FinTech

What is FinTech?

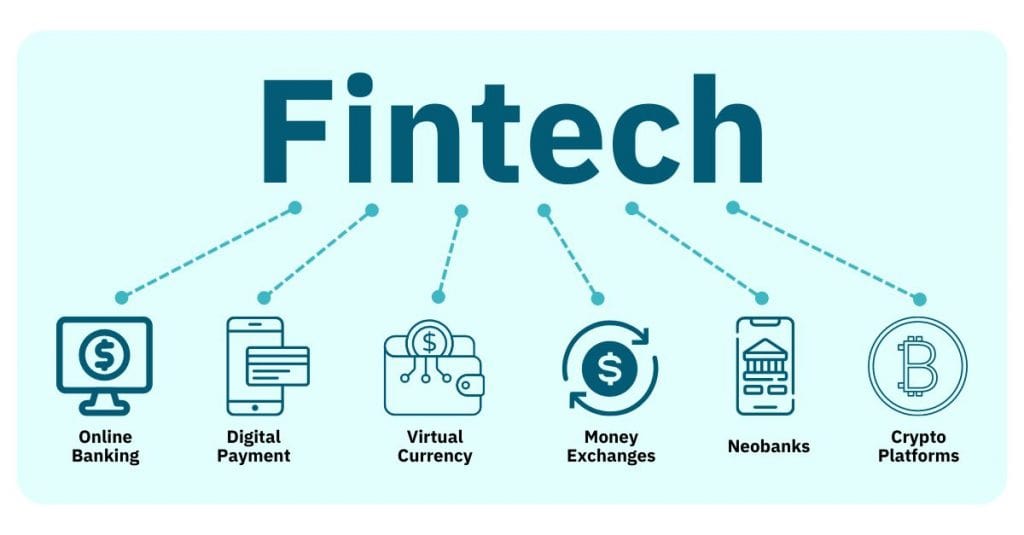

FinTech (“financial technology”) is usually any system, software, or technology that enables individuals or organizations to digitally access, manage, or get financial information or conduct financial transactions.

FinTech emerged as a way to assist customers in addressing financial difficulties and moving closer to their financial goals throughout the course of the previous ten years as they utilized digital technologies at an increasing rate. As a result, customers now depend on fintech for a variety of purposes, including financing, investing, and budgeting, in addition to its obvious daily advantages.

“Technological innovations will be the heart and blood of the banking industry for many years to come.”

John Stumpf, former CEO of Wells Fargo

Understanding of FinTech

FinTech offers standard financial services to individuals and companies in a new ways that were not previously possible. For example, a lot of traditional banks have developed mobile applications that allow users to access bank services without actually visiting a bank, such as checking your balance, making transfers or paying the bills. A lot of services used by businesses, including real estate operations and loan services, are also automated by fintech. FinTech companies may now better understand their clients and increase their marketing efforts and product development by combining artificial intelligence with the vast amount of consumer’s data.

When it comes to the fintech applications in blockchain and cryptocurrency, consumers may be exposed to the certain risks. It is absurd to think that fintech is morally superior over big traditional banks. A lot of potential online businesses are having trouble due to new regulations. It’s still adviced to look at fintech with caution as hacking attempts rise and digital data grows more comprehensive. Although opinions on the security of fintech solutions differ, and fintech is a 100% useful nowadays, consumers are still concerned about the protection of their personal data when dealing with businesses online.

Latest news about FinTech

- Tim Grant, a former Galaxy Digital executive, has launched Deus X Capital, a $1 billion investment firm with a focus on private equity, venture capital, and fund allocation in digital asset, blockchain, fintech, and institutional capital markets sectors. Grant has held various roles, including Head of EMEA at Galaxy Digital and CEO of SIX Digital Exchange. Stuart Connolly will join the firm as Chief Investment Officer, consolidating all investments previously associated with Red Acre Ventures. Deus X Capital aims to invest and nurture innovative digital asset, fintech, and capital markets businesses.

- Singapore’s money authority (MAS) has announced a new program called FSTI 3.0, which will spend up to S$150 million over three years to support FinTech ideas. The program will introduce three new tracks: Enhanced Centre of Excellence, Innovation Acceleration, and Environmental, Social, and Governance FinTech. The Enhanced Centre of Excellence track will include corporate venture capital (CVC) entities, while the Innovation Acceleration track will foster innovative FinTech solutions using Web 3.0 technologies. The ESG FinTech track will support projects addressing ESG data, reporting, and analytics needs. The program also supports advanced capability development in areas like Artificial Intelligence and Data Analytics.

FAQ

The majority of countries currently have principal national financial authorities regulating fintechs. For example, fintech companies are required to follow the anti-money laundering regulations. It requires financial institutions to take measures to prevent and detect money laundering.

The use of digital banking services has increased due to the pandemic. When traditional bank branches were not available and individuals avoided doing business face-to-face, companies and customers switched to FinTech alternatives for online payments, investing, and banking. The demand for digital financial services and products increased as a result.

FinTech has pushed offline banks’ digital transformation, resulting in the creation of online and mobile banking systems. With user-friendly applications and websites, customers can now manage their accounts and pay their bills, send money and other useful features.

« Back to Glossary IndexDisclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

More articles

Victoria is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.