How Aave’s Latest Update Is Driving Innovation in DeFi by Improving Risk Management and Borrowing Efficiency

In Brief

Cryptocurrency assets have seen a significant increase in value since 2010, driven by investor interest and financial uses. Aave’s v3.2 update introduces Liquid eMode, improving asset classification and borrowing strategies.

Cryptocurrency assets have grown at a very impressive rate. The entire value of cryptocurrencies increased from almost nothing in 2010. This exponential rise can be attributed to growing investor interest as well as the growing number of financial uses for digital assets.

The release of v3.2 by Aave is one recent example. This update highlights the continuous innovation in the industry by introducing notable enhancements to the borrowing and risk management tools.

The addition of Liquid eMode, which expands on the High-Efficiency Mode (eMode) that was previously in place, is one of the update’s primary features. With this improvement, assets may be more precisely categorized according to their Loan-to-Value (LTV) ratios, liquidation bonuses, and thresholds. The ability to apply several eModes to a single asset gives consumers unparalleled flexibility over their collateral and borrowing strategies, which is why this development is significant.

Recognizing and Reducing Risks

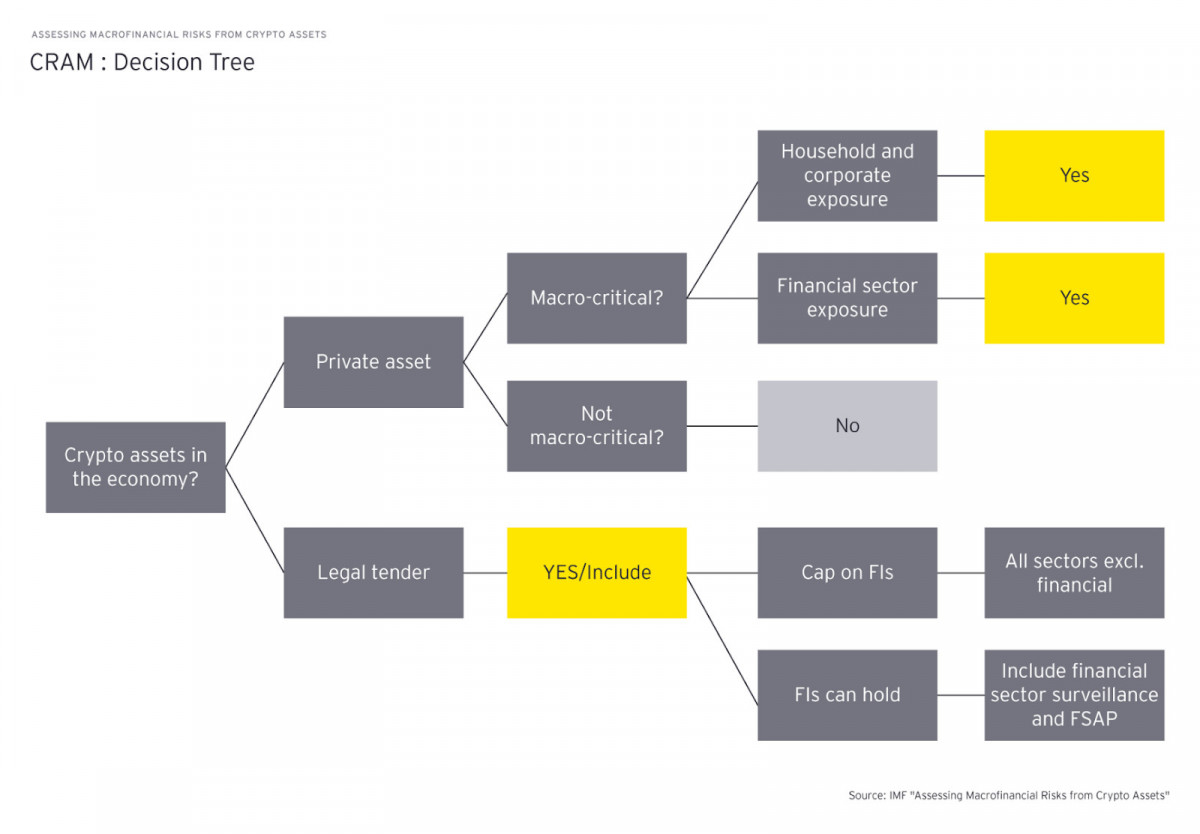

Robust solutions for risk assessment and management are becoming increasingly necessary as the DeFi business expands. The Crypto Risk Assessment Matrix, or C-RAM, model is one method that is becoming more popular. This methodology offers a thorough approach to assessing the hazards connected to cryptocurrencies on a national and worldwide scale.

Three phases make up the C-RAM model’s operation. It evaluates the macro-criticality of cryptocurrency assets in an economy first. It then maps hazards particular to each nation across different areas of susceptibility. Lastly, it assesses the hazards at the global level related to the broad use of cryptocurrencies. A comprehensive awareness of possible risks, from operational weaknesses to systemic importance, is made possible by this methodical approach.

Photo: EY

Streamlining Risk Administration in Smart Contracts

In the DeFi industry, smart contracts have become a potent instrument for risk management. These blockchain-based self-executing contracts have the ability to automate intricate financial transactions and enforce certain conditions without the need for middlemen.

Smart contracts are advantageous in several ways when it comes to risk management. They can enforce collateral requirements in lending platforms, automatically trigger fail-safes during market volatility, and control asset concentration to reduce risks. Additionally, smart contracts are essential for preserving liquidity in decentralized exchanges, putting stop-loss orders in place to minimize possible losses, and enabling automated checks that facilitate regulatory compliance.

Throughout a blockchain’s lifecycle, smart contracts may create and store on-chain data, which offers important information for risk assessments. By using this data to improve compliance procedures and identify any fraud, DeFi operations will have an additional degree of security.

Improving Features of Borrowing

More advanced borrowing features are being added to DeFi protocols as they develop, giving users more efficiency and flexibility. Efficiency modes, or eModes, are noteworthy discoveries that provide more precise control over collateral and borrowing tactics.

With the help of these advanced borrowing capabilities, users may apply more sophisticated investing strategies, obtain higher leverage for certain asset combinations, adjust risk parameters based on asset attributes, and maximize capital efficiency in a variety of market scenarios. These features enable users to customize their borrowing tactics according to their investment objectives and risk tolerance, which may open up new use cases and draw in a wider spectrum of players to the DeFi ecosystem.

The Importance of Protocol Upgrades

Updating DeFi protocols on a regular basis is essential for enhancing efficiency, security, and usefulness. These updates frequently concentrate on minimizing gas usage, simplifying code bases, and improving risk management skills.

More adaptable risk management is now possible with the addition of features like different efficiency modes for a single asset thanks to recent protocol updates. In an effort to enhance system performance generally, they have also concentrated on eliminating obsolete or superfluous code.

To safeguard lenders and ensure protocol solvency, enhanced liquidation processes have been put in place, and upgraded oracle systems offer more precise and dependable pricing feeds. These updates show how DeFi initiatives are still dedicated to improving their services and meeting the changing demands of customers and the larger financial ecosystem.

The improvements in borrowing characteristics and risk management are encouraging, but they also bring with them some new difficulties. These systems may be more challenging for typical users to comprehend and utilize due to their increasing complexity. If advanced features are not developed appropriately, there is a chance that malicious actors will take advantage of them.

Furthermore, with the increasing interconnectivity of DeFi protocols, systemic risks resulting from the collapse of a single key protocol or a series of platform-wide liquidations must be taken into account. Regulatory issues are also quite important. As the importance of DeFi increases, regulators are becoming more attentive to this market. To maintain long-term viability, future advances in risk management and borrowing features will need to strike a balance between innovation and compliance.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.