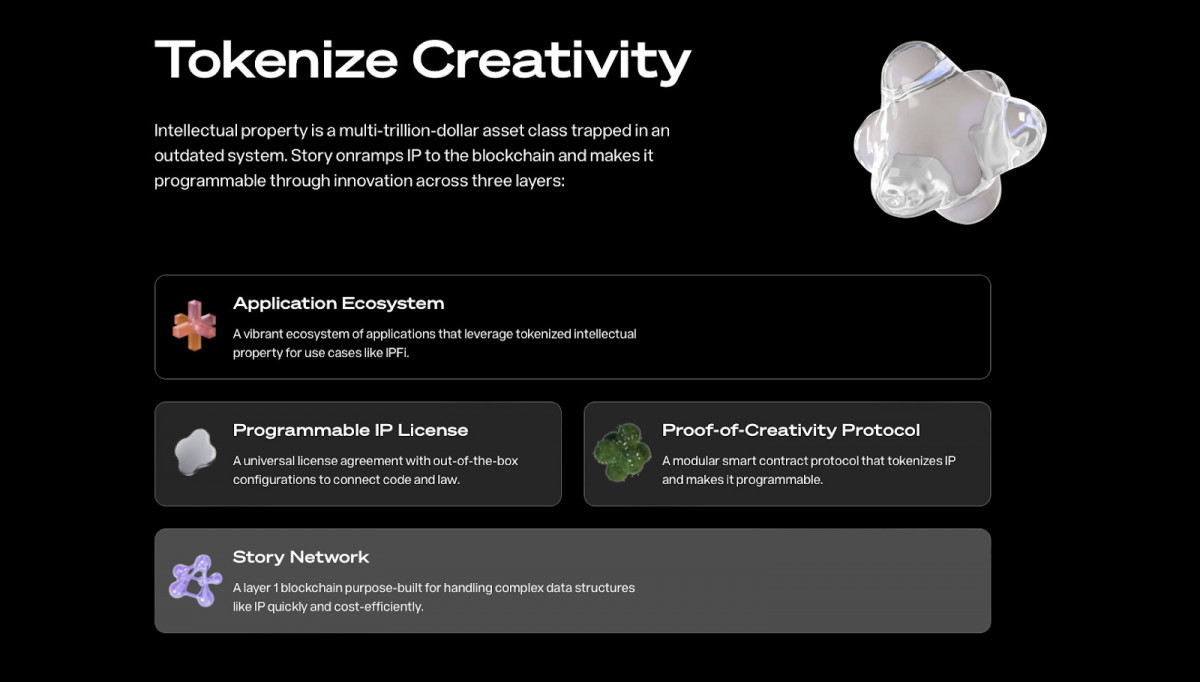

Story Protocol

Everyone in crypto loves to say we need “real-world use cases,” but usually that means fintech clones or loyalty points with extra steps. Rarely does the conversation veer into… intellectual property law. But that’s exactly where Story Protocol is staking its ground – and surprisingly, it’s not a half-baked niche project. This thing is an entire layer-1 blockchain built specifically to register, license, and monetize IP. We’re talking songs, characters, storylines, logos – turned into programmable, remixable, royalty-splitting assets, all living on-chain.

Source: Story Protocol

Now, you’d be forgiven for assuming this is a novelty play. But clearly someone’s buying the vision: Story’s raised a cool $140 million from a16z, Hashed, and – in the most 2025 crossover imaginable – Paris Hilton’s 11:11 Media. And May brought a new push: they launched a global “IP Buildathon” with tracks spanning from licensing infrastructure to AI-native copyright tools, and opened the gates for devs to actually start building on top of the chain.

Source: Story Protocol

Under the hood, this isn’t just some Ethereum sidecar. Story is its own sovereign chain, built with Cosmos SDK but running an EVM-compatible environment – so you get flexibility plus familiar tooling. The native token, $IP, does triple duty: governance, gas, and a clever little burn mechanic. Every time someone registers content, licenses IP, or transacts on-chain, a small chunk of $IP gets burned. It’s a deflationary twist that ties token sink directly to protocol usage. Stakers keep the network secure, and everyone from platform builders to fanfic remixers can, in theory, earn a piece.

Source: Story Protocol

The chain itself has technically been live since earlier this year, so May was less about turning the lights on and more was about firing up the ecosystem. The vibe now is “early Cambrian,” with Story seeding the ground and hoping something weird and wonderful grows. Will it be anime-style DAO IP, AI model licenses, or fair-trade Taylor Swift remixes? Too soon to say, but the pieces are being laid.

Source: Story Protocol

That said, let’s not pretend there aren’t landmines. The legal side of on-chain IP is still very much uncharted territory. Most creators aren’t sitting around waiting for their Solidity moment. And spinning up a whole new L1 instead of building on existing rails adds a layer of commitment (and friction) that only makes sense if the ecosystem actually shows up.

But to their credit, the Story team isn’t pretending the hard parts aren’t hard. They’ve got the runway, the tooling, and a thesis that feels more timely than it might have a year ago. In a post-AI world where IP ownership is about to get seriously messy, there’s a case to be made for putting the rules of engagement on-chain – before they get eaten alive by synthetic media and copyright chaos.

Tanssi

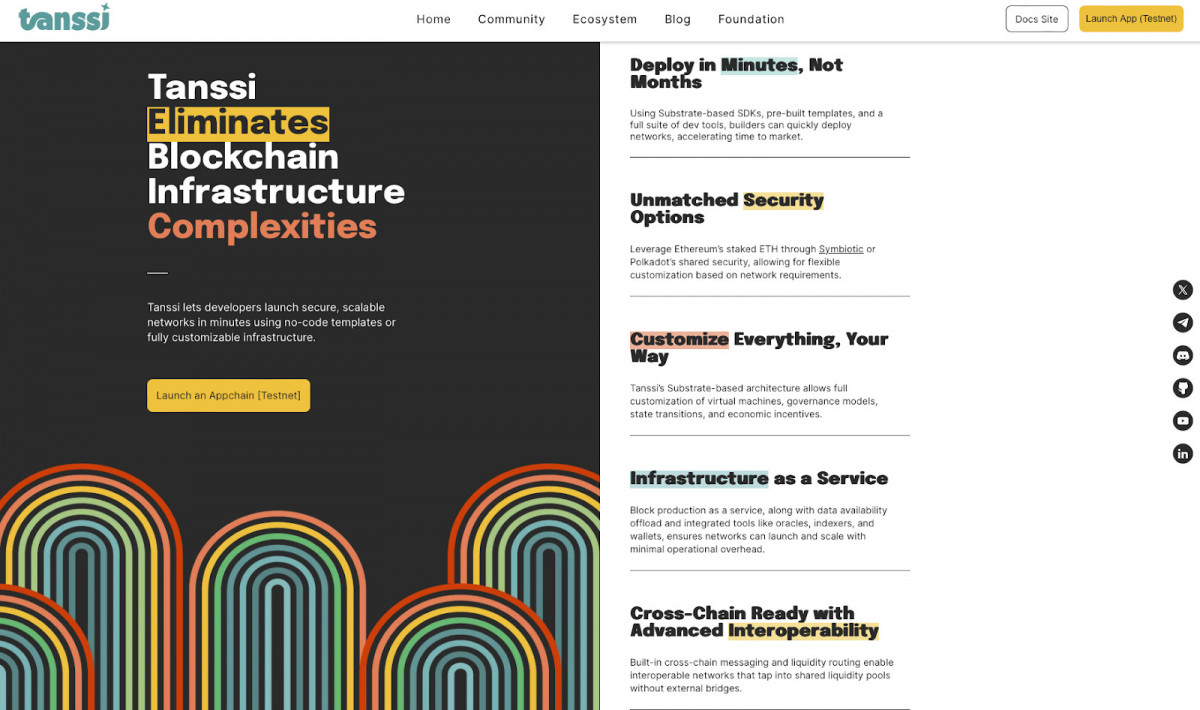

Launching a blockchain is still, frankly, a slog. Even now, in the back half of 2025, you’re usually looking at six months, a deep protocol team, and a low six-figure budget just to get something vaguely production-ready. Tanssi thinks that whole process is broken – and they’re going for the throat with their “Blockchain in minutes” pitch. Sounds like a meme, we know, but they seem serious.

Source: Tanssi Network

What they’re building is more than a dev toolkit – it’s a launch platform for full-blown appchains. Kind of like spinning up your own blockchain server, but with plug-and-play components: governance settings, consensus layer, Ethereum-compatible dev tools, and built-in support for shared security frameworks like Ethereum restaking or Polkadot’s validator set. Under the hood it’s built on Substrate, so there’s real muscle behind it. Pick your stack, hit deploy, go live. At least, that’s the promise.

Source: Tanssi Network

In May, they rolled out their final public testnet – a dry run for mainnet, which is slated to land sometime in June. And this isn’t a ghost town testnet, either. Teams are already using it to deploy chains, coordinate validators, and plug into integrations. The Tanssi crew says there are 150+ projects in the queue – ranging from DeFi experiments to real-world asset platforms to gaming networks. That’s a lot of activity, and while some of it’s definitely pre-TGE froth (yes, the token is coming), there’s substance there.

Source: Tanssi Network

They’re not flying blind either. Tanssi raised $9 million from a strong lineup – Arrington Capital, HashKey, and even Gavin Wood himself, which makes sense given the Substrate roots. So this isn’t some fork-of-a-fork dev team duct-taping something together. They’re plugged in with the infrastructure crowd that’s been building serious protocol gear for years.

Still, we’re not all-in just yet. The biggest question looming over Tanssi is existential: do most teams actually want their own chains? Cosmos and Avalanche subnets planted that flag years ago, but uptake has been niche at best. Tanssi is betting the market shifts if the barrier drops – that with tools like restaking and modular SDKs, teams will favor sovereignty over shared space. Maybe. But we’re not there yet.

For now, it’s all about how mainnet lands. Who launches, what sticks, and whether these appchains become ghost towns or living ecosystems. A clean testnet is a good start – but the real story begins when value flows, and we’re going to watch it closely.

Sahara AI

If we were handing out awards for “most ambitious project of the month,” Sahara would win it with zero competition. They’re not just trying to slap a token on AI – they’re going after the whole stack. Think: data licensing, model attribution, royalty payouts – all wired together through an on-chain backend economy. The pitch is pretty wild: turn every part of the AI training pipeline into a traceable asset. If your data helps train a model, the system knows about it, and you get paid.

Source: Sahara Labs

That’s the vision, and in May, they inched a little closer. Sahara dropped its first public testnet – codenamed SIWA – after running a private phase that came with some eyebrow-raising usage stats: 3.2 million total accounts, 1.4 million daily actives. Either we just found Web3’s most adopted AI infra overnight… or someone’s counting very generously. Still, alongside the testnet, they rolled out a long partner list – 40+ names including AWS, Google Cloud, and UC Berkeley. That’s a lot of reach for a project still early in its arc.

Source: Sahara Labs

What raised our eyebrows even more was the note that Sahara’s already generating revenue on its data services platform – and testnet users are sharing in that. That’s not the usual “just click around and break stuff” approach. They’re treating this testnet like a proving ground with real economic flow, not just a sandbox with training wheels.

Source: Sahara Labs

Money-wise, they’re well armed. $43 million raised from a stacked list: Pantera, Polychain, Binance Labs, Samsung Next, and more. So there’s real institutional belief here – and probably a fair bit of pressure to deliver.

But look, the truth is, this is uncharted territory. There are very real, very messy questions sitting under all this: How do you actually prove a model used a specific dataset? Who owns what if the training data came from half the internet? Can you really build a royalty flow for AI that doesn’t crumble under gas costs or legal scrutiny? None of that’s trivial, and none of it’s solved yet.

Also worth flagging: no mainnet, no token, and some of the heavier logic (like licensing vaults and payout flows) is still more concept than code. So while it feels big – and it might turn out big – right now it’s still early scaffolding. A big moonshot, but a moonshot all the same.

Wrap-Up

So yeah – May had some interesting dynamics to it. Mainnets shipped, testnets went public, and a few projects reminded us that under the noise, people are still building wild, ambitious things. Let’s be honest: some of this will flop, sooner or later. Some projects might quietly underpin the next cycle of actually useful infrastructure. And some… well, we’ll be back in a few months to see if any of it stuck.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.