How Nvidia’s $3.34 Trillion “AI-pocalypse” Outstood Microsoft and Apple

In Brief

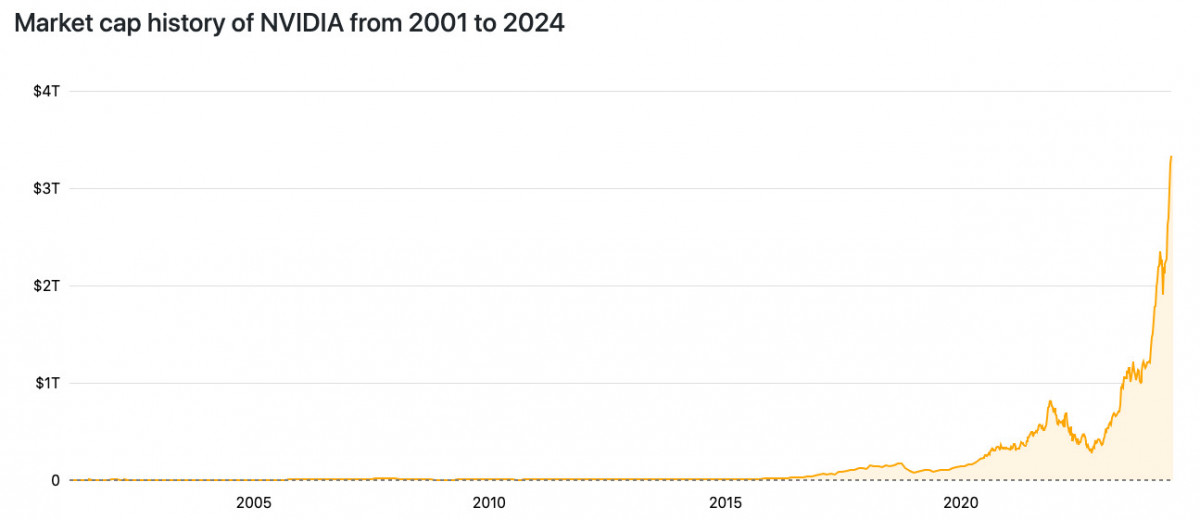

Nvidia, a chip maker for AI and graphics processing, has surpassed Microsoft and Apple as the most valuable publicly listed business globally, with a market valuation of $3.34 trillion.

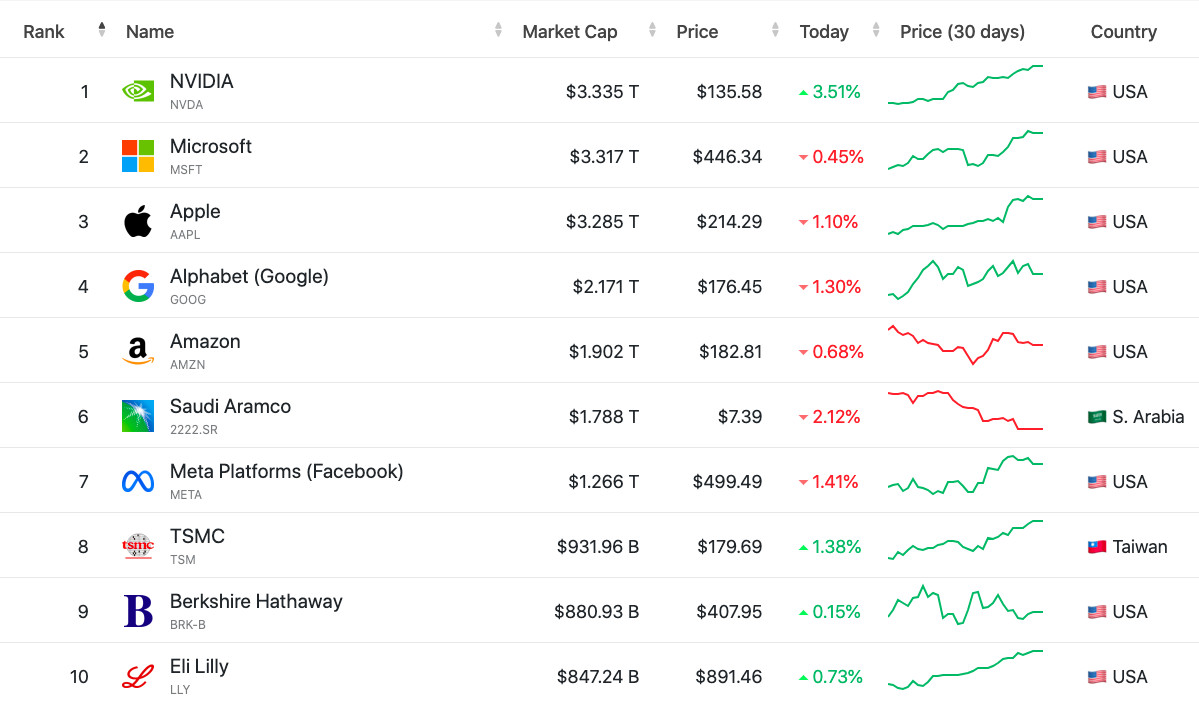

The computer giants Microsoft and Apple have been overtaken by Nvidia to take the title of most valuable publicly listed business in the world. The company that makes chips for AI and graphics processing has surpassed its rivals with a market valuation of $3.34 trillion.

When Nvidia first started out in 1993, it was a gaming firm that made high-performance graphics cards for video games. But when it realized artificial intelligence had the ability to change everything, the company’s path took an unusual shift, and it redirected its resources to build the necessary technology.

Photo: Companiesmarketcap

The AI Arms Race and Nvidia’s Competitive Edge

Nvidia’s graphics processors are being used by big tech firms like OpenAI, Google, Amazon, and Microsoft to create artificial intelligence systems and infrastructure. Nvidia’s processors, which were first created to display visuals for video games, have shown they can handle the computational demands of artificial intelligence (AI) algorithms and offer the processing power needed to run and train these models.

By early adopting AI and customizing its hardware and software for AI workloads, Nvidia was able to establish an advantage in the sector. Nvidia established itself as a supplier of an AI ecosystem including hardware, software, cloud services, and pre-trained AI models with specialized processors and software for AI development.

According to research firm Omdia, Nvidia dominates this growing sector, accounting for over 70% of sales of AI chips and playing a major role in generative AI model training. Due to its domination, demand has increased dramatically. Nvidia has exceeded Wall Street estimates by anticipating a 64% increase in quarterly sales in May 2023.

Photo: Companiesmarketcap

The AI Prowess of Nvidia: The Basis

Since releasing CUDA software in 2006, which allowed programmers to utilize its GPUs for purposes other than graphics rendering, Nvidia has been involved in artificial intelligence. This made it easier to use Nvidia’s CPUs for machine learning and image recognition, which helped to establish Nvidia’s place in AI.

Later, Nvidia made an investment in designing hardware and software specifically designed to handle AI workloads. As a result, it produced products like the DGX-1 supercomputer for AI training, which it gave to the AI research firm OpenAI in 2017.

AI processors from Nvidia, such as the H100, are said to be up to nine times quicker for AI training and thirty times faster for inference than the A100, which it replaced. These processors enable numerous artificial intelligence (AI) systems that power applications like language models and self-driving vehicle technologies, together with Nvidia’s software.

The Tipping Point: Artificial Intelligence and the “iPhone Moment”

Nvidia has been making steady progress in AI, but the emergence of generative AI recently has spurred this growth. The success of ChatGPT and other similar applications led to a spike in demand for Nvidia’s processors, as businesses needed the processing power to create and run these models.

This is the “iPhone moment” for AI, according to Nvidia CEO Jensen Huang, who compared it to how Apple’s smartphone ushered in a new era of computing. Huang thinks that generative AI will fundamentally alter the way that technology is utilized, with Nvidia leading the way in this transformation.

Due to its supremacy in AI chips, Nvidia has demonstrated outstanding financial success. In the most recent quarter, data center revenue increased by 427% year over year and accounted for 86% of total sales. According to Forbes, this helped Nvidia surpass IT giants Apple and Microsoft in terms of market value and raised Huang’s net worth to over $117 billion.

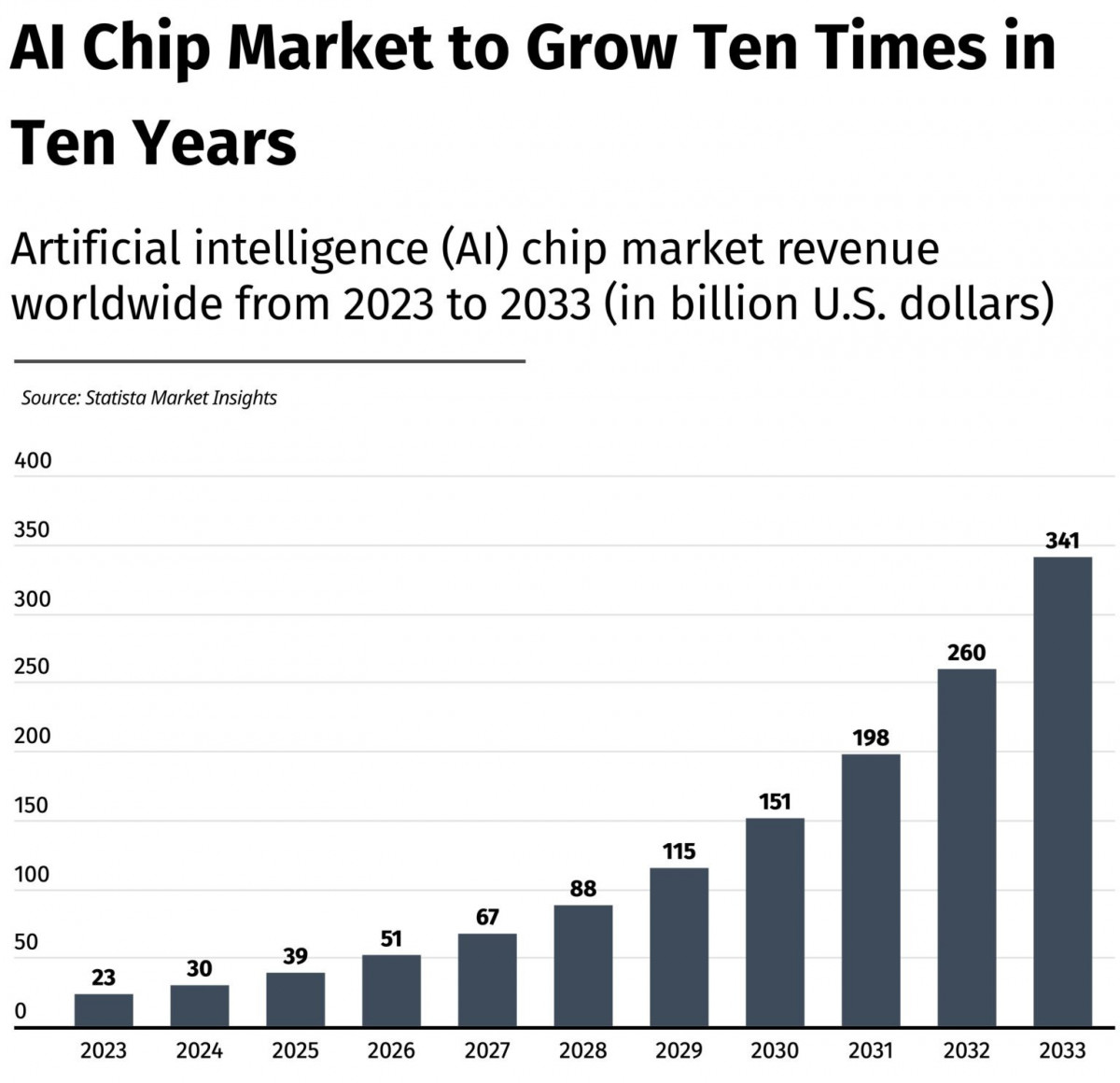

Market Situation for AI Chips

The market for AI chips has expanded significantly in recent years due to the growing need for AI-powered technology in a variety of sectors. This increase has been accelerated by the global AI boom, which started last year and is predicted to expand tenfold over the next ten years to reach $300 billion in revenue.

Artificial intelligence (AI) chips are specialized semiconductor devices that carry out intricate computations and operations needed for AI applications. This results in increased efficiency, reduced power consumption, and better cost-effectiveness. In the upcoming years, it is anticipated that the demand for these gadgets will explode globally.

Data from Statista and Market.us predict that the worldwide AI chip industry will reach $30 billion in 2024, a $7 billion increase over the previous year’s earnings. The market revenue is projected to more than quadruple over the following three years, culminating in more than $65 billion by 2027.

Photo: Statista

It is anticipated that the market would reach $100 billion by 2029, and by 2023, it will have grown to $260 billion. Revenues are predicted to increase by 1,000% to $341 billion in 2033 from this year. The amount of venture capital invested in AI chip startups has also increased dramatically; in 2023, over $20 billion, or $5 billion more than the year before, was invested in these companies.

This year’s investment activity is anticipated to be driven by investor involvement in the potential and applications of AI chips. By 2024, over $20 billion in new capital is predicted to enter the market, bringing the total three-year funding of AI chip companies to an astonishing $60 billion.

The Path Ahead: Sustaining Nvidia’s Dominance

Being the most valuable public business in the world, there are concerns about Nvidia’s ability to maintain its leadership in the face of growing competition and shifting AI trends.

With its extensive AI ecosystem and decades of GPU specialization, Nvidia creates obstacles to entry for firms like AMD and Intel trying to catch up in the AI chip market. Customers and partners are still drawn to it because of its integrated hardware, software, cloud services, and AI model libraries.

Nvidia plans new AI chip designs every year as part of its commitment to innovation. Its attempts to progress AI computing are demonstrated by the Grace Hopper platform, which combines GPUs and microprocessors.

However, with chip demand skyrocketing, Nvidia must guarantee product accessibility and affordability, which puts supply limits in place. Nvidia’s advantages may be disrupted by the emergence of open-source AI models and the focus on energy efficiency.

Nvidia has emerged as the industry leader in AI chips this year thanks to its early emphasis on technology and the creation of a wide range of AI product partners. Its success with generative AI has made it the most valuable public business in the world, yet maintaining this supremacy will require managing changes in the AI environment and competition.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.